DJI Cuts Prices Across Multiple Products: Can the Consumer Drone Monopolist Escape 'Anxiety'?

![]() 10/15 2025

10/15 2025

![]() 469

469

For DJI, price cuts are just the first step in addressing crises. Balancing user trust with market expansion, achieving cross-scenario migration of technological advantages, and uncovering new value in saturated markets will be crucial future challenges.

As the leader in the consumer drone sector, the low-profile DJI has found itself briefly embroiled in public controversy, recently topping Weibo's trending list.

'I just bought the Pocket 3 All-in-One Set for 4,838 yuan, and within ten days, it dropped by 900 yuan. Yet, offline purchases don't qualify for the online price protection policy,' complained some consumers on social media.

In October 2025, DJI suddenly launched a new round of price cuts, sparking a flurry of social media roast (tucao, meaning 'complaints') like 'stock trading in the tech circle' and 'early buyers lose out.'

Looking back, a seemingly routine promotion hides established corporate strategies, but deeper down, it reveals the drone giant's growth anxiety.

As the absolute monopolist with over 70% of the global consumer drone market, DJI once rested easy behind its technological and channel 'moats.'

Now, voluntarily breaking price barriers may stem from various product pressures, yet it also signals survival instincts amid industry upheaval. At the very least, the price cuts not only sting users but also reflect hidden concerns behind the 'strong get stronger' myth in the smart hardware industry.

Furthermore, this signals the potential beginning of dismantling the absolute monopoly myth in the entire consumer drone sector.

01 Are the Price Cuts a Sign of Helplessness?

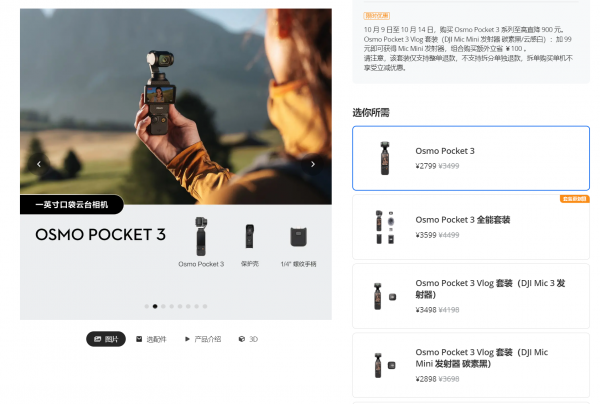

Analyzing the specific products in this round of price cuts, DJI's reductions from October 9 to October 14 are substantial: the Pocket 3 Standard Edition drops by 700 yuan (3,499→2,799 yuan), the Action 4 by up to 1,129 yuan, and the Mini 4 PRO by 1,478 yuan.

'Price adjustments are common in the smart hardware industry, including phones and PCs, but DJI rarely took the initiative to adjust prices over the years. This 'first drop' leads us to speculate they're either preparing for new product iterations or aiming to crush competitors,' said a DJI distributor.

Typically, following the GTM (Go To Market) strategy prevalent in consumer electronics, a product's sales momentum fluctuates from launch to end-of-life. Take the Pocket 3: since its November 2023 launch, it initially commanded a premium, with total sales exceeding 10 million units.

Now, nearly two years into its lifecycle, clearing inventory through price cuts to pave the way for next-gen products aligns with commercial tactics, assuming original supply-demand and material plans remain balanced.

However, seemingly reasonable explanations have subtle nuances: 'minimal promotion, short cycle.'

These traits suggest a focus on efficiency-driven tactics, potentially tied to old product clearance speed and competitive pressures. In other words, on one hand, firms must accelerate inventory turnover during pricing windows; on the other, Insta360's August announcement and public beta of its panoramic drone, the 'Yingling Antigravity A1,' directly encroaches on DJI's core business, exerting pressure.

This implies DJI's price cuts may be a 'counterattack' against Insta360's relentless offensive, aiming to regain market attention through stronger pricing and presence.

Objectively, due to shifting external environments, the consumer drone sector is no longer DJI's exclusive playground. XAG's Consumer 2 series targets the mid-range market with a 'half-price, same specs' strategy, while Insta360 leverages synergies between action cameras and drones to capture young users.

Additionally, upgraded phone stabilization and widespread AI editing tools have led many potential users to abandon dedicated aerial devices for more cost-effective camera options. Consumer drones have shifted from 'novelty products' to 'upgrade products,' with users making more rational decisions, significantly narrowing the 'technological premium' space.

The essence of this price war reflects an industry growth logic shift driven by multiple factors.

02 Can Integrating the 3C Ecosystem Spark a Second Growth Curve?

Even without price cuts, DJI faces growth challenges.

Previous reports indicate DJI's revenue surpassed 80 billion yuan last year, up 35% year-on-year, with net profits reaching 12.056 billion yuan. Considering its high-ticket products like drones, DJI theoretically boasts strong scale and profitability. However, some distributors reveal DJI still seeks new, larger commercialization opportunities.

Another industry insider close to DJI noted, 'While DJI lacks mature rivals in drones, we distributors have store expansion targets.' DJI's official website (official website) also shows ventures into 3C ecosystem products like robotic vacuums and power banks.

