The 'Price-Tightening Curse' for Cars Looms! Selling Below Cost and Pay-to-Unlock Features Face Stringent Regulation

![]() 12/15 2025

12/15 2025

![]() 347

347

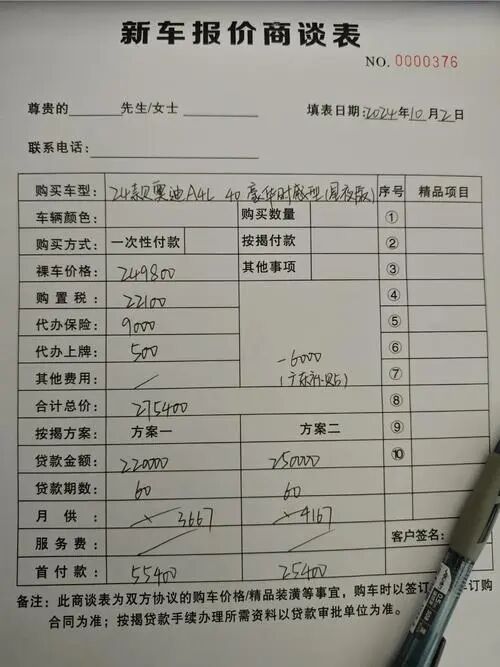

When consumers step into 4S dealerships, they are frequently bombarded with a plethora of promotional activities, ambiguous 'pay-to-unlock' features, and questionable 'limited-time offers.' Come next year, they might have well-defined regulations to safeguard their rights.

