Cars and smartphones boost Xiaomi's performance

![]() 08/22 2024

08/22 2024

![]() 564

564

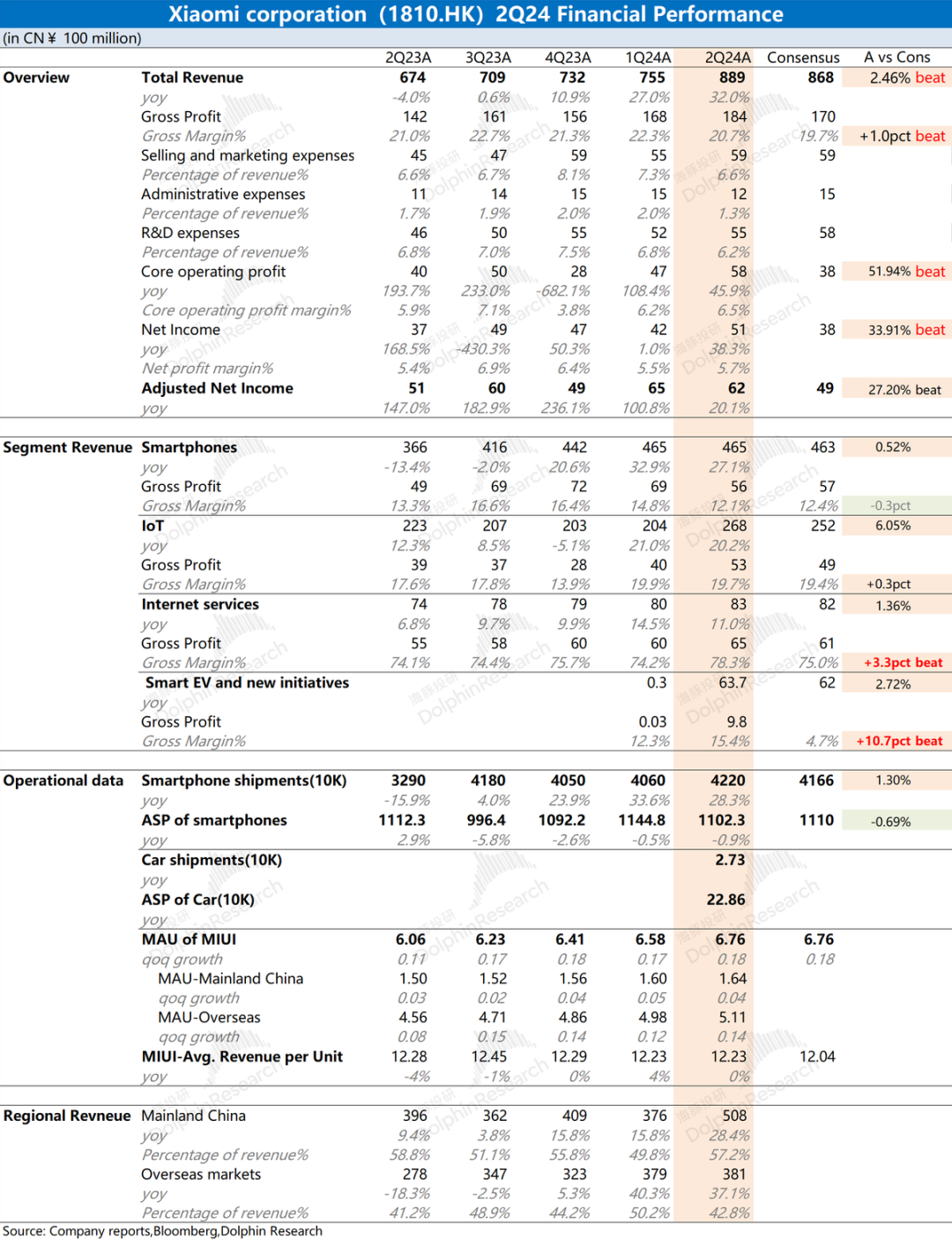

Xiaomi Group (1810.HK) released its financial report for the second quarter of 2024 (ending June 2024) after the Hong Kong stock market closed on the evening of August 21, 2024, Beijing time. The key points are as follows:

