Eight-Day Holiday Sparks Fierce Competition in Intelligent Driving Sector

![]() 10/16 2025

10/16 2025

![]() 507

507

By Wu Xiubo

During the recent National Day holiday, the transportation sector witnessed a surge in activity, while intelligent driving brands maintained a notable silence.

According to a CCTV.com report, an average of 12.5 million new energy vehicles (NEVs) took to the roads daily during the holiday, marking a 30% year-on-year increase and a 70% surge compared to regular days. This immense travel demand created complex traffic scenarios, offering an ideal testing ground for intelligent driving products.

Historically, the National Day holiday has served as a key moment for automakers to showcase their intelligent driving advancements. In 2023, brands such as NIO, XPENG, Li Auto, Zeekr, and Avatr released travel reports in the first week post-holiday. In 2024, dubbed the "first year of intelligent driving" by the industry, Huawei and Li Auto rushed to publish their intelligent driving reports within 48 hours of the holiday's end.

However, this year, following the golden week's record-breaking travel volumes, automakers have remained conspicuously quiet. To date, among leading NEV manufacturers, except for Huawei and Xiaomi, most have ceased publishing intelligent driving-related reports on their information channels.

This silence coincides with significant developments in the new energy industry, marking another frontier in the intelligent driving race.

Public information reveals that in the first week post-National Day holiday, both XPENG and NIO underwent major personnel and organizational restructuring in their intelligent driving teams, with several senior executives affected. Notably, XPENG replaced its head of intelligent driving, with Li Liyun stepping down as leader of the Autonomous Driving Center and Liu Xianming, the leader of the World Base Model, assuming the position.

The absence of reports and the executive turnover amidst contrasting stillness and activity signal a subtle shift in the sector's competitive landscape, transitioning from the "first year of intelligent driving" in 2024 to the "first year of universal intelligent driving" in 2025.

1. The First Year of Universal Intelligent Driving: Industry Adopts New Strategy

From the decline in report volume to business team restructuring, a clear trend has emerged: the industry is shifting its focus from numerical penetration rates to "cutthroat" technological competition in the transition to universal intelligent driving.

This shift is evident in the intelligent driving data released by automakers. Taking Huawei's ecosystem as an example, public data shows that during the 2025 Golden Week, Huawei Qiankun intelligent driving cooperative models achieved 294 million kilometers of assisted driving, including 243 million kilometers on highways and 51 million kilometers in urban areas.

Compared to last year's National Day data, two notable changes have occurred. Firstly, the total mileage of intelligent driving has surged. During this year's National Day holiday, Huawei's models recorded 3.4 times the intelligent driving mileage of the same period last year, with active users of assisted driving reaching 90.8%. Secondly, the proportion of urban assisted driving has seen a slight increase, accounting for 17.3% of the total mileage, though the average speed in urban areas decreased by 1.5 km/h compared to last year.

These figures indicate that for NEV manufacturers, convincing users to try intelligent driving on highways is no longer a challenge. Instead, the true obstacle to universal adoption lies in urban areas, characterized by narrow streets and frequent accidents.

For automakers struggling in the competitive market, after competing on features like in-car refrigerators, TVs, battery range, and charging efficiency, the ability to introduce reliable L3 and L4 level intelligent driving in urban areas first will enable them to gain a competitive edge in both the capital and consumer markets.

From a technological perspective, urban intelligent driving is where the "long tail" of past technological routes lies. Since Tesla pioneered the end-to-end route in 2019, this method of training intelligent driving models through actual road test data collection has been widely adopted. However, it has also exposed shortcomings in subsequent deployment scenarios, particularly in urban areas where sudden appearances of electric bicycles, pedestrians, complex road sections under temporary closure for repairs, and illegally driving vehicles pose significant safety threats. These "killers" are unlikely to appear frequently in traditional road test data, making it difficult for intelligent driving models to learn and provide feedback from these fragmented, occasional data points.

