Seres invests over 10 billion in Huawei's Yinwang, exposing Huawei's automotive BU's assets

![]() 08/26 2024

08/26 2024

![]() 420

420

Author | Zhang Lianyi

Following AITO, Seres will also acquire a 10% stake in Huawei's Yinwang.

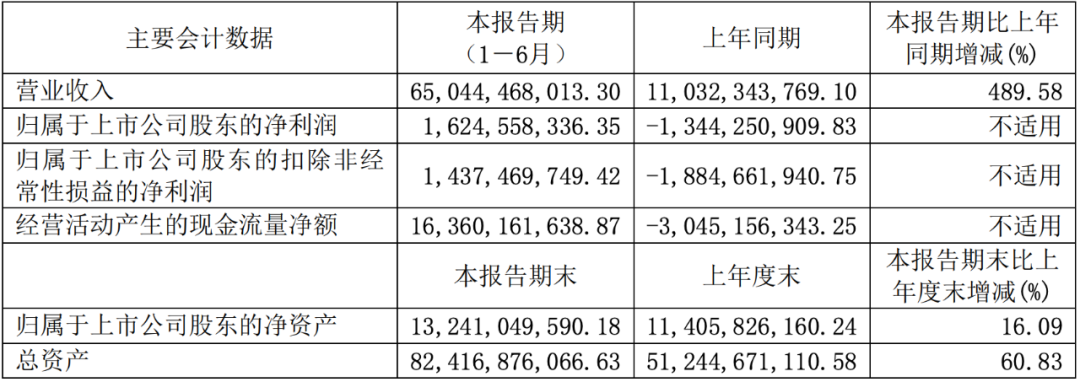

On August 25, Seres Group Co., Ltd. (hereinafter referred to as "Seres") issued the "Announcement on the Progress of Planning Foreign Investment" (hereinafter referred to as the "Announcement") stating that its subsidiary Seres Automobile Co., Ltd. (hereinafter referred to as "Seres Automobile") will purchase a 10% stake in Shenzhen Yinwang Intelligent Technology Co., Ltd. (hereinafter referred to as "Yinwang") held by Huawei Technologies Co., Ltd. (hereinafter referred to as "Huawei") by paying cash, with a transaction value of RMB 11.5 billion.

This announcement comes less than a month after Seres officially announced its intention to invest in Yinwang on July 28, marking rapid progress.

Overview of Seres' investment in YinwangTwo days before the announcement, on August 23, Seres and Huawei held a signing ceremony for their deepened strategic cooperation agreement and Seres Automobile's investment in Yinwang in Shenzhen.

At the signing ceremony, Zhang Xinghai, Chairman of Seres, said, "This investment in Yinwang marks an upgrade in Seres' cooperation with Huawei from a 'business' to a 'business + equity' comprehensive partnership, opening a new chapter of sustainable development from 1 to N in our collaboration. Seres will firmly support Yinwang in becoming an open platform for the intelligentization of the automotive industry, striving to achieve an annual production and sales target of one million AITO vehicles within three years, driving the supply of one million sets for Yinwang, and realizing mutual benefit." On the day the announcement was released, Seres released its financial results for the first half of 2024. Thanks to the growth in sales of new energy vehicles (AITO series models), Seres achieved operating revenue of RMB 65.044 billion in the first half of the year, an increase of 489.58% year-on-year; net profit was RMB 1.625 billion, turning a profit from a loss year-on-year.

