Long Video Membership: From Stingy to Annual SVIP

![]() 08/30 2024

08/30 2024

![]() 517

517

【Tidal Business Review/ Original】

"Tonight, after work, I'm going to binge-watch the latest episodes of 'Edge of Water' on Youku, catch up on iQIYI's 'Nine Prosecutors,' and watch the new talk show on Tencent Video..." For Chloe, there's nothing more relaxing than watching dramas after work.

"To keep up with all these shows, I recently subscribed to Youku, iQIYI, and Tencent Video," Chloe said.

In contrast to the past when video memberships were mainly borrowed, people's willingness to spend money on long-form video platforms has significantly increased. For example, in the first half of this year, Tencent Video achieved double-digit growth in membership revenue for two consecutive quarters, fueled by hit shows like 'Splendor,' 'Celebration of the Year 2,' 'Feathered,' and 'Rose Story'.

The increase in consumers' willingness to spend can be attributed to the market's long-term education on content payment, raising users' awareness of paying for content. Additionally, platforms' continuous production of high-quality hit content drives users to gradually form a habit of paying.

The long-form video ecosystem, once dominated by talent shows, IP dramas, and popular variety shows, is now evolving into a competition among platforms in terms of in-house production capabilities and format innovation.

01 While Others Compete for Traffic, Long-Form Video Platforms Race Against Time

"Honestly, if the dramas and variety shows on these platforms weren't exactly to my liking, I would have just watched highlights on short-form video platforms. It's efficient, fast, and cost-effective," Chloe said.

Years ago, before the rise of short-form video platforms, comprehensive video platforms that offered a wide range of content were virtually every long-form video platform's ultimate goal.

In 2020, Tencent Video introduced the concept of a 'Rainforest Ecosystem,' aiming to facilitate the circulation of PGC (Professionally Generated Content), PUGC (Professionally-User Generated Content), and UGC (User Generated Content) within the platform. At the same time, iQIYI also had ambitious plans, expanding into areas like online literature, comics, games, and VR in addition to video content. iQIYI CEO Gong Yu even talked about building an ecosystem from an 'apple tree' to an 'apple orchard'...

However, with the diverse entertainment options available today, consumers have limited leisure time to devote to long-form video platforms. Currently, competing for users' limited entertainment time is a challenge that all long-form video platforms must face together.

So, how can platforms encourage users to spend money and time on them? The answer is simple: high-quality content.

In the past, long-form video platforms heavily relied on purchasing content. The 'big IP + big traffic' formula drove platforms to bid aggressively for content, leading to skyrocketing costs for actors' salaries, IP rights, and director/screenwriter fees. With limited entertainment options, traditional TV stations and long-form video platforms could still operate despite high content costs.

However, with the rise of online games and short-form video platforms, long-form video platforms, which rely on advertising and membership revenue, have inevitably fallen into a growth dilemma. In a market with limited resources, blindly spending money on content without a clear strategy is unsustainable.

Therefore, long-form video platforms have embarked on a path of cost reduction and efficiency enhancement through layoffs, reducing non-core businesses, increasing membership prices, and producing in-house dramas to lower content costs. While big IPs remain essential, the standards and requirements have changed significantly.

Despite a 16% decrease in new dramas in 2023 compared to 2021, the results were evident. iQIYI and Tencent Video achieved full-year profitability, while Youku's losses narrowed significantly. The era of 'losing money for market share' in long-form video is over.

Meanwhile, high-quality in-house content produced by platforms has undoubtedly gained recognition from audiences. For example, Youku's 'Edge of Water,' which debuted with an 8.1 rating on Douban and has since risen to 8.2, has become the highest-rated domestic suspense drama of the year. iQIYI's 'My Altay,' also based on quality content, gained popularity and even boosted local tourism. Tencent Video's 'Long Season' and 'Splendor' also achieved both critical and commercial success.

"Where there is traffic, there is a market," applies to long-form video platforms, where "good content equals traffic and market share."

02 Youku, iQIYI, Tencent Video, Mango TV: A New Game Has Begun

With quality content as the foundation, the question now is how to play the cards right in the game among Youku, iQIYI, Tencent Video, and Mango TV.

First, Tencent Video, as part of a multi-business conglomerate, leverages synergies across its businesses. The collaboration between China Literature, New Classics Media, and Tencent Video provides a robust content pipeline and a foundation for hit shows.