The limitations of the end-to-end model have made the demand for "route innovation" in intelligent driving increasingly urgent. Over the past two months, from Li Auto, XPENG, and Yuanrong Qixing's official announcements of integrating VLA large models into their vehicles to Huawei and NIO's frequent emphasis on WA models, a "great age of discovery" surrounding new intelligent driving technologies has quietly arrived.

As we transition between old and new eras, how will the remaining players choose their paths?

2. How Will the "Straight-A Students" Pass the Intelligent Driving Exam?

To date, leading brands have developed three evolutionary approaches in response to the industry's traditional end-to-end model.

Using learning as an analogy, Momenta, representing the "reformist" approach, believes that the issue lies in the "learning process" of intelligent driving. The traditional end-to-end model does not provide high-quality data for large models, and the "trial and error" and "rewards" in the learning process are not prominent enough. Thus, Momenta advocates for replacing the traditional route with a reinforcement learning-based one-stage end-to-end model. Compared to large models that solve traditional educational problems, Momenta's R6 Flywheel Large Model, which practices with "Huanggang Dense Exam Papers," has indeed shown improved performance in handling complex problems, such as detouring around construction zones and avoiding obstacles at night.

In contrast, the "pragmatist" approach represented by Li Auto, XPENG, and Yuanrong Qixing focuses on optimizing "exam details." Road driving, like exams, requires specific analysis of each problem, regardless of how many similar questions have been encountered before, and constant vigilance for hidden traps in the questions. Even top-performing large models in the field of intelligent driving must analyze specific issues and develop comprehensive abilities in "observation, reasoning, and decision-making." This is precisely the origin of the VLA technological concept. Unlike the "data mapping" of traditional end-to-end models, the VLA system integrates three modalities—vision, language, and action—enabling it to convert visually perceived information into language descriptions, perform logical reasoning through language models, and ultimately output specific action instructions. It can even predict road conditions over extended periods of tens of seconds.

The cost of this approach is evident. Due to the additional step involved, VLA's demand for computing power and data far exceeds that of all traditional intelligent driving models. Media calculations indicate that the cost of a single VLA training session reaches 1.5 times that of DeepSeek-V3. To support this, brands like XPENG and Li Auto have had to increase their investment in computing power, establishing massive cloud training clusters to sustain the daily training of VLA models.

