How does iQIYI fail to squeeze out profits?

![]() 08/26 2024

08/26 2024

![]() 546

546

Not fatal, but can't follow a blind path

On August 22nd last year, iQIYI delivered its best quarterly financial report in history for the second quarter. However, a year has passed, and iQIYI can no longer feel that sense of triumph.

The second-quarter report showed that iQIYI's total revenue in Q2 2024 was 7.4 billion yuan, a year-on-year decline of 5%. The net profit attributable to iQIYI was 68.7 million yuan, while the net profit for the same period in 2023 was 365.2 million yuan, a year-on-year decrease of 81%. Among them, membership service revenue reached 4.5 billion yuan, down 9% year-on-year, and online advertising service revenue was 1.5 billion yuan, down 2% year-on-year. Again, the number of members for this quarter was not disclosed.

The direct reason for the decline in various indicators is that the platform lacks blockbusters.

According to Yunhe Data, iQIYI had only 3 works listed in the top 10 most-watched dramas on the entire network in H1 2024. However, even the market shares of its dramas such as "South to North," "Chasers," and "City Within a City" during the same period were not dominant, failing to replicate the overwhelming impact of previous blockbusters like "The Knockout," "The Longest Promise," and "Lotus Pavilion."

Image source: Yunhe Data

Entering 2024, iQIYI's revenue has declined year-on-year for two consecutive quarters, ending five consecutive quarters of revenue growth since Q4 2022. Whether for market performance or capital expectations, iQIYI needs to fight a tough battle in the second half of the year.

01 Cost reduction without efficiency gains: Missteps in iQIYI's content strategy transformation?

Against the backdrop of limited revenue growth, "cost reduction and efficiency enhancement" has been one of iQIYI's core strategies to achieve profitability in recent years.

In the first quarter of this year, iQIYI's revenue declined by 5% year-on-year, but relying on a 5% decrease in content costs and a 17% reduction in selling, general, and administrative expenses, the company successfully achieved a 10% year-on-year increase in operating profit margin, reaching 14%.

The second-quarter financial report showed that iQIYI's total cost in Q2 2024 was 5.7 billion yuan, a year-on-year decrease of 2%. Among them, content costs were 4.1 billion yuan, flat year-on-year.

However, continuing cost reduction in the second quarter did not lead to an excellent profit performance for iQIYI, as it had in previous quarters.

In addition to an 81% year-on-year decline in net profit, iQIYI's operating profit also fell 44% year-on-year to 342 million yuan.

Against the backdrop of declining revenue, the marginal effect of cost reduction driving profit growth is diminishing.

The core reason behind this is that iQIYI made a "misjudgment" in its strategic transformation. On the one hand, iQIYI misjudged the popular drama genres and made errors in its bets on big dramas. On the other hand, there was a misjudgment in assessing the growth of the overall long-video industry, user growth, and the tipping point for user payment capabilities, leading to premature monetization efforts and even overexploitation of paying users.

From a content creation perspective, period dramas have undoubtedly been the most eye-catching segment in long-video performance this year. Ancient costume dramas like "Celebration of Remainder Years 2," "Flying with the Phoenix," and "Ink Rain and Cloud" have dominated the screens.

