Behind Kingsoft Office's fluctuating share price: Beyond product barriers, proving technical barriers is also crucial

![]() 08/22 2024

08/22 2024

![]() 414

414

On the other hand of C-end progress and B-end transformation, Kingsoft Office must eventually confront AI capabilities and paid growth issues

Image source: WPS official website

After the AI boom drove up share prices, Kingsoft Office has come full circle.

In November 2022, ChatGPT officially emerged, causing share prices of all AI-related companies in the capital market to surge for several months. As an AI application scenario that fits well and has a clear implementation direction, Kingsoft Office also saw a rapid rise during this period, increasing by over 100% from HK$240 within four months and setting a record high of HK$527.74.

However, after experiencing the highlights brought by hype, the accompanying factor of gradually manifested AI capabilities has been a continuous decline in share prices. Over the past year, apart from the rebound brought about by the launch of WPS's AI application functions and the market's recovery, the company's share price has been declining, and it is currently below HK$200, even lower than before the surge in 2022.

Image source: Choice

CICC also released a research report on Kingsoft Office in July, stating that due to the short-term implementation pace of WPS_AI, B-end licensing demand, and B-end subscription transformation, the company's 2Q24 performance fell below market expectations.

So, how has Kingsoft Office's business performed in this half-fiscal year since it completely abandoned advertising and went all-in on AI? How has its flagship product WPS performed? What kind of response will the capital market give to Kingsoft's current potential issues?

01

In the first half of 2024, the office white horse met market expectations

On the evening of August 20, Kingsoft Office released its financial report for the first half of 2024. The report shows that in the first half of this year, Kingsoft Office achieved revenue of RMB 2.413 billion, a year-on-year increase of 11.09%, and net profit attributable to shareholders of RMB 721 million, a year-on-year increase of 20.38%. Deducting non-recurring gains and losses, the net profit attributable to shareholders was RMB 688 million, a year-on-year increase of 19.35%. Both revenue and net profit continued to achieve double-digit growth.

Among various businesses, Kingsoft Office's domestic individual office service subscription business generated revenue of RMB 1.529 billion, a year-on-year increase of 22.17%; domestic institutional subscription and service business generated revenue of RMB 442 million, a year-on-year increase of 5.95%; domestic institutional licensing business generated revenue of RMB 324 million, a year-on-year decrease of 10.14%; international and other business generated revenue of RMB 115 million, a year-on-year decrease of 18.12%.

Among them, within the individual business, the most basic and essential monthly active device count maintained steady growth.

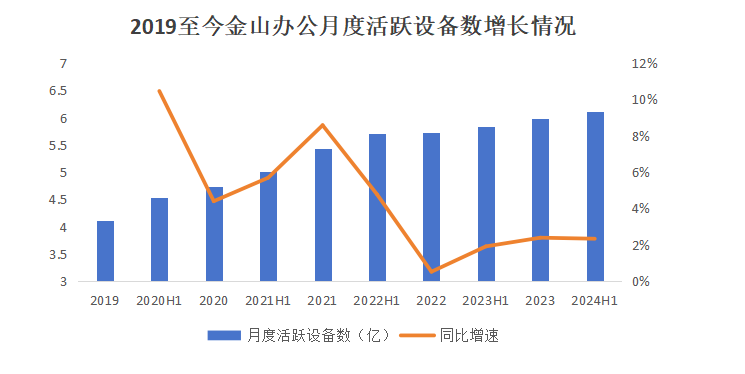

According to the financial report, the number of monthly active devices in H1 2024 was 602 million, a year-on-year increase of 3.08%. Although the growth in the first half of this year appears to have stagnated, after experiencing a rapid penetration period and breaking through 600 million monthly active users, the stagnation in monthly active user growth was expected. Maintaining positive growth is already a commendable achievement.

