JD.com soars after earnings: glimmer of hope or comeback?

![]() 08/19 2024

08/19 2024

![]() 597

597

Text & Images | Tangjie

In May of this year, Liu Qiangdong and his "brotherhood theory" once again made headlines. At that time, people mainly ridiculed and lamented the loss of the golden age of the internet. However, when the company's second-quarter earnings were released, the market realized that this company, which had been "assumed" to be behind the times, still had new potential to unleash.

Analyzing JD.com involves understanding an old logic: when a new third player emerges to challenge the market leader, the second player often suffers. In the past, JD.com successfully disrupted the book and home appliance industries, overtaking competitors like Dangdang and GOME. Now, JD.com finds itself in the role of the challenged, facing the rise of Pinduoduo and being forced to re-embrace low prices, setting aside its previous focus on high-end and quality products. The outcome is uncertain, but the process promises to be intense.

The outcome of this battle is yet to be determined, but what's clear is that it's not JD.com's performance that's suffering, but rather those who have grown complacent. In the second quarter, JD.com achieved its highest-ever quarterly net profit. Although revenue growth was minimal, the company's robust performance and historically low PE ratio fueled a post-earnings surge in its stock price.

After two consecutive days of gains, two key questions arise: First, does JD.com have a competitive advantage in the era of cost-conscious consumers? Second, can it continue to deliver quality results for shareholders, as it did in Q2, while maintaining its competitiveness?

01 Back to Low Prices

It's important to clarify that JD.com's low-price advantage is not absolute; rather, it's based on a combination of slight price differences and superior after-sales services like fast delivery, creating an overall value proposition.

As China's leading e-commerce platform, JD.com operates both a direct sales model and a platform that supports third-party merchants. Its unique strength lies in its investment in logistics infrastructure, which gives it a significant edge in delivery speed and quality.

However, these advantages only matter if consumers choose to buy from JD.com. In a service-oriented market, these perks can be a selling point, but in a cost-conscious environment, price remains the primary concern. Since 2022, environmental changes have driven consumers towards more cost-effective options, making delivery speed less of a priority. As a result, JD.com's prospects were dimmed, reflected in its declining stock price over the past three years.

In response to these changes, Liu Qiangdong returned to JD.com in early 2023 and announced a renewed focus on price competitiveness, aiming to restore the company's edge in a shifting market.

Before JD.com officially launched its "Billion Subsidy" program, we happened to compare prices between JD.com and Pinduoduo for a smartphone purchase. At that time, significant price differences existed. Now, however, such gaps have largely disappeared across major e-commerce platforms.

For instance, the price difference between an iPhone 14 Pro Max on JD.com and Pinduoduo was once as high as RMB 700. Currently, prices for the iPhone 15 Pro Max on JD.com, Taobao, and Pinduoduo are all around RMB 7,600.

This narrowing of price gaps began before the 2023 618 shopping festival, with no platform offering drastically lower prices since then. For JD.com, regaining price competitiveness was no easy feat, requiring significant effort over an extended period. Remarkably, just three quarters after announcing its renewed focus on pricing (in Q1 2023), JD.com has already seen positive results starting in Q1 2024.

