Groundbreaking Achievement: China Unveils First Carbon-Based Chip Production Line, Circumventing EUV Lithography Limitations

![]() 07/21 2025

07/21 2025

![]() 463

463

In June of this year, Chongqing witnessed the launch of China's first carbon-based chip production line, spearheaded by the PKU Chongqing Carbon-Based Integrated Circuit Research Institute. This marks a significant leap forward in domestic chip technology, freeing the industry from the shackles of ASML's EUV lithography machines and paving a new avenue for Chinese chip development.

The race in carbon-based chip technology between China and the United States has been ongoing for years, with China's PKU team firmly at the forefront. This dominance is not only attributed to the rapid pace of technological advancements by the PKU team but also to the robust foundation of China's domestic basic material technology industry.

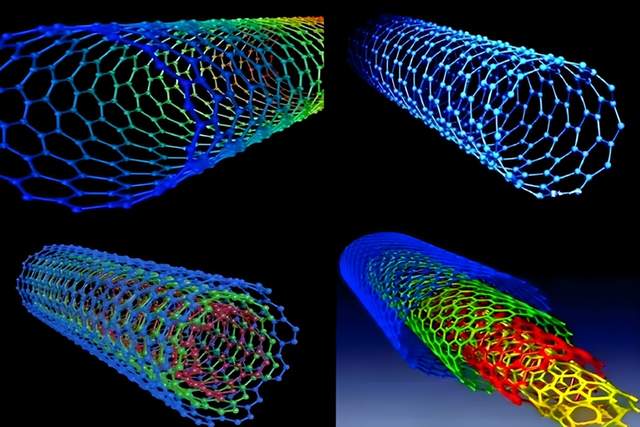

In 2017, the PKU team, led by Peng Lianmao and Zhang Zhiyong, achieved a breakthrough in carbon nanotubes, successfully fabricating 5-nanometer gate carbon nanotube CMOS devices. It wasn't until 2019 that the MIT team in the United States constructed a 16-bit processor using carbon nanotubes. Since then, the rivalry in carbon-based chip technology has primarily been between PKU and MIT, with numerous groundbreaking papers on carbon transistors published in prestigious journals like Nature and Science.

In 2017, the PKU team developed a CPU comprising approximately 2,500 transistors, performing on par with Intel's early 80486. By 2019, MIT's carbon nanotube CPU boasted up to 14,000 transistors but performed comparably to the 80386. The crux lies in China's advantage in carbon-based materials.

The carbon nanotubes constructed by the PKU team in China achieve a purity of 99.999999%, significantly outperforming the 99.9999% purity of those created by the MIT team. This disparity in purity directly translates to a substantial difference in CPU performance, underscoring China's lead in basic material science.

Since the PKU team's groundbreaking research and development in carbon nanotube technology, they have continued to push the boundaries of carbon-based chip technology. Simultaneously, efforts are underway to commercialize these chips. In this endeavor, material research and development have emerged as the linchpin for commercial success, an area where China's stakeholders have collaborated to steadily advance.

In 2018, China embarked on the construction of a 4-inch carbon-based wafer production line and soon succeeded in fabricating a 4-inch carbon-based wafer with a 5-micron gate length. With the successful mass production of these wafers, ancillary technologies such as chip design, lithography, and packaging are also gaining momentum. Notably, these technologies adhere to independent research and development principles, exclusively utilizing domestic equipment to avoid technological dependency.

However, the cost of 4-inch carbon-based wafers remains prohibitive for civilian applications, limiting the widespread use of carbon-based chips in everyday consumer products. While their application in military and other specialized sectors is progressing, these advancements are not yet accessible to the general public.

In 2023, a Chinese enterprise achieved a milestone by fabricating an 8-inch carbon-based wafer with a maximum carbon nanotube purity of 99.99999999%, achieving economic viability. Additionally, chip performance has seen a remarkable improvement—the higher the purity, the greater the performance enhancement, a testament to the unique properties of carbon nanotubes. This signifies that the commercialization of carbon-based chips is within reach.

With the PKU Chongqing Carbon-Based Integrated Circuit Research Institute poised to establish the country's first carbon-based production line, the commercialization process has officially commenced, marking the true maturation of carbon-based chip technology. It is conceivable that in the near future, we will witness the advent of carbon-based chips for civilian use.

China's accelerated push towards commercializing carbon-based chips is also driven by the pressing need to develop its domestic chip industry. Constrained by ASML's EUV lithography machines, China faces formidable challenges in advancing processes below 5 nanometers. Exploring new chip materials offers a path to overcome this impasse, and the commercialization of carbon-based chips stands as one of the most promising and expeditious routes.

The competition between the United States and China in carbon-based chips is further fueled by the approaching limitations of silicon-based chip technology. It is widely acknowledged that processes below 10 nanometers at TSMC and Intel are more akin to numerical exercises than genuine technological breakthroughs, often relying on other technological innovations to enhance chip performance and branding them as new generations. Consequently, the United States is also investing heavily in the research and development of new chip materials. Currently, it is evident that China holds a lead over the United States in this nascent field of new chip materials.