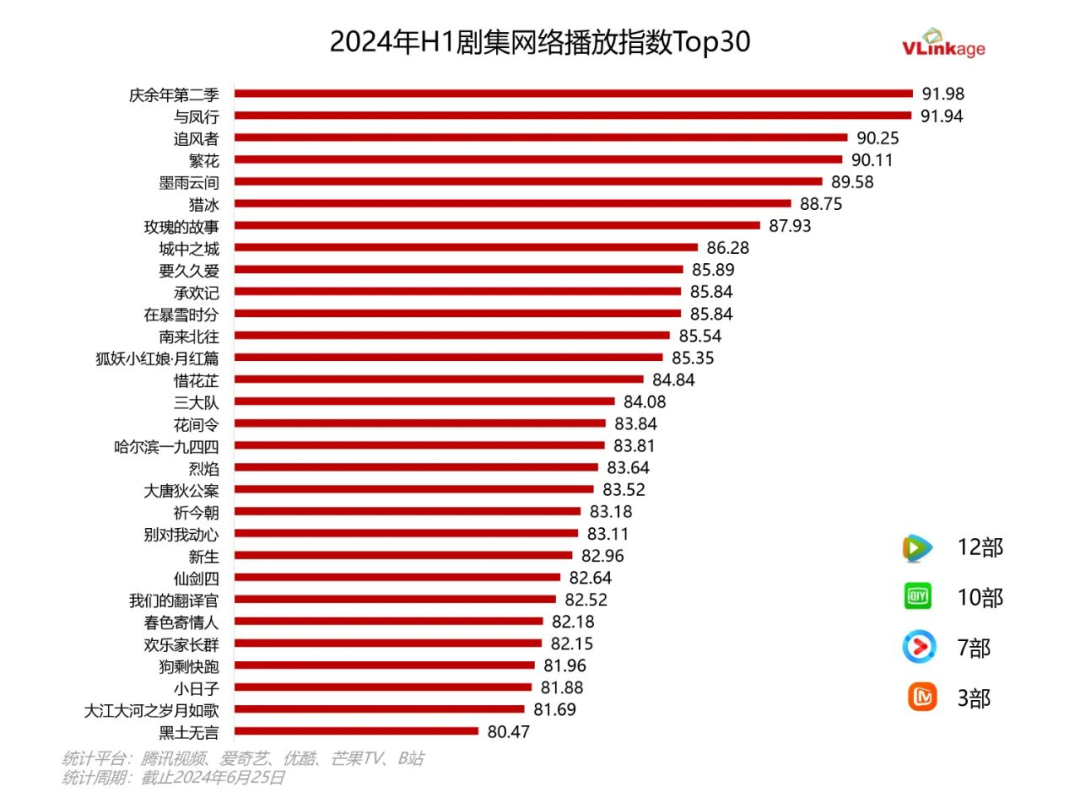

According to VLinkage data, 10 out of the top 30 dramas with the highest online playback index in H1 were period dramas, accounting for one-third of the total.

Image source: VLinkage

With the market's enthusiasm, the platforms have also achieved impressive results in attracting advertisers. Tencent Video's "Flying with the Phoenix" and "Celebration of Remainder Years 2" have accumulated 416 and 286 advertisements, respectively, continuously setting new records for in-station popularity. Youku's dark horse drama "Ink Rain and Cloud" saw its advertising revenue and the number of advertisers nearly quadruple five days after its premiere, achieving a phenomenal turnaround in the industry.

However, all the excitement belongs to others, as iQIYI has missed out on blockbusters consecutively.

According to data from EntGroup Pro, iQIYI had 47 exclusive dramas in H1 2024, a year-on-year increase of 20%, with a cumulative play count of 12.776 billion, ranking first among the top three video platforms.

At the iQIYI World Conference in April this year, Wang Xiaohui stated that "future blockbusters lie in realism," aiming to balance the fan base and give importance to the "old and young" demographics, which have long been neglected by long-video platforms, by ramping up efforts on period dramas.

However, the increase in the number of dramas and the improvement in quality have not received positive market feedback, instead appearing somewhat "one-sided."

In addition to exploring realistic themes, iQIYI has also launched "Micro Dust Theater" and "Great Minds Theater," focusing on the stories of ordinary people and presenting literary works with both artistic and commercial value through short dramas and stylized imagery. While "My Altay" does demonstrate pioneering qualities and a sense of quality, its theme and content make it difficult to become a widely popular blockbuster.

Furthermore, "Small Funny Theater" has also collaborated with Xiren to produce several comedies such as "Dogsheng Runs Fast," "Young Master and Me," and "King, Don't Panic." While these comedies have received good reviews, their small scale and limited audience make them more of a beneficial experiment.

iQIYI's innovation directions are becoming increasingly cutting-edge and vertical, which has led to a lack of tangible results in the short term.

With the frontline under pressure, rear supply cannot stop, and iQIYI's membership fees have continued to rise. From 2020 to 2022, iQIYI raised its prices three times at the end of the year, with monthly membership fees increasing from 19.8 yuan to 30 yuan and annual membership fees from 178 yuan to 258 yuan, representing increases of 51.52% and 44.94%, respectively.