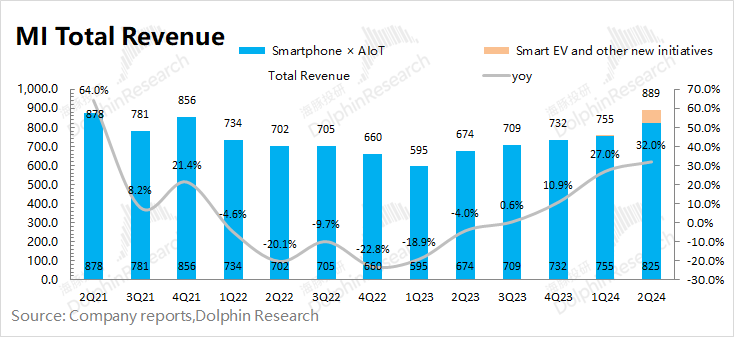

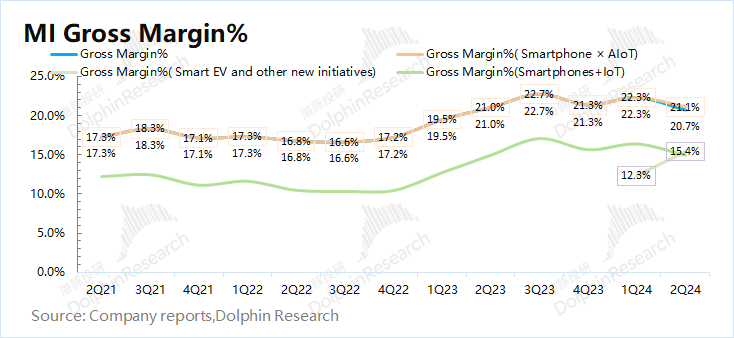

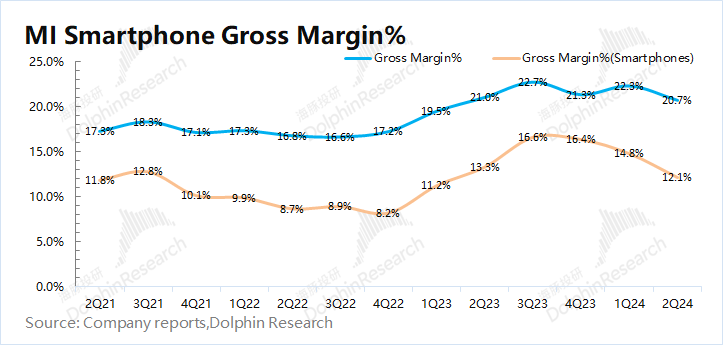

1. Overall performance: Both revenue and gross margin exceeded expectations. Xiaomi Group's total revenue for the quarter was 88.9 billion yuan, a year-on-year increase of 32%, better than market expectations (86.8 billion yuan). The company's revenue growth this quarter was mainly driven by the growth of traditional businesses (smartphones and AIoT) and the new automotive business. Xiaomi Group's gross margin for the quarter was 20.7%, a year-on-year decline of 0.3 percentage points, but still better than market expectations (19.7%). The decline in gross margin was mainly due to seasonal promotions and the slightly lower gross margin of the automotive business compared to the company's overall level.

2. Traditional hardware business: Double-digit growth in smartphones and IoT business, with a traditional hardware gross margin of 14.9%.

1) Smartphone business continues to recover: The company's smartphone revenue accelerated, with a year-on-year increase of 27.1% in this quarter. This was mainly driven by an increase in Xiaomi smartphone shipments, with the average selling price stabilizing above 1,100 yuan.

