"Abandoned" JD.com is lost in a spree of low prices!

![]() 08/28 2024

08/28 2024

![]() 549

549

A few days ago, the scene of JD.com's (JD.O; 9618.HK) steep fall was still vivid in memory, with doubts about being "abandoned" lingering.

On August 20, U.S. Eastern Time, JD.com's U.S. shares plunged 10% intraday, closing down 4.57% at $28.19 per share. Then, on August 21, after the Hong Kong stock market opened, JD.com Group plummeted 11.05% and closed down 8.73% at HK$102.40 per share.

Tracing the roots of JD.com's plunge leads directly to Walmart, the largest retailer in the United States.

Suddenly Betrayed by an Ally

According to filings submitted by Walmart on August 20 on the SEC website, the company no longer holds any shares of JD.com Group. Meanwhile, the number of JD.com shares held by Walmart subsidiaries Newheight Holdings Ltd. and Qomolangma Holdings Ltd. have also been changed to 0.

Sources revealed that Walmart plans to sell 144.5 million JD.com shares at a price range of $24.85 to $25.85 per share. If calculated at the highest asking price, Walmart could cash out $3.74 billion.

Based on financial reports, as of March 31, 2024, Walmart held 145 million ordinary shares and 72.05 million American Depositary Shares (ADS) of JD.com Group, totaling a 9.4% stake and holding 3.1% of the voting rights, making it JD.com's largest shareholder after Liu Qiangdong.

It cannot be said that JD.com was completely unaware, although it was prepared, it was still caught off guard by Walmart's liquidation and reduction of holdings. After all, it has been more than eight years since Walmart made a strategic investment in JD.com in June 2016.

At that time, Walmart obtained 145 million newly issued Class A ordinary shares of JD.com Group by selling its stake in YHD.com to JD.com, accounting for approximately 5% of JD.com's total issued share capital, with an estimated value of $1.5 billion. Meanwhile, the transaction terms between Walmart and JD.com included a non-compete agreement valid for the next eight years, preventing the two companies from initiating or investing in competing businesses.

A careful analysis of this transaction from years ago reveals that YHD.com served as a mutually beneficial tool, with both parties having their own agendas.

For JD.com Group, the primary hope was to strengthen its core competitiveness through Walmart's global procurement and supply chain system advantages, rapidly integrating its resources while expanding and advancing its globalization process.

On the other hand, Walmart relied more on JD.com's platform and logistics resources to boost its O2O business, addressing the impact of e-commerce on the retail market at that time. After the transaction, Walmart increased its stake in JD.com multiple times, peaking at a 12.1% shareholding.

It was originally a mutually beneficial cross-border business partnership, but just as the eight-year non-compete arrangement expired, Walmart resolutely left, leaving JD.com alone.

According to Walmart's response, the decision to reduce its stake enables the company to focus on its strong China business, including Walmart China and Sam's Club, and allocate funds to other priorities. It also stated that this change in equity investment would not affect any business-level cooperation between the two parties.

It seems intentionally pointed out that the liquidation of JD.com is merely a result of Walmart's strategic deployment for its future business, but is this really the case? Or has JD.com's appeal to shareholders gradually diminished?

Multiple Shareholders Abandoning JD.com?

JD.com has already experienced the betrayal of an ally in Tencent.

In December 2021, Tencent Holdings reduced its stake in JD.com from 16.9% to 2.3%, ceasing to be JD.com's largest shareholder, and Tencent's President Martin Lau also resigned from JD.com's board of directors, causing JD.com Group's share price to plummet 7.02% on that day.

As early as 2014, just before JD.com's listing on Nasdaq, Tencent acquired a 15% stake in JD.com through a combination of e-commerce assets and cash injections. After the listing, Tencent made a strategic investment of RMB 199 million in JD.com, becoming its largest shareholder for a long time.

However, affected by the heavy asset model, JD.com suffered significant losses in the early years after its listing, achieving its first profit only in 2019. At that time, some strategic investors chose to cash out and leave, but Tencent continued to stand by JD.com.