Tencent's recent financial report highlights that two of the top three most-watched dramas on Chinese online video platforms in the first half of 2024 were produced by New Classics Media and aired on Tencent Video, all based on China Literature's IP.

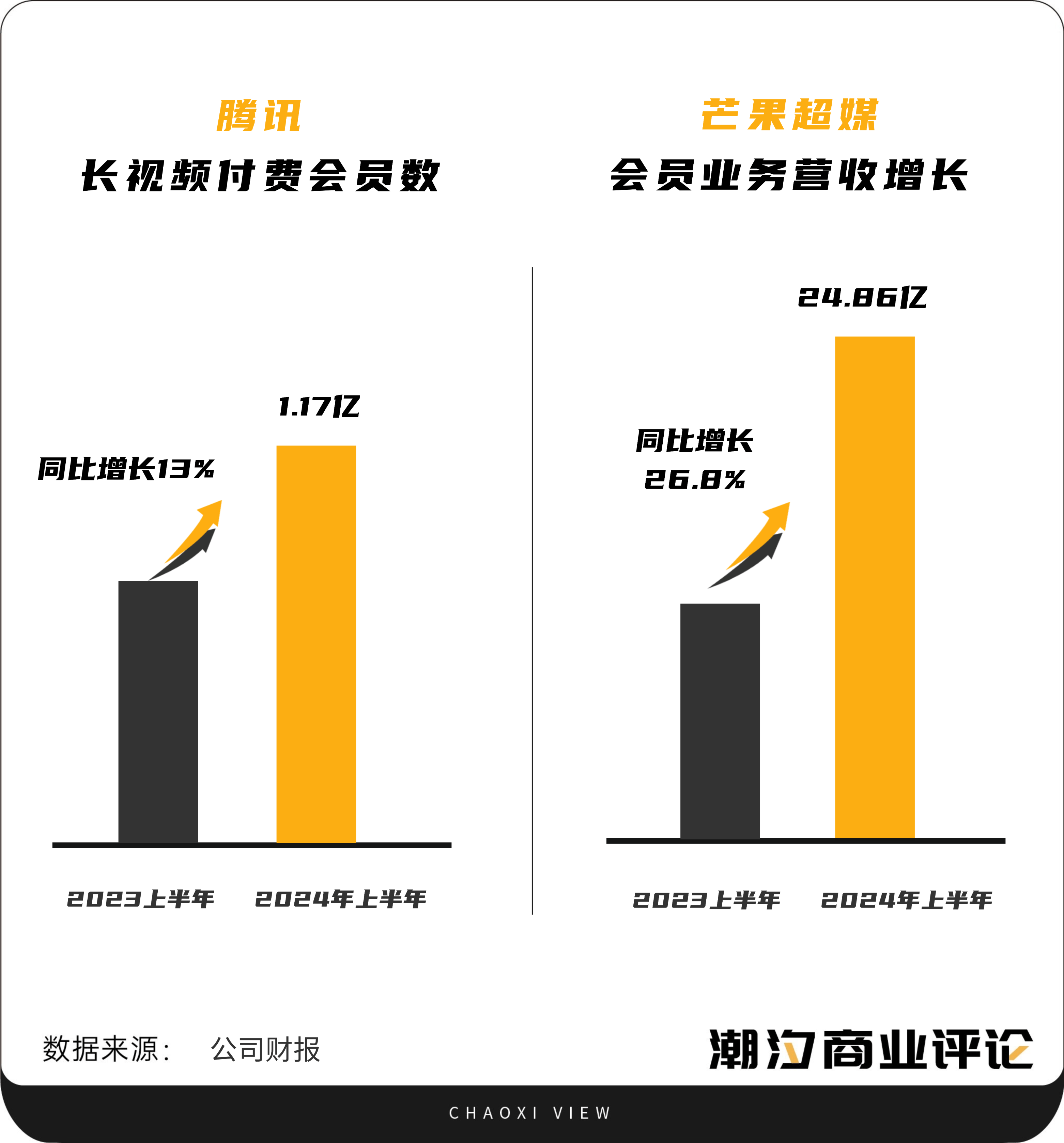

From the smash hit 'Splendor' at the beginning of the year to the consecutive blockbusters in Q2, including 'Feathered,' 'Celebration of the Year 2,' and 'Rose Story,' Tencent Video significantly contributed to its two main revenue streams: membership and advertising. According to Tencent's financial report, the number of paying members for long-form video increased by 13% year-on-year to 117 million in the first half of 2024, while advertising revenue grew by 30% in the second quarter.

