Intel is anxious to compete with Qualcomm in the automotive market

![]() 08/19 2024

08/19 2024

![]() 491

491

Refusing to supply chips for the iPhone was a painful lesson that caused Intel to miss out on the entire mobile internet era. In the era of automotive intelligence, Intel knows that it cannot afford to miss out again.

Recently, Intel released its second product in the automotive sector, the ARC A760-A dedicated graphics card for vehicles. This product launch follows Intel's high-profile announcement at CES this year of its entry into the automotive market and the release of its automotive cockpit SoC.

According to Jack Weast, Intel's Vice President, the dedicated graphics card for vehicles is primarily intended to meet the display and large model computing requirements of automotive cockpits. Specifically, the graphics card boasts 229TOPS of computing power and is equipped with 16GB of DDR6 memory, enabling automotive manufacturers to deploy large models with up to 14B parameters.

In terms of specifications, Intel's computing power allocation is quite generous, essentially exceeding the current requirements of automotive smart cockpits.

Moreover, as Intel's flagship PC graphics card brand in recent years, the ARC series also supports eight independent displays simultaneously displaying 4K content in automotive applications. Jack even boasts that users can "play the top PC games in the car."

Perhaps continuing the trend of graphics cards evolving from integrated motherboards (or SoCs) to standalone units during the PC era, Intel's automotive graphics card aims to capitalize on the gap between Qualcomm's integrated cockpit SoCs and NVIDIA's autonomous driving chips. It seeks to address the growing demand for large AI models in smart automobiles and potential future requirements for intelligent driving capabilities on the vehicle side.

The redundant computing power and show of strength reflect Intel's eagerness to enter the smart automobile market, hoping to create a miracle with its efforts.

Scheduled for deployment in vehicles in 2025, this graphics card holds significant meaning for Intel. After suffering defeats in the AI chip business to NVIDIA and trailing Qualcomm in mobile devices, Intel hopes to make a comeback in smart automobiles.

"Intel had a five-year hiatus, but now we will reclaim what we have lost," Li Zhe, Intel's Sales Director for Automotive Business, declared after the press conference, setting such a goal.

For Intel, which is currently facing declining profitability, plummeting market value, and process failures in its new-generation CPUs, seizing the automotive chip market has become a "last resort."

Defining smart automobiles from a PC perspective: Intel provides redundant computing power

In Intel's view, smart automobiles may be closer to PCs.

This is evident from the specifications of the graphics card. According to its specifications, Intel's automotive graphics card is essentially a "automotive-grade" adaptation of existing desktop-grade graphics cards. In addition to meeting the necessary capabilities of wide temperature range, reliability, and stability for automotive use scenarios, it also supports various drivers, media decoding formats, and virtualization (SR-IOV) for PC application scenarios.

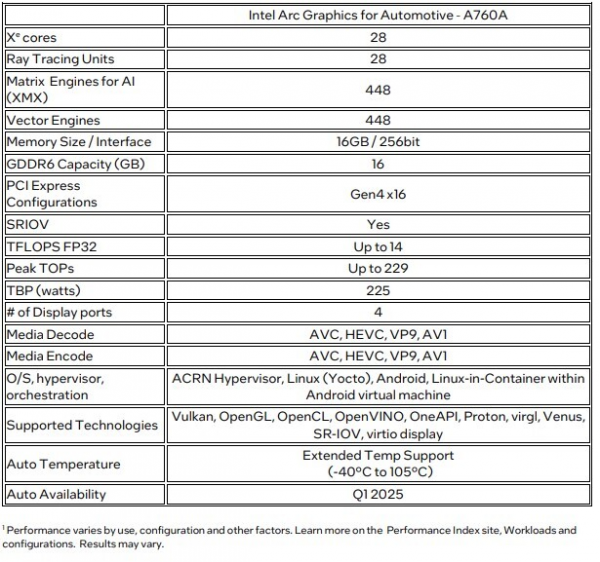

Image: ARC A760-A specifications (Source: techpowerup)

This approach is primarily a result of Intel leveraging its existing experience. On the one hand, in designing the chip, Intel drew inspiration from Qualcomm's 8295 chip, which reused the Snapdragon 888 design, and adapted its existing graphics card series to create this automotive graphics card. On the other hand, leveraging its past experience in PCs and data centers, Intel further proposed the concept of aligning automotive intelligence with hardware such as PCs.

"PCs, data centers, and current automobiles share significant similarities. From a software architecture perspective, the underlying system level of automobiles is more akin to data centers, requiring consideration of various aspects such as virtualization, different domains, and security. However, the upper-level experience of AI applications is very similar to that of PCs. Some traditional legacy applications in automobiles are based on mobile platforms," explained Li Ying, Vice President of Intel and General Manager of Intel China's Software and Advanced Technology Business Unit.