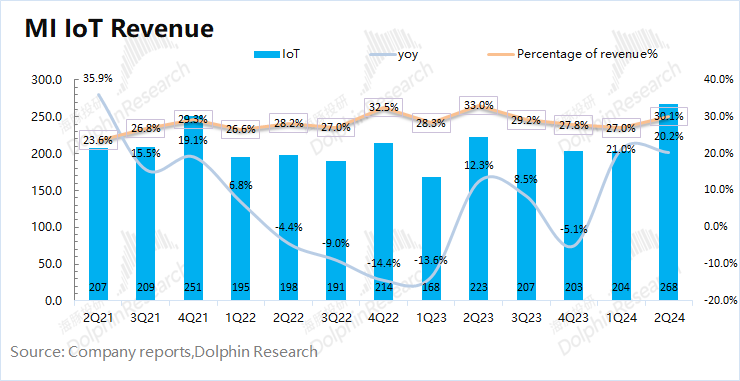

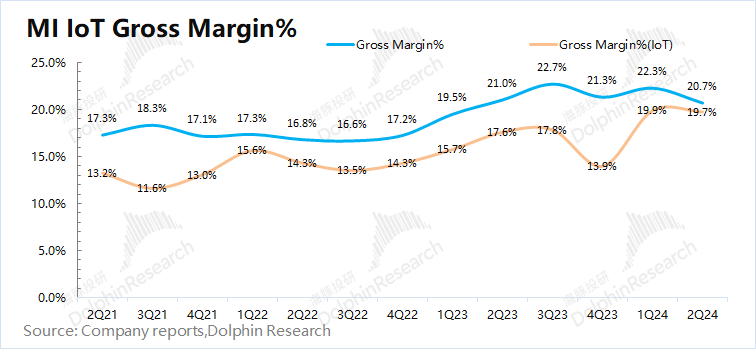

2) IoT business hits a new high: The company's IoT revenue reached 26.8 billion yuan in this quarter, a year-on-year increase of 20.2%. The main growth in this quarter came from other IoT products, including tablets, smart appliances, and wearable devices.

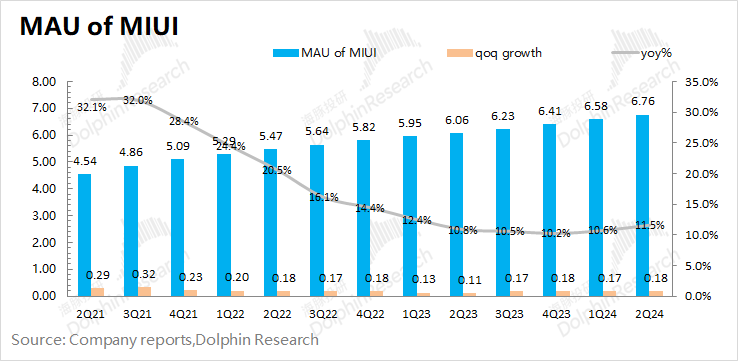

3. Internet services: Accelerated monetization on the user side. Internet services continued to grow this quarter and remained the most stable segment of the company. Xiaomi not only increased its global MIUI user base this quarter but also improved its ARPU per user year-on-year. Dolphin estimates Xiaomi's domestic ARPU at 33.85 yuan this quarter, a year-on-year decline of 7%, while the overseas ARPU was 5.28 yuan, a year-on-year increase of 20.4%. With over three-quarters of Xiaomi's users now overseas, accelerated monetization of its overseas user base is expected to further drive ARPU growth.

4. Automotive business: Gross margin significantly exceeded expectations. Xiaomi's automotive business generated revenue of 6.24 billion yuan in the second quarter of 2024, in line with market expectations (6.2 billion yuan). The automotive business's gross margin reached 15.4% this quarter, far exceeding market expectations (4.7%) and higher than the company's traditional hardware business's consolidated gross margin (14.9%).

Dolphin's overall view: Xiaomi's financial report is impressive, and the SU7 has reignited hope.

The company's revenue and profit for the quarter exceeded market expectations. Compared to the slight over-performance on the revenue side, Xiaomi's profit exceeded expectations even more notably. From an operational perspective, Xiaomi's core operating profit for the quarter reached 5.8 billion yuan, close to the company's historical quarterly high (6 billion yuan), thanks to the recovery of traditional businesses, accelerated monetization of internet services, and the incremental contribution from the automotive business.

Specifically: 1) The smartphone business has seen steady growth in shipments and market share, despite a slight decline in average selling price; 2) The IoT business hit a new high, driven by growth in tablets, appliances, and wearable devices; 3) Internet services saw accelerated monetization of overseas operations and improved gross margins; 4) The automotive business delivered its first results, exceeding market expectations.