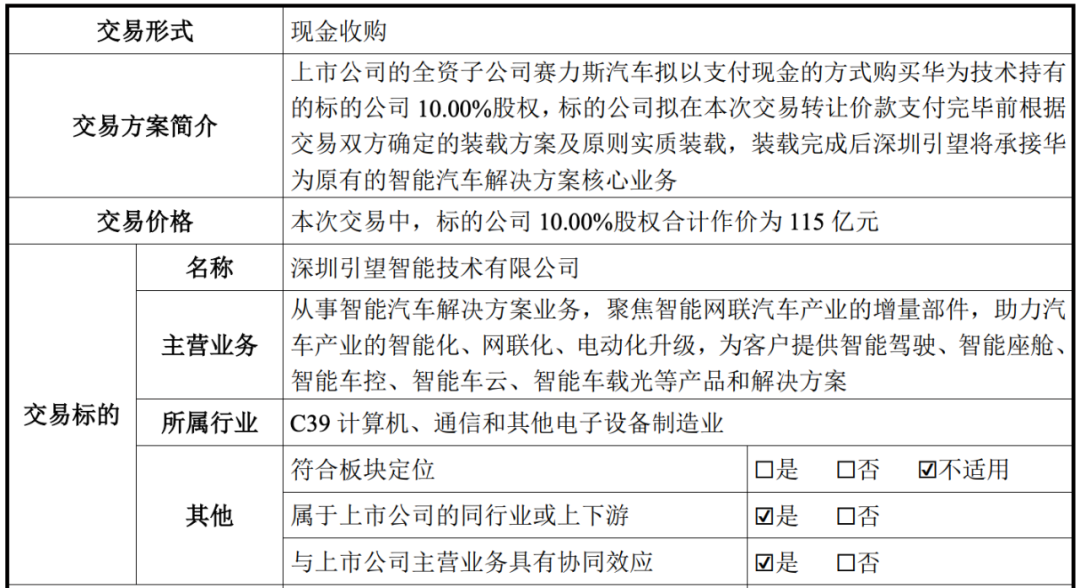

Furthermore, Seres disclosed the financial data of Shenzhen Yinwang for the first time. The announcement stated that based on the audited simulated financial statements of Shenzhen Yinwang's intended loaded business, the company's sales revenue in 2022 and 2023 reached RMB 2.098 billion and RMB 4.7 billion, respectively; operating revenue for the first half of 2024 was RMB 10.435 billion, with a net profit of RMB 2.231 billion.

Revenue and Cost Status of YinwangThe total assets of the 10% equity in Yinwang account for 22.44% of Seres' total assets in 2023, with net assets accounting for 100.83% and operating revenue accounting for 1.31%. In this regard, Seres believes that this acquisition will have a positive impact on the company's investment income, enhancing the total assets, net profit scale, and basic earnings per share of the listed company.

With the finalization of collaborations between Changan Automobile (AITO) and Seres, Huawei's Yinwang, the vessel tasked with carrying a "technologically open platform with diverse equity," is about to set sail.

01 Seres' investment, benefiting continuously from Huawei

Seres' investment in Yinwang is almost a replica of Changan's AITO investment.

First, the investment amount and shareholding ratio are the same.

According to the announcement, Seres will purchase a 10% stake in Yinwang by paying cash, with a transaction value of RMB 11.5 billion. This means that two external shareholders have already been confirmed to invest in Huawei's Yinwang, both valuing it at RMB 115 billion.

Seres announces the payment method and deadline for the considerationSecondly, the payment methods are the same, both involving three installments, with corresponding preconditions for each payment.

In principle, the ownership of technologies and assets dedicated to Yinwang's loading business, as well as personnel, held by Huawei and its affiliates belong to the transfer scope and can meet the needs of Yinwang's independent and sustainable loading business.

After receiving the first transfer payment, Huawei will initiate specific loading activities, transferring technologies, assets, personnel, etc., within the scope of this transfer to Yinwang in an appropriate manner as agreed upon in the relevant transaction documents.

The closing date is the day when Seres completes the second transfer payment to Huawei. Huawei and Yinwang shall jointly ensure that the substantive basic loading is completed no later than the closing date. From the closing date, Seres will enjoy corresponding shareholder rights in accordance with the relevant provisions of Yinwang's articles of association and shareholders' agreement.

Thirdly, the corporate governance arrangements are the same, with Seres Automobile having the right to nominate a director to Yinwang's board of directors.

On August 19 of this year, Changan Automobile issued an "Announcement on the Progress of the Investment Cooperation Memorandum and Joint Venture's Foreign Investment," introducing the board arrangement. At that time, the announcement stated that the board of directors consisted of seven members, with the number of seats determined by shareholders' shareholdings; Huawei had the right to nominate six directors, and AITO Technology had the right to nominate one director.

