"Ctrip: Finally, a Normal Chinese Concept Stock Among the Laggards and Crazy Ones!"

![]() 08/28 2024

08/28 2024

![]() 435

435

"On the morning of August 27, Beijing time, Ctrip Group released its fiscal second-quarter 2024 earnings report after the U.S. market close. In summary, the weakening domestic business and the robust inbound/outbound and overseas business offset each other, resulting in revenue that was generally in line with expectations. However, the non-GAAP profit exceeded expectations significantly. The key points are as follows:

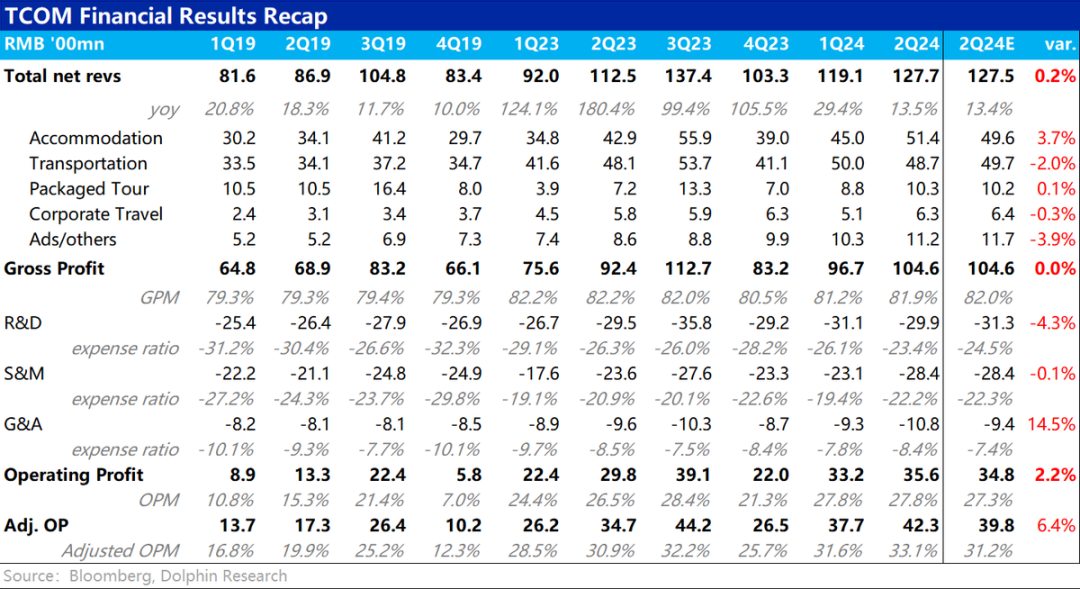

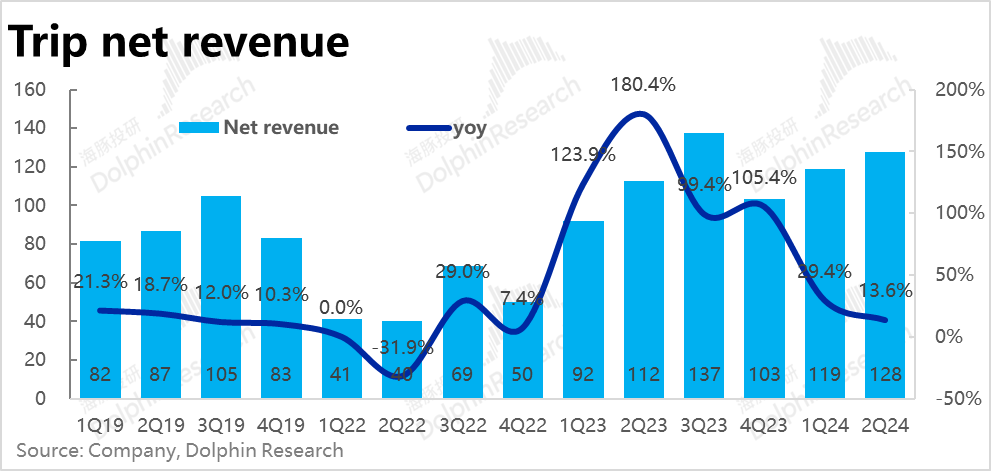

1. In terms of overall revenue, Ctrip achieved a net income of RMB 12.8 billion (excluding business taxes) in this quarter, an increase of 13.6% year-on-year, which is broadly in line with expectations. Compared to the nearly 30% growth in the previous quarter, the revenue growth rate in this quarter decreased significantly. Analyzing the domestic and inbound/outbound & overseas businesses separately:

For the domestic business, the company disclosed that hotel bookings on its domestic platforms increased by approximately 20% year-on-year, which includes bookings for local hotels and outbound accommodations made domestically. Therefore, the growth rate of domestic hotel bookings is likely in the mid-teens range.