Regarding the 15.4% gross margin of the automotive business, Dolphin believes: ① It provides a certain degree of safety for the company's automotive business amid fierce price competition; ② The automotive business has not dragged down the company's overall performance, and its current gross margin is already higher than Xiaomi's traditional hardware business (14.9% for smartphones and IoT combined); ③ As automotive production capacity further expands, the automotive business's gross margin is expected to continue to improve. This means that Xiaomi has not only entered the mid-range electric vehicle market but also has sustainable business development.

Sustainable automotive operations deserve corresponding valuations, but currently, valuations for peers in the new energy vehicle industry have declined significantly. Based on Xiaomi's current automotive performance, it corresponds to a valuation range of approximately $5 billion to $10 billion, which has a limited impact on Xiaomi's overall market value. Overall, the company's core profit for the full year is expected to exceed 20 billion yuan. While this financial report can boost market confidence in the company, further share price gains will require stronger performance (such as a surge in automotive sales or significant growth in smartphones/IoT) and an overall shift upwards in valuation multiples.

Detailed Analysis Follows

I. Overall Performance: Revenue & Gross Margin, Both Better Than Expected

Due to the inclusion of the automotive business, Xiaomi adjusted its financial reporting for this quarter, dividing its operations into two categories: "Smartphones & AIoT" and "Automotive & Innovation."

1.1 Revenue

Xiaomi Group's total revenue for the second quarter of 2024 was 88.9 billion yuan, a year-on-year increase of 32%, better than market expectations (86.8 billion yuan). The company's revenue growth this quarter was driven by both traditional businesses and the new automotive business.

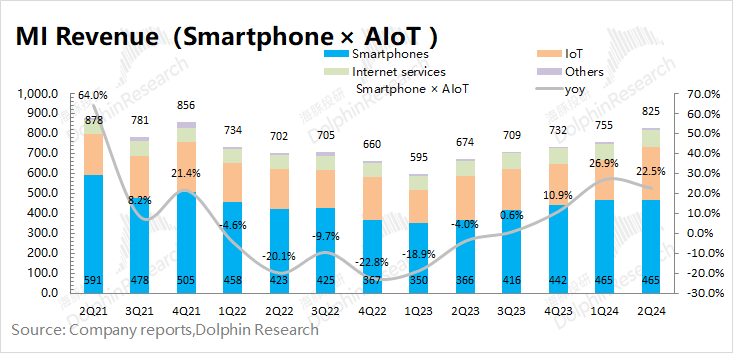

1) Xiaomi's Smartphones & AIoT business (traditional business) generated revenue of 82.5 billion yuan, a year-on-year increase of 22.5%. All three segments of smartphones, IoT, and internet services saw varying degrees of growth this quarter.

2) Xiaomi's Smart Automotive & Innovation business (new business) generated revenue of 6.37 billion yuan, accounting for 7.2% of total revenue, with approximately 6.24 billion yuan coming from vehicle sales.

1.2 Gross Margin

Xiaomi Group's gross margin for the second quarter of 2024 was 20.7%, a year-on-year decline of 0.3 percentage points but still better than market expectations (19.7%).

The decline in gross margin this quarter was mainly due to seasonal promotions and the slightly lower gross margin of the automotive business compared to the company's overall level.

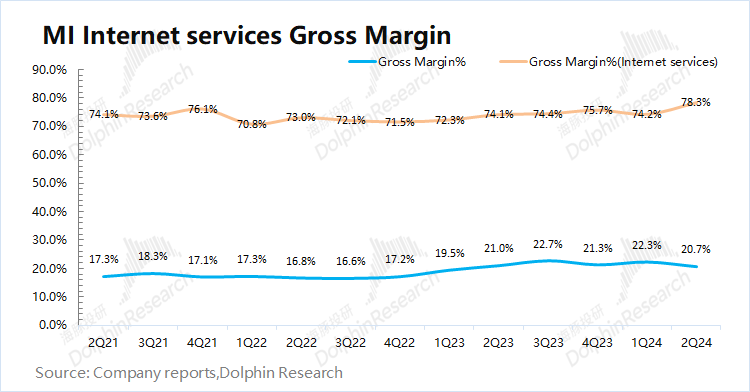

1) Xiaomi's Smartphones & AIoT business (traditional business) had a gross margin of 21.1% this quarter, with the smartphone business significantly impacted by seasonal promotions. Gross margins for IoT and internet services increased year-on-year, with the internet services gross margin reaching 78.3%.

