Tencent Video Accounts Progress Slowly While WeChat Ecosystem Moves Forward

![]() 08/16 2024

08/16 2024

![]() 563

563

On August 14, Tencent appeared in public with a financial report boasting impressive earnings.

In the second quarter, Tencent reported revenue of 161.117 billion yuan, an 8% year-on-year increase, and operating profit of 58.443 billion yuan, a 27% year-on-year increase. Specifically, the recovery of the gaming business was the most significant highlight in Tencent's financial report for this quarter.

However, many people are more focused on the "hope of the village" represented by video accounts, especially in the context of Tencent founder Pony Ma stating at the beginning of 2024 that Tencent would fully develop e-commerce on video accounts.

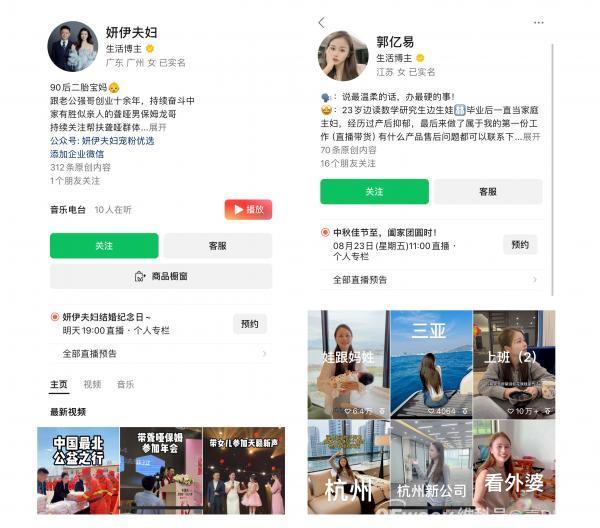

Over the past two years, video accounts have been regarded as a traffic sink, attracting more and more people. Those who once operated official accounts have joined in, and influencers who struggled to gain traction on platforms like Douyin and Kuaishou have shifted their focus to video accounts. Leading broadcasters like Guo Yiyi and Yan Yi Couple have emerged on video accounts.

As a result, every move made by video accounts now affects countless people.

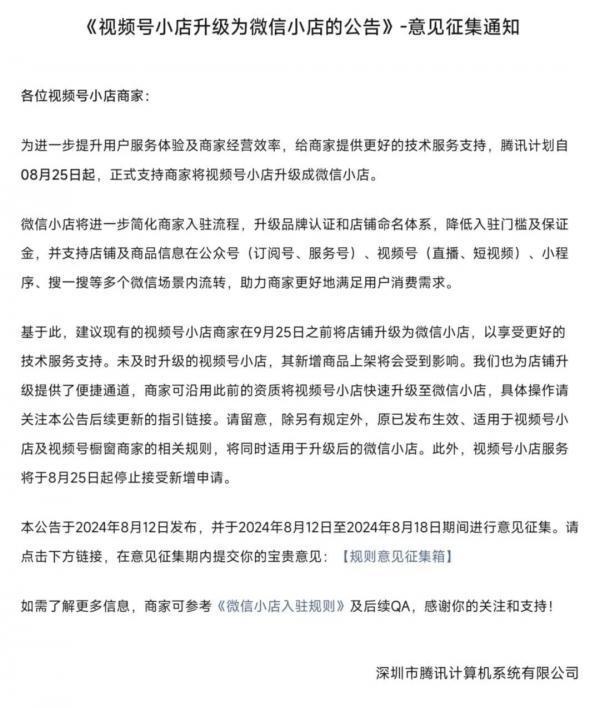

Just two days before the financial report, Tencent announced that it would upgrade video account shops to WeChat shops, sparking discussions among merchants about the future direction of e-commerce on video accounts.

While the financial report did not contain much data specifically about video accounts, the outside world's curiosity about Tencent's video account strategy has only intensified.

Halfway through 2024, how much untapped potential remains in video accounts? How far are they from catching up with Douyin? Can they shoulder Tencent's growth ambitions? Let's analyze it together.

01 Rapid Growth, but Still Lagging Behind Douyin, Yet Establishing a Presence Among the Top Players

Video accounts continue to accelerate their growth trajectory.

In this financial report, Tencent mentioned that the total user engagement time on video accounts increased significantly year-on-year. The development of video accounts has driven the growth of advertising business and gross profit. Additionally, thanks to the income from technical service fees for e-commerce on video accounts and the steady growth of cloud services, Tencent's enterprise services revenue achieved double-digit growth.