In contrast, bookings for outbound travel accommodations and flights in this quarter have recovered to over 100% of the same period in 2019. Revenue from pure outbound travel business increased by a whopping 70% year-on-year. The number of inbound tourists in the first half of the year also increased by 150% year-on-year.

It is clear that while domestic local travel is gradually returning to normal, the robust growth in inbound/outbound and pure outbound travel has somewhat compensated for the slowdown in domestic business.

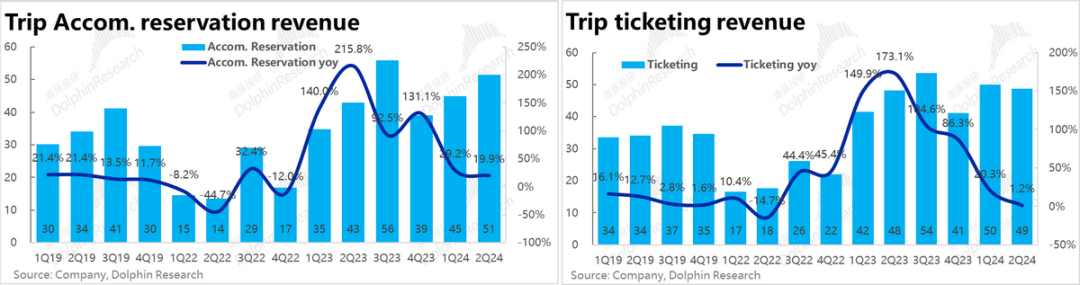

2. According to the revenue reported in the earnings release, revenue from hotel booking business increased by nearly 20% year-on-year, slowing down by 9 percentage points compared to the previous quarter but still maintaining a decent growth rate. However, revenue growth in ticketing business plummeted to 1.2%, approaching zero growth. According to the company's explanation, the sharp decline in ticketing revenue growth was due to lower airfare prices and reduced bundled sales of insurance products.