In 2023, although iQIYI did not increase membership fees, it proactively restricted screen mirroring and introduced a paid advanced viewing plan, attempting to make existing members pay higher usage costs.

This forced "pay-to-win" strategy has indeed been effective.

The financial report shows that iQIYI's Average Revenue per Membership (ARM) for the four quarters of 2023 was 14.35 yuan, 14.82 yuan, 15.54 yuan, and 15.98 yuan, respectively, showing a gradual increase. In the Q1 2024 financial report, iQIYI stated that its monthly ARM reached a new high in the first quarter, marking six consecutive quarters of sequential growth.

However, this has led to a growing backlash. In 2024, iQIYI has been criticized by users on social media multiple times for its membership fees. Basic members on various platforms have lost the right to skip ads. The financial report shows that iQIYI's membership service revenue was 4.8 billion yuan and 4.5 billion yuan in Q1 and Q2 2024, respectively, down 2% and 10% year-on-year.

If iQIYI continues to raise membership fees without providing popular blockbusters, it is likely to continue losing users.

The financial report shows that as of December 31, 2022, iQIYI had 120 million subscribers. By December 31, 2023, this number had decreased to 101.1 million.

Over the course of a year, iQIYI's subscriber base dropped by approximately 18.9 million. Starting from the first quarter of this year, iQIYI stopped disclosing the number of subscribers.

According to data from QuestMobile, in March 2024, iQIYI had 401 million monthly active users, down 19.5% year-on-year.

Meanwhile, Tencent Video's paid subscriber base increased by 13% year-on-year to 117 million in the second quarter of this year, surpassing that of iQIYI.

At this rate, before iQIYI can produce quality content, its loyal followers may already have moved to other platforms.

02 Flops among top dramas and acclaimed dramas: The blockbuster methodology fails?

iQIYI's entry into a negative cycle was actually predictable. After last year's "The Knockout" became a hit, iQIYI has consistently given users a sense of "scratching the surface" without truly satisfying them, as many of its dramas and variety shows fell short of expectations.

At the beginning of the year, iQIYI bet on "South to North," which aired on CCTV-8 and attracted up to a million concurrent viewers, with eight advertisements per episode and over 290 total advertisements. Unfortunately, the show failed to surpass 10,000 in popularity and generated far less buzz than "Prosperity."

Following this, "The Young Judge of Dali Prefecture" and "Detective Chinatown 2" were released, both based on established IPs. However, due to their poor quality, their popularity only reached over 8,000. It was not until "Chasers," starring Wang Yibo, debuted that it broke through the circle with its unique financial + espionage perspective and the actors' high level of buzz. Unfortunately, iQIYI did not plan ahead, and the show was advertisement-free from the middle to the end, making it iQIYI's first drama to surpass 10,000 in popularity this year.

As for iQIYI's bets on "City Within a City" and "Harbin 1944," despite the presence of veteran actors, the latter halves of their stories collapsed, leading to a sharp decline in both popularity and reputation, causing much concern.

The root cause lies in iQIYI's conservatism in content creation and track layout. Active and young audiences have not favored iQIYI, and its top dramas have failed to spark cross-section discussions, resulting in a low blockbuster rate.

The revamped Mist Theater with dramas like "Untold Story," "The Invisible Shadow Boy," and "Misplacement" were all considered key projects by the platform based on early promotions. However, their dull and tedious plots, combined with somewhat boring actor combinations, allowed Youku's "Dim Light" and "Newborn" to establish the "White Night Theater" brand.

During the summer season, major platforms release their top productions to compete for users. Facing Tencent Video's "Celebration of Remainder Years 2," iQIYI bet on "Fox Demon Matchmaker: Moon Red."

At last year's iQIYI Joyfest, this drama was promoted as a key project and secured 56 advertising sponsorships before its premiere. The creative team behind the hit xianxia drama "Love and Redemption" was in charge, with leading actors Yang Mi and Gong Jun, and based on a popular Chinese manga IP, it seemed poised to make a big splash.