Newou Draw

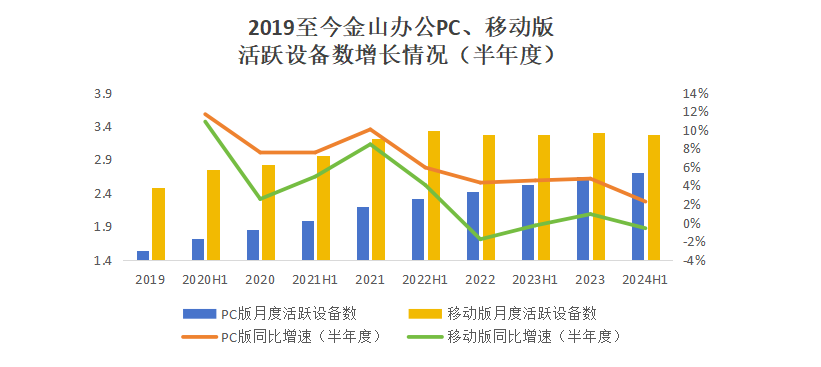

Breaking it down further, the monthly active device counts for the PC and mobile versions of WPS were 271 million and 328 million, respectively, with year-on-year growth rates of 7.11% and 0.31%, respectively.

It is universally acknowledged that employees mainly use the mobile version of WPS for simple viewing and editing, while the PC version is the core area for conversion to paid subscriptions. Although Kingsoft Office achieved year-on-year growth in both mobile and PC versions, the growth rate of the PC version also showed a downward trend when measured over a six-month period, further confirming that WPS's user base has reached its ceiling.

Newou Draw

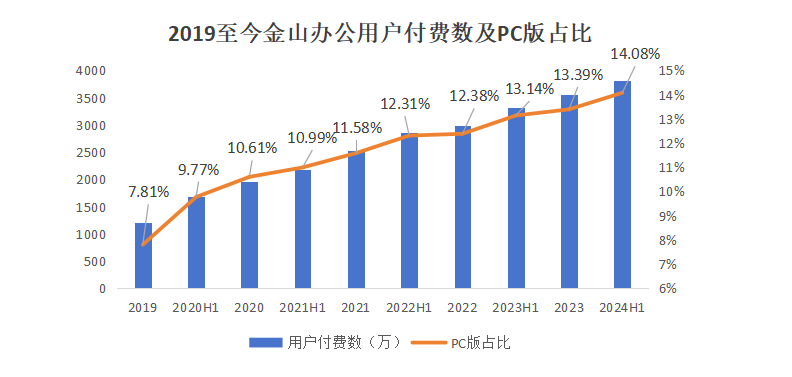

Given that the free user base cannot grow rapidly like in the past, the burden of increasing revenue from individual business falls on user conversion rates.

According to the interim report, Kingsoft Office had 38.15 million paying users in the first half of the year, a year-on-year increase of 14.79%. The paying user/PC version ratio, which can be seen as the payment rate, also reached a new high, indicating that Kingsoft has performed well in user conversion. Especially driven by AI capabilities, it has injected new vitality into the seemingly slowing payment rate growth and ultimately contributed to a 22.17% increase in individual business revenue to RMB 1.529 billion.

Newou Draw

In terms of institutional business, neither institutional subscription business nor institutional licensing business showed particularly optimistic results based on the data.

The growth rate of institutional subscription business declined rapidly. Although the interim report did not directly mention the reasons, the reasons mentioned previously were still implied in the text—the launch of the new WPS 365 office platform, and the ongoing transformation of institutional subscription sales models towards a dual transformation of products and sales models. Some deceleration is reasonable before the transformation is complete.

Institutional licensing business is more like a "remnant of the old era." Kingsoft Office is also promoting the transformation from site licensing to a standard subscription model, which short-termly leads to slower apparent revenue growth, which is understandable. The company also stated that "related contract liabilities have maintained healthy growth," so there is no need to worry too much about the decline in licensing business.

Overall, in Kingsoft Office's most reliable C-end, both the monthly active device count and the actual user conversion rate have maintained excellent performance, and there is even an upward trend with the support of AI. Although Kingsoft Office's B-end business is temporarily hindered during the transformation pain period, it does not affect its long-term development, and the company has maintained a healthy growth rate.