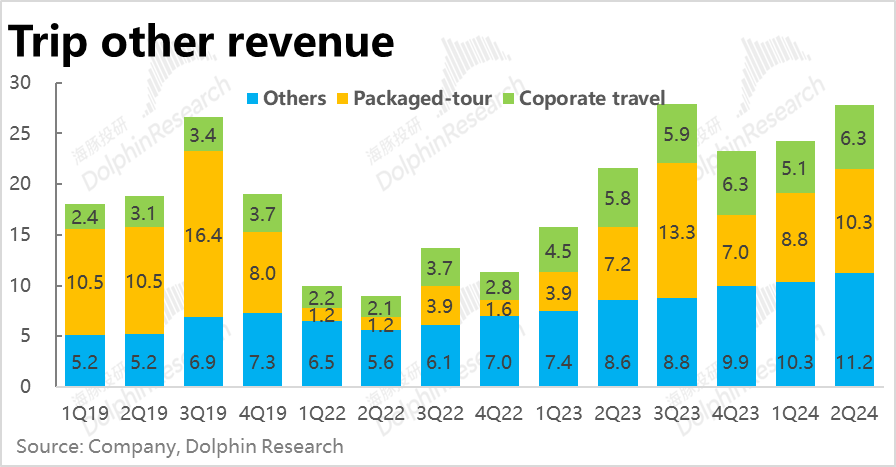

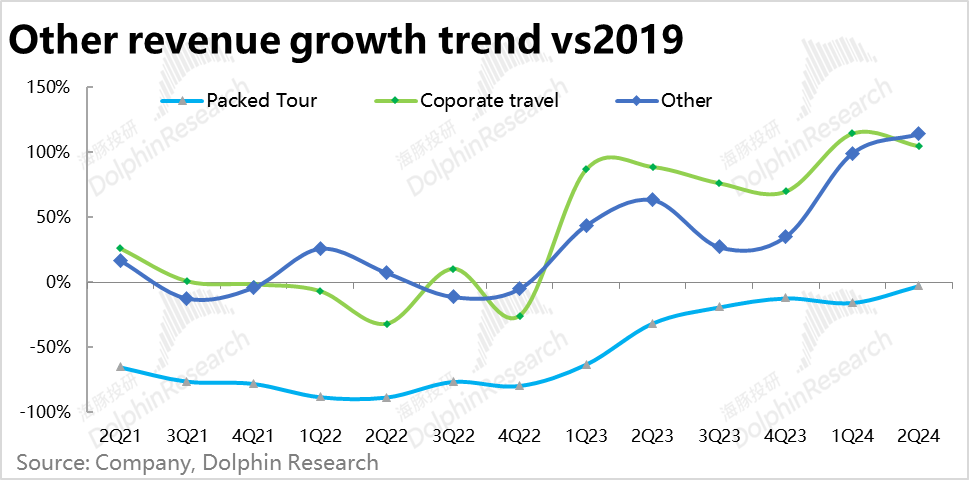

Among its businesses, other revenues, primarily from advertising, increased by 114% compared to the same period in 2019, further rising from 99% in the previous quarter, making it the strongest-growing new business. It is evident that the company has made good progress in promoting its high-margin advertising business, which contributes more to the company's profits than revenue.

3. In terms of expenses, marketing expenses for this quarter amounted to RMB 2.84 billion, an increase of approximately 20% year-on-year, significantly higher than revenue growth. This indicates that under the pressure of slowing domestic business and the need to expand inbound/outbound and overseas business, the company's marketing expenses are indeed rising. However, despite the significant increase in marketing spending, other expenses remained cautious. R&D expenses decreased by nearly 2% year-on-year, and administrative expenses increased by only 6% year-on-year. Overall, the combined operating expenses, after adjusting for the higher marketing expenses and lower R&D and administrative expenses, were generally in line with market expectations.

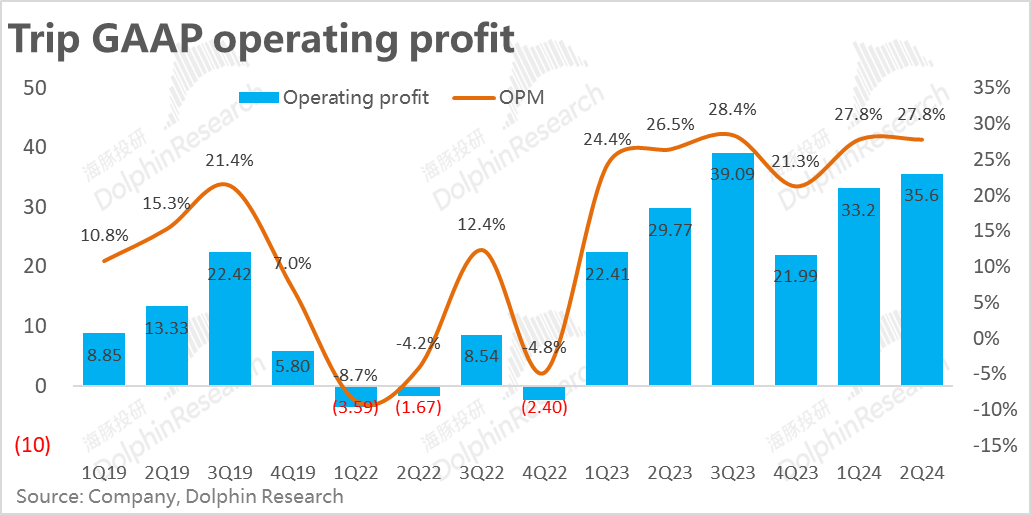

4. From a profit perspective, under GAAP, as the actual revenue, gross profit, and operating expenses were not significantly different from market expectations, the operating profit under GAAP was RMB 3.56 billion, slightly above the expected RMB 3.48 billion.

