Car dealerships' survival after price wars: Domestic brands make up for shortcomings, joint ventures falling behind?

![]() 08/22 2024

08/22 2024

![]() 594

594

It's widely known that competition in the domestic auto market is incredibly fierce, with many mainstream automakers facing significant revenue pressures. To seize the remaining market share, they have resorted to various tactics. Price reductions, commonly referred to as "price wars," are the most common approach. Vehicles like the Accord and Camry, which once cost over 200,000 yuan, now offer discounts of tens of thousands of yuan, with entry-level models available for around 150,000 yuan, astonishing consumers.

As dealerships and direct stores, which are closely tied to automakers' revenue, have been impacted, they too are facing difficult times, as evidenced by recent incidents such as dealers 'pressuring' Porsche and Guanghui Auto seeing its market value evaporate by over 80 billion yuan.

Xiaotong wonders: if product prices are discounted, will service quality suffer as well?

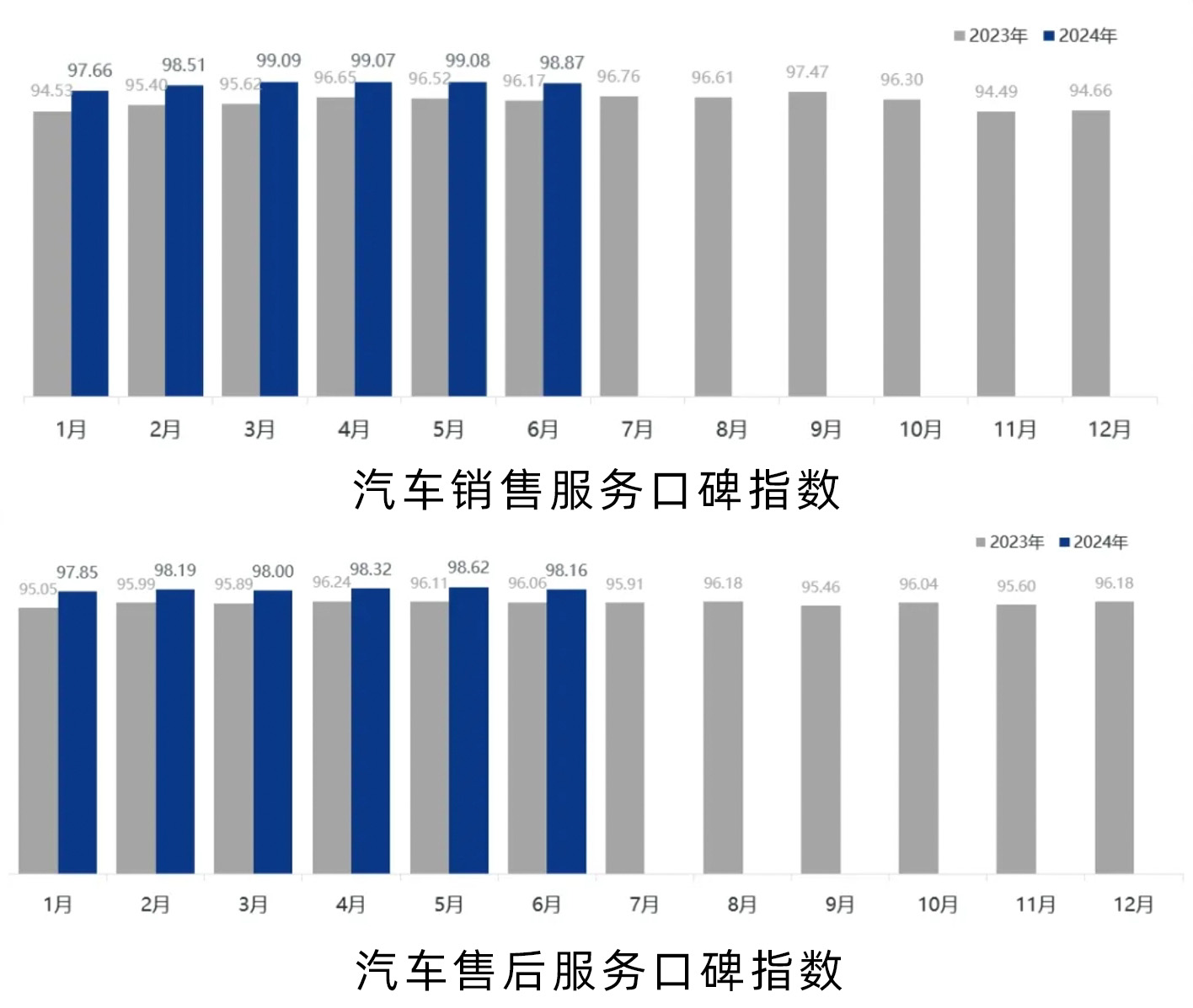

To address this question, Xiaotong reviewed relevant data. According to the "2024 June China Automotive Consumer Reputation Index Report" released by the China Automotive After-sales Service Quality Monitoring Big Data Platform (hereinafter referred to as "the Report"), the automotive sales service reputation index in June was 98.87 points, an increase of 2.7 points year-on-year but a decrease of 0.21 points month-on-month. Similarly, the automotive after-sales service reputation index decreased by 0.05 points month-on-month to 98.16 points, an increase of 2.10 points year-on-year.

This is somewhat surprising: consumers generally perceive that dealership service attitudes have improved compared to last year. Although there has been a slight decline since the second quarter, the overall service standard remains high. However, these data cover a broad range and can only reflect overall market trends.

To gain a clearer understanding of the true service attitudes of dealership brands, Xiaotong conducted on-site visits to multiple automotive dealerships and direct stores in Guangzhou. During these visits, it was observed that some dealerships had relatively simple service processes, while others had certain service issues.

Xiaotong summarizes the service situations of different automotive brands in selected Guangzhou dealerships based on factors such as showroom layout, reception, product explanations, and professional services. Please take a look.

Xiaotong believes that a single visit does not represent the overall service attitude of an entire brand. Even within the same dealership, there can be differences in ability and attitude among different sales personnel. Therefore, the conclusions drawn are for reference only. If this visit helps dealerships improve their service processes to some extent, that would be excellent.