Unlike the industry consensus that automobiles are more like smartphones, Intel aims to extend the AI transformation seen in PCs to automobiles. "Thanks to our experience in AIPC, the in-vehicle platform has also achieved rapid adaptation with large models in China," said Gao Yu, General Manager of Intel China's Technology Department.

Regarding AI capabilities, Intel's automotive graphics card offers far more computing power than Qualcomm's 8295 chip, with up to 229TOPS to support large models with over 14B parameters deployed on the client side. Leveraging its abundant computing power, Intel's automotive graphics card can simultaneously run multiple "smaller" large models, transforming a range of application scenarios such as travel assistants, health managers, and business secretaries with AI large models.

However, Intel's vision may be slightly "ahead of its time."

Judging from the current smart cockpit designs of leading smart automobile manufacturers, the AI applications in cockpits are still far from requiring high computing power. Although smart automobiles commonly feature AI assistants, recent updates from companies like NIO (Banyan), XPeng (Tianji), Great Wall (Coffee OS), and HarmonyOS Automotive focus primarily on interaction logic, functional design, and seamless in-vehicle experiences rather than computing power. Automotive manufacturers currently prefer solutions like the dual Qualcomm 8295 chips in the ZEEKR 009 or Huawei's rear-seat "external" tablet approach to meet display demands.

If we consider the camera input capabilities supported by the Arc A760-A and Intel's potential involvement in integrated cockpit and driving solutions, the parameters of this automotive graphics card appear somewhat awkward.

Although in terms of graphics card memory bandwidth, which is a bottleneck for large intelligent driving models, the Arc A760-A (with a reference value of 560GB/s for the A770, though actual specifications are not specified) is unlikely to be less than NVIDIA's Orin X's 204.8GB/s. However, considering actual computing power, Intel's automotive graphics card falls short of NVIDIA's Orin X and is significantly inferior to NVIDIA's next-generation intelligent driving chip, the Thor, with 2000TOPS of computing power.

Future smart automobiles will undoubtedly require greater cockpit computing power. However, in the face of current mainstream automotive cockpit chips, Intel's significant computing power redundancy raises questions about cost control, which may be of utmost concern to automotive manufacturers who are highly price-sensitive.

Is automotive the last resort for Intel facing setbacks?

Once the pride of the PC era, Intel now finds itself in a low morale state. Laying out a strategy for smart automotive chips may be Intel's most prudent choice in over a decade.

Intel's current crisis is evident in the "sluggish" performance of its second-quarter 2024 financial results released in August. The report showed that Intel's quarterly total revenue was $12.83 billion, a year-over-year decline of 0.9%, with net losses expanding from $381 million in the previous quarter to $1.61 billion.

Intel's poor financial performance stems from its inability to capitalize on the "era dividend" in the AI age.

Since Intel's revenue primarily comes from its Client Computing Group (CCG) and Data Center and AI Group (DCAI), analyzing the growth of its core businesses reveals Intel's "comprehensive lag" in the AI era.

Among them, the CCG (mainly PCs) was the only segment to see growth in Q2 2024, achieving revenue of $7.41 billion, up 9.3% year-over-year. However, considering the trend of AI-driven PC generational upgrades in 2024, Intel did not secure excess returns.

On the surface, amid the global PC shipment recovery trend, Intel's 9.3% revenue growth "kept pace" with the industry's 5.4% shipment growth. In contrast, AMD, another player in the PC CPU market, although still relatively small in size, is "eroding" Intel's CCG growth space with revenue of $1.492 billion and a year-over-year growth rate of 49.5%, according to its Q2 2024 financial results.

On the other hand, in the DCAI segment (excluding the impact of Intel's spin-off of the Altera business in Q1 2024), Intel's actual revenue for the quarter was approximately $3 billion, down 3% year-over-year. This can almost be described as a "unique performance curve" in an era of high demand for AI computing power.

While new demands in data centers (or intelligent computing centers) in the AI era also drive demand for CPUs, most of this demand is bundled within the product portfolios of vendors like NVIDIA and AMD. In other words, in the AI computing era, Intel remains primarily a "CPU specialty store."

NVIDIA Compute Solution Configuration List (Source: NVIDIA)

Intel's current decline is not merely the result of its CPUs being outpaced by GPUs in the AI era but rather a cumulative effect of consecutive strategic missteps.

In 2006, before the global smartphone boom, Intel declined an opportunity to supply chips for the iPhone. By missing out on the iPhone, Intel "missed" an entire mobile era and ultimately paved the way for Apple to develop its own suite of chips and toolchains, ultimately leading to a complete split with Intel on the Mac side.

At the dawn of AI's practical value (2017-2018), Intel passed up an opportunity to acquire a stake in OpenAI, citing the inability of generative AI to enter the market short-term and the inability to quickly realize investment returns.

