Has Toyota finally made up its mind to bet on hybrids again?

![]() 08/19 2024

08/19 2024

![]() 638

638

The future of the automotive industry has never been about a simple debate over powertrains.

Toyota, the world's largest automaker, has once again made a significant change in its largest single market that supports its sales. Recently, Reuters reported that Toyota is working to convert all or almost all of its North American product lines to hybrid vehicles.

This news sparked much discussion. Why has Toyota, which has traditionally been cautious about new energy vehicles, abandoned its stance on gasoline-powered cars? After all, Toyota's former president Akio Toyoda, a die-hard fan of gasoline cars, demonstrated his drifting skills during a recent trip to Shanghai.

From an outsider's perspective, the demand for new energy vehicles in the North American market is far less than that in the Chinese market, and the North American market remains Toyota's largest overseas profit cow.

According to financial reports, Toyota's sales in the North American market accounted for 29.62% of its global sales in 2023, surpassing even its home market and the Asian market. Furthermore, the North American market contributed 12.6% of Toyota's profits, second only to Japan and Asia.

It can be said that Toyota, which has stuck to its guns, still made a fortune in 2023. Behind the significant changes in the North American market lies profound thinking.

Two Considerations, One Goal

In fact, starting from the second half of the year, Toyota began promoting its hybrid models in multiple markets. On July 17, Toyota showcased its latest Prius hybrid model ahead of the Indonesia International Motor Show. The new cars on display included a gasoline-electric hybrid and a plug-in hybrid, both of which will be sold in Indonesia through imports.

Except for a few markets like China, where sales have been hindered, Toyota's hybrid models have been in high demand in the North American market. For example, in the US market, some consumers reported that Toyota's Corolla hybrid models required a price increase of more than 30% and even a delivery period of more than six months.

It's worth noting that in China, products like the Corolla Hybrid have fallen into a situation where they are discounted heavily to promote sales. Some netizens have commented sarcastically that the US market is not as discerning as the Chinese market.

However, it is undeniable that in the US market, which lacks strong competitors, Toyota remains the best-selling brand. Especially when compared to domestic brands like General Motors, Japanese products are known for their durability and affordability, which appeal to ordinary consumers.

But challenges are also coming with the US elections. Back in March this year, the US government issued a restriction order to curb emissions, requiring that average vehicle emissions be halved by 2026.

This move has increased the demand for new energy vehicles in the US market. According to statistics, sales of Toyota's new energy vehicles in the US market have increased by 45% year-on-year since the beginning of this year, far exceeding its overall growth rate.

And Toyota is not the only beneficiary. Honda has also seen growth, with its CR-V and Accord hybrid models becoming top sellers in the US market, accounting for more than 50% of sales.

It can be said that influenced by policies, Japanese brands represented by Toyota are expanding rapidly in the North American market, and authoritative data also shows that hybrid models are more environmentally friendly.

