"November Auto Market Reveals 'Production-Sales Disparity': Over 3.5 Million Units Produced, Retail Sales Drop by 8%"

![]() 12/15 2025

12/15 2025

![]() 534

534

"In November, China's monthly automobile production surpassed 3.5 million units for the first time, reaching an all-time high," stated Chen Shihua, Deputy Secretary-General of the China Association of Automobile Manufacturers (CAAM), during a monthly analysis session on December 11.

CAAM data indicates that in November, automobile production and sales volumes reached 3.532 million units and 3.429 million units, respectively, marking a 5.1% and 3.2% increase month-on-month and a 2.8% and 3.4% rise year-on-year, continuing an upward trend. For the first 11 months, cumulative production and sales stood at 31.231 million units and 31.127 million units, respectively, showing an 11.9% and 11.4% year-on-year increase.

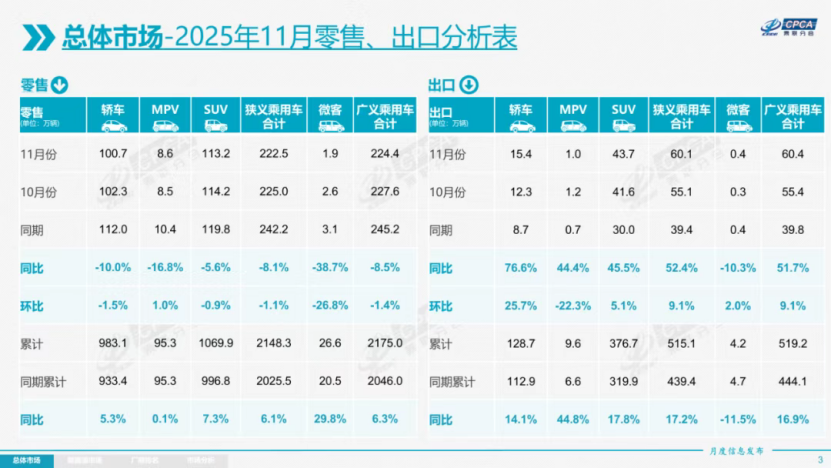

However, data from the China Passenger Car Association (CPCA) reveals that retail sales remained sluggish in November, with passenger car retail sales nationwide decreasing by 8.1% year-on-year and 1.1% month-on-month, signaling weakened consumer purchasing power. This 'production-sales disparity' is not accidental but arises from the interplay of policy shifts, market structural changes, and global competitive pressures.

Production and Wholesale Boom, While Retail Sales Lag

In November, CAAM data showed that nationwide automobile production and sales volumes reached 3.532 million units and 3.429 million units, respectively, achieving positive growth both month-on-month and year-on-year, with production hitting a new record.

Behind this accomplishment, automakers actively capitalized on policy opportunities. With the New Energy Vehicle (NEV) purchase tax exemption policy nearing its end-of-year expiration, companies accelerated production to secure orders and meet annual targets. Chen Shihua noted that despite a high base, firms maintained rapid supply, with both passenger and commercial vehicle markets performing strongly, especially NEVs, whose monthly market penetration exceeded 53% for the first time. Cumulatively, production and sales from January to November reached 31.231 million units and 31.127 million units, respectively, up approximately 11.5% year-on-year, making another annual record highly probable.

However, CPCA data indicates that despite record production and wholesale figures, terminal consumption cooled. In November, nationwide passenger car retail sales stood at 2.225 million units, down 8.1% year-on-year and 1.1% month-on-month, remaining 'subdued' for two consecutive months. This 'production-retail disparity' heightened industry inventory pressure, with manufacturer inventories rising by 60,000 units in November, in stark contrast to a 220,000-unit decline year-on-year.

The retail decline stems from multiple factors, including the fading impact of short-term policies and long-term consumption constraints. CPCA Secretary-General Cui Dongshu noted that last November's 'trade-in' subsidies drove retail peaks, creating a high base for comparison this year. Meanwhile, daily 'trade-in' subsidies dropped to 30,000 units in November 2025, weakening the policy's impact. More critically, cautious economic outlooks led some households to delay purchases, awaiting 2026 policies, falling short of domestic demand expectations.

By energy type, traditional fuel vehicle retail sales declined more sharply. In November, conventional fuel passenger car retail sales hit 900,000 units, down 22% year-on-year and 7% month-on-month, with cumulative retail sales down 6% year-on-year from January to November. This reflects an accelerating shift from fuel to NEVs, although a new consumption balance has yet to emerge.

