Xiaomi Motors Enters Europe: Carmakers Fight Their Way Out of Tariff Dilemma

![]() 08/28 2024

08/28 2024

![]() 630

630

Edited by Liu Jingfeng

Europe has recently become one of the most closely watched markets by Chinese automakers. On the one hand, some automakers are gearing up to enter the European market. During Xiaomi's live broadcast from its Turpan summer testing base on August 17th, Lei Jun, Chairman and CEO of Xiaomi, along with Group President Lu Weibing and Vice President Wang Xiaoyan, conveyed a message to the outside world: Xiaomi is studying when to enter the European market with its vehicles. Europe is poised to become the first stop for Xiaomi Motors' overseas expansion.

Earlier, Lei Jun revealed during a July live stream event that Xiaomi Motors plans to enter the European market by 2030 and emphasized the company's goal of becoming one of the top five automotive brands globally. Although Xiaomi Motors has not officially entered overseas markets yet, netizens have already shared photos of Xiaomi SU7 being used in overseas markets such as Dubai, Russia, and Turkey on various social media platforms. During the Paris Olympics, Xiaomi vehicles even flashed across the streets of Paris. Apart from Xiaomi, on August 26th, Gu Hongdi, Co-President of Xpeng Motors, told the media during an interview that Xpeng Motors is planning to enter the Australian, New Zealand, UK, and Irish markets.