Ultimately, their paths diverged, potentially due to disagreements in business philosophy with JD.com. In the third quarter of 2021, JD.com Group reported another net loss, and JD.com emphasized once again at its earnings conference that it would continue to operate with low profit margins.

As an investor, Tencent may have lost patience. At that time, in addition to JD.com, Tencent had invested in numerous technology and internet companies such as Pinduoduo, Meituan, and Kuaishou. After choosing to "abandon" JD.com, Tencent still had the thriving Pinduoduo.

In July 2016, Pinduoduo completed a Series B funding round of $110 million, led by Tencent. Since then, Tencent has continued to invest, contributing $1.369 billion to Pinduoduo's pre-IPO round in 2018, alongside Sequoia China. According to Pinduoduo's latest shareholding ratio, as of the end of February 2024, founder Huang Zheng held 25.4% of the shares, while Tencent held 14.1%, making it the second-largest shareholder.

Facts have proven that Tencent made the right bet. Since turning profitable in 2021, Pinduoduo has demonstrated outstanding profitability. According to the latest data, in the first quarter of 2023, Pinduoduo's net profit margin exceeded 30%, far surpassing JD.com and Alibaba.

As of the close of U.S. trading on August 22, Pinduoduo's total market value reached $204.4 billion. In contrast, JD.com's share price was $26.64, with a 55.17% decline over the past three years, leaving it with a total market value of only $42.4 billion, a decrease of over $120 billion from its peak in 2021.

Today, the tumbling secondary market, coupled with major shareholders liquidating their holdings, has intensified the market's pessimism towards JD.com. Observers speculate that JD.com has been collectively abandoned by capital.

Is Low Price Just a Stimulant?

To solve the problem, one must first identify its source, and JD.com's issues need to be traced back to the company itself.

Since the end of 2022, Liu Qiangdong, who had not been seen in public for some time, unexpectedly appeared in a video during JD.com's management training session, harshly criticizing senior executives for their "arrogance" and pointing out that JD.com was losing its low-price advantage. Upon his return, Liu Qiangdong launched a major reform, adjusting the company's structure, personnel, strategies, and management, emphasizing the need to regain the low-price strategy.

Since 2023, JD.com has launched a "Billion Subsidy" channel, a "9.9 Free Shipping" channel, lowered the threshold for free shipping on self-operated products, and recently adjusted the "Buy Expensive, Double Refund" policy, aiming to attract more consumers through low prices.

Now, more than a year and a half into the low-price strategy, what are the results?

According to JD.com Group's recently released second-quarter 2024 report, the group is exhibiting a trend of "increasing profits through price wars." In the second quarter of 2024, JD.com Group's revenue increased by 1.20% year-on-year to RMB 291.397 billion, with net income attributable to shareholders increasing by 90.91% year-on-year to RMB 12.644 billion, resulting in a net profit margin of 4.33%, a record high and exceeding market expectations.

Regarding this, JD.com Group stated that due to the expansion of gross profit margins across multiple categories and disciplined promotions, JD.com Retail's profitability Overall improvement in the second quarter, with operating profit increasing by 24.13% year-on-year to RMB 10.108 billion.

However, despite these results, Morgan Stanley quietly revised its revenue forecasts for JD.com in 2025 and 2026, decreasing them by 5% and 10%, respectively. This may stem from the current strange phenomenon of "increased profits without increased revenue" at JD.com Group.

From 2020 to 2023, JD.com Group's revenue growth rates were 29.28%, 27.59%, 9.95%, and 3.7%, respectively, showing a significant slowdown. JD.com's 1.2% revenue growth in the second quarter of 2024 set a new historical low.

It can be seen that JD.com's return to low prices in 2023 not only failed to boost business growth but gradually led to stagnation.

It is worth mentioning that during the 2024 618 sale, JD.com temporarily changed its slogan from "good and cheap" to "cheap and good," determined to solidify the low-price mindset among users.

However, second-quarter data revealed that JD.com's electronics and home appliances business, which contributes half of its revenue, continued to decline even under the stimulus of the 618 sale, with related business revenue falling 4.60% year-on-year to RMB 145.061 billion.