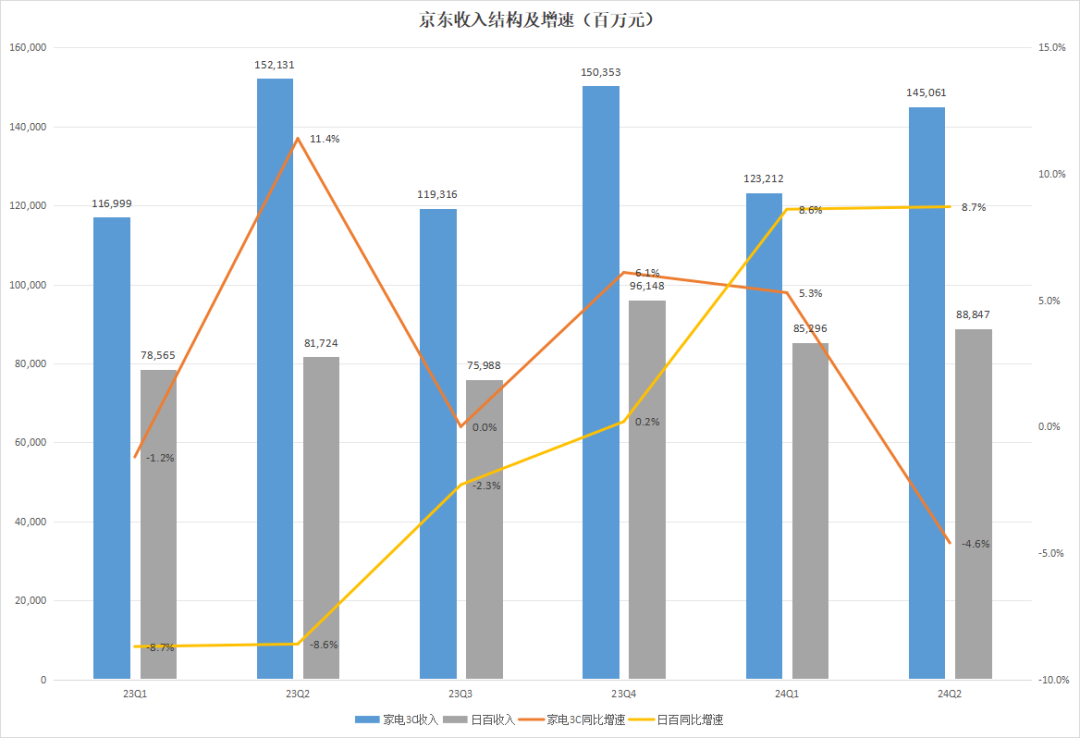

Source: JD.com Quarterly Financial Reports, Tangping Index Analysis

JD.com's revenue primarily comes from merchandise sales, which reached RMB 233.9 billion in Q2 2024, accounting for 80% of total revenue. Within merchandise sales, home appliances and 3C products contributed RMB 145.1 billion (down 4.6% YoY), while general merchandise contributed RMB 88.85 billion (up 8.7% YoY) for the second consecutive quarter.

JD.com's price competitiveness is most evident in general merchandise, where consumers are more price-sensitive. For high-value items like smartphones and home appliances, shipping services are relatively similar across platforms. However, for lower-value general merchandise, JD.com's ability to offer fast and convenient delivery at competitive prices gives it a significant advantage, as demonstrated by its superior performance in this category compared to macro consumption data.

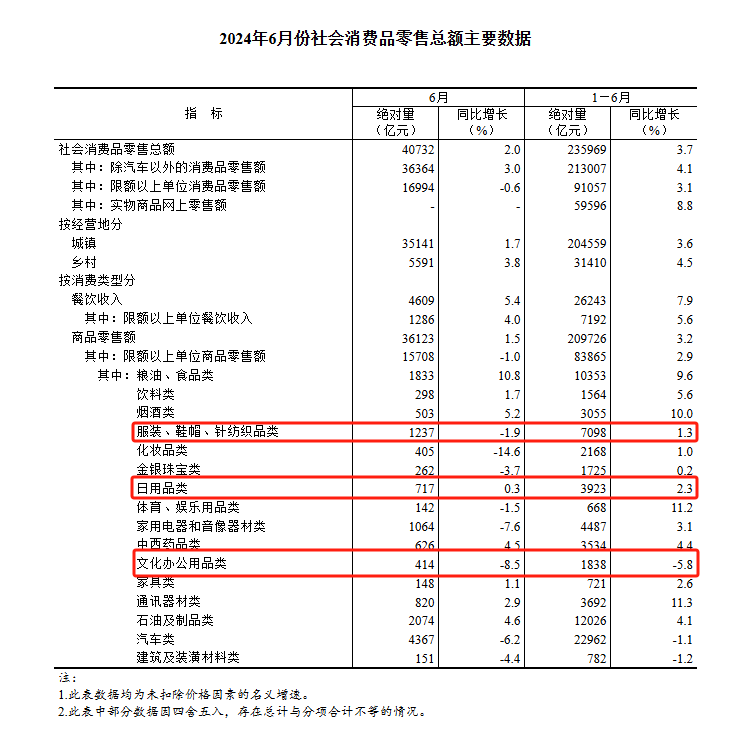

According to National Bureau of Statistics data for the first half of 2024, several major consumer goods categories related to general merchandise showed either negative or low single-digit YoY growth. In contrast, JD.com's general merchandise revenue grew by 8.6% YoY to RMB 174.14 billion, a notable achievement.

In the relatively strong home appliance and mobile phone categories, JD.com's revenue declined by 0.3% YoY in H1 2024. However, this decline is not indicative of weakened competitiveness, as the macro growth rate for these categories was minimal during the same period. Given JD.com's growth rate of over 5%, its slight YoY decline in H1 2024 is in line with market expectations.

Overall, JD.com's breakthrough in the general merchandise category has impressed the capital market, demonstrating the company's execution capabilities. Liu Qiangdong's commitment to low prices has been translated into action, allaying concerns about JD.com's competitiveness.

02 Sustained Profit Growth

JD.com, along with Alibaba and Pinduoduo, has faced significant negative sentiment in the market. This is unsurprising given the industry's intense competition and consumers' focus on cost-effectiveness. Despite this, each platform has struggled to translate its performance into stock price gains.

Despite its strong performance, JD.com has not been immune to industry headwinds. However, we believe that a turning point has arrived. E-commerce remains a significant driver of consumption growth, with online retail sales growing by 8.8% YoY in H1 2024, outpacing overall retail sales growth of 3.7%.