Exports Fuel Growth, Domestic Brands Accelerate Global Reach

Amid weak domestic demand, auto exports emerged as the primary growth driver, a trend emphasized by both CAAM and CPCA. CAAM data shows November auto exports reached 728,000 units, up 48.5% year-on-year, surpassing 700,000 units for the first time. From January to November, cumulative exports hit 6.343 million units, up 18.7% year-on-year, with a full-year target of 7 million units within reach.

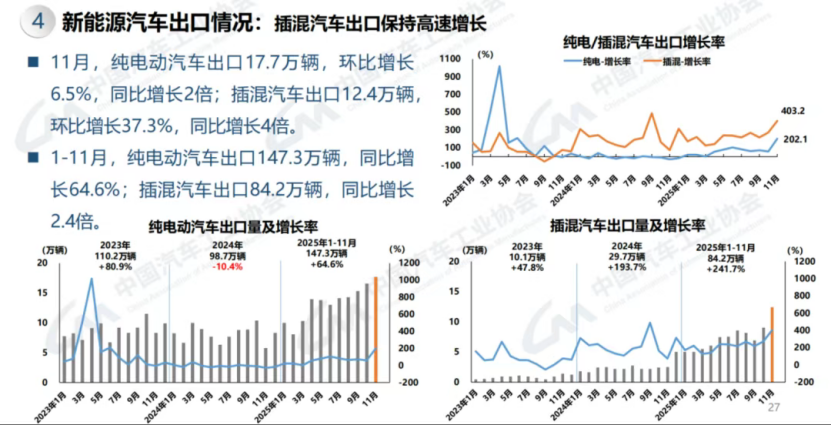

CPCA data confirms this surge: November passenger car exports (including complete vehicles and CKD kits) reached 601,000 units, up 52.4% year-on-year, a monthly record. Notably, NEVs drove export growth, with 300,000 NEVs exported in November, up 2.6 times year-on-year, and 284,000 NEV passenger cars exported by manufacturers, up 243.3% year-on-year. These figures indicate accelerating global expansion of Chinese NEVs with improving structural optimization.

Plug-in hybrid electric vehicles (PHEVs) stood out in exports, with over 120,000 units exported in November, up 4 times year-on-year. This reflects their appeal in emerging markets with underdeveloped infrastructure, where PHEVs' dual electric and fuel capabilities win favor. Export destinations diversified, with Mexico, Belgium, the UK, the UAE, and Brazil emerging as new growth poles alongside traditional markets like Russia, marking a strategic shift from single-market dependence to global diversification.

Domestic brands led this export wave. Both datasets show Chinese brand passenger car sales accounted for 71.4% of the market in November, with market share rising. Domestic brand exports reached 525,000 units, up 52% year-on-year. Leading firms like BYD, Chery, and Geely excelled, with BYD exporting 128,000 NEV passenger cars in November and Chery topping overall vehicle exports.

This dual benefit of domestic growth and global expansion solidified Chinese brands' domestic dominance and established a new global image of electrification and intelligence. However, challenges persist. Cui Dongshu noted the auto industry's sales profit margin stood at just 4.4% in the first 10 months of 2025, far below the over 30% for upstream raw material sectors, highlighting severe profit 'hollowing.' Unreasonable upstream price hikes amid weak consumption not only suppress demand but also erode Chinese automakers' global competitiveness.

The November 2025 auto production and sales data reflects an industry in transition. Production capacity expansion, global export布局 (layout - retained as is for its specific meaning in context), and NEV penetration breakthroughs form the core competitiveness of China's auto industry. With over 31 million units produced and sold and over 6.3 million units exported from January to November, achieving a new annual record and a successful '14th Five-Year Plan' conclusion appears likely.

Positive policy signals also emerged for next year. On December 8, the Political Bureau of the CPC Central Committee convened to discuss 2026 economic work, emphasizing steady progress and quality enhancement. Earlier, six ministries, including the Ministry of Industry and Information Technology, issued the

"The meeting's spirit and policy documents send positive signals, boosting confidence, stabilizing market expectations for next year, expanding auto consumption across the supply chain, and laying a solid foundation for a strong '15th Five-Year Plan' start," Chen Shihua said.

Layout|Yang Shuo Image Sources: CAAM, CPCA, Qianku Network