Just as over a decade ago, in multiple price wars against GOME and Suning, JD.com emerged victorious with its commitment to "maintaining zero gross margin on major appliances for three years." At that time, Suning's Zhang Jindong sarcastically remarked that JD.com's success was merely a short-term expansion fueled by "stimulants" and was unsustainable, which may now be proving prophetic.

In the race for the "lowest price" across the internet, JD.com is not alone in losing its way; the entire e-commerce industry is struggling.

According to StarChart data, the 2024 618 shopping festival started 10 days earlier than previous years but experienced its first sales decline since its inception in 2008, with total online sales declining by nearly 7% year-on-year to RMB 742.8 billion. According to the National Bureau of Statistics, China's online retail sales increased by 9.8% year-on-year to RMB 7.1 trillion in the first half of 2024, a significant slowdown from the 13.8% growth rate in the same period last year.

The price wars among comprehensive e-commerce platforms are the primary reason for the decline in sales, and live streaming e-commerce may no longer be as appealing. Longer cycles, more competitive pricing and services, yet no growth in return have dampened the enthusiasm of all e-commerce practitioners, including platforms and brands.

How has low pricing, once a powerful tool for Pinduoduo's rapid growth, now become ineffective?

Continuous Complaints Amidst Reform

The logic behind Pinduoduo's growth is relatively simple: whoever captures traffic captures the market. Initially, it accumulated user resources through low prices, and later, it rebuilt trust with users through tactics such as only offering refunds and buy now, pay later, reversing the stereotype of low quality and counterfeit products in consumers' minds and thereby enhancing user loyalty.

Unlike Pinduoduo's development path, JD.com initially relied on low prices to capture the market but later leveraged its "self-operated + logistics" model to establish a brand moat based on quality and service, gradually solidifying its position in the e-commerce sector.

Xu Lei, the former CEO of JD.com Group, believed that the company should not abandon its infrastructure and fulfillment advantages, nor its credibility advantage in the self-operated model. "We will never be able to achieve the absolute low prices of platforms like Pinduoduo or Douyin E-commerce," he said.

However, Liu Qiangdong had his own ideas. If the high-cost self-operated business could not meet the platform's low-price demands, he believed it could be achieved through POP (third-party merchants). To attract more POP merchants, Liu Qiangdong launched the "Spring Dawn Plan."

To incentivize POP merchants to match or even undercut competitors' low prices, Liu Qiangdong vowed, "Whoever offers the lowest prices will receive preferential traffic allocation."

The so-called platform subsidies essentially pit merchants against each other, with individual merchants ultimately footing the bill. This may explain why JD.com's low-price strategy has not significantly impacted its profit growth.

However, the pain of reform has also ensued.

The drastic strategic adjustments have left JD.com in a highly "fragmented" state, with conflicts arising between quality and low prices, between middle- to high-income groups and the broader consumer base, and even between quality-focused and price-conscious factions.