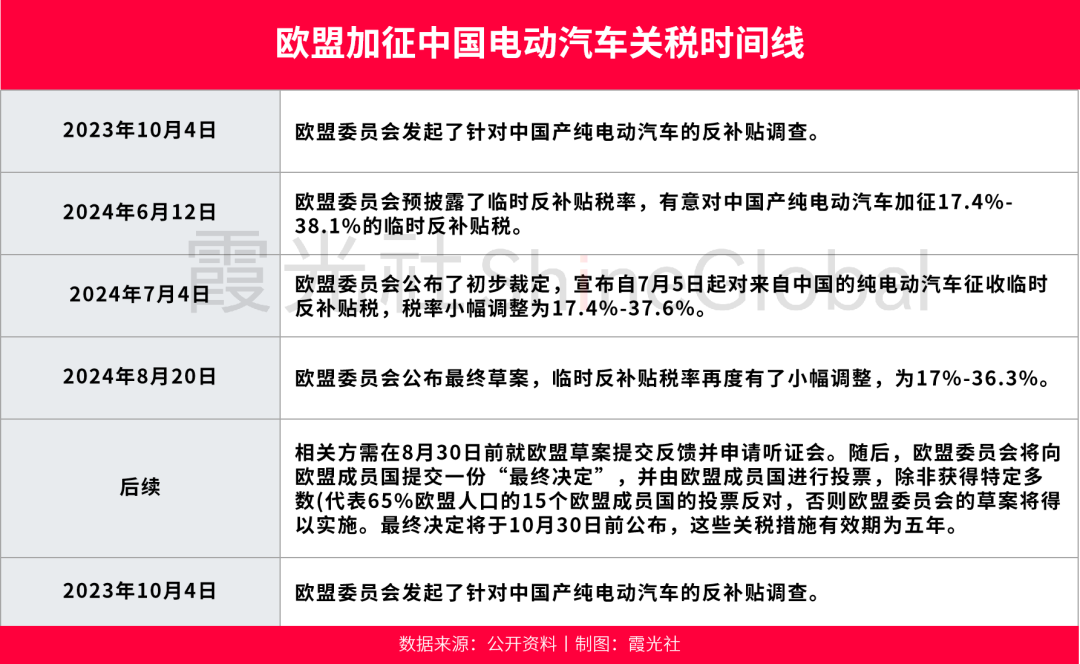

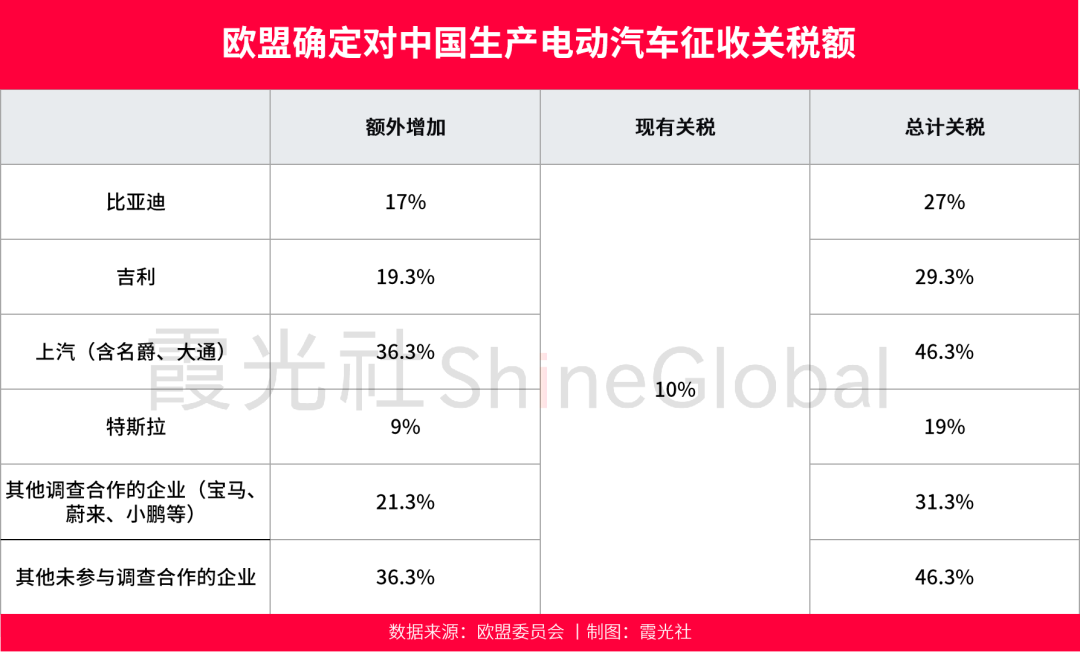

He Xiaopeng also recently revealed that the company is actively planning to build an electric vehicle production base in Europe. On the other hand, on August 20th, the European Union disclosed the final information on its anti-subsidy investigation into Chinese electric vehicles, making minor adjustments to the proposed tariff rates but maintaining its stance on imposing tariffs on imported Chinese electric vehicles. The anti-subsidy tax rates for the sampled Chinese electric vehicle companies BYD, Geely, and SAIC were 17%, 19.3%, and 36.3%, respectively, while Tesla's anti-subsidy tax rate was "specially applied" at 9%. Amid the "tariff stick," various opinions have emerged. Can Chinese automakers still achieve profitability overseas after the imposition of tariffs? How are automakers responding? We've done some calculations to present the different fates of Chinese automakers selling in Europe under tariffs.

Europe is the third-largest automotive market globally, after China and the United States. Its market competition is relatively low compared to domestic markets, and prices and gross margins are generally higher than in China. Therefore, for domestic automakers, the European market is an indispensable "cake." Just before the opening of the Paris Olympics, Xiaomi SU7 appeared on the streets of Paris, leading some to speculate that Xiaomi Motors was ready to go on sale in Europe. However, the official response later stated, "There are no plans to sell cars in overseas markets in the coming years. The Xiaomi SU7s seen by everyone were actually exhibition vehicles for Xiaomi's 'Full Ecosystem of People, Cars, and Homes' special exhibition in Paris, displayed in the museum district."

SU7 on the streets of Paris

Earlier, during the 2024 UEFA European Championship, attentive netizens discovered that BYD had become the official travel partner of the tournament. This marked the first time the European Championship had partnered with a new energy vehicle brand and the first time it had collaborated with a Chinese automotive brand.

Behind the continuous rise in "exposure," there has been a solid increase in sales of Chinese automakers in the European market. As a typical representative of the "new three foreign trade exports," China's new energy vehicles are experiencing a remarkable surge in exports to Europe. In 2023, China exported 640,000 pure electric vehicles to Europe, accounting for 41.27% of China's total exports. In the first four months of 2024, the number of electric vehicles made in China registered in Europe, including the UK, increased by 23% year-on-year to 119,300 vehicles.

According to the latest analysis by T&E, a professional institution studying clean energy transportation in Europe, nearly one-fifth (19.5%) of electric vehicles sold in Europe last year were made in China, and this figure is expected to reach one-quarter (25%) by 2024. The rapid expansion of Chinese automakers has not only posed challenges to the European automotive market but also had a profound impact on the future direction of the entire European automotive industry, even triggering significant panic effects.