Youku, which was relatively weaker among the 'big three' platforms (Youku, iQIYI, Tencent Video), emerged as a dark horse in the first half of the year through strategic content development. For example, Youku's 'Night Theater' produced three hits, including 'Glimmer,' 'Rebirth,' and 'Edge of Water,' which broke the conventional narrative framework and rhythm of dramas, achieving both critical and commercial success.

In ancient costume dramas, Youku also delivered hits like 'Flowers Among Us,' 'Cherish the Flowers,' and 'Ink Rain Among the Clouds,' with 'Ink Rain Among the Clouds' amassing over 2.3 billion views, approaching the viewership of 'Celebration of the Year 2'.

Mango TV continues to excel in variety shows, with the hit 'Singer 2024' dominating the market. Leveraging its expertise in production, sponsorship, and ecosystem building, Mango TV offers serialized developments and derivative programs like 'extended episodes' and 'special operations,' enhancing user stickiness and willingness to pay.

According to Mango TV's financial report, its membership revenue reached 2.486 billion yuan in the first half of 2024, up 26.8% year-on-year.

Compared to the hits produced by Youku, Tencent Video, and Mango TV, iQIYI seemed to falter in delivering blockbusters in the first half of the year, lacking the overwhelming presence of past hits like 'Storm Dancer,' 'The Long Ballad,' and 'Lotus Tower'.

In the first half of 2024, iQIYI had only one show, 'Wind Chaser,' that surpassed 10,000 in heat. Even its flagship 'Mystery Theater' struggled, with shows like 'Dislocation,' 'The Boy Who Can't Be Seen,' and 'Untold Story' failing to replicate past successes, losing out to Youku's 'Night Theater' in the 'mystery brand' battle.