It is worth mentioning that Seres' announcement also mentions that Seres Automobile has the right to nominate a member of the audit committee, which was not mentioned in Changan Automobile's previous announcement.

It can be foreseen that most automakers investing in Yinwang in the future will follow a similar template.

As Huawei's deepest automotive partner, Seres has been the biggest beneficiary, which is increasingly evident in its financial reports, especially since the beginning of this year.

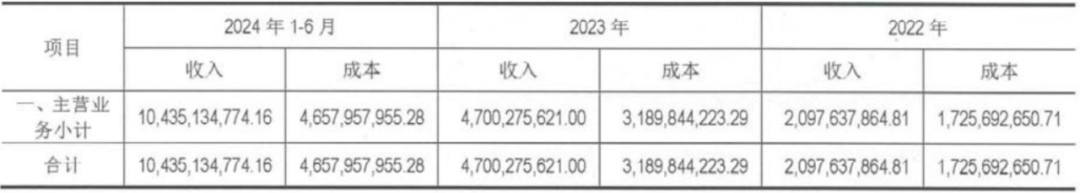

Seres' 2024 interim report shows that operating revenue for the first half of the year was RMB 65.044 billion, an increase of 489.58% year-on-year; net profit attributable to shareholders of listed companies was RMB 1.625 billion; while in the first half of 2023, Seres' net profit attributable to shareholders of listed companies was -RMB 1.344 billion.

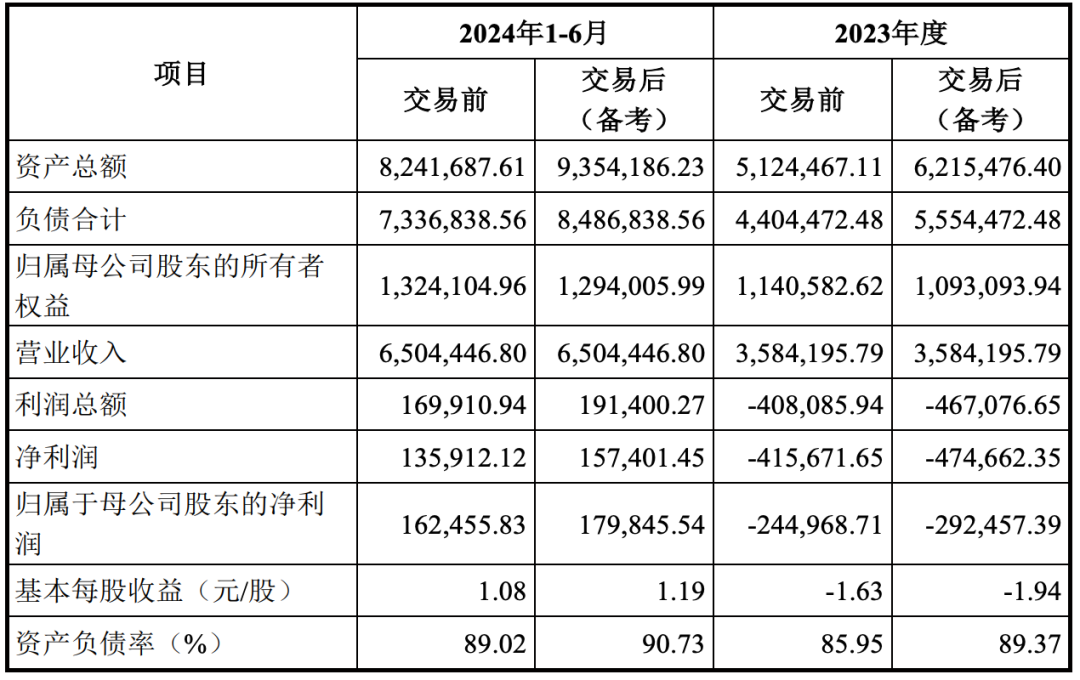

Seres' financial data for the first half of this year (unit: yuan)In particular, the second quarter performance was outstanding. The financial report showed that its second-quarter revenue and net profit were RMB 38.483 billion and RMB 1.405 billion, respectively.