On August 20th, the European Commission disclosed on its official website a draft decision on imposing a definitive countervailing duty on pure electric vehicles imported from China. The draft primarily included three updates: firstly, further adjustments to the countervailing duty rates for Chinese electric vehicle manufacturers; secondly, Tesla exports from China would enjoy the lowest individual tariff rate; thirdly, the EU decided not to retroactively impose countervailing duties. Specifically, the proposed latest tariff rates for various Chinese electric vehicle manufacturers are: 17.0% for BYD (down 0.4%), 19.3% for Geely (down 0.5%), and 36.3% for SAIC Motor (down 1.3%). Other automakers cooperating with the EU's countervailing duty investigation face a rate of 21.3% (up 1.5%), while those not cooperating face a rate of 36.3% (down 1.3%). Tesla will be subject to an individual tariff rate, currently set at 9%. Combined with the original 10% basic tariff, the highest tariff on pure electric vehicles made in China exported to the EU could reach 46.3%.

It is worth noting that this tariff level is far beyond the EU's normal trade tariff range of 10% for passenger car imports. The day after the draft was released, the China Association of Automobile Manufacturers (CAAM) spoke on behalf of the Chinese automotive industry, expressing strong dissatisfaction with the EU's final disclosure. Its statement noted that imposing high countervailing duties on Chinese electric vehicles poses significant risks and uncertainties for Chinese enterprises operating and investing in Europe, undermines their confidence, and will have severe adverse effects on driving the development of the EU's automotive industry, increasing local job opportunities, and achieving green and sustainable development. The Wall Street Journal also reported that some European automakers, including Volkswagen, opposed the EU's move to impose tariffs on imported Chinese electric vehicles, fearing it could escalate trade frictions and damage the European automotive industry in the long run.

Hong Yong, an expert from the China Digital and Real Integration 50 Forum Think Tank, believes that the EU's imposition of tariffs may increase the export costs of Chinese automakers, affecting their price competitiveness, especially putting pressure on small enterprises that rely on cost advantages. This could prompt automakers to reassess their pricing strategies and potentially absorb some of the tariff costs to maintain market share. Regarding Xiaomi Motors' plan to enter the European market, a parallel importer said that previously exported Xiaomi SU7s were first purchased domestically and then exported overseas as used cars, priced at around $22,000 to $40,000. Now, with the new tariff policy, prices may increase by $10,000. "If Xiaomi now enters the market through official channels, the selling price is likely to be within this range or even higher, as it must also consider the cost of after-sales services," said the importer.

Faced with tariffs of up to 46.3%, whether automakers still have profit margins depends on two aspects: sales data and profit data. Firstly, the proportion of vehicles sold by Chinese brands to the EU is not significant. From January to May 2024, BYD, SAIC Motor, Geely, and Great Wall sold 176,000, 407,000, 162,000, and 163,000 overseas vehicles, respectively. Their sales of pure electric vehicles in EU member states were 8,000, 27,000, 700, and 800, respectively. The proportion of pure electric vehicle sales in EU member states to total overseas sales was 4.6%, 6.6%, 0.4%, and 0.5%, respectively. Considering this, the impact of the EU Commission's tariff rates and imposition targets on Chinese automakers is limited in terms of total volume.

Secondly, overseas selling prices are inherently higher than domestic ones, and some models still have profit margins even after the tariff increase. According to Rhodium's calculations, even with the tariff increase, BYD's Seal U (known domestically as Song PLUS EV) can still achieve an average profit margin of about 10%, or about €4,000, in Europe. In contrast, the domestic profit margin for this model is only around RMB 10,000. However, after the tariff increase, MG4 from SAIC Motor and Tesla Model 3 saw their overseas sales profits turn negative. In addition, the new tariffs will also have some impact on smaller players like NIO, Xpeng, and Nezha, as well as automakers that rely on production in China and shipping to the EU. Therefore, domestic automakers will face different fates in response to the EU's tariff increase.

In the short term, compared to lowering the "free on board" (FOB) price, which could trigger anti-dumping measures, domestic automakers can pass on the impact of tariffs to consumers or dealers by increasing end-user prices in Europe or compressing dealer margins. Meanwhile, cost control is also an essential measure for automakers to cope with tariff barriers. Apart from domestic supply chain cost advantages, BYD, SAIC Motor, Chery, and others have formed auto transport roll-on/roll-off fleets, which are expected to further reduce their transportation costs.