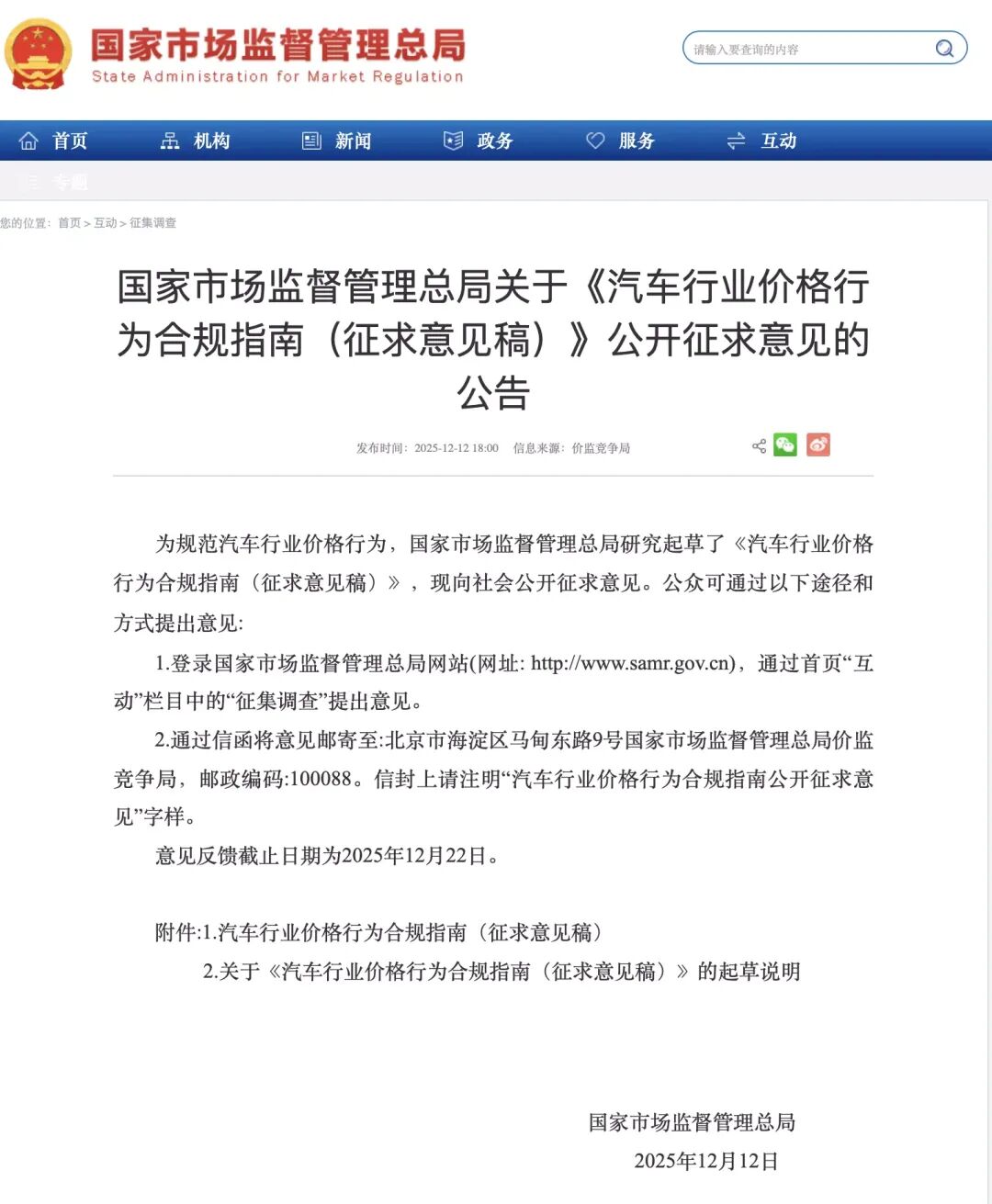

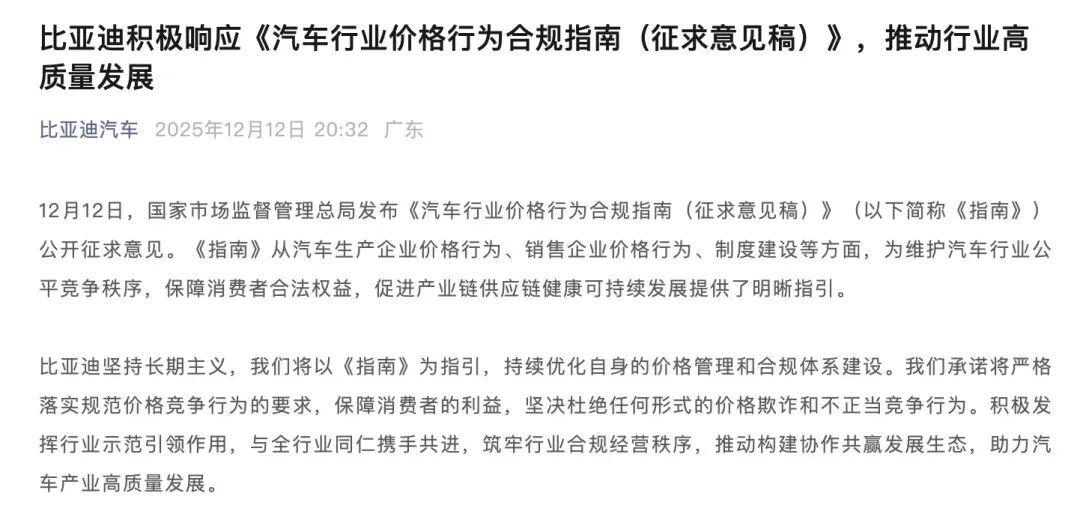

On December 12, the State Administration for Market Regulation drafted and publicly released the "Compliance Guidelines for Pricing Behavior in the Automotive Industry (Draft for Comment)" for public feedback.

These guidelines, encompassing five chapters and twenty-eight articles, offer explicit regulations on pricing behavior throughout all stages of automotive production and sales. Detailed provisions span from vehicle pricing and spare parts costs to transparent labeling and promotional activities.

Pricing irregularities in the automotive industry have long been a focal point for regulatory authorities. In September of this year, the "Work Plan for Stable Growth in the Automotive Industry," jointly issued by eight departments including the Ministry of Industry and Information Technology, explicitly called for "further standardizing the competitive order in the automotive industry."

China's automotive market has now entered a phase of 'stock competition.' In this market environment, some companies have resorted to irrational price competition to seize market share, which not only undermines the healthy development of the industry but also affects the consumer experience.

The "Guidelines" drafted by the State Administration for Market Regulation serve as specific operational norms developed in this context, aiming to "unify regulatory rules and clarify legal boundaries" for pricing behavior in the automotive industry and guide automotive production and sales companies to operate in compliance with the law.

Focusing on Price Regulations in Three Key Areas

The "Guidelines" put forward several specific regulatory requirements to address prominent issues in current automotive industry pricing behavior, focusing on three key areas.

For manufacturers, the "Guidelines" explicitly prohibit price collusion, including fixing or altering price levels and ranges. Notably, the "Guidelines" detail nine scenarios of "selling below cost," encompassing methods such as discounts, subsidies, over-delivering goods while under-invoicing, resulting in actual factory prices falling below production costs.

Regarding the sales process, the "Guidelines" emphasize regulating transparent labeling and promotional activities. Operators are explicitly required to prominently display vehicle names, sales prices, models, and main configurations in their business premises.