2) Xiaomi's Smart Automotive & Innovation business (new business) had a gross margin of 15.4% this quarter, which is still lower than the company's overall gross margin but far exceeds market expectations (4.7%). Dolphin believes that considering Xiaomi's existing hardware (smartphones + IoT), the automotive business's gross margin (15.4%) is already higher than that of traditional hardware (14.9%). This has alleviated market concerns about the impact of the automotive business on profits.

II. Automotive Business: Establishing a Stronghold in the Mid-Range Market

The market is particularly interested in the progress of Xiaomi's automotive business. Specifically, Xiaomi's automotive business generated revenue of 6.24 billion yuan in the second quarter of 2024, in line with market expectations (6.2 billion yuan).

In terms of volume and price, the company shipped 27,300 vehicles in the second quarter, with an average selling price of 229,000 yuan per vehicle. Due to initial production capacity constraints, shipments have gradually increased, with monthly sales now stabilizing above 13,000 units. In just three months, Xiaomi has entered the top 10 domestic new energy vehicle brands and established a strong presence in the mid-range market.

As of June 30, 2024, Xiaomi had opened 87 sales outlets in 30 cities. The company expects to complete the delivery of 100,000 SU7 series vehicles ahead of schedule in November and aims for a new annual target of 120,000 vehicles.

Although production capacity is still ramping up, the gross margin of Xiaomi's automotive and innovation business reached 15.4% this quarter, far exceeding market expectations of 4.7%. In the midst of intense price competition in the overall vehicle market, this double-digit gross margin provides a certain degree of safety for the company and has not dragged down its hardware business.

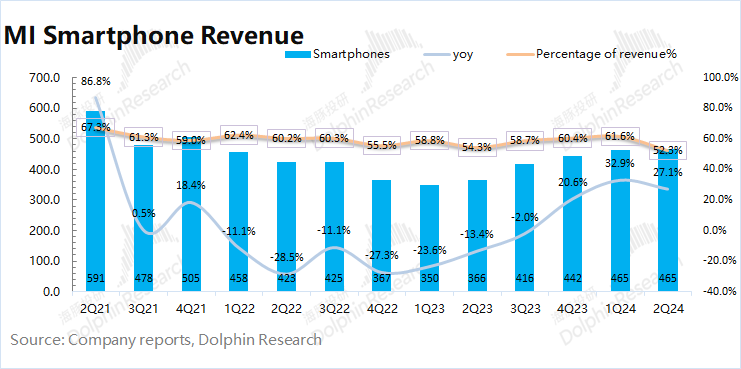

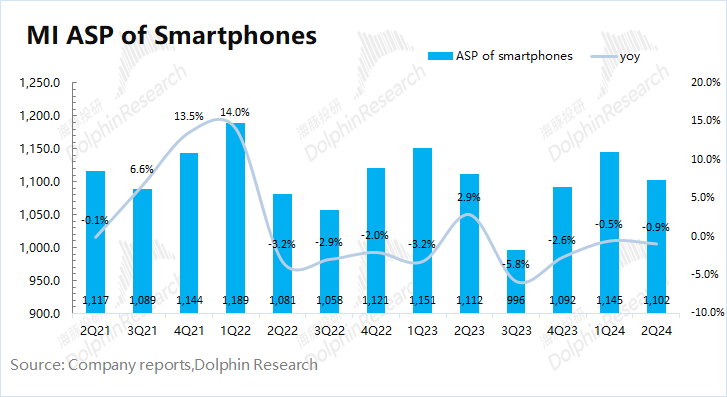

III. Smartphone Business: Volume Growth at the Expense of Price, Market Share Increases

Xiaomi's smartphone business generated revenue of 46.5 billion yuan in the second quarter of 2024, a year-on-year increase of 27.1%. The growth was primarily driven by a steady recovery in shipments.

Dolphin analyzed Xiaomi's smartphone business in terms of volume and price:

Volume: Xiaomi shipped 42.2 million smartphones in the second quarter of 2024, a year-on-year increase of 28.3%. Of the additional 10 million smartphones shipped this quarter, approximately 1.4 million were in the domestic market, while approximately 7.5 million were in overseas markets. Xiaomi's market share continued to increase in both domestic and overseas markets during the second quarter.