Direct stores in malls: Quality service even if you're not buying a car

Xiaotong first visited automotive direct stores located in malls. Compared to traditional 4S dealerships in remote areas, mall-based direct stores have higher foot traffic. According to Xiaotong's observations, most consumers entering these stores are simply there for the experience, with relatively few intending to make a purchase.

It's important to note that Xiaotong chose to visit on a weekday when mall foot traffic was low. During these times, staff members may be busy with tasks other than sales, which objectively poses additional challenges to their service.

1. Tesla: Professional staff with patience throughout the explanation.

Tesla began deploying in malls in early 2020, pioneering the "mall-based direct sales" model. This approach has helped expand the brand's visibility. During Xiaotong's visit, the Tesla direct store had only one entrance, similar to other shops in the mall. The staff member sitting near the entrance quickly noticed Xiaotong's arrival and introduced the products promptly, even if they were busy on their computer beforehand.

The salesperson demonstrated exceptional competence, inviting Xiaotong to sit in the driver's seat for a hands-on experience despite knowing Xiaotong's low intention to purchase. In response to the direct comment about the "too plain interior," the salesperson calmly explained the brand's design philosophy without showing any negative emotions like impatience or ridicule. After Xiaotong completed the static experience, the salesperson introduced Tesla's current financial policies and invited Xiaotong for a test drive.

Whether you genuinely plan to buy a car or simply stop by for an experience, you can expect excellent service at this Tesla direct store.

2. Yuanhang Automobile: Luxurious store decoration with sincere sales staff.

In contrast, the brand that impressed Xiaotong more was Yuanhang Automobile. Many may be unfamiliar with this automotive brand, which has only been around for two years. Its products are mid-to-large-sized, priced between 200,000 and 400,000 yuan, focusing on "cost-effective luxury."

Although the brand is not particularly well-known and lacks impressive sales figures, the showroom is significantly larger than other automotive brands located in malls. Furthermore, the enthusiastic attitude of the sales staff left a deep impression on Xiaotong. Despite Xiaotong's initial intention of just browsing, the salesperson actively invited Xiaotong to experience the car and promptly demonstrated its unique features.