When a company starts exploring deeper growth in its core category or new ventures, it's often due to a maturing industry Dividend cycle (bonus cycle) or weakening moats.

Breaking it down, in the main track (track), CIResearch data shows China's consumer drone market growth slowed from 45% in 2020 to 18% in 2024—not ideal for DJI.

Regarding moats, DJI isn't entirely secure. Its consumer drone monopoly relies on dual barriers of technology and channels.

Technologically, its annual R&D investment stays around 15%, building a formidable patent wall of nearly 40,000 items. Its flight control system achieves centimeter-level positioning with proprietary algorithms, the Inspire 3 supports 8K 120fps professional shooting, and its image transmission enables high-definition long-distance transmission—core technologies underpinning product competitiveness.

Channel-wise, distributors note DJI's strict offline control: 'Many want to join, but entry isn't easy. Beyond standard channel access and price controls, authorized agents face stringent management. Unsuitable ones may be culled within a year or two. For stores, DJI demands prime locations and high branding standards.'

While less cutthroat than smartphones, DJI maintains rigorous channel and retail management, prioritizing quality over quantity, with nearly 500 authorized offline stores leading the industry.

Yet, successful firms face constant challenges. Many aim to replicate DJI's success or breach its moats, particularly tech giants.

Besides Insta360 and XAG, OPPO and Vivo are developing Pocket-like projects. Lujiu Business Review (Lujiu Business Review) learned Vivo has assembled a 'nearly 100-person team' for a product expected next year, while Honor considers similar ventures. Xiaomi and Hohem collaborated on a gimbal camera, positioning it as a 'pocket camera' for the mid-low end.

All signs indicate DJI needs change. Frankly, its price cuts already signal 'anxiety.' To alleviate it, crossing into smart home appliances and other 3C sectors becomes vital for a second growth curve, with robotic vacuums as a priority.

However, this crossover journey is fraught with opportunities and challenges. Take this year's ROMO P robotic vacuum, equipped with dual-lens fisheye sensors—DJI's first crossover product generated modest buzz.

From an advantage perspective, DJI's crossover has natural foundations: accumulated sensor technology and algorithms directly apply to ground devices, while its mature, high-standard channel system enables rapid market penetration.

With deeper layout (layout), DJI could build an 'air-ground integrated' smart space ecosystem, with drones handling outdoor mapping and security patrols, and ground devices managing home cleaning and environmental monitoring, creating synergistic scenarios.

Yet, the smart appliance market is brutally competitive. Robotic vacuums are dominated by Xiaomi, Ecovacs, Roborock, and Yunjin, controlling over 90% of the market, with severe product homogenization and price wars spanning from budget to premium segments.

Users prioritize obstacle avoidance precision, cleaning efficiency, and battery life—metrics requiring long-term ground scenario data accumulation, fundamentally different from aerial scenarios.

Whether DJI's aerial tech advantages can translate to ground competitiveness remains uncertain. More critically, with diminishing government subsidies and an uncertain real estate market, new entrants face higher costs to capture market share, potentially diluting DJI's channel edge in this red ocean.

The success of this crossover venture will significantly impact DJI's ability to break through growth ceilings.

03 The Consumer Drone Monopoly May Be Reshaped

Returning to the consumer drone sector, DJI's crossover into the 3C ecosystem reflects not just business realignment but signals an impending industry reshuffle.

Historically, consumer drones integrated technologies from flight control, imaging, and materials, creating high entry barriers. The market was far more concentrated than the industrial drone sector, which, due to fragmented scenarios, exhibited 'high growth, low concentration' traits. In contrast, consumer drones formed a head monopoly, leaving DJI with few true rivals for a decade.

While DJI's monopoly remains unshaken short-term, long-term technological democratization and market shifts are eroding its moats, potentially ushering in a diversified competition era.

Notably, AI democratization is cracking early monopoly barriers.

Once, DJI's proprietary flight control and obstacle avoidance algorithms were key patents. Now, with open-source AI frameworks and declining computational costs, many SMEs access high-quality algorithm support. Some emerging brands, leveraging third-party AI solutions, achieve comparable intelligent obstacle avoidance and auto-tracking to DJI, rapidly narrowing the tech gap.

At the product level, market differentiation opportunities abound.

Take the DJI Pocket 3's lack of waterproofing, limiting its use in rain or swimming. Phone giants, with inherent advantages, see this as a prime opportunity for new product development.

From a smart hardware lifecycle perspective, all products follow 'introduction-growth-maturity-decline' stages. Even giants like DJI cannot defy industry laws.

The consumer drone shift from 'blue ocean' to 'red ocean' reflects inevitable market maturation, where intensified competition drives tech diffusion and price declines—a trend DJI's price cuts echo.

Looking back, as with this year's seismic changes in the food delivery market, business competition is ever-evolving.

For DJI, price cuts are just the first crisis response. Balancing user trust with market expansion, migrating tech advantages across scenarios, and uncovering new value in saturated markets will define its future.

For users, rather than fixating on short-term price swings, anticipating innovative products from this competition is wiser. Ultimately, in the tech-market tug-of-war, consumer choice reigns supreme.