The company stated that the significant increase in revenue was mainly due to the increase in new energy vehicle sales. Data showed that in the first six months of this year, Seres' cumulative sales of new energy vehicles reached 200,900 units, an increase of 348.55% year-on-year.

This was mainly attributed to the AITO brand. According to data released by AITO, in the first half of this year, the brand's cumulative sales reached 181,197 units, ranking second among new force brands after NIO, with a gap of less than 8,000 units between them.

In Seres' view, the cooperation with Huawei has continued to escalate through this transaction, upgrading their strategic partnership to a "business cooperation + equity cooperation" model.

02 Revenue exceeds 10 billion in the first half, Yinwang's finances disclosed

"Shenzhen Yinwang will take over Huawei's core business of intelligent automotive solutions." Seres clarified Yinwang's ownership and positioning in the announcement.

Shenzhen Yinwang Intelligent Technology Co., Ltd. was established on January 16 of this year and is wholly owned by Huawei Technologies Co., Ltd., with a registered capital of RMB 1 billion. It engages in the research and development, design, production, sales, and service of automotive intelligent systems and component solutions, with its main business areas including automotive intelligent driving solutions, intelligent cockpits, intelligent vehicle control, intelligent vehicle clouds, and intelligent in-vehicle lighting.

Yinwang established in January this yearTwo months after the establishment of Shenzhen Yinwang, Huawei subsequently established branches in Dongguan, Nanjing, Suzhou, Shanghai, and Hangzhou, with registered capital ranging from RMB 40 million to RMB 100 million.

The legal representatives are all Zheng Liying, the current Chairman of Petal Payment (Shenzhen) Co., Ltd.

At the same time, Huawei has also applied for the registration of multiple trademarks such as "Yinwang," "Yinkan," "Yinzhong," "INVISOL," and "INNOWARD," with international classifications including scientific instruments and transportation tools.

Although it has been established for some time, Seres stated that as of the announcement, Yinwang had not yet completed its business loading.

It noted that Huawei and Yinwang intended to complete the substantial loading according to the loading plan and principles determined by both parties before the payment for the transfer of this transaction was completed. After the loading was completed, Yinwang would take over Huawei's original core business of intelligent automotive solutions, including assets, personnel, intellectual property rights, etc.

According to the loading plan and principles, Huawei intended to load assets, personnel, intellectual property rights, etc., onto Yinwang. As of July 31, 2024, Huawei intended to transfer a total of 6,838 patents and patent applications, including other patents required for the loaded business; intended to transfer and license technologies related to the loaded business, including software, code, documentation, and data related to the loaded business; intended to transfer and license a total of 1,603 trademarks and trademark applications, with 1,600 trademarks and trademark applications intended for licensing.

Yinwang's R&D expenses in recent yearsHowever, the scope of loading patents, technologies, and trademarks is ultimately subject to the relevant loading agreement.

According to the report issued by Zhongjing Minxin (Beijing) Asset Appraisal Company, as of January 2024, using the market approach, the total equity value of Shenzhen Yinwang's shareholders was RMB 115.256 billion. The announcement disclosed that as of the current date, Shenzhen Yinwang had not yet completed its business loading. Huawei intended to complete the substantial loading after the payment for the transfer of this transaction was completed, and after the loading was completed, Yinwang would take over Huawei's original core business of intelligent automotive solutions, including assets, personnel, intellectual property rights, etc.

Concurrent with the announcement, Seres also released a simulated audit report for Yinwang (hereinafter referred to as the "Report").

The report showed that Yinwang's sales revenue in 2022 and 2023 reached RMB 2.098 billion and RMB 4.7 billion, respectively. Operating revenue for the first half of 2024 was RMB 10.435 billion, with a net profit of RMB 2.231 billion.

In terms of business, Yinwang's main areas of operation include intelligent driving, intelligent cockpits, intelligent vehicle control, intelligent vehicle clouds, and intelligent in-vehicle lighting.