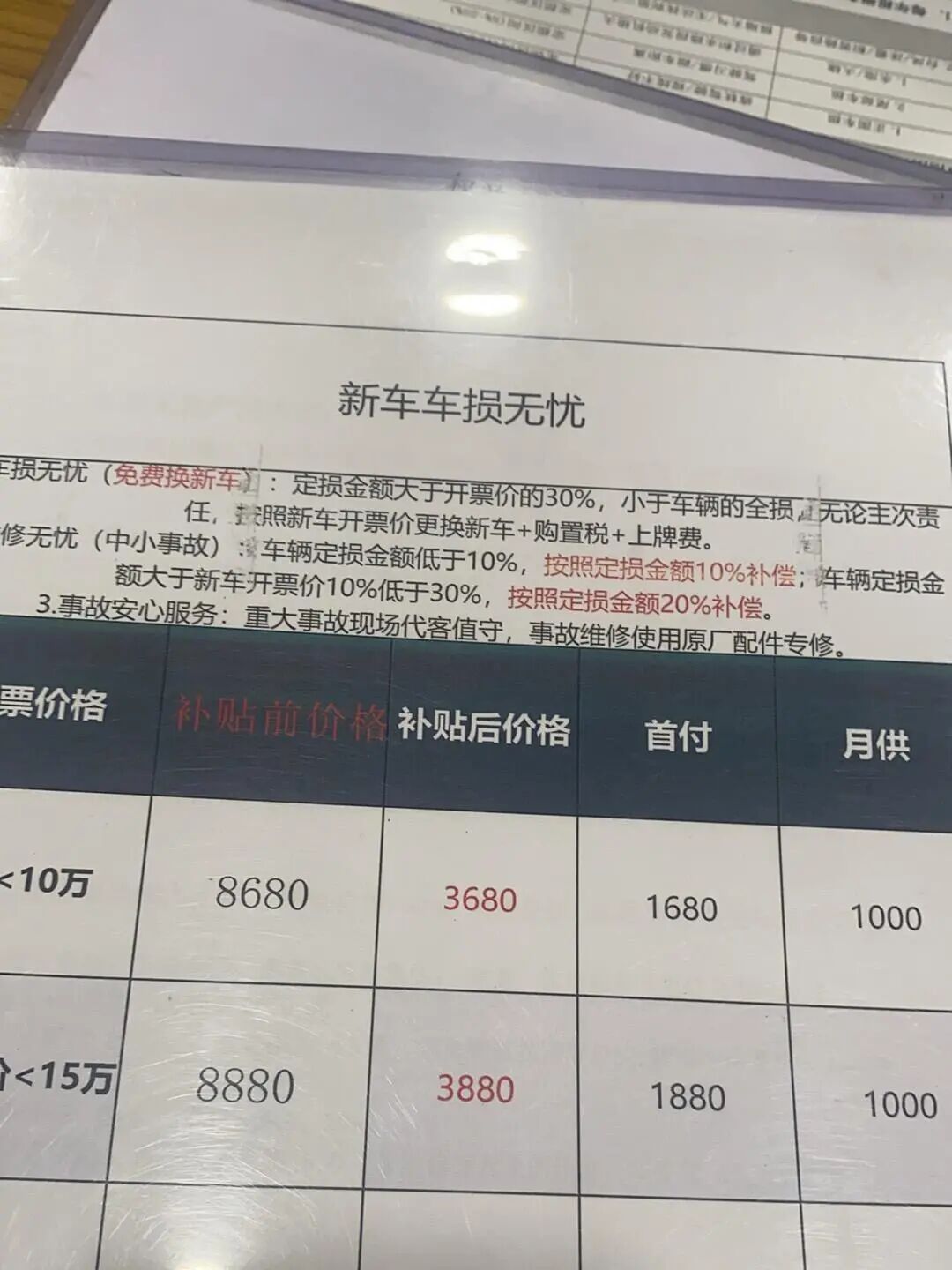

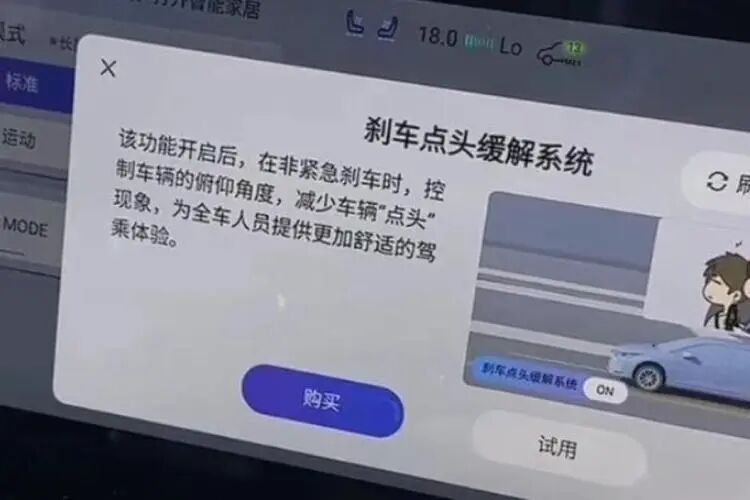

In response to the recent emergence of "pay-to-unlock" features, the "Guidelines" specifically stipulate that for features with a free trial period, the free duration and subsequent charging standards must be disclosed at the time of sale. For differentiated value-added features requiring payment, clear disclosure must be made at the time of sale, and no charges may be imposed without explicit notification.

For platform operators, the "Guidelines" mandate that they respect the independent pricing rights of operators within the platform, refrain from mandatory or disguised mandatory participation in promotional activities, and actively assist market regulatory authorities in supervision and inspection.

This policy arrives at a critical juncture when China's automotive industry is transitioning from "scale-led" to "technology-led" growth. On one hand, the policy will shift the focus of corporate competition from price wars to value wars. With restrictions on malignant (malicious) price competition below cost, companies will place greater emphasis on product innovation, technological upgrades, and service optimization.

On the other hand, the policy will help establish a more transparent market environment. The detailed provisions on transparent labeling in the "Guidelines" will enable consumers to better understand the true prices and configurations of vehicles, reducing consumer disputes caused by information asymmetry.

Automakers and Consumers Express Support

Following the release of the "Guidelines," several automakers swiftly issued statements expressing their support. This positive response reflects the industry's urgent need for standardized competition.

"These guidelines have come at a very opportune time," said a senior executive from an automaker who wished to remain anonymous. "Over the past few years, price wars in the industry have exhausted all participants, and some companies' promotional tactics have deviated from the essence of business."

Another marketing executive from a new energy vehicle company pointed out, "The regulation of 'pay-to-unlock' features in the 'Guidelines' is particularly crucial. This new business model requires clear rules to protect consumer rights while providing guidance for companies."

Automotive industry analysts believe that automakers' active support reflects not only a response to regulatory guidance but also the industry's need for self-purification. "A healthy competitive environment is vital for the long-term development of the industry, especially for leading companies that require stable market expectations," said an analyst.

