Metaverse Bubble Burst? Here Are Some "Data Truths"

![]() 08/20 2024

08/20 2024

![]() 597

597

In recent years, the tech industry has shown immense enthusiasm for the concept of the 'metaverse,' which promises to transform online experiences by offering immersive virtual worlds where we can work, entertain, and socialize in unprecedented ways.

Tech giants and investors have poured billions into this vision, with Meta (formerly Facebook) leading the charge. However, recent data suggests that the metaverse bubble may have burst, leaving many to question its future.

To understand the current landscape, we need to step back and look at what the metaverse initially promised.

Meta CEO Mark Zuckerberg became the face of this movement, rebranding his company and investing heavily in virtual reality technology.

Researchers at Citibank even predicted that the metaverse could attract 5 billion users and grow into a $13 trillion market.

These bold claims sparked a gold rush, with companies and individuals rushing to stake their claims in this digital frontier.

01. The Sudden Decline of the Metaverse

Today, the situation is vastly different.

Meta's ambitious metaverse division, RealityLabs, has been bleeding money. In the last quarter alone, it lost $4.5 billion, with total losses since inception exceeding $46 billion. These figures are far from the profitable future once envisioned.

More telling is the fate of Horizon Worlds, Meta's flagship metaverse platform aimed at adults. Despite extensive marketing efforts, the platform struggles to attract its target audience. Ironically, it has unexpectedly gained popularity among children, contrary to its design.

02. The Collapse of the Crypto Metaverse

The metaverse concept isn't limited to traditional tech companies.

Crypto-based virtual worlds emerged with a complete ecosystem, promising decentralized ownership and unique digital assets.

These blockchain-based platforms gained hype and reached astronomical valuations. However, they too experienced a sharp downturn.

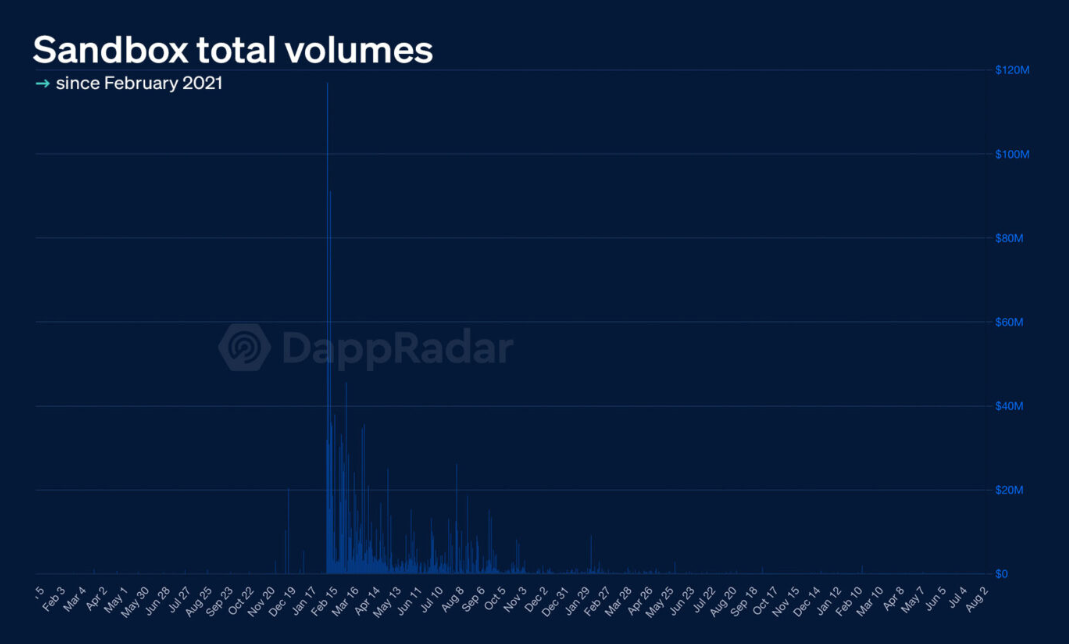

Take The Sandbox, a virtual world once valued at over $7 billion, whose daily trading volume plummeted by 99.9%. At its peak, it saw $117 million in daily transactions, but now averages just $8,000 per day.

This isn't an isolated case. Decentraland, another pioneering Crypto metaverse platform, saw a similar 99.9% drop in daily trading volume, from $2.5 million at its peak to less than $5,000 now.

