"Green-plate hybrids" sell well, is gasoline still the end of new energy?

![]() 08/22 2024

08/22 2024

![]() 426

426

Lead

Introduction

Despite the over 50% penetration rate of new energy vehicles (NEVs) in the market, it's not yet time to celebrate.

Despite the chaos in the overall automotive market in the first half of this year, including price wars and media battles that caused multiple frustrations for market participants, or the cracks in market development that caused anxiety for everyone, one thing remains clear: the penetration rate of NEVs continues to improve, and consumer attitudes towards NEVs have undergone significant changes.

This trend strongly suggests that the market transformation is progressing at a pace in line with our expectations. In China, in particular, the belief that "NEVs are the future" is only being reinforced with each round of market turnover.

However, as the NEV market begins to differentiate, we must raise a new question: if battery electric vehicles (BEVs) are separated from the NEV matrix, will the market continue to follow this trend?

Simply put, while the penetration rate of NEVs continues to rise, the growth rate of BEV sales lags behind this trend. The emergence of numerous hybrid vehicles, while contributing to the NEV market's boom, seems to have overshadowed the constraints facing the future development of BEVs.

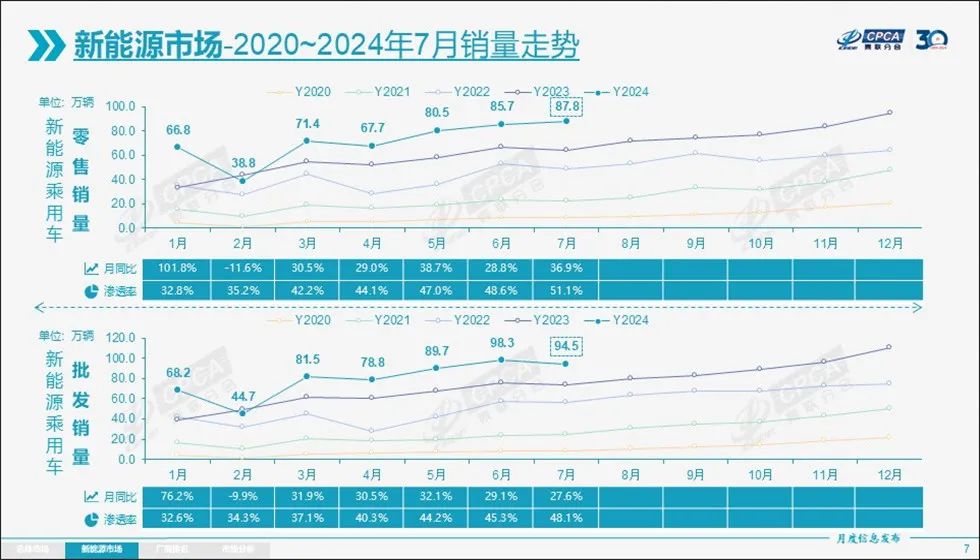

In July, a total of 878,000 NEVs were sold in the Chinese market, representing a year-on-year growth of 36.9%. However, upon closer inspection, the growth rate of BEVs lags significantly behind green-plate hybrids, indicating that China's NEV market has a strong unique character. Behind this impressive performance lies a changing market reality worthy of contemplation.

For a long time, we have believed that due to the urgent demand for electrification, Chinese electric vehicle manufacturers quickly rose to the top of the market, and consumers' understanding of electric vehicles far surpassed that of other countries. As new business models emerged, every step taken by China's NEV market attracted attention from the entire industry.

Now, it seems that this market may have merely taken a unique development path with Chinese characteristics. Whether it can evolve into a global benchmark for a perfect transformation, as we envision, remains to be seen over time.

Market Differentiation Emerges

Currently, China's automotive market is accelerating its transition away from internal combustion engines at an impressive pace.

It was widely believed that as the NEV market began to rapidly penetrate the automotive market, scaling up to annual sales of over 25 million vehicles, China's NEV industry had entered a new stage of success through scale. Everything happening in the market suggested that the global automotive transformation center was taking root in China.

Furthermore, as leading domestic automakers continue to announce that Chinese automakers will dominate the market, while using electric drive technology to drive out joint venture brands, there is little reason to doubt the development of the NEV industry.

Since last year's Shanghai Auto Show, it has become evident that foreign automakers are struggling to keep up with China's automotive market evolution. Few would deny that China's automotive future is being rewritten. However, as everything seems to be progressing positively, it is unclear how to feel about the NEV market being propped up primarily by green-plate hybrids.

The slowdown in BEV sales has not come suddenly.

Let alone the numerous new electric vehicle makers, both domestic and international, that have halted operations this year, even Tesla, with its sales growth rate dropping from nearly 90% in 2021 to around 40% in 2023, has canceled plans to build factories in Thailand, Malaysia, and other locations. Even the seemingly finalized plan to build a factory in Mexico has been postponed until after the U.S. elections.