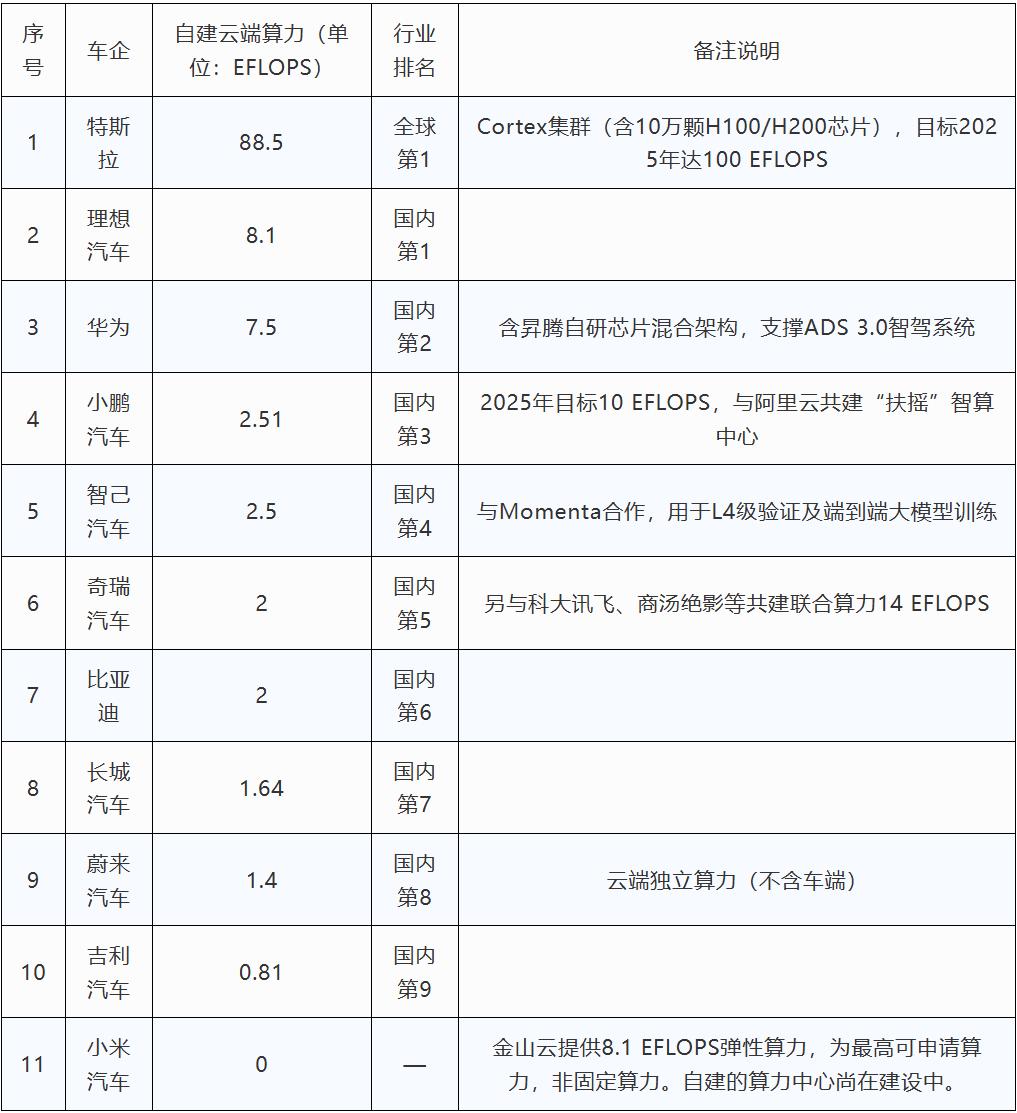

Public data shows that as of August this year, among global automakers' cloud computing power rankings, Tesla leads with approximately 100 EFLOPS, while other leading intelligent driving brands such as Li Auto (8.1 EFLOPS), XPENG (10 EFLOPS), and Xiaomi (11.4 EFLOPS) have computing power that is generally an order of magnitude lower. Brands like NIO, which are two orders of magnitude lower, have cloud computing power that is almost insufficient to support efficient VLA training.

Even so, for some brands, the current performance of VLA is still insufficient to meet their needs. In the view of the "idealists," represented by Huawei and NIO, both traditional end-to-end models and VLA essentially rely on the "excessive practice" of feeding large amounts of road test data. Instead of excessive practice, directly understanding the textbook and exam syllabus is the key to enabling intelligent driving to generalize and fear no exams. This has given rise to the most aggressive technological route in the field of intelligent driving: WA (World Model).

Unlike VLA's "vision-text-decision" logic, the core of the WA route is to simulate reality in the cloud, creating a "virtual digital world" for intelligent driving to replicate. This allows intelligent driving models to fully learn and understand the logic of the real world in the virtual world, enabling them to navigate real-world driving scenarios with ease. Wang Jun, the head of Huawei ADS R&D, once provided a vivid analogy: "If we compare the intelligent driving system to a student, VLA approaches exams by doing a massive amount of practice questions and may be at a loss when encountering unfamiliar questions. In contrast, WA first understands the knowledge points and can derive answers through logical reasoning, regardless of the new questions encountered."

Similarly, Li Bin of NIO once stated in an internal email, "WA enables the car to possess 'imagination' rather than just 'memory.'" It is worth mentioning that Liu Xianming, the newly appointed head of XPENG's intelligent driving division during this personnel adjustment, was previously the leader of the World Base Model. This has been interpreted by the outside world as XPENG's move towards the WA technological route.