Among them, the intelligent driving solution business includes intelligent driving software and algorithms, intelligent driving operating systems, fusion perception, etc.; the intelligent cockpit business includes in-vehicle modules, cockpit software, cockpit peripherals; the intelligent vehicle control business includes the intelligent digital vehicle platform iDVP, thermal management system TMS, and intelligent vehicle control operating system; the intelligent vehicle cloud business includes basic telematics service platforms, remote upgrades (OTA), vehicle history records (VHR), digital keys, problem diagnosis, security services, etc.; and the in-vehicle lighting business includes augmented reality head-up displays (AR-HUD), intelligent lighting modules, etc.

According to the "Summary of the Draft Major Asset Purchase Report" released by Seres, combined with the target company's financial data and future business prospects, this acquisition of a minority stake in the target company is expected to have a positive impact on the listed company's investment income, enhancing the listed company's total assets, net profit scale, and basic earnings per share.

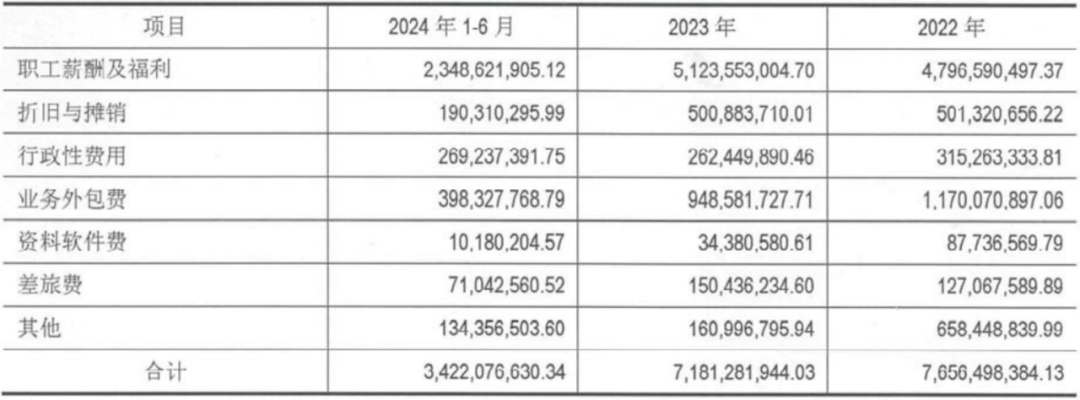

Financial changes in Seres before and after the transaction (unit: ten thousand yuan)After this transaction, Seres' net profit in 2023 will change from -RMB 4.157 billion to -RMB 4.747 billion, net profit attributable to shareholders of the parent company will change from -RMB 2.450 billion to -RMB 2.925 billion, and basic earnings per share will change from -RMB 1.63 per share to -RMB 1.94 per share; net profit in the first half of this year will change from RMB 1.359 billion to RMB 1.574 billion, net profit attributable to shareholders of the parent company will change from RMB 1.625 billion to RMB 1.798 billion, and basic earnings per share will change from RMB 1.08 per share to RMB 1.19 per share.

Seres stated, "Combining Yinwang's financial data and future business prospects, this acquisition of a minority stake in the target company is expected to have a positive impact on the listed company's investment income."

03 The giant ship sets sail, with Huawei continuously bringing freshness

From AITO to Seres, within less than a week, Yinwang finalized collaborations with two automakers, and Huawei's automotive BU, this giant ship, is finally setting sail independently.

Or perhaps, it would be more accurate to say that the "locomotive" is about to depart.

Shenzhen and Huawei signed the "Investment Cooperation Memorandum" in November last yearIn November last year, when Shenzhen and Huawei signed the "Investment Cooperation Memorandum," Yu Chengdong, Chairman of Huawei's Intelligent Automotive Solution BU, said, "We have always believed that China needs to build an open platform for electrification and intelligence that involves the participation of the entire automotive industry, an open platform with a 'locomotive.'"

He also pointed out that while deepening cooperation with Changan, Huawei would also work with more strategic partner automakers to continuously explore new models of open and win-win cooperation, jointly seize the opportunities of the electrification and intelligence transformation of the automotive industry, and realize the dream of the rise of China's automotive industry.

Judging from the above statements, Yinwang bears not only the responsibility of an intelligent technology company but also that of being "a technologically open platform with diverse equity," open to various automakers.

After AITO and Seres entered the fray, there have been many speculations about who else Yinwang might attract.