However, Tencent remains relatively secretive about specific performance metrics related to video accounts.

In the previous quarter, Tencent only disclosed the growth data for user engagement time, which exceeded 80% year-on-year. Among the limited data disclosed in the financial report, the revenue from video account advertising was revealed in the second quarter of last year, exceeding 3 billion yuan.

Still, the rapid growth of video accounts can be observed through data from third-party research institutions.

In terms of user data, video accounts have been in beta testing since early 2020 and, by 2023, their daily and monthly active user numbers closely trailed those of Douyin and surpassed Kuaishou.

According to a research report by Guohai Securities, in 2023, video accounts had 900 million monthly active users (MAU) and 450 million daily active users (DAU), with an average daily usage time of 54 minutes per user. Douyin, the primary competitor, had 1.1 billion MAU and 760 million DAU. Meanwhile, Kuaishou's financial report showed 700 million MAU and 374 million DAU at the end of 2023.

From a revenue perspective, video accounts still lag behind Douyin and Kuaishou but are in a rapid development phase.

Regarding Gross Merchandise Volume (GMV), Tencent has only mentioned in WeChat public lectures that GMV achieved nearly triple growth in 2023, without specifying the exact figure. However, according to a report by "LatePost", GMV for e-commerce on WeChat video accounts reached approximately 100 billion yuan in 2023.

Nevertheless, this 100 billion yuan figure is still less than one-tenth of Douyin's and Kuaishou's. Kuaishou's 2023 financial report indicated that its annual e-commerce GMV exceeded 1.18 trillion yuan for the first time. According to 36Kr, Douyin's e-commerce GMV was approximately 2.7 trillion yuan in 2023, with around 1.4 trillion yuan achieved in the first half of the year alone.

This does not diminish the fact that, as a latecomer in the short video space, video accounts have rapidly surpassed 100 billion yuan in GMV, securing a place in the industry.

Looking at top broadcasters on the platform, Douyin boasts influencers like Luo Yonghao, Dong Yuhui, and Sanyang, while Kuaishou has the Xinba Family. While video accounts have not adopted the centralized traffic approach of supporting superstar influencers, they have still nurtured a few benchmark cases.

Guo Yiyi, a popular e-commerce influencer on video accounts, achieved over 30 million yuan in GMV during a July 2023 live stream and exceeded 50 million yuan in total sales during the Singles' Day period.

Screenshot of Video Account

Another example is the Yan Yi Couple, who started their video account at the end of 2022, primarily showcasing their daily family life. They began e-commerce in May 2023 and, within a year, increased their monthly GMV from over 2 million yuan to over 20 million yuan per live stream.

Perhaps due to the impressive performance of video accounts in 2023, Pony Ma stated at the beginning of this year that Tencent would fully develop e-commerce on video accounts, making them the "hope of the entire Tencent empire."

02 Video Accounts Progress Slowly, While WeChat Ecosystem Moves Forward

In 2024, video accounts are a crucial business for Tencent, a fact that requires no further validation.

However, compared to video accounts themselves, Tencent may currently prioritize, or feel compelled to unleash, the potential of the WeChat ecosystem.

One indication of this may be found in the financial report's data disclosure. Despite the elevated status of video accounts, which were emphasized as the primary focus in the report, the data related to them remains limited.

Instead, the entire WeChat ecosystem shines brightly in Tencent's financial report. Tencent disclosed that WeChat had 1.371 billion monthly active users, with total mini-game revenue exceeding 30% year-on-year growth and total user engagement time for mini-programs growing by over 20% year-on-year.

Furthermore, Tencent has been continuously adjusting the structure of its video account team.

In May this year, WeChat announced that the video account live e-commerce team would be merged into the WeChat Open Platform (including mini-programs and official accounts) team, under the responsibility of the head of the WeChat Open Platform.

This adjustment suggests that the video account e-commerce team will further integrate with the WeChat ecosystem.

On August 12, Tencent announced that it would upgrade video account shops to WeChat shops, allowing them to display and circulate product information across platforms such as official accounts (subscription and service accounts), video accounts (live streams and short videos), mini-programs, and search functions.

Source: Tencent Official

This is interpreted as a step towards further integration of video accounts with official accounts, mini-programs, and other channels, enabling them to tap into larger public traffic dividends.

During the earnings call, Tencent President Martin Lau's explanation further corroborates this point.

Lau mentioned that after Tencent's recent repositioning of live e-commerce, it "resembles a WeChat e-commerce system" more closely.