02

Under the crown of AI, WPS faces more changes and challenges

From a financial report perspective, the individual business has gained new growth vitality with the support of AI capabilities. The institutional business is in the midst of the painful transition from licensing to subscription, and its growth potential is not in doubt, driven by AI applications and localization. However, does this mean that Kingsoft Office can rest easy?

The answer is naturally no. In the past year, when AI capabilities emerged, Kingsoft Office has faced its own troubles in terms of public opinion, AI capabilities, and payment rates.

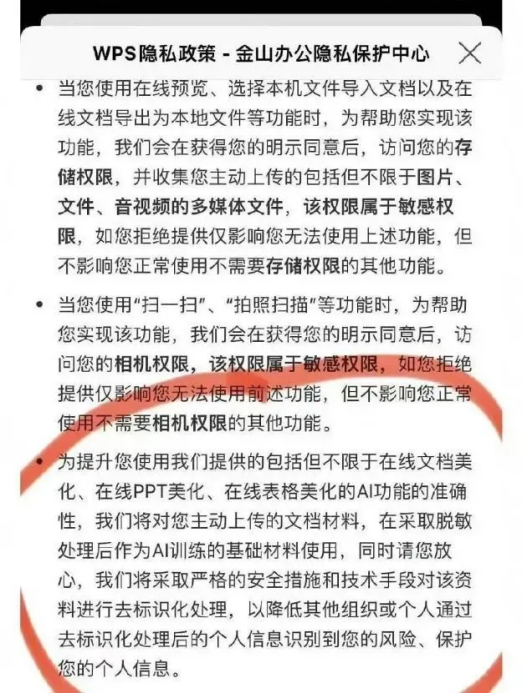

In terms of public opinion, WPS's privacy concerns once caused users to feel uneasy, and its confusing charging rules were often criticized by paying users.

In November last year, users discovered that in an updated user privacy policy of WPS, it was clearly stated: "We will use the documents you voluntarily upload, after desensitization, as basic materials for AI training." Many users suspected that all content using WPS could potentially be used for AI training.

Image source: WPS

After this incident escalated, People's Daily commented, "The more everything can be digitized, collected, and analyzed, the more necessary it is to draw a bottom line, build a dam of information security, and give users the right to choose or even say 'no'."

Although WPS quickly apologized, stating that "all user documents will not be used for any AI training purposes and will not be used in any scenario without the user's consent," Zhang Qingyuan also said in an interview that the privacy agreement was written at least three years ago and was intended for PPT layout beautification, which had nothing to do with AI training. Nevertheless, the incident still caused considerable impact at the time.