For consumers, the implementation of the "Guidelines" will bring a more transparent car-buying experience. "The most frustrating thing about buying a car now is comparing prices," said Ms. Chen, who is preparing to purchase a vehicle. "There are significant price differences across sales channels, and it's hard to distinguish genuine 'limited-time offers' from fake ones. I hope the new regulations will make pricing more transparent."

The "Guidelines" also address consumer pain points regarding false promotions. According to the regulations, automotive sales companies are prohibited from using deceptive "market prices" or "manufacturer's suggested retail prices" for comparison in their promotions, as well as falsely labeling "limited-time discounts" or "clearance prices."

Additionally, the "Guidelines" regulate the practice of offering free gifts, requiring honest labeling of the names and quantities of gifts, with prices or values of gifts to be clearly indicated "wherever possible." This will make various gifts and additional services offered during car purchases more transparent.

Regulating Prices Does Not Mean Price Hikes

With the introduction and implementation of the "Guidelines," China's automotive market in 2026 may witness a new competitive landscape. Price competition will become more regulated, and companies will allocate more resources to technological innovation and service enhancement.

Intelligent driving may emerge as a new focal point of competition. Industry analysts predict that by 2026, urban navigation-assisted driving (urban NOA) will "accelerate its standardization from the 200,000-yuan price range to the 150,000-yuan range," transforming intelligent driving from a premium option to a standard feature.

Meanwhile, competition among Chinese automotive brands in the high-end market will intensify. Reports indicate that by 2026, domestic brands will launch a coordinated offensive into the "core territory of traditional luxury brands," particularly at the intersection of family users and technological luxury.

Value-added services such as automotive finance and after-sales service may also become new profit growth points for automakers. The "Guidelines" compliance requirements for pricing in these areas will encourage companies to provide more standardized and transparent services.

Policy drafters have specifically regulated "pay-to-unlock" features, requiring clear disclosure of free trial periods and subsequent charging standards at the time of sale. This means consumers will enjoy greater transparency when faced with an increasing number of software-defined automotive features in the future, significantly reducing post-purchase disputes.

As the guidelines are implemented, the competitive rules in China's automotive industry are being redefined. With the fading smoke of price wars, technology, innovation, and user experience will become the key factors determining the fate of automakers.