The opportunity Intel seized was the IDM 2.0 plan implemented at the dawn of AI's popularity (2021-present). In essence, IDM 2.0 involves Intel designing and manufacturing its own chips while also offering foundry services to others and outsourcing some of its production to other foundries. Corresponding to this plan, Intel embarked on a lengthy and capital-intensive process of building fabs and outsourcing some cutting-edge products to TSMC.

However, given Intel's gradual decline in the AI era, its fab construction and advanced process foundry services have ultimately become a "double-edged sword." With net profits eroded and manufacturing faults in the 13th and 14th generation chips, Intel provided a third-quarter 2024 earnings guidance far below market expectations.

Furthermore, coupled with the gradual "elimination" of Intel's autonomous driving subsidiary Mobileye in China's smart automotive market by players like LIXIANG and ZEEKR, and the loss of market share in autonomous driving solutions to Horizon Robotics, Intel's direct involvement in the smart automobile sector has become an "unavoidable" choice.

H1 2024 Market Share of Intelligent Driving Solutions for Chinese Independent Brand Passenger Vehicles (Source: Gaogong Automotive)

Amid the intense competition in China's smart automobile market, Intel recognizes the importance of continuous technological leadership and forward-looking R&D. "We in the US may not yet see this change, but it is unfolding globally. Emerging electric vehicle players from China and Southeast Asia are building cars around batteries and computers," Jack remarked at CES this year.

Perhaps by leveraging the trend of automotive intelligence, Intel can also seize the "east wind" of the AI era. However, with Intel's entry, the automotive chip market landscape has entered an era of intense competition.

The Spring and Autumn Warring States Period of Automotive Chips

In fact, the automotive cockpit chip market is already highly contested.

Driven by the need for automotive intelligence upgrades, traditional automotive cockpit chip manufacturers (such as NXP) are primarily shipping chips for existing projects, with their market share gradually declining year over year. The overall market is undergoing a generational shift in cockpit chips.

According to the "Top 10 Deliveries of Passenger Vehicle Cockpit Chips in the Chinese Market in H1 2024" report by Gaogong Auto, Qualcomm ranks second with a market share of 23.72%. Meanwhile, consumer chip manufacturers like MediaTek, NVIDIA, Intel, AMD, and Hisilicon, which specialize in entertainment and high-computing domains, are participating in the market segmentation process, albeit with smaller market shares currently.

Ranking of Passenger Vehicle Cockpit Chip Deliveries in the Chinese Market in H1 2024 (Source: Gaogong Auto)

Among them, MediaTek is waging a price war in the smart automobile sector, offering chips at prices generally 30 dollars cheaper than competitors. Following its success in the smart driving chip market, NVIDIA is deepening its influence in the automotive cockpit sector with its AI chip + CUDA intelligent automobile ecosystem architecture and the upcoming integrated cockpit and driving chip, Thor. As for Hisilicon, it primarily benefits from Huawei's collaboration with automakers to bring HarmonyOS to vehicles.

However, amidst the "civil war" among chip manufacturers, automakers and Tier 1 automotive suppliers are also seeking to get involved. The primary reason is that the overall cockpit solutions offered by chip manufacturers are "somewhat expensive."

Taking Qualcomm's cooperation model as an example, the price of a single Qualcomm 8155 chip is approximately $180, while the 8295 costs around $300. Moreover, to utilize this chip effectively, automakers must also bear development license fees, project service fees, and the cost of developing teams for chips and applications. Given these factors, it is no wonder that some automakers are considering developing their own chips. For instance, ECARX, a subsidiary of Geely Automobile, has collaborated with Xintec to develop an integrated chip for cockpit, autonomous driving, and parking functions. Similarly, as NIO recently successfully taped out its smart driving chip, the release of its cockpit chip is not far off.

The "chaotic" state of the automotive cockpit market means that Intel faces pressure from the entire industry chain. In addition to competition from fellow chip manufacturers and automakers' scrutiny of service capabilities, Intel must also collaborate with third-party partners to "bolster its reputation." However, with key partners at this press conference limited to SenseTime (primarily for DMS and OMS systems), Zhipu.AI (for AI large models), and Thundersoft (for in-vehicle infotainment displays), Intel's efforts in this regard clearly have a long way to go.

However, as AI changes all smart terminals, Intel's use of computing power and AI capabilities as an entry point for automotive cockpits undoubtedly captures the industry trend. After all, no player can currently provide a suitable answer to the question of how automotive cockpit AI can demonstrate differentiated capabilities. Cockpit AI, which is dominated by assistants, is far less advanced than the end-to-end large model applications of AI in autonomous driving.

Perhaps the relatively blank field of AI applications in automotive cockpits provides Intel and other competitors with an opportunity to start on an equal footing. However, regardless, entering the smart automotive chip market is one of the few remaining opportunities for Intel.