In this system, WeChat not only builds an ecosystem based on video accounts or live streams but constructs an e-commerce ecosystem within WeChat itself, connecting it to the entire WeChat ecosystem, which will undoubtedly receive additional support from official accounts and live streams.

He also explained that this is somewhat similar to Tencent's mini-program ecosystem. "For years, the mini-program ecosystem seemed to generate little revenue, but when its potential is unleashed, massive user participation creates enormous value for online and offline merchants and content providers, becoming a significant revenue source for various sectors, including mini-games. This will also be Tencent's model for developing WeChat e-commerce."

This situation is not surprising. After all, from both user and merchant perspectives, the advantage of video accounts lies in the traffic dividends of the WeChat ecosystem.

You've probably heard the saying, "If you missed official accounts a few years ago, you can't afford to miss video accounts now." Some individuals who choose video accounts come from the WeChat ecosystem. For instance, as official accounts have become somewhat conventional, those operating within the WeChat ecosystem have turned to video accounts as their first stop in transitioning to short videos.

Others have joined due to the increasingly competitive e-commerce environment on platforms like Douyin and Kuaishou. For instance, the Yan Yi Couple came to video accounts because they found Douyin's environment too competitive, while video accounts offered a relatively untapped traffic pool.

To some extent, Tencent is mimicking Douyin by expanding the content ecosystem of video accounts through interest-based recommendations. Tencent's financial report emphasizes that the increase in user engagement time on video accounts is attributable to the optimization of recommendation algorithms.

However, unlike Douyin, video accounts possess a unique public-private domain integrated ecosystem. Their social networking model based on acquaintances and vast user base are their distinguishing features and advantages, offering small and medium-sized merchants an opportunity to break through.

Pony Ma is well aware of this, stating at the year-end meeting earlier this year that Tencent's crucial focus is not merely following others but combining its unique strengths to develop short videos centered on social networking among acquaintances.

In navigating e-commerce for short videos, Tencent is learning from Douyin but does not intend to rely solely on its path. Instead, by strengthening the WeChat ecosystem and creating an "e-commerce ecosystem," Tencent aims to forge a path untraveled by others.

03 Tencent Ultimately Relies on the WeChat Ecosystem

Video accounts carry immense hopes, with platform merchants flocking in to earn money through them, and Tencent looking to them for growth.

It's important to note that before the second quarter of this year, Tencent's domestic gaming business had declined for two consecutive quarters. The weakness of its flagship business has highlighted the importance of video accounts to Tencent. As expected, video accounts have begun driving growth in Tencent's two primary business pillars: advertising and ToB revenue from enterprise services.

No one can ignore the potential of video accounts. E-commerce on video accounts serves as Tencent's tentacle into the broader e-commerce and local services sectors. Tencent, which rose to prominence through social networking and gaming, aims to unlock its potential in broader markets. Amidst the dominance of Taobao and JD.com, Tencent seeks to carve out a share, and as Douyin and Kuaishou compete with Meituan, Tencent also aims to capture a piece of the local services pie.

However, it cannot be denied that video accounts are still in their infancy, and e-commerce on video accounts is in the early stages of transaction infrastructure development. For video accounts to truly take off, they cannot do without the vast WeChat ecosystem.

Source: Tencent Official

Pony Ma once described Tencent's potential as "old trees sprouting new shoots." Since then, Tencent's innovative and growth-oriented businesses have been referred to as "new shoots." Video accounts are among these new shoots, but as the financial report reveals, mini-programs and mini-games, also classified as new shoots, have already demonstrated robust vitality, becoming a driving force behind Tencent's growth.

To explore e-commerce and local services, Tencent must compete for market share amidst the giants, relying on a robust ecosystem to achieve higher-quality growth. By integrating products like video accounts, mini-programs, official accounts, and WeChat search, WeChat accelerates the circulation of traffic and connects the entire business system.

In previous earnings calls, Lau outlined a vision: "Search, mini-programs, and video accounts have deep ecological connections with WeChat, forming an ever-expanding content ecosystem. We believe that over time, Tencent's growth will continue to benefit from the sustained growth of these high-quality revenue streams, which are still in the early stages of commercialization."

Under this vision, the WeChat ecosystem remains WeChat's most solid foundation, and leveraging the combined strength of the WeChat ecosystem will lay the groundwork for Tencent's next takeoff.

Images sourced from Tencent's official website. Unauthorized use is prohibited.