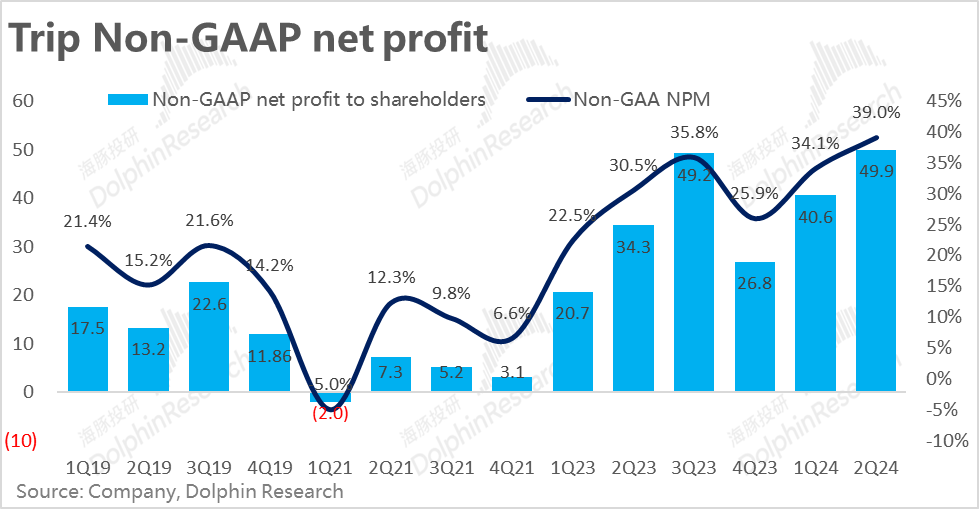

Under Non-GAAP, after adding the RMB 670 million in share-based compensation expenses for this quarter (RMB 450 million in the previous quarter), the actual operating profit of RMB 4.2 billion was slightly above the market expectation of around RMB 4 billion.

Dolphin Investment Research Insights:

Ctrip's quarterly earnings report, while not exceptionally strong from a strict perspective, met expectations with revenue growth slowing significantly from an elevated base. The operating profit under GAAP was only slightly above expectations, with modest sequential growth and flat profit margins, not overly surprising.

However, what sets Ctrip apart is that while nearly all the consumer-focused companies covered by Dolphin Investment Research in this quarter experienced varying degrees of "bombshell" earnings, with revenue growth mostly falling short of expectations, Ctrip managed to deliver growth in line with expectations while also exceeding profit expectations, making it a rare high-quality performer.

The underlying logic is that as the broader travel and hospitality market struggles with weakening domestic demand, Ctrip is better positioned to benefit from the recovery in inbound/outbound travel demand and recent visa-free policies with multiple countries. Therefore, the rapid recovery in inbound/outbound and overseas travel demand has largely offset the slowdown in domestic business. Meanwhile, as inbound/outbound and overseas travelers tend to spend more per trip, the platform's monetization potential is higher, benefiting the company's profit release. This quarter's results largely validate the market's relatively bullish outlook.

One weakness in this quarter was the near-zero growth in ticketing business, partly attributed to Ctrip's reduced efforts in bundling insurance products with ticket sales. In Dolphin's view, this choice reflects the company's proactive effort to balance platform monetization and user experience, given its overall positive business outlook, and is not a severely negative development.

Looking ahead, the company expects further moderation in domestic revenue growth in the next quarter, especially in terms of average daily rate (ADR). However, inbound/outbound business is expected to recover further compared to the second quarter, and pure overseas business (Trip.com) will maintain high double-digit growth. With these offsetting factors, next quarter's growth is expected to be roughly flat with this quarter, while profits will further increase. From a valuation perspective, due to the prior significant correction, the company's pre-market capitalization corresponds to roughly 17x its 2024 post-tax operating profit. While this valuation is not cheap compared to other Chinese stocks, it is not exorbitant given Ctrip's "forward-looking" inbound/outbound and overseas business layout and its scarcity as a company with decent performance. Future stock price performance will depend on whether the overseas business can deliver stronger-than-expected growth and profits.

In terms of share repurchases, the company repurchased USD 300 million in this quarter, slightly less than 1% of its current market capitalization, indicating a relatively modest repurchase effort compared to other Chinese companies. According to management, the current repurchases are primarily aimed at offsetting the dilution from share-based compensation rather than being driven by significant undervaluation.

Detailed Comments Follow

I. Domestic Market Stabilizing, but Overseas Market Picking Up the Slack, No Need for Alarm

In terms of overall performance, Ctrip achieved a net revenue of RMB 12.8 billion (excluding business taxes) in this quarter, an increase of 13.6% year-on-year, broadly in line with expectations. Despite the elevated base, the significant slowdown in revenue growth compared to the nearly 30% growth in the previous quarter still validates the normalization of overall domestic travel demand.

The slowing domestic travel demand but significant recovery in inbound/outbound travel is a consensus and default judgment for this quarter's performance. So, what's the actual situation?