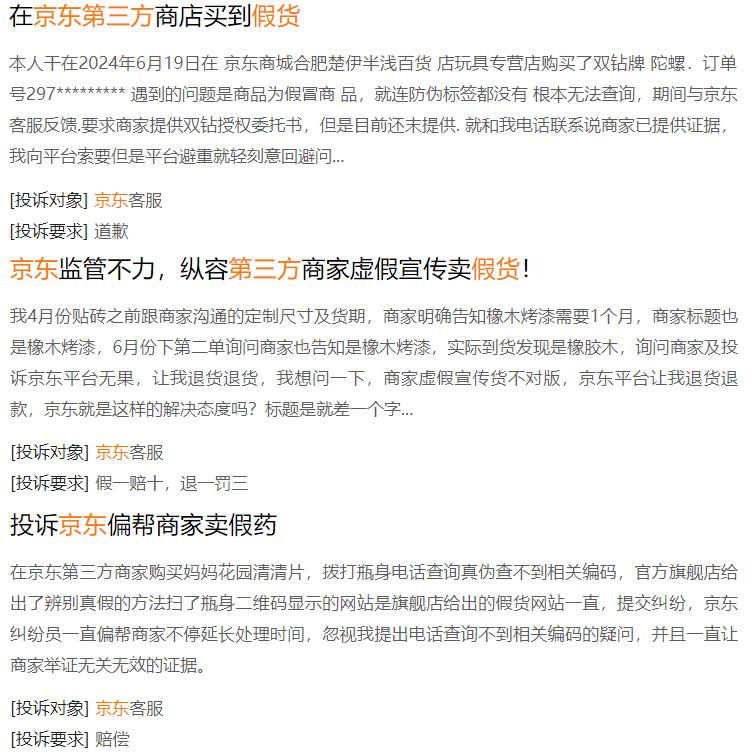

For example, the rapid influx of POP merchants, with varying levels of quality, has made it difficult to distinguish authentic products on the platform, contradicting JD.com's long-standing image of high-quality service. Consumers have voiced their dissatisfaction, saying things like, "JD.com is no longer a guarantee of quality" and "The current service and after-sales are really poor."

Image source: Heimao Complaints

JD.com has not only lost consumer trust but also betrayed merchants.

Ahead of the 2024 618 sale, JD.com's book publishing subsidiary proposed a promotion offering full-range book price guarantees at 2-3 times the discount for eight consecutive days, essentially forcing book suppliers to sell at a loss. Consequently, nearly 60 publishing houses collectively declared their intention not to participate in JD.com's 618 promotion.

The book publishing industry is just a microcosm of the 618 sale. JD.com aimed to attract users with low prices but overdid it, failing to fully consider merchants' perspectives despite hoping to lure customers with discounted offerings.

Moreover, to incentivize POP merchants to join, JD.com blurred the lines between self-operated and POP merchants, announcing that it would no longer differentiate between them, enabling traffic "parity."

As a result, to compete with self-operated stores and achieve greater sales through thin margins, some POP merchants began to engage in price undercutting and product diversion. Self-operated stores, seeking to maintain sales, had no choice but to join in the price competition. Previously, Luzhou Laojiao suspended cooperation with JD.com after repeated price reductions on its "Guojiao 1573" series products.

Currently, the exact number of POP merchants on JD.com has not been disclosed in detail. According to CEO Xu Ran during the first-quarter earnings call, as of the end of the first quarter of 2024, the number of active POP merchants on JD.com had surpassed one million.

Xu Ran added that compared to competitors, JD.com still lags in the supply of third-party goods. Over the next few quarters, third-party merchant data will remain a focus for expanding scale. JD.com Group has previously stated that rapid monetization of the third-party merchant business is not its primary short-term goal and that this business, along with overall GMV, is gradually entering a healthy growth trajectory.

Perhaps this implies that for JD.com Group, the self-operated business remains the core of the platform, while POP merchants primarily serve as a supporting role in implementing the low-price strategy.

In the future, as the low-price strategy further unfolds, how can the platform protect merchant rights? How can it properly manage the competition between self-operated and POP merchants? How can it ensure that JD.com's core users perceive the same high-quality service they have come to expect? And in an environment where Douyin and Pinduoduo are fiercely competing for market share, how can JD.com attract price-conscious consumers who may otherwise flock to these platforms?

These are all urgent questions for JD.com to consider.

What is the "Wolf Spirit"?

Since 2024, JD.com Group has been frantically addressing its deficiencies in instant retail, integrating and upgrading JD.com Hourly Delivery and JD.com Home Delivery into "JD.com Instant Delivery," indicating the urgency felt from competition.

JD.com's eagerness also stems from its decision to begin layoffs a month before the 618 sale, followed by measures such as stricter attendance policies and shortened lunch breaks, rather than waiting until after the busy 618 period to address personnel adjustments. Liu Qiangdong even redefined the concept of "brotherhood," bluntly stating, "Those who consistently perform poorly and never strive are not my brothers."

It is evident that JD.com is returning to its "wolf spirit," fueled by Liu Qiangdong's dissatisfaction and anxiety about the company's current situation and his urgent desire to turn things around. However, amidst these drastic measures, there are inevitable moments of overexertion.

From Zhongguancun to Yizhuang Economic Development Zone, JD.com has come a long way over 20 years. At the turn of the century, JD.com rode the wave of China's booming internet industry. Through the ups and downs, JD.com has grown into a giant, yet its kingdom now bears signs of wear and tear.",