If even Tesla, the industry leader, is facing such challenges, can any other BEV manufacturer thrive independently? The answer is undoubtedly no.

In the first half of this year, the most notable event in the BEV market was Xiaomi's entry with its SU7 model, which garnered significant consumer interest upon its launch, leading to delivery delays and further fueling optimism about the BEV market's prospects.

However, as data emerges, a rational analysis suggests that Xiaomi's success alone does not represent the market's overall trend.

Over the past seven months, BEV-only manufacturers have felt the pressure of slowing demand acutely. This is evident in the struggles of major BEV players like GAC Aion, Xpeng's initial setback with its first BEV, the differentiated market performance of Huawei-backed extended-range hybrids and BEVs, and ZEEKR's shift towards launching a hybrid flagship model next year despite its previous commitment to BEVs.

Are BEVs Really Struggling? Not exactly. Ultimately, the rapid sales growth of BEVs in previous years may have prematurely exhausted the market, and the ecological advantages surrounding BEVs have yet to reach the broadest range of automotive users.

Moreover, the current automotive consumer sentiment is clear. Fewer people are willing to spend money on new cars, and when they do, balancing their enthusiasm for BEVs with the inherent advantages of green-plate hybrids is a real test of their wallets.

The Appeal of Green-Plate Hybrids

Earlier this month, the China Passenger Car Association (CPCA) reported that the retail penetration rate of NEVs in China surpassed 50% for the first time, reaching 51.1%, with a significant year-on-year increase. The industry was understandably thrilled, hailing the dawn of the NEV era.

Broadly speaking, no one disputes this trend as the automotive industry's transformation is universally acknowledged. However, looking back at this year's market trends, green-plate hybrids have emerged as the driving force behind the NEV market, while BEVs face increasing development bottlenecks.

Moreover, this situation is not temporary. Reality repeatedly reminds us that failing to develop plug-in hybrids or extended-range hybrids could lead to significant disadvantages for many brands, even threatening their survival.

The popularity of engine-equipped NEVs is evident. Weekly sales rankings show that most brands rely heavily on extended-range hybrids, including Lixiang, Wenjie, Shenlan, and Lantu. After nearly five years of market penetration, consumers understand that choosing such NEVs is more practical than insisting on BEVs given similar policy support.

Perhaps with further improvements in charging infrastructure and the widespread availability of charging stations, the disadvantages of BEVs will diminish. Coupled with advancements in battery, motor, and electronic control technologies, BEVs' driving range will significantly increase. However, from the perspective of automakers, technical routes can always change if the market does not demonstrate expected vitality and potential.

Even the CPCA acknowledges that innovative Chinese automakers' development of plug-in hybrid and extended-range technologies has led to technological breakthroughs, securing a 78% share of the global plug-in hybrid market.

For automakers that cannot rely solely on BEVs for their development, researching engine-equipped NEVs is indeed opportune. Previously, brands like NIO and Leapmotor have demonstrated that to reverse the declining sales of BEVs, such products are essential. Going forward, no one can afford to ignore the current market opportunities.

Recently, as a typical example, AVATR introduced its new AVATR 07 model equipped with Kunlun extended-range technology, further emphasizing the trend.

Regardless of the numerous technical advantages highlighted, the introduction of this model underscores the need for more green-plate hybrids to accelerate the industry's electrification transformation in China. Chinese consumers also require such models that combine long BEV driving ranges with reduced range anxiety.

In conclusion, despite significant advancements in battery, motor, and electronic control technologies that position China's automotive industry to disrupt global automotive trends, Chinese consumers' demands are becoming more realistic following a brief market boom. They will not compromise on their needs solely because of BEV advantages but will embrace technology integration and innovation.

Against this backdrop, the industry should pay closer attention to why BEV sales have slowed due to the influx of green-plate hybrids, rather than merely focusing on the confidence boosted by the NEV market's penetration rate exceeding 50% for the first time. It is crucial to carefully consider future development plans.

"If enterprises lack self-sufficiency and cannot turn a profit, they will not go far; capital cannot rely solely on stories and concepts but must generate profits; Chinese automakers should reflect on themselves, prevent 'internal competition,' maintain industrial competition order, and safeguard hard-earned industrial achievements."

As charging infrastructure develops and expands, plug-in hybrids and extended-range vehicles only need occasional charging to compensate for their inefficiency compared to traditional hybrids and the burden of carrying heavy and expensive batteries. Furthermore, plug-in charging habits will only become more prevalent.

In contrast to the BEV market's downturn, hybrid electric vehicles (HEVs) and mild hybrid electric vehicles (MHEVs) are increasingly recognized by the market.