Price: Xiaomi's average selling price for smartphones was 1,102 yuan in the second quarter of 2024, a year-on-year decline of 0.9%. The decline in average selling price was primarily due to increased competition in mainland China and a higher proportion of shipments to relatively low-priced overseas markets (such as Latin America and Africa), structurally lowering the company's overall average selling price. Nonetheless, the average selling price remained stable above 1,100 yuan.

Xiaomi's smartphone business generated a gross profit of 5.65 billion yuan in the second quarter of 2024, a year-on-year increase of 15.9%, accounting for 30.7% of the company's total gross profit. The gross margin for the smartphone business was 12.1% this quarter, a year-on-year decline of 1.2 percentage points, primarily due to increased competition in mainland China and seasonal promotions.

Despite the slight decline in gross margin, Xiaomi's market share increased across different segments, and the overall smartphone business remained on an upward trajectory.

IV. IoT Business: Emerging from Downturn, Hitting New Highs

Xiaomi's IoT business generated revenue of 26.8 billion yuan in the second quarter of 2024, a year-on-year increase of 20.2%. The IoT business continued to recover this quarter, primarily driven by growth in mainland China's major appliance business and overseas markets' tablet and wearable device revenue.

The company did not directly disclose data on its major IoT products (TVs and laptops) in this quarter. Based on the financial report, Dolphin estimates that Xiaomi's main IoT revenue remained at approximately 4.8 billion yuan. The main growth this quarter came from other IoT products, with revenue reaching 22 billion yuan, a year-on-year increase of 25.4%.

Among other IoT businesses, Xiaomi's tablet business grew by 67.6% year-on-year, smart appliance business grew by 38.7%, and wearable device revenue grew by 31%, contributing significantly to the IoT business's growth.

Xiaomi's IoT business generated a gross profit of 5.28 billion yuan in the second quarter of 2024, a year-on-year increase of 35.1%. The IoT business's gross margin was 19.7%, a year-on-year increase of 2.1 percentage points, primarily due to increased gross margins for wearable devices and smart appliances.

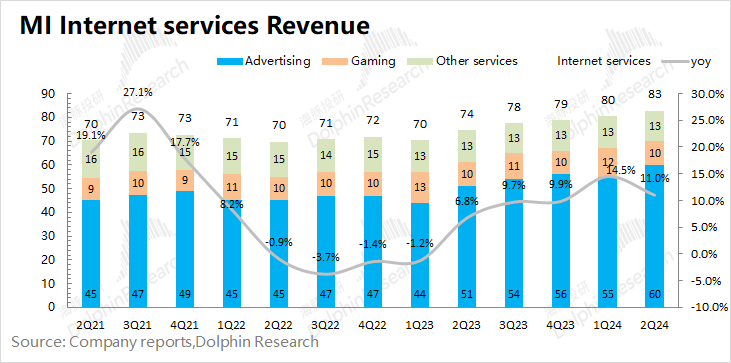

V. Internet Services: Improved Advertising Monetization

Xiaomi's internet services business generated revenue of 8.27 billion yuan in the second quarter of 2024, a year-on-year increase of 11%, accounting for 9.3% of the company's total revenue.

A detailed breakdown of internet services segments is as follows:

1) Advertising Services: The largest component of Xiaomi's internet services. Xiaomi's advertising services generated revenue of 6 billion yuan in this quarter, a year-on-year increase of 17.6%, primarily driven by improved content distribution and monetization capabilities.

2) Gaming Revenue: Remained stable. Xiaomi's gaming revenue was 1 billion yuan this quarter, flat year-on-year.

3) Other Value-Added Services: Xiaomi's other value-added services generated revenue of 1.3 billion yuan this quarter, with financial technology services remaining stable.

Comparing Xiaomi and Apple's performance in value-added services, companies with software entry points are relatively more resilient to risks. Xiaomi's internet services business set a new revenue high this quarter.