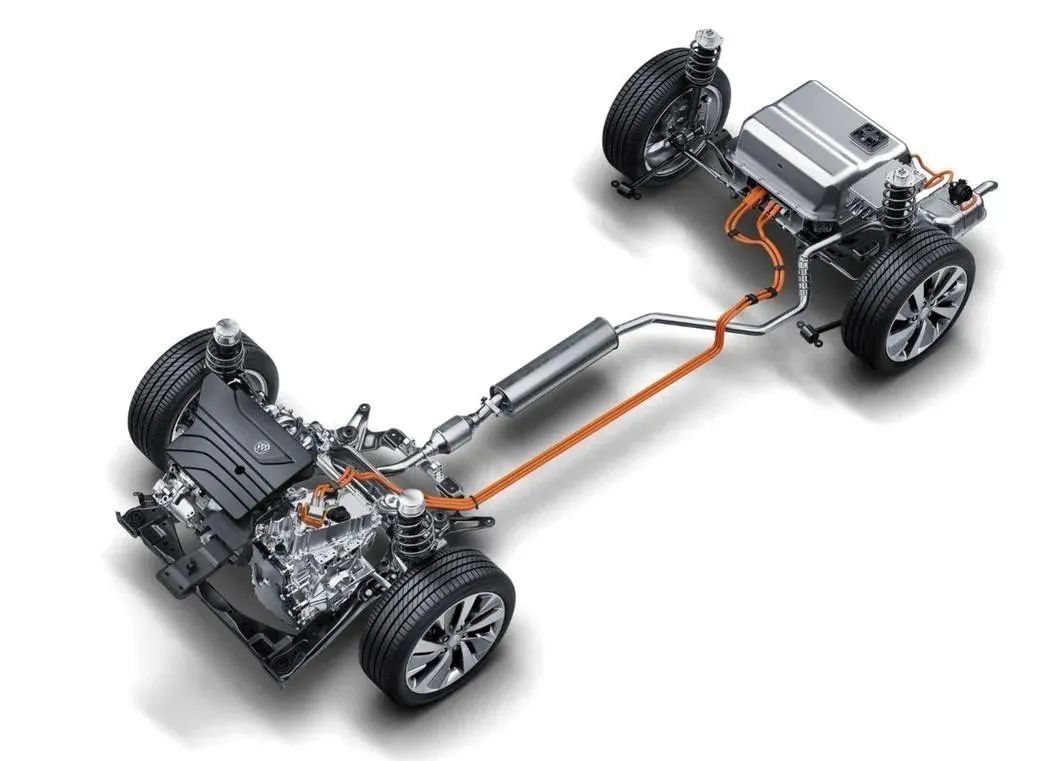

A new study by the International Council on Clean Transportation (ICCT) shows that over the full vehicle lifecycle, self-charging hybrid electric vehicles (HEVs) emit 2.2-2.5 times more greenhouse gases than battery electric vehicles (BEVs), while plug-in hybrid electric vehicles (PHEVs) emit about twice as much.

With such data to support it, American consumers will be more inclined to choose plug-in hybrids.

For markets like Southeast Asia, Toyota considers more about how to maintain its dominant position, where local people also have a strong demand for environmentally friendly cars.

However, from an objective perspective, while pure electric vehicles are more environmentally friendly, their high prices and underdeveloped charging networks also restrict their development. Therefore, hybrid models become a good choice.

Meanwhile, as Chinese new energy vehicle companies continue to increase their presence in Southeast Asia, they are likely to affect the sales of Japanese brands in the region. To maintain their market advantage, Japanese brands represented by Toyota are increasing their investment in hybrid models.

From a practical perspective, Toyota appears to be increasing its investment in hybrid models globally, but its primary consideration stems from different market factors, all aimed at maintaining the global influence of Japanese automobiles.

Losing Ground in the Largest New Energy Market

As an important component of new energy vehicles, hybrid models have gradually become the mainstream of the market this year. In addition to their popularity in the North American market, hybrid models have also experienced faster growth than pure electric models in the European market.

According to statistics, hybrid vehicle sales in the German market increased by 18.4% in July this year, while pure electric vehicle sales decreased by 36.8%. At the same time, the market share of pure electric vehicles fell from a high of 20% to 12.9%.

Although the situation in the Chinese market is not as pronounced, it can still be seen that the growth of pure electric vehicles has slowed down, and plug-in hybrids have become the main driving force for the growth of new energy vehicle sales.

The competition for hybrid technology began decades ago, and Japanese brands began laying the groundwork for it as early as the last century.