First, in terms of domestic business, Ctrip's hotel bookings on its domestic platforms increased by approximately 20% year-on-year, including bookings for local hotels and outbound accommodations made domestically. In other words, the growth rate of domestic hotel bookings is likely only in the mid-teens range.

In contrast, bookings for outbound travel accommodations and flights in this quarter have recovered to over 100% of the same period in 2019. Revenue from pure outbound travel business increased by a whopping 70% year-on-year. Meanwhile, the number of inbound tourists in the first half of the year also increased by 150% year-on-year.

It is evident that while domestic local travel is gradually returning to normal, inbound/outbound and pure outbound travel have experienced relatively robust growth, to some extent compensating for the slowdown in domestic business.

According to the revenue reported in the earnings release, revenue from hotel booking business increased by nearly 20% year-on-year, slowing down by 9 percentage points compared to the previous quarter but still maintaining a decent growth rate. However, revenue growth in ticketing business plummeted to 1.2%, approaching zero growth. Based on the company's explanation and industry feedback, the significant decline in airfare prices is likely one of the reasons for the sharp drop in ticketing revenue growth. Additionally, the company explained that bundled sales of insurance products with tickets have also decreased this quarter, which contributed to slower revenue growth but also helped enhance consumer experience.

II. Advertising Business Continues to Grow Robustly

Apart from the two pillar businesses mentioned above, among Ctrip's other three businesses:

1) Corporate travel business increased by approximately 105% compared to the same period in 2019, slightly slowing down from 115% in the previous quarter. As the company's primary new business focus, the volume of corporate travel business has doubled since pre-pandemic levels, and the marginal slowdown in this quarter is not significant, indicating relatively inelastic corporate travel demand.

2) Package tour products are still 2.5% below the same period in 2019, with further improvement in recovery compared to the previous quarter but still the weakest performer.

3) Other revenue, primarily from advertising, increased by 114% compared to the same period in 2019, with a continuously rising growth rate, making it the strongest-growing new business. It is evident that the company has made good progress in its advertising business, which has a high profit margin and contributes more to the company's profits than its revenue proportionately.

III. Marketing Expense Growth Offset by Other Expenses, Resulting in Significantly Higher Adjusted Net Profit

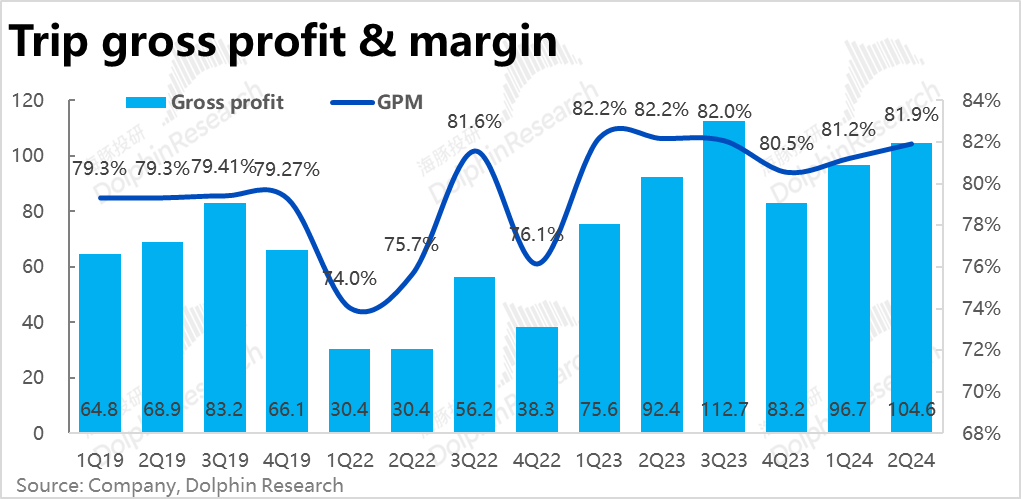

In terms of profitability, Ctrip's gross margin continued to increase slightly by 0.7 percentage points to 81.9% quarter-on-quarter, though still slightly below the peak in 2023, but rising continuously over the past three quarters. Dolphin Investment Research believes that the quarter-on-quarter increase in gross margin is likely due to the higher proportion of more profitable outbound business. The absolute gross profit amounted to nearly RMB 10.5 billion, exactly in line with market expectations, with a year-on-year increase of 13%, generally in line with revenue growth.