Salesperson demonstrating the touchscreen function on the door panel

3. Domestic new forces: Avita had a longer wait, but overall performance was good.

Sales staff from JiYue, LanTu, XPENG, and NIO, who also had a single entrance, were able to quickly follow up. The JiYue salesperson's conversational style was friendly and approachable, like chatting with a friend. As for AVATR, which has an open store design, the salesperson did not immediately notice Xiaotong browsing the cars, resulting in a wait of about six minutes before follow-up. However, the salespeople from these brands were attentive during product explanations, patiently answered Xiaotong's questions, and only requested contact information after observing Xiaotong's intent to purchase.

4. New energy vehicles under traditional brands: "You ask, I answer," with stiff service

In comparison, traditional brands like smart, Buick New Energy, and Dongfeng Nissan New Energy mostly stuck to a basic "you ask, I answer" approach. The staff's service attitude was not proactive. During Xiaotong's visit, they merely observed from a distance and did not actively invite test drives until Xiaotong inquired. Overall, Xiaotong could not give these brands high marks for their service.

Automotive brands located in malls generally have no issues with their showroom appearances. However, there are notable differences in their timeliness of follow-up explanations and attitudes during explanations. Xiaotong believes that it's understandable if sales staff do not immediately follow up when foot traffic is low, as long as they maintain a good service attitude and can answer questions, they will not leave a poor impression on visiting customers.

Automotive brands in malls have two objectives: selling cars and expanding brand awareness. In Xiaotong's opinion, the latter is more crucial since most mall visitors are there for entertainment and shopping, with very few intending to buy a car on impulse. In contrast, traditional dealerships are typically located in areas with lower foot traffic for the convenience of after-sales service and transportation. While sales and after-sales are their primary focus, does this necessarily translate to better service attitudes in traditional 4S stores? The reality may differ.

Better service in 4S stores? Performance varies across brands

To align with the objective conditions of mall-based direct stores, Xiaotong also chose to visit traditional dealerships during weekday working hours. The first stop was GAC Toyota, a joint venture brand.

1. GAC Toyota: Professional sales staff, but chatting at the entrance detracts from the experience.

In Guangzhou, classic, durable, and fuel-efficient Japanese cars are popular among family users, attracting many visitors even during non-weekend hours. The GAC Toyota dealership Xiaotong visited had 5-8 sales staff standing and chatting at the entrance. Arranging so many sales staff on duty during low-traffic hours indicates that business is relatively good at this dealership.

However, Xiaotong was puzzled that the sales staff at the entrance did not acknowledge her arrival. It wasn't until she entered the store that a salesperson followed up. Xiaotong believes that taking a brief break during low-traffic hours is understandable, but ignoring customers upon their entry can leave a poor impression and potentially lose potential buyers.

One positive aspect is that the salesperson asked if Xiaotong needed assistance with vehicle introductions. Upon receiving a "no," the salesperson did not continue to follow. Xiaotong observed other salespeople introducing products to other customers and found them to be professional, with comprehensive explanations covering product highlights, financing options, and competitor comparisons. They also promptly invited customers for test drives. In terms of competence, the service at this dealership is not poor, but considering the work attitude of the staff at the entrance, Xiaotong can only give a "moderate" rating for service attitude.

Subsequently, Xiaotong visited dealerships of GAC Honda and SAIC Volkswagen, both joint venture brands.

2. GAC Honda & SAIC Volkswagen: Customer information required before vehicle viewing, causing pressure for customers.

In addition to highlighting product features, SAIC Volkswagen sales staff also shared landing prices of other products, providing comprehensive information to potential buyers.

However, both dealerships required customer information before vehicle viewing, which might not significantly impact serious buyers but could lead to harassment for hesitant customers. As Xiaotong received numerous sales calls on the same evening after her visit, this requirement may leave a negative impression and encourage low-quality lead generation. Xiaotong suggests that dealerships learn from mall-based direct stores by only requesting customer information after confirming their purchase intention to avoid harassment and ensure high-quality leads.