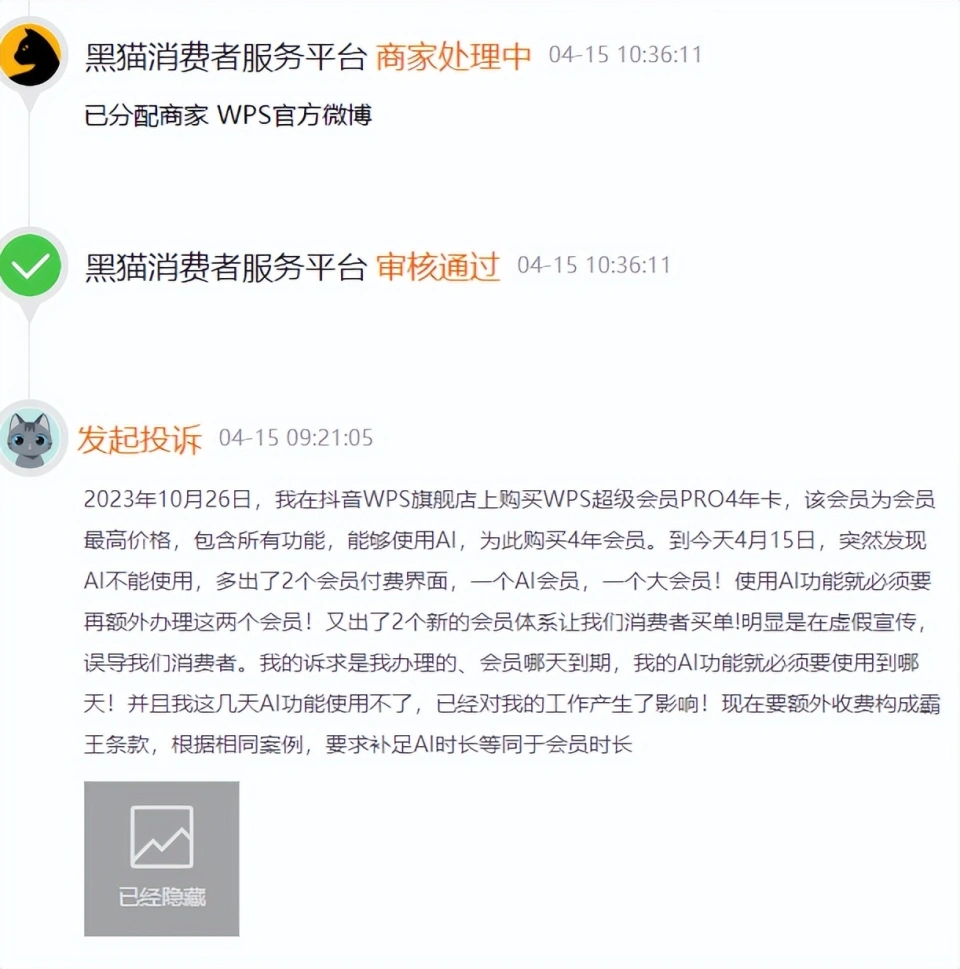

In May of this year, WPS was again criticized by users on a large scale for its "Russian doll-style" charging for various memberships. On the Heimao Complaint Platform, consumers complained that they had already purchased WPS Super Member Pro, which includes all functions, but found that they still needed to pay separately for AI services.

Image source: Heimao Complaint Platform

Their complaints resonated with netizens, who commented that WPS's more than 10 membership package types were too confusing, and related benefits were constantly being stripped away after purchase, resulting in a poor user experience.

The relevant person in charge of WPS responded that the AI services previously offered to members were a benefit, and the benefit period had now ended. WPS did not acknowledge the existence of the "Russian doll-style" charging described by consumers. Although the company technically has a valid stance, such a complex and confusing pricing strategy not only tarnishes WPS's reputation but also hurts the hearts of paying users who have invested real money.

In terms of large model capabilities, Kingsoft Office has chosen the most correct path, but it seems to lack sufficient technical strength.

In terms of AI technology integration, Kingsoft Office has adopted a strategy of "large model cooperation + small model self-development." Rather than developing a large model, it cooperates with established large model companies and focuses on application-side development.

Specifically, Kingsoft Office has established in-depth cooperation with large model vendors such as Minimax, Zhipu AI, iFLYTEK, Ali Group, and Baidu, integrating these large models' capabilities into the WPS AI ecosystem. Users can choose the optimal solution from different large models, such as using Shangtang for math problems, Baidu for poetry, Zhipu for PPT creation, and MiniMax for article reading.

At the same time, Kingsoft Office is also developing small models on an open-source platform, enabling them to provide relatively high-quality services in vertical fields at a low cost (e.g., using an NVIDIA GeForce RTX 4090 graphics card).

However, even though Kingsoft Office has chosen this "most correct" path, due to its lagging AI foundational capabilities compared to Microsoft, which grew on the OpenAI platform, WPS still has ample room for improvement in AIGC content production capabilities.

Moreover, Kingsoft Office experienced three consecutive crashes in less than two months, raising significant doubts about its technical capabilities in the market.

On June 28, WPS experienced a service interruption, and on July 8, WPS services encountered problems again, including but not limited to the inability to open cloud documents, load online documents in mini-programs, or log in to WPS accounts. Many users reported that "their documents were not saved when the server crashed."