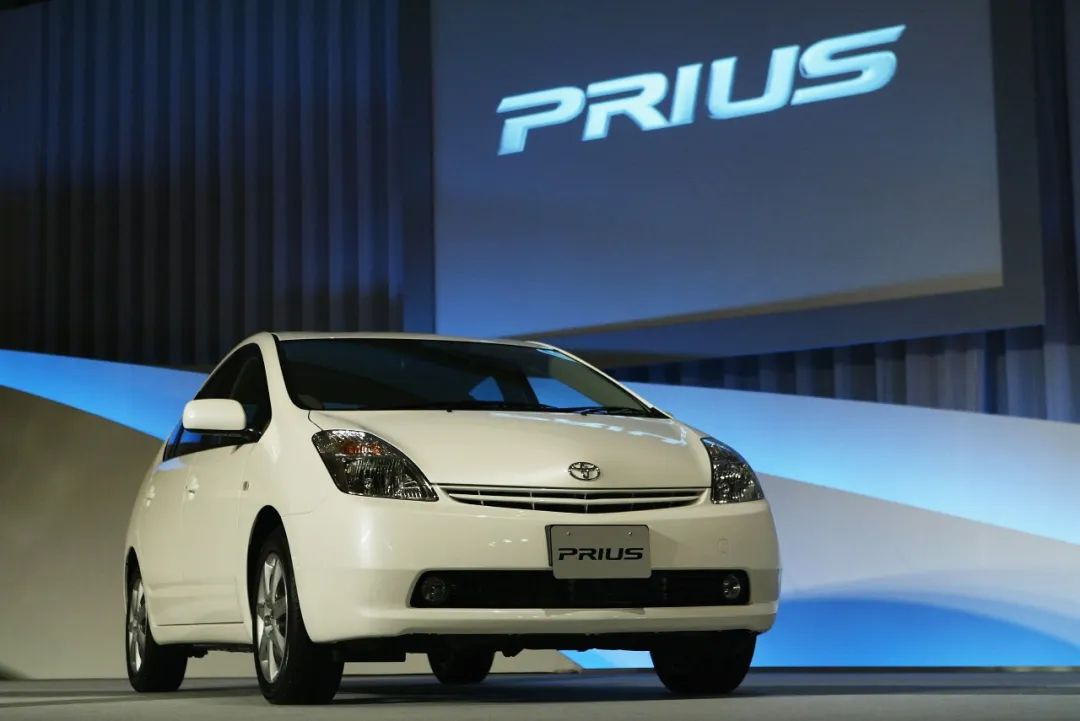

In 1997, Toyota introduced the world's first mass-produced hybrid model, the Prius, marking a new round of competition within the Japanese automotive industry. Since then, brands such as Honda, Nissan, and Mitsubishi have joined the development of hybrid models.

Due to the limitations of the times, Japanese brands, including Toyota, tended to focus on the HEV mode, where the engine is the primary power source and the electric motor assists. This also contributed to Toyota's arrogance.

Because Toyota's R&D achievements surpassed those of its competitors at the time, the company became arrogant about its HEV technology. For example, in the Chinese market, the price of Toyota's hybrid models was once more than 30,000 yuan higher than that of conventional models, reflecting the company's confidence in its technology.

However, for consumers, the energy-saving benefits brought by this price difference were far from satisfactory, leading to a lack of popularity for hybrid models in the Chinese market for a period. Later, with the development of domestic new energy vehicles and the launch of larger-battery plug-in hybrids, consumers saw the true energy-saving benefits.

For example, Honda's Accord PHEV, which is popular in the US market, has seen dismal sales in the Chinese market. With a starting price of 225,800 yuan, which is 46,000 yuan higher than the gasoline version, it offers only an 82-kilometer driving range with a 17.7 kWh battery.

Honda's operations have essentially removed themselves from the hybrid game in China, mirroring the struggles of other Japanese brands in the Chinese market.

It's worth mentioning Mitsubishi Motors, which has been forced to withdraw from the Chinese market. Recently, Japanese media revealed that the mid-cycle facelift of the Outlander will switch to a plug-in hybrid powertrain and be equipped with a 12.3-inch infotainment system.

The Outlander was once a sales driver for Mitsubishi before it withdrew from the Chinese market, achieving annual sales of 120,000 units in 2019.

However, due to misjudgments about the Chinese market, Mitsubishi's sales began to decline rapidly in 2020, and it took just three years for the company to withdraw from the Chinese market, ending in disarray.

It's worth noting that in its competition with Toyota in hybrid technology, Mitsubishi introduced a plug-in hybrid version of the Outlander as early as 2013, but failed to introduce it to the Chinese market before its withdrawal.

Perhaps Mitsubishi believed that relying solely on plug-in hybrids would not save them in the Chinese market.

While this argument may be overly simplistic, it holds some truth for current Japanese automakers. It can be seen that few Japanese brands remain in the Chinese market, and those that do are constantly launching new energy products, from plug-in hybrids to pure electric vehicles, in an attempt to cater to the Chinese market.

However, the market share of Japanese brands has continued to decline, and they struggle to understand why, despite their best efforts.

What they fail to realize is that even with a new powertrain, the interiors of Japanese cars still resemble those from decades ago, featuring compact digital dashboards and small infotainment screens with limited functionality.

While the Chinese market may appear to be replacing gasoline-powered cars with new energy vehicles on the surface, it is also replacing outdated gasoline-powered cars with intelligent and connected vehicles. Chinese consumers are no longer satisfied with just having a car that runs; they want more features and functionality.

The reason why Tesla has become a representative of new energy vehicles lies in its simple yet sophisticated human-machine interaction, which turns the car into a new network carrier rather than just a means of transportation.

Clearly, Japanese brands have yet to recognize this factor and continue to follow their own path. News has emerged that the Nissan GT-R, known as the "Japanese Ferrari," will launch a new hybrid model in 2027.

It can be said that under Toyota's leadership, Japanese brands have once again bet on the hybrid race, with no time to reflect on their failure in the world's largest new energy market.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.