Of course, the most aggressive technological route also faces the most severe challenges. In addition to the even more daunting costs and R&D investment compared to the VLA route, the current stage of WA's implementation is far from being truly usable and effective.

In contrast, VLA has already been integrated into products and has become a core selling point to attract consumers. To date, Li Auto's first all-electric SUV, the i8, which premiered in July this year, has already implemented the VLA large model "on board." Meanwhile, after an OTA upgrade in September, XPENG's G7 Ultra has also been equipped with the latest VLA model.

In comparison, Huawei and NIO, which have embraced the WA model, are still on the "eve" of the technological breakthrough critical point. For many other brands, the final whistle has not yet blown, and the brutal competition in the intelligent driving industry continues.

3. The Qualifying Rounds Are Over, and the Elimination Rounds Begin

If we compare the current competition in intelligent driving to a football tournament, in the past, brands were only vying for "qualification." Now, the basic qualifying rounds are over, and brands are about to face real, intense elimination rounds. In the new battle for the "first year of universal intelligent driving," how to stay in the game presents an even more brutal competition.

As He Xiaopeng stated in March this year, "Today, no brand dares to claim a secure position. The elimination rounds are over. Everyone faces challenges, some bigger than others."

Returning to the "intelligent driving battlefield" that automakers collectively believe in, today's competition in intelligent driving is no longer about the debate between "maps and LiDAR" but rather a new battleground for full-stack R&D capabilities and ecological collaboration in technology.

Among these, two trends have gradually emerged. In the short term, due to the lack of a truly disruptive user experience in intelligent driving, the competition between WA and VLA, both in the first tier, may not immediately produce a winner. However, it is certain that behind the fierce competition among leading brands, small and medium-sized intelligent driving manufacturers that "cannot keep up" are already facing the risk of being phased out.

Previously, media statistics revealed that among unlisted intelligent driving companies, two have encountered bankruptcy liquidation, two are facing bankruptcy reorganization, and several are embroiled in acquisition and integration disputes. Behind this, on the one hand, is deterrence from extremely high costs. VLA relies on excessive investment in computing power and data. Public data shows that the cloud training clusters of domestic small and medium-sized automakers generally remain at 0.2-0.6 EFLOPS, only one-tenth of Li Auto's 5.39 EFLOPS. Zhou Guang, CEO of Yuanrong Qixing, pointed out that an intelligent driving company needs to deliver mass-produced vehicles on a scale of 100,000 units to establish the basic data foundation for building a VLA architecture.

On the other hand, is deterrence from the demand for integrated capabilities. In the past, small and medium-sized automakers could rely on a "patchwork" approach, standing on the intelligent driving stage by "buying chips, algorithms, and annotations." However, as the competition in intelligent driving enters deeper waters, leading players are constructing their technological barriers through a self-developed closed loop of "chips-data-models," forcing the supply chain ecosystem to make choices.

From a long-term perspective, despite the potential divergence in technological pathways, all roads ultimately converge at the same destination. Vehicle-Level Automation (VLA) and World-Level Automation (WA) are not mutually exclusive; rather, VLA emphasizes practical implementation, whereas WA is oriented towards future advancements.

It's worth noting that XPENG is adopting a dual-track strategy. At present, the vast majority of new energy vehicle manufacturers have not attained self-sufficiency. Even those that have, find their resources insufficient to sustain intelligent driving R&D investments on a scale of billions. Whether pursuing VLA or WA, these manufacturers cannot proceed without the support of the capital market.

By implementing VLA in vehicles to attract users and using WA as a strategic bet to appeal to investors, XPENG is, without a doubt, taking a bold and risky step compared to other automakers that follow a more gradual approach.

Regarding the returns from this high-stakes move, the market will undoubtedly provide a clear verdict, either by the end of this year or, at the latest, next year.