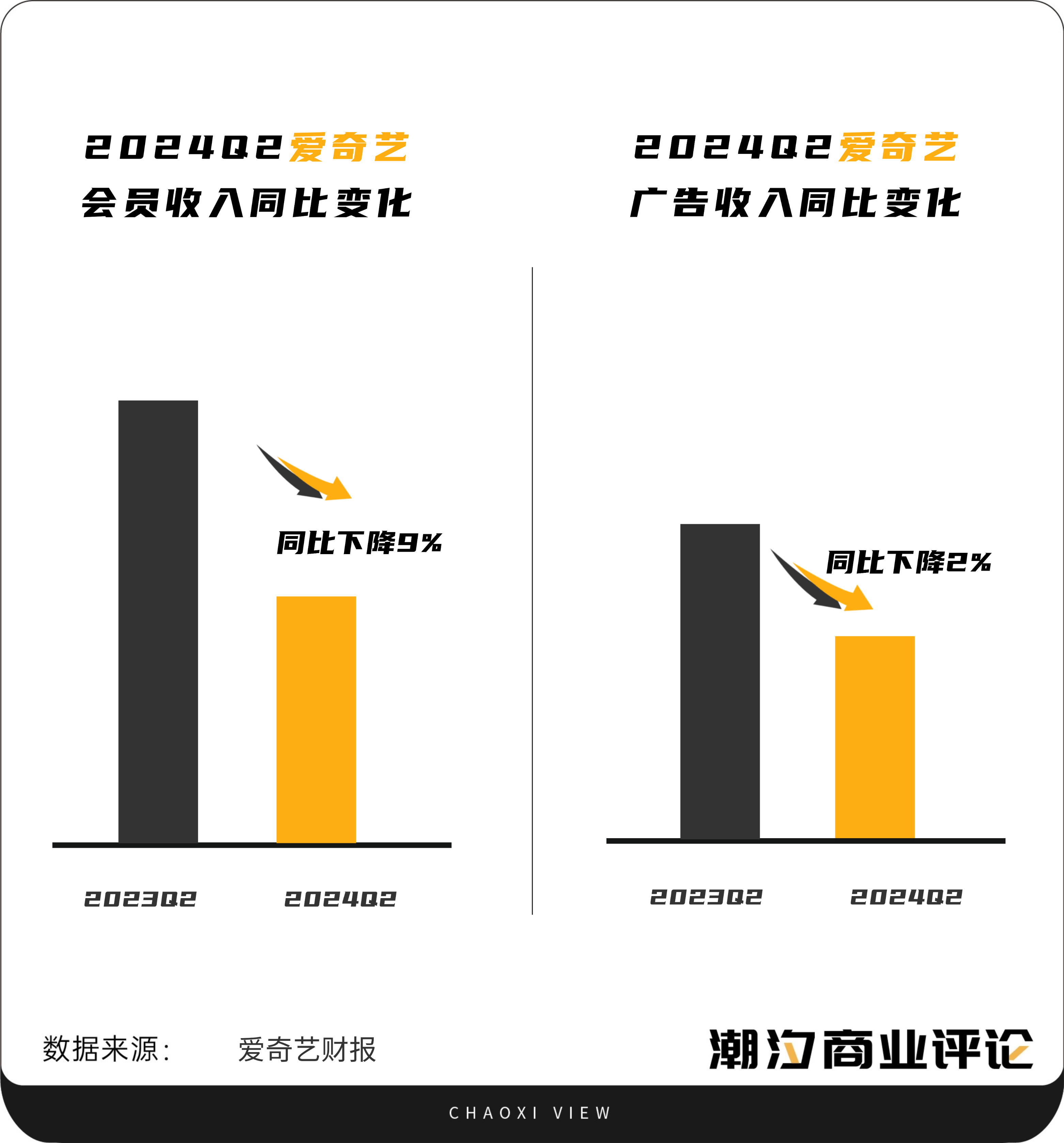

According to iQIYI's Q2 financial report, its membership and advertising revenues declined by 9% and 2%, respectively, year-on-year in 2024Q2.

iQIYI's lack of hits may be related to its dispersed content focus. In 2024, iQIYI aims for a broad content layout. In April, Wang Xiaohui, iQIYI's Chief Content Officer, mentioned at the iQIYI World Congress that future hits would lie in realism, while balancing the fan base structure remained a priority.

Besides exploring realistic themes, iQIYI launched the 'Micro Dust Theater' and 'Great Masters Theater,' focusing on ordinary people's stories and presenting artistic and commercial literary works through short dramas and stylized visuals. While 'My Altay' demonstrated pioneering quality, its niche theme made it difficult to become a mass hit.

Compared to Youku, Tencent Video, and Mango TV's clear strategic directions, iQIYI's current development path seems less definitive.

In 2024, long-form video platforms have undoubtedly embarked on a new game based on 'good content.' Long-form video's immersive experience, which short-form video finds difficult to match, ensures its continued relevance as a vital source of mental nourishment for the masses.

Now, Youku, iQIYI, Tencent Video, and Mango TV each have their unique strategies, but to solidify their positions in consumers' hearts, they must continue to churn out hits.

Why must they be hits?

Whether it's commercial derivatives of IP value, upgrading from monthly to annual subscriptions, or international distribution of major dramas, these events are all built on 'heat.' Heat drives traffic conversion, and without it, the lack of buzz and social value makes it challenging for consumers to sustainably pay for platform content.

However, hits also mean uncertainty. In an uncertain environment, businesses tend to pursue certainty due to its low risk and stable returns. Hits, on the other hand, defy certainty and standards, with no surefire method; they are a product of favorable conditions and even a bit of luck.

Audiences' aesthetic fatigue decreases over time. Even if a replication of 'Storm Dancer' were made with the same artistic level, its chances of becoming a hit would diminish due to a lack of novelty.

In the business world, there are no undefeated champions. What sets winners apart is their ability to learn from failures and increase their chances of success. Just as in long-form video platforms' 'hit-making,' not every content becomes a hit, but there are patterns to increase the proportion of hits.

So, how can long-form video platforms enhance their hit-making probability?

To some extent, short dramas and the film market offer valuable insights. Speed is crucial since consumers' aesthetic preferences and social discourse evolve rapidly. Content production is a race against time. Precisely targeting audiences, as mentioned earlier, allows content to captivate viewers by anticipating their interests and viewing habits. Additionally, analyzing hit case studies and key data through technological means offers potential for hit replication.

"One reason I don't subscribe annually is that if there are no good dramas, I feel like I've wasted my monthly subscription. But once there's good content, I'll renew immediately," Chloe said.

You see, that's how business works.