Although there are no definitive results at present, Yu Chengdong has given a certain scope. In November 2023, when Huawei revealed its intention to form a new company with Changan, Yu Chengdong had already publicly extended invitations for equity participation to Beijing Automotive Group (BAIC), JAC Motor, Seres, Chery, and other companies that have collaborated with Huawei in the intelligent selection business; subsequently, he also publicly called on FAW Group and Dongfeng Motor, two state-owned enterprises, to join the joint venture platform.

In March this year, Yu Chengdong, Chairman of Huawei Intelligent Automotive Solutions BU, responded to the statement by You Zheng, Deputy General Manager of Dongfeng Motor Group Co., Ltd., that they were actively promoting the participation in Huawei's intelligent automotive solutions business in collaboration with FAW Group.

However, as of now, neither FAW nor Dongfeng has provided any new response regarding the investment. Nevertheless, it appears that there is at least an intention for cooperation between the two parties.

Led by technology companies, state-owned and private automakers have joined forces to create a brand-new platform-level smart car supplier, which is unprecedented in China's automotive industry.

'If you want to build a great company, you must rebuild the architecture of the car,' said Wang Yanmin, President of Huawei Consumer Business Group Smart Car Business Department, in an interview with the media in early 2024.

In fact, this has been Huawei's ongoing effort since entering the 'automotive circle.' In May 2019, Huawei's Intelligent Automotive Solutions BU was established, officially entering the smart car field as an automotive component supplier.

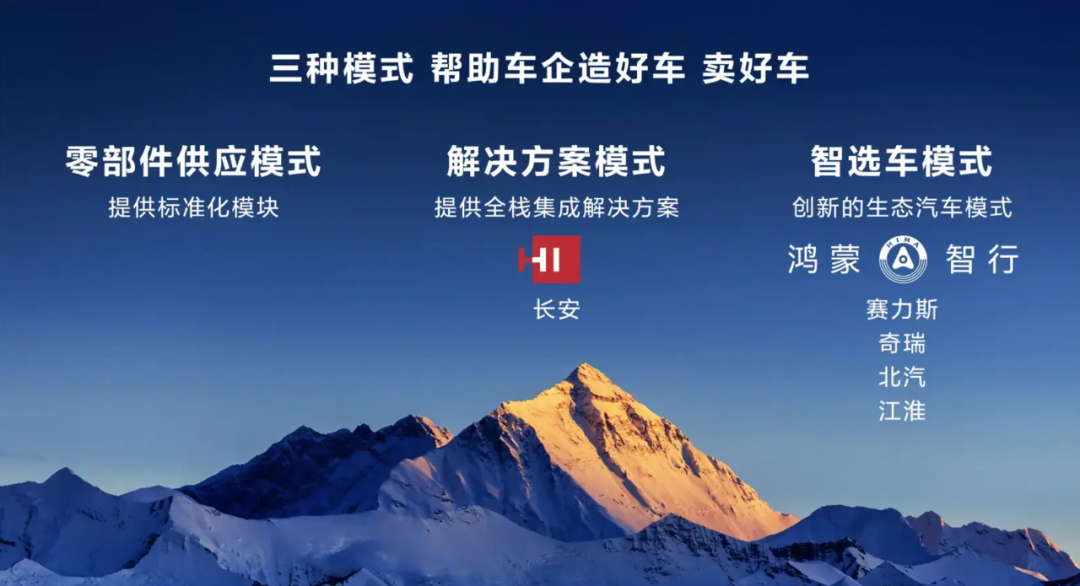

Huawei's three 'car-making' models have undergone multiple adjustments, gradually clarifying its main business into three distinct categories: the first is a Tier 1 component supplier model; the second is the Huawei HI model, which provides full-stack smart car solutions for automakers; the third is the Huawei Smart Selection model, where Huawei is deeply involved in product definition, design, marketing, user experience, and other aspects.

Now, with the independent establishment of the BU for cars and the introduction of external funding, Huawei is not only strengthening its voice in the automotive industry but also attempting to disrupt the existing norms. Who will join the investment race next, and what does the future hold? We eagerly await the answers. -END-