Image source: IT Home

The error codes for both cloud document crashes were "no healthy upstream" and "upstream connect error or disconnect / reset before headers. reset reason: connection failure," causing many netizens to question whether Kingsoft had seriously conducted relevant technical maintenance.

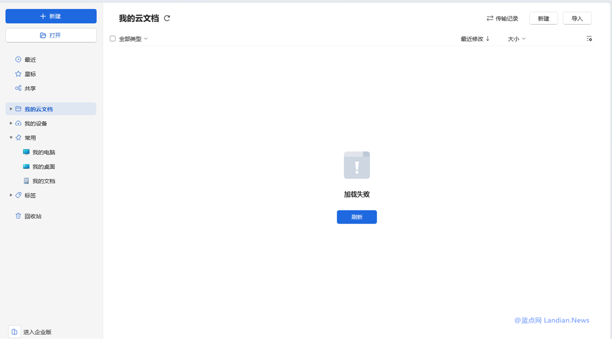

On August 21, the day after the financial report was released, WPS experienced another crash, rendering it unusable. Users could not view files saved in WPS cloud documents, and reminders such as "load failed" appeared.

Image source: LanDian Network

When inquiring about the situation, the official customer service was offline, and the @WPS Customer Service private message responded, "We apologize for the inconvenience caused to you. The issue you reported is currently being urgently repaired. Please follow the WPS Customer Service WeChat official account, and we will notify you via the official account after restoration. Thank you for your understanding." As of now, WPS has not yet completed the repairs.

Many users are accustomed to storing publicly shared documents on online office platforms like Kingsoft Docs. If the service is interrupted, some regions will be unable to access these files, causing inconvenience to users' work, study, and life. Even more concerning is that if users do not have local backups of their files and experience three crashes within two months, how can they regain users' trust if files are lost?

Finally, although Kingsoft Office's C-end user payments still have considerable momentum, it is undeniable that future paid business will become increasingly challenging to develop.

In recent years, users have become increasingly accepting of internet payments, but office software like WPS differs significantly from video and audio platforms. This is because the needs of most people can be met within the free range, and even occasional demands for paid features are infrequent. Furthermore, daily or monthly passes or shared accounts for various office software sold on Xianyu and Taobao can fully meet these needs.

The sale of related benefits has become a complete industrial chain, reflecting the increasing difficulty in expanding the payment rate from another perspective.

How to enhance technical capabilities to make users feel that it is worthwhile in an era where free and easy-to-use AI is ubiquitous and willingly spend money might be the biggest challenge facing Kingsoft Office.

Image source: Xianyu

03

Closing Remarks

As a white horse among domestic office software, WPS has always been considered a product comparable to Microsoft Office. In the wave of localization and compared to its lagging competitors, Kingsoft Office has advantages that set it apart, giving it the confidence to abandon advertising and focus on providing functional services to users.

However, in an environment where everyone has access to AI, the question remains: how much are WPS's various functions truly worth, and how much market value does Kingsoft Office truly deserve? The crux lies in how much genuine incremental value AI can bring to WPS, which determines whether it can transform from a simple office software to an irreplaceable tool. This is the most crucial question Kingsoft Office must answer in the AI era.

References:

1. "Can Kingsoft Office Compete with DingTalk and Feishu?", DoNews;

2. "Kingsoft Office's Decade: Inflated Ambitions and Hidden Worries Behind AI Transformation", Xinmou;

["3. "Kingsoft Office's Business and Thoughts - Q1 2024", Xiao Bei Value Investment;

4. "Kingsoft Office: What Kind of Change is Next?", Node Finance;

5. "Outstanding Performance! Net Profit Soars 95 Times in 10 Years, A Highly Profitable Company", Teacher Zhang's Investment Research;

6. "Hands in Pockets, Can't See a Rival Yet: The Leading Office Software Kingsoft Office", Copycat Value's Kakashi;

7. "Kingsoft Office: Q2 2024 Earnings Forecast Lower Than Market Expectations, AI Applications Bring Potential Growth", Eastmoney.com.