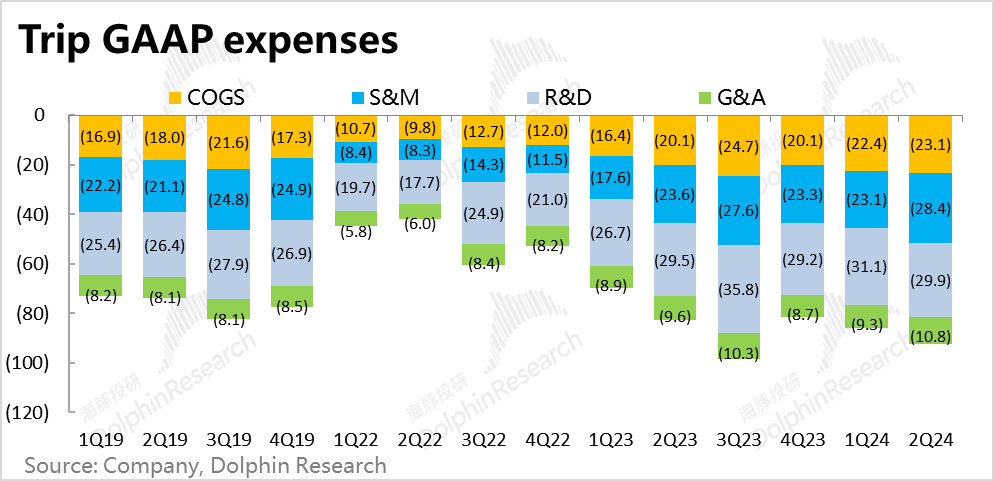

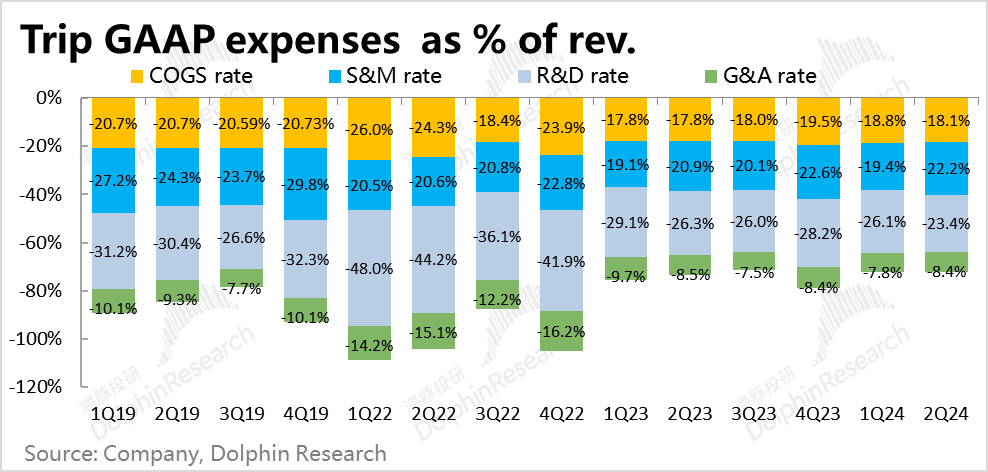

In terms of expenses, marketing expenses amounted to RMB 2.84 billion in this quarter, an increase of approximately 20% year-on-year, significantly higher than revenue growth. This indicates that under the pressure of slowing domestic business and the need to expand inbound/outbound and overseas business, the company's marketing expenses are indeed rising.

However, despite the significant increase in marketing spending, other expenses remained cautious. R&D expenses decreased by nearly 2% year-on-year, and administrative expenses increased by only 6% year-on-year, with share-based compensation expenses reaching RMB 300 million in this quarter, an increase of RMB 80 million year-on-year.

Overall, after adjusting for the higher marketing expenses and lower R&D and administrative expenses, the combined operating expenses were generally in line with market expectations.

Under GAAP, as the actual revenue, gross profit, and operating expenses were not significantly different from market expectations, the operating profit under GAAP was RMB 3.56 billion, slightly above the expected RMB 3.48 billion.

Under Non-GAAP, after adding the RMB 670 million in share-based compensation expenses for this quarter (RMB 450 million in the previous quarter), the actual operating profit of RMB 4.2 billion was slightly above the market expectation of around RMB 4 billion.

- END -

// Reprint Authorization

This article is originally created by Dolphin Investment Research. For reprinting, please obtain authorization.