03. The Decline of Digital Assets

One of the most compelling aspects of these virtual worlds was the ability to own and trade digital assets, often in the form of Non-Fungible Tokens (NFTs). These tokens could represent anything from virtual real estate to in-game items.

At the height of the metaverse craze, prices for these assets soared. Now, their values have all but evaporated.

In The Sandbox, daily NFT sales once reached $10.2 million but now rarely exceed $10,000.

This pattern repeats on other platforms, with AxieInfinity, once a Play-to-Earn gaming exemplar, seeing its trading volume plummet from nearly $1 billion to under $2 million.

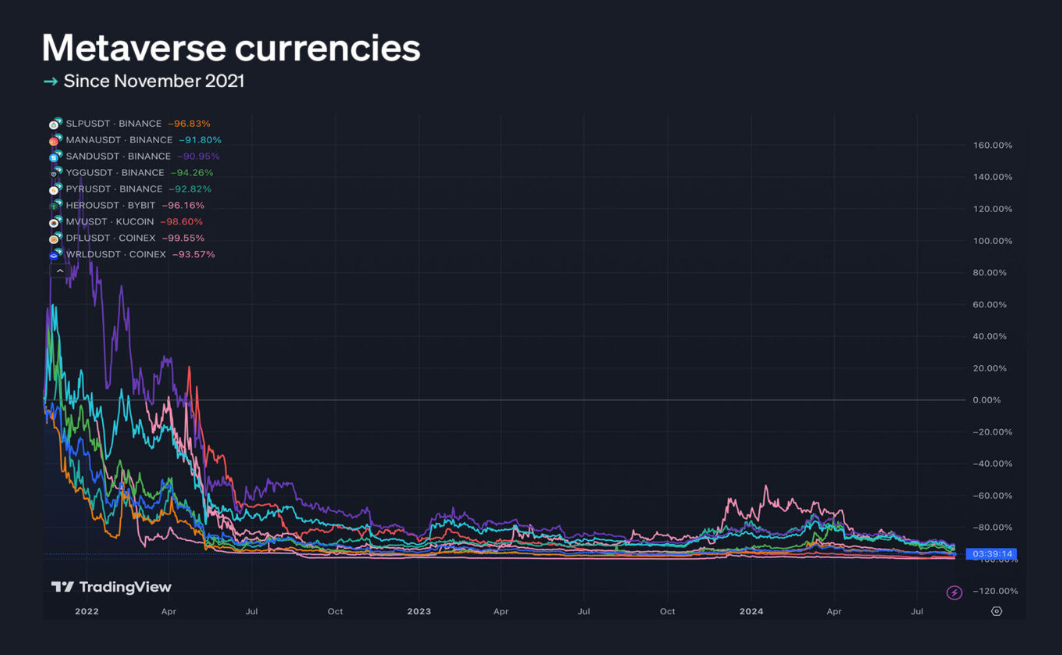

Crypto associated with these 'metaverse' projects has also underperformed. Tokens like MANA (Decentraland), SAND (The Sandbox), and AXS (AxieInfinity) have lost over 90% of their value from their November 2021 peaks.

This decline isn't limited to individual projects; the entire metaverse Crypto sector has shrunk significantly, with its total market capitalization falling from $50 billion to $16 billion.

04. What Caused This Collapse?

Several factors contributed to this rapid decline.

Firstly, initial hype created unrealistic expectations. The technology required for a truly immersive and seamless virtual experience is still in its infancy. Many users found current offerings clumsy and disappointing compared to the promised vision.

Furthermore, the concept itself may be too abstract for mainstream adoption. While tech enthusiasts were excited, average internet users struggled to understand how the metaverse would meaningfully enhance their digital lives. High entry costs, both in hardware and learning curves, further limited adoption.

The broader economic downturn and Crypto market crash also played significant roles. With scarce investment capital and lower risk appetites, many metaverse projects found it challenging to sustain development and user growth.

Despite these setbacks, it's premature to write off the metaverse concept entirely.

Technology often follows a cycle of hype, disillusionment, and eventual practical application. Some proponents, like Mark Zuckerberg, believe in the long-term potential of the metaverse and continue to invest heavily in its development.

History shows that even after significant market corrections, innovative ideas reemerge in more practical forms.

Just as companies like Amazon and eBay emerged from the dot-com bubble to become tech giants, some metaverse projects may find their footing and deliver value in ways we haven't yet imagined.