The rise of platforms like Pinduoduo and Temu highlights a key trend: no merchant can afford to rely solely on a single platform or influencer. Mature e-commerce platforms are gaining stronger bargaining power with merchants, as they are essential for product distribution in today's consumer landscape.

Despite intense competition, JD.com has maintained stable revenue growth over the past six quarters, with solid cash flow and a healthy debt-to-asset ratio. Its financial performance is impressive, apart from a slight slowdown in growth rates.

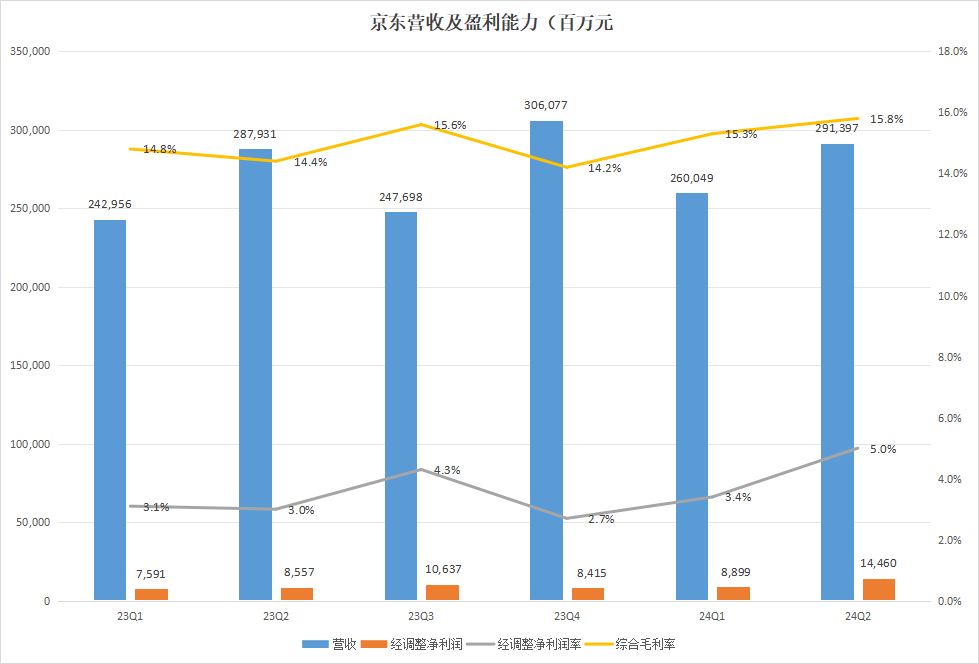

Source: JD.com Quarterly Financial Reports, Tangping Index Analysis

JD.com last reported a loss in Q1 2022. Since then, the company has been profitable in every quarter, with adjusted profit margins and gross margins continuing to rise. In Q2 2023, under its ongoing low-price strategy, JD.com achieved a quarterly net profit of RMB 12.6 billion and an adjusted net profit of RMB 14.46 billion, both record highs.

JD.com's management attributed this profit growth to its low-price strategy, emphasizing that cost reductions were achieved through economies of scale and technology-driven supply chain innovations, without sacrificing user experience, product quality, or partner interests.

JD.com's economies of scale are evident in its financial performance. Despite a modest 1.2% YoY increase in total revenue in Q2, operating costs decreased slightly. Operating cash flow surged 41% YoY to RMB 74 billion, fueled by a 10% YoY increase in accounts payable to RMB 182.25 billion and a more modest 6.6% YoY increase in accounts receivable to RMB 21.64 billion.

These figures underscore JD.com's strong position in the supply chain. While some may view this as exploiting upstream suppliers, JD.com's positive advertising revenue growth over the past two quarters indicates strong merchant recognition of the platform. Given the current competitive landscape and JD.com's established low-price advantage, we believe its scale advantage is unlikely to erode quickly, and merchants are unlikely to abandon the platform. As such, profit growth is sustainable and expected to remain robust in 2024.

03 Conclusion

JD.com is not a perfect company and has some notable shortcomings. In Q1 2024, its revenue grew by 7% YoY, while adjusted net profit grew by only 3.4%. In Q2, revenue growth slowed to 1.2% YoY, while adjusted net profit growth accelerated to 5%. These fluctuations suggest that JD.com has yet to strike the right balance between growth and profitability, and such volatility may persist or even intensify in the coming quarters.

The capital market's preferences are not static. While both growth and profit are ideal, the market may prioritize one over the other at different times. Nevertheless, even after its recent gains, JD.com's stock remains relatively inexpensive. Over the past 12 months, JD.com's adjusted net profit totaled RMB 42.41 billion. At its current Hong Kong stock price (equivalent to RMB 316.64 billion), JD.com's trailing 12-month adjusted PE ratio stands at just 7.5 times, significantly lower than its five-year average of 36 times.

If you believe in JD.com's survival and potential success, now may be an opportune time to invest.

Disclaimer: This article is for learning and discussion purposes only and does not constitute investment advice.