3. BYD Dynasty dealership: Thoughtful service, "offering water" to make friends.

For the next stop, Xiaotong chose a BYD Dynasty dealership. After all, as the best-selling automotive brand in China, Xiaotong had two preconceptions about the service attitude of BYD dealerships: First, there are many car buyers, so sales staff may not be able to attend to everyone, leaving Xiaotong to explore on his own; second, customers are often required to leave their contact information upon entering the store, and salespeople try to attract customers with price incentives.

However, the first thing Xiaotong received upon entering the store was water from the salesperson, making it the only dealership among those Xiaotong visited secretly in the past two days to proactively offer beverages. Other dealerships may have beverages available, but they would typically only offer them during the transaction process. Xiaotong truly felt the sincerity of "making friends" at the BYD dealership, no wonder BYD is so popular.

One unique aspect is that while other dealerships directly ask for WeChat to communicate, this salesperson still preferred exchanging business cards – business cards allow customers to actively choose whether to communicate, whereas WeChat often leads to passive information reception. Details reveal the truth.

When explaining the product's highlights, the BYD Dynasty salesperson also provided Xiaotong with a configuration sheet for reference, demonstrating thorough attention to detail. Other bonuses included a pack of wet wipes given to Xiaotong as he was leaving. Although the BYD Dynasty dealership's showroom is not as spacious as others, it left a profound and positive impression on Xiaotong. Without exaggeration, it provided the best service level among all dealerships visited by Xiaotong.

Finally, Xiaotong observed dealerships of three luxury automotive brands: Mercedes-Benz, smart, and BMW. It must be said that the showroom environments and comfort levels of these three dealerships are impeccable.

4. Mercedes-Benz brand showroom: High customer traffic, sales staff overwhelmed.

The Mercedes-Benz showroom had many customers, so much so that Xiaotong observed cars for about ten minutes without being approached by a salesperson; in contrast, the smart dealership located in a remote area was relatively quiet. Although Xiaotong was promptly greeted by sales staff upon entering, they returned to their workstations after letting Xiaotong explore the vehicles on his own.

5. BMW dealership showroom: Spacious, professional sales staff strongly promoting new energy vehicles.

The BMW dealership showroom is spacious, with well-organized areas. Although customers are asked to leave their contact information upon entering, the overall car-viewing process is smooth. In response to Xiaotong's question about which car to buy within a budget of 300,000 to 400,000 yuan, the salesperson provided professional suggestions and allowed Xiaotong to experience each recommended model. Notably, after listening to Xiaotong's inquiry, the salesperson mentioned considering new energy vehicles twice, suggesting that BMW dealerships have stricter sales requirements for new energy vehicles.

In comparison, there is not a significant difference in professionalism and service attitude between traditional dealerships and mall-based direct stores. However, the best and worst store visits were at dealerships, highlighting significant variations among brands and stores. Direct stores in malls tend to have more consistent service levels, which is inevitable given the different modes of operation:

Under self-operated direct store mode, brands have stronger control over service quality, making it more manageable. In contrast, under third-party dealership mode, brand control is weaker, and service quality depends on the management level of the dealership. This pattern holds true across industries.

Complaints about varying service levels at 4S stores are not new. Overall, the service levels at dealerships visited during this survey met Xiaotong's expectations. Xiaotong believes that the consistently low average service levels at dealerships stem partly from their unique position in the industrial chain.

Mall-based direct stores cannot fully replace traditional 4S stores, giving traditional 4S stores the confidence to "have nothing to fear." It seems that a simple "price war" focused on products alone cannot drive all-round progress in the industry. There is still considerable room for improvement in sales services across major brands.

Varying service quality, notable progress among domestic brands

Based solely on Xiaotong's survey results, there are distinct differences in service tones among luxury, joint venture, and domestic brands.

1. Luxury brands excel in hardware configuration. Due to their luxurious nature, luxury brand dealerships generally boast well-equipped and upscale hardware facilities, with thoughtful designs extending to parking lots, exhibition areas, and after-sales service areas. Some even provide gaming and cultural exhibition areas. These details, which traditional joint venture and domestic brands cannot match, enhance the brand experience for customers.