Dolphin analyzed Xiaomi's internet services business in terms of volume and price:

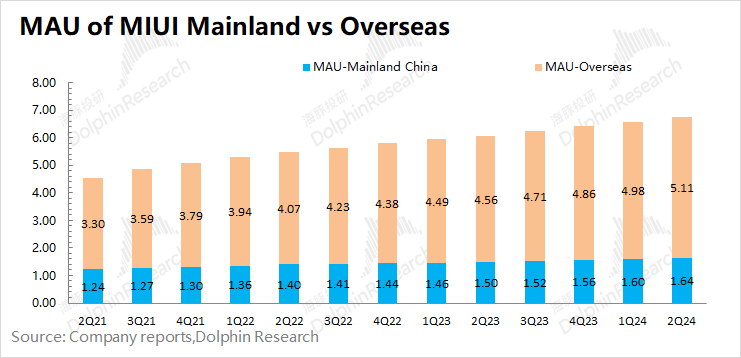

MIUI User Base: As of June 2024, Xiaomi had 676 million monthly active MIUI users, a year-on-year increase of 11.5%. The growth rate of MIUI users rebounded this quarter, with user numbers continuing to expand at a double-digit rate.

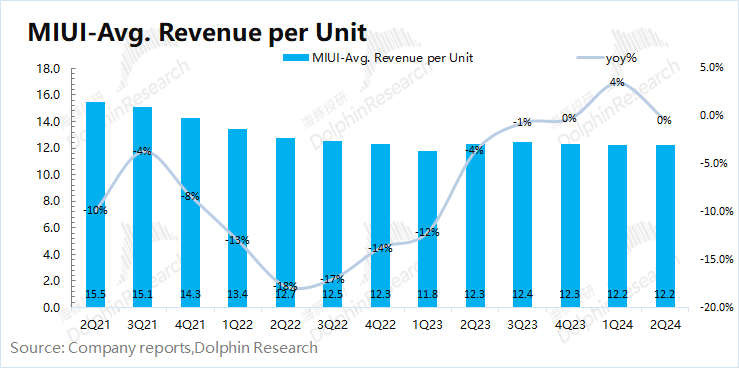

ARPU value: Based on the total number of MIUI users, the ARPU value for a single quarter is calculated. This quarter, Xiaomi's Internet services ARPU value was 12.2 yuan, remaining stable. For Xiaomi's ARPU value this quarter, the increase in overseas users' ARPU value roughly offset the decline in domestic ARPU value.

In the second quarter of 2024, Xiaomi's Internet services business generated a gross profit of 6.47 billion yuan, up 17.3% year-on-year. The gross margin for Internet services increased by 4.2 percentage points year-on-year, primarily due to the continued increase in the company's advertising business share.

Compared to other companies in the advertising industry, Xiaomi, with its access to terminal entry points, has maintained a high gross margin of over 70% for its Internet business. In an era where competition for existing traffic has intensified, the Internet entry-level traffic track has a better landscape and unique advantages. As the share of advertising business increases, Xiaomi's gross margin for Internet services is expected to continue to rise.

VI. Overseas Market: User Growth and Accelerated Monetization

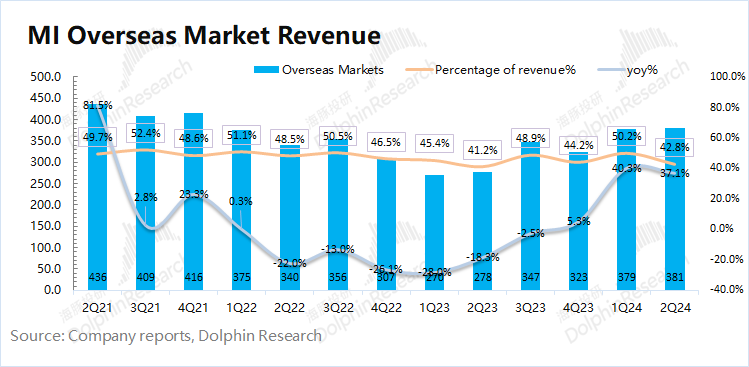

In the second quarter of 2024, Xiaomi's overseas revenue reached 38.1 billion yuan, up 37.1% year-on-year, but its share of total revenue declined to 42.8%. The decline in overseas revenue share was mainly due to the inclusion of the automotive business in the financial statements.