However, unexpectedly, the heavily altered plot drew backlash from the original manga fans, the lead actors' chemistry disappointed fans, and the intrusive advertisements turned off casual viewers. As a result, "Moon Red" was quickly overshadowed by the buzz around "Ink Rain and Cloud" and "The Story of Rose," ending uneventfully despite its grand premiere.

The failure of "Moon Red" not only weakened iQIYI's competitiveness during the summer season but also impacted the production timelines for the next two installments of the "Fox Demon Matchmaker" live-action series, "Bamboo Industry" and "Royal Power."

Replacing "Moon Red," "Yan Xin Ji" starred Song Yi, who has two blockbusters on iQIYI, and Luo Yunxi, who gained popularity through "Eternal Love of Dream." The premise of a face-blind male lead and a transforming female lead was fresh, but the childish plot failed to save "Yan Xin Ji's" viewership.

Within a week of its premiere, the highest number of concurrent online viewers did not exceed 100,000, and the number of advertisers dropped from 7 to 2. Yunhe downgraded its rating from S to A+, and the drama's peak popularity on the platform was only 8,585, consistently overshadowed by "Through the Years."

Among the dramas released by iQIYI in the first half of the year, there were indeed some outstanding works, such as "My Altay" and "The Great Journey." However, these two dramas had prominent strengths and weaknesses.

"My Altay" brought the local tourist season forward from June to May, attracting approximately 2.67 million visitors, an 80% year-on-year increase, and generating tourism revenue of 2.2 billion yuan, almost doubling. However, due to its niche topic, it primarily spread by word of mouth among highly educated young people.

"The Great Journey" provided a new perspective on ancient costume suspense and new martial arts, receiving a high rating of 8.5 on Douban. However, its peak popularity on the platform was only 4,666, far below the median.

Both dramas had production teams with numerous successful cases. "My Altay" was handled by the rising star in the film and television circle, Ruyi Entertainment, with producer Qi Kang having worked on highly acclaimed works such as "The Innocent," "Hooligans," and "A Moment in June." The producer and screenwriter of "The Great Journey," Bai Yicong, has successively served as the producer of "Old Nine Doors," "The Ultimate Note," "The Imperial Coroner," and "The Three-Body Problem."

It can only be said that the tumultuous drama market poses new challenges to the creative ports and the IP methodology constructed by the platform. Whether it's the production team switch in "Xiren's Magical Night" and "The King of Comedy Monologue Season" or iQIYI's near-fatal misstep with "Let's Farm," blockbusters seem to be both determined and undetermined by creators.

The summer season is drawing to a close, and iQIYI has gained significant attention with "The Lonely Boat" and "The Nine Prosecutors." While the quality and buzz of these two dramas do not fully align with industry norms, the combination of Zhang Songwen and Zhang Yi inevitably brings to mind the lingering influence of "The Knockout," reflecting the cyclical nature of the content industry.

Final Thoughts

However, iQIYI is still in a strong position for sustained profitability in the long-video industry and has the opportunity to continue exploring the balance between content, users, and advertisers.

Furthermore, in the second half of the year, iQIYI plans to release smaller blockbusters like "Tales of Mystery of Tang Dynasty: Journey to the West." According to the latest Yunhe data for July, iQIYI has regained its leading position in the drama market share.

During the second-quarter earnings call, iQIYI also disclosed the progress of several high-quality IP series developments. The third season of "Tales of Mystery of Tang Dynasty," titled "Tales of Mystery of Tang Dynasty: Chang'an," will enter the production stage, while "Fearless," "Detective Chart," and "Cloud Courier" will successively launch their second seasons.

In the words of iQIYI CEO Gong Yu, "The key to the long-term development of the long-video industry lies in the sustained supply of quality content and the win-win situation between content quality and commercial benefits, which is also iQIYI's unchanging pursuit."

Perhaps this is the current panacea for iQIYI.

Abandoning old stereotypes, jumping out of the single-industry ceiling competition model, and seeking certainty in the industry may be issues that iQIYI needs to reconsider in the next four months.