Some European think tanks argue that compared to US tariff policies, the EU's proposed tariff increase is still a relatively moderate measure, aimed not at shutting out Chinese cars but at accelerating localization efforts. For Chinese enterprises, producing Made-in-EU electric vehicles is not just about addressing tariff issues. More importantly, local production allows direct exposure to the European market's regulatory environment, especially under the background of the 2050 net-zero emissions goal and related compliance regulations around the EV life cycle, such as supply chain compliance, battery production compliance, and product compliance, enabling the accumulation of necessary experience in advance.

As China's most important overseas market for new energy vehicles, the most influential Chinese automakers in Europe are Geely (including Volvo, Polestar, and Zeekr), SAIC (including MG and MAXUS), and BYD. According to EU-EVS data, Geely's Volvo saw a 71.1% year-on-year increase in exports to Europe in the first half of the year, ranking first in export sales with over 50,000 vehicles. SAIC MG and BYD followed closely behind, selling approximately 33,000 and 12,000 vehicles, respectively.

Multiple European institutions tend to believe that even under the new tariff scheme, the price advantage of the top three Chinese enterprises remains their core competitiveness, and European local brands still lack advantages in terms of cost-effectiveness. This is also reflected in the data. According to data, the average price of pure electric vehicles exported to the EU by Chinese brands in 2023 was €25,269. According to Jato Dynamics, the average selling price of electric vehicles in Europe is approximately €65,000, more than twice the price of Chinese models. After the implementation of the new tariff scheme, the top three Chinese automakers (Geely, SAIC MG, and BYD) will lose approximately 30% of their price advantage on average.

Even so, Chinese brands maintain a competitive price advantage over local players. Taking BYD's ATTO 3 (known domestically as Yuan PLUS) as an example, its starting price in the UK is £36,500, while its starting prices in Germany and France are approximately €38,000, equivalent to approximately RMB 260,000 to RMB 300,000. In comparison, a similarly configured BMW iX1 with a 150kW motor, 64.7kWh battery pack, and intelligent driving functions has a starting price of €47,900 in Europe (approximately RMB 380,000) before taxes.

Of course, after the tariff increase, some enterprises may choose to raise prices. According to Reuters, both SAIC MG and NIO have hinted at the possibility of future price increases. However, compared to other automakers, Chinese brands still maintain a certain price advantage. In the long term, localized supply is the general trend, and contributing to local taxes and employment is also expected to alleviate overseas resistance. Currently, Chinese automakers are accelerating their plans to build factories in Europe. In December 2023, BYD announced plans to build a new energy vehicle production base in Szeged, Hungary, which will be constructed in phases and is expected to create thousands of local jobs. In May this year, BYD executives publicly stated that the company may establish a second auto assembly plant in Europe by 2025.

In April 2024, Chery Automobile signed an agreement with Spanish automotive company Ebro-EVMotors to establish a joint venture in Barcelona, Spain, to produce new electric vehicles and create 1,250 jobs. Dongfeng Motor is also in contact with the Italian government regarding investment and factory establishment. Xpeng Motors has publicly stated that it is actively assessing the feasibility of establishing local manufacturing capabilities in Europe. Jiang Wei, Professor at the Antai College of Economics & Management, Shanghai Jiao Tong University, and Chief Scientist at the Shenzhen Institute of Industry, believes that "cooperation leads to win-win outcomes." Chinese automakers achieving localized production in Europe or cooperating with local automakers for production is the direction policymakers hope to guide and an inevitable process for the internationalization of Chinese automakers. Liu Chunsheng, Associate Professor at Central University of Finance and Economics, shares a similar view.

He believes that after the EU imposes tariffs, Chinese automakers will face new opportunities and challenges in the European market. The opportunity lies in the fact that the European market's demand for new energy vehicles continues to grow, providing broad market space for Chinese automakers. At the same time, competition in the European market is also relatively fierce, which will urge Chinese automakers to continuously improve their technical level and brand image to win market share. This is not to say that challenges can be ignored. The most obvious change brought about by the imposition of tariffs is to increase the operating costs of Chinese automakers in the European market and compress their profit margins. At the same time, consumers in the European market have higher requirements for the quality and performance of automobiles, which will also pose higher challenges to the products of Chinese automakers.