Due to the 32.9% growth in Xiaomi's overseas Internet business this quarter, the company's overseas hardware revenue grew by nearly 40%. Combined with the 31.3% year-on-year increase in Xiaomi's smartphone shipments in overseas markets (excluding China), Dolphin Insights believes that Xiaomi's IoT business also experienced double-digit growth in overseas markets this quarter.

In terms of MIUI user distribution, Xiaomi had 676 million MIUI users by the end of this quarter, of which 511 million were from overseas markets. In other words, although Xiaomi originates from mainland China, over three-quarters of its users are now overseas. With Xiaomi's vast overseas user base, the company's ability to monetize its overseas Internet business will directly affect its performance, and currently, the per-user ARPU value for overseas users is still much lower than that of domestic users.

Dolphin Insights estimates that Xiaomi's domestic user ARPU value was 33.85 yuan this quarter, down 7% year-on-year, while the overseas user ARPU value was 5.28 yuan, up 20.4% year-on-year, which was the primary source of growth for the company's overseas Internet business this quarter.

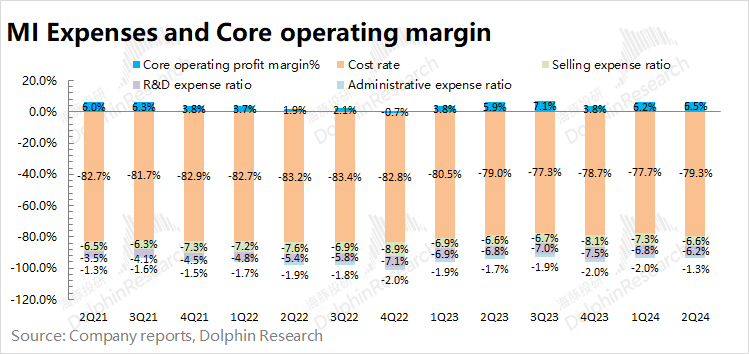

VII. Expenses and Performance: Stable Expenses and Steady Profit Growth

In the second quarter of 2024, Xiaomi's total expenses amounted to 12.58 billion yuan, up 23.6% year-on-year. The increase in expenses this quarter was mainly due to varying degrees of growth across all three expense categories.

R&D Expenses: At 5.5 billion yuan this quarter, up 20.7% year-on-year, accounting for 6.2% of revenue. The R&D expenses increased again this quarter, primarily due to an 869-person increase in R&D personnel, mainly driven by increased investment in automotive and innovative business R&D.

Sales Expenses: At 5.9 billion yuan this quarter, up 31.8% year-on-year, accounting for 6.6% of revenue, mainly affected by increased overseas logistics costs, promotional and advertising expenses, and higher salaries for promotion personnel.

Administrative Expenses: At 1.18 billion yuan this quarter, up 3.4% year-on-year, accounting for 1.3% of revenue, remaining relatively stable.

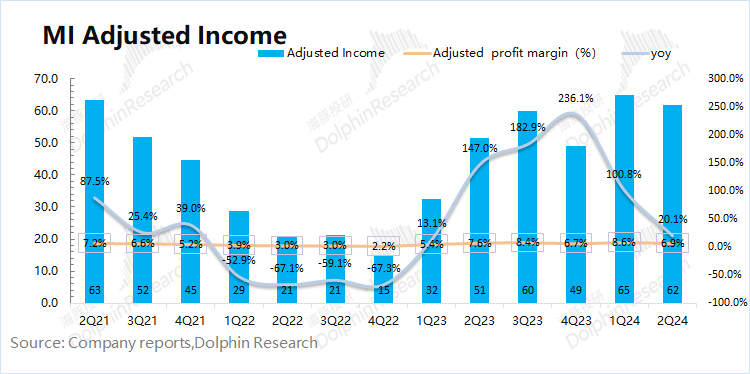

Adjusted net profit for the second quarter of 2024 was 6.2 billion yuan, up 20.1% year-on-year. From an operational perspective (excluding changes in fair value of investments), the company's core profit for this quarter reached 5.8 billion yuan, up 45.9% year-on-year.

The company's improved performance was primarily driven by the recovery of its hardware business, the addition of the automotive business, and increased gross margins for software services and other areas. Currently, the automotive business has not significantly impacted the company's performance, and the company's overall gross margin remains around 20%, providing a solid foundation for sustained profitability.