Another aspect that enhances customer identification with luxury brands is the systematic management of service attitude. Taking the BMW dealership visited by Xiaotong as an example, there are clear divisions of labor among appointment registration, professional sales, and other processes. We are like goods on an assembly line, with dedicated sales reception at each stage. If you plan to buy a BMW model, you can not only enjoy meticulous service but also facilitate after-sales communication.

2. Joint venture brands lag in service. Whether dealerships or direct stores, many only offer basic services. Let alone proactively offering beverages or inviting test drives, it's not uncommon to encounter salespeople who only respond when asked questions or are stingy with words, making customers feel unappreciated.

Xiaotong believes that joint venture brands offer basic services because they consistently attract stable customer traffic in Guangzhou, allowing salespeople to close deals without much effort. Naturally, they gradually lose the motivation to provide high-quality services. However, for customers who prioritize products, the current level of service at joint venture brand dealerships is sufficient.

3. Domestic brands have finally addressed their service shortcomings. Perhaps inspired by Tesla's successful mall-based operations, domestic brands have largely followed suit by establishing mall-based direct stores, especially for new energy vehicle brands seeking increased visibility. Their presence in malls is gradually growing, a feature largely absent among traditional joint venture and luxury brands.

While most direct stores are smaller than traditional dealerships, their service levels are significantly higher. Salespeople typically invite customers to experience in-car space, infotainment systems, and comfort features and proactively offer test drives, giving customers a comprehensive understanding of the vehicle's basic performance and functions.

Xiaotong noticed a positive correlation between domestic brand sales and service quality. For example, during the undercover visit to BYD, the brand maintained a professional and thoughtful service attitude in product explanations and customer reception, with even simple gestures like offering water and wet wipes surpassing many traditional joint venture brands. Additionally, Xiaotong previously visited an Ideal Automobile store where water was also offered as a standard service.

Service: Another cornerstone for automotive brands amidst product homogenization

Joint venture brands indeed held significant sway in the gasoline-powered era, but the domestic auto market has entered the era of electrification, where joint venture brands have lost ground in the new energy sector. They have resorted to lowering prices of popular gasoline models to attract customers.

Initially, price reductions were attractive, but the "price war" has been raging for over a year, and "high cost-performance" seems to be losing its effectiveness.

Taking Japanese brands preferred by Guangzhou customers as an example, the latest data shows that Toyota, Honda, and Nissan sold 143,400, 52,567, and 47,102 vehicles in the Chinese market in July, respectively, down 6.1%, 41.4%, and 20.8% year-on-year. The number of competitive models is gradually decreasing, with only four Honda models (Accord, Civic, HR-V, and CR-V) selling over 50,000 units in the first seven months, and three Nissan models (Sylphy, Qashqai, and Teana) making significant contributions.

Actually, the declining trend of Japanese brands emerged in the first quarter of this year. Apart from adjusting product prices in a timely manner, Japanese brands also accelerated their electrification transformation to compete with domestic brands. To survive, Japanese brands are actively seeking change. As the "face" of Japanese brands in the Chinese market, dealerships should also make strategic adjustments in a timely manner. If they do not improve their service attitude, the outcome is predictable.

After much discussion, can dealership service quality truly determine a brand's sales? The answer is undoubtedly no. However, Xiaotong believes that the impact will not be too significant in the short term. But once consumers widely associate negative labels with a brand's service, the brand will need to expend more effort to repair its reputation.

Based on Xiaotong's experience, the in-store experience at traditional joint venture brands is indeed not as good. If Xiaotong did not initially prioritize these joint venture brands, he might directly abandon them due to their service attitude.

Of course, evaluating service attitudes is subjective, and different customers may judge the same salesperson differently. Even the same salesperson may vary in service levels at different times, highlighting the difficulty in delivering consistent service. As service delivery relies on people, managing people is the most challenging aspect. To ensure service standards, automotive brands must possess exceptional management capabilities.

As automotive products become increasingly homogenized, "service" will become another high ground for industry competition in the long run. The story of competing on both products and services has already played out in the gasoline-powered vehicle market. Any automotive brand that can establish a "Haidilao-style" benchmark service will gain another layer of competitiveness.

Source: Leitech