Where does China lag behind in automotive chips?

![]() 09/02 2024

09/02 2024

![]() 608

608

Author | Zhang Lianyi

As automobiles continue to evolve towards intelligence, the value of chips has become increasingly apparent. According to McKinsey projections, by 2030, the semiconductor market for L3 and higher-level autonomous vehicles in China alone could reach $13 billion.

However, according to the China Automotive Technology and Research Center, China's domestic automotive chip market accounts for only 4.5% of the global market, with a staggering 90% reliance on foreign chips.

From a vehicle-wide perspective, automotive chips can be broadly categorized into ten types, including control chips, computing chips, sensor chips, memory chips, communication chips, security chips, power chips, driver chips, power supply chips, and analog chips.

"After reviewing automotive chips, excluding diodes and transistors, the average number of chips in a pure electric vehicle is 437, while in a hybrid vehicle, it's 511," said Zou Guangcai, Deputy Secretary-General of the China Automotive Chip Industry Innovation Strategy Alliance at the 20th China Automotive Industry Development (Teda) International Forum at the end of August. He added that China has a solid foundation in power supply and analog chips, which are widely used in vehicles but are relatively inexpensive, sometimes costing as little as a few cents, hence their lower value proportion.

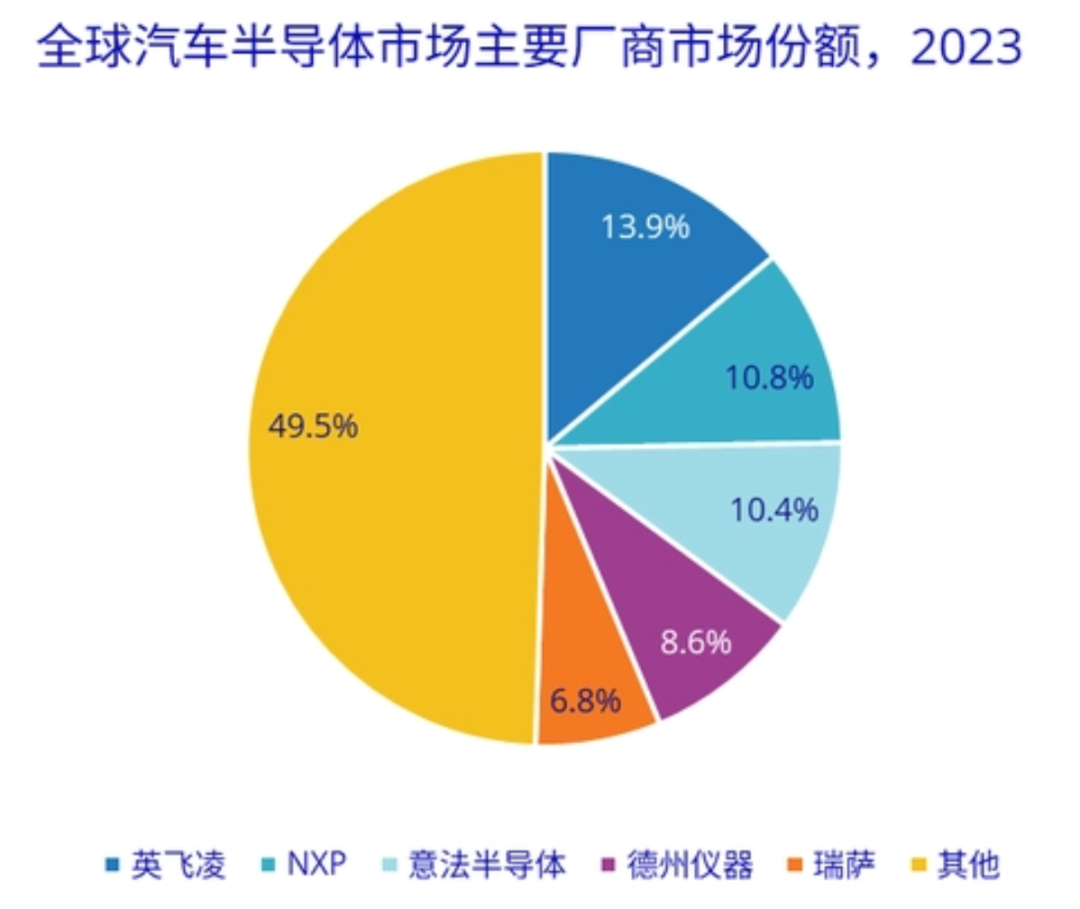

From a global perspective, the automotive chip market is dominated by a handful of leading manufacturers, with the top ten accounting for over 70% of the global market, primarily consisting of enterprises from developed countries. These companies not only hold a significant market share but also diversify their product portfolios across multiple chip categories. "This suggests that for China to emerge as a leading player in the automotive chip industry, it is imperative to expand into various chip categories beyond specializing in just one," Zou Guangcai noted.

01 Security chips dominate, but China's chips face 'choking points'

Recently, Zou Guangcai conducted a survey on China's chip landscape.

In terms of market share, high-security MCUs for control chips have a relatively low domestic production ratio, while other MCU categories have seen significant domestic substitution, with an overall vehicle integration rate of 10%.

For computing chips, China has introduced some low-to-mid-range products into vehicles, but high-performance options remain scarce, with an overall application rate exceeding 20%.

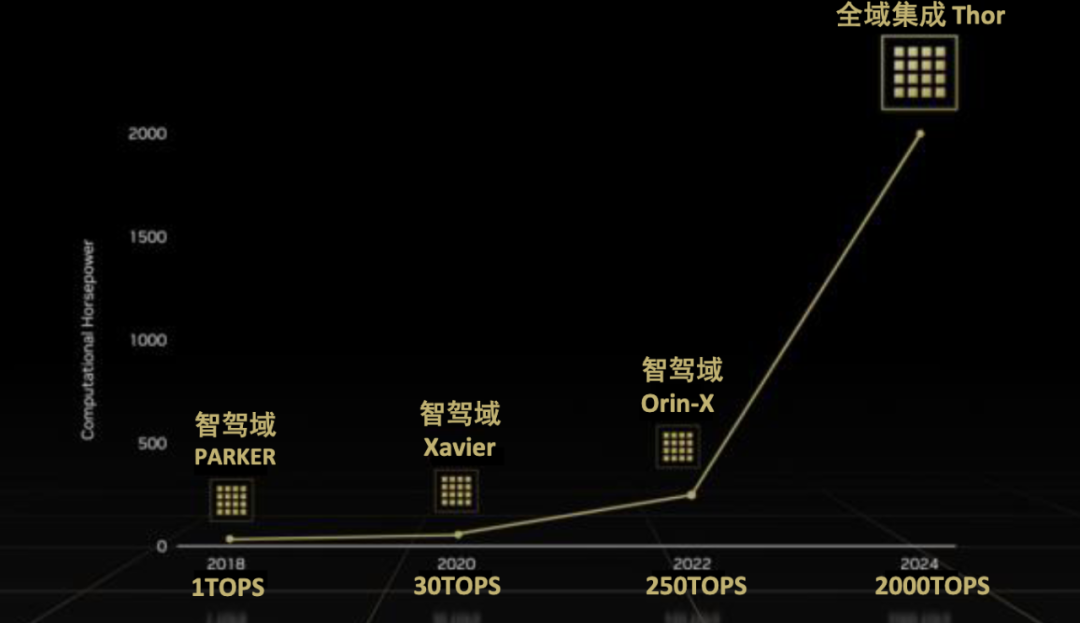

NVIDIA continues to enhance the computing power of its autonomous driving chips. The memory chip sector, with a solid foundation, accounts for 25% of the overall market.

Communication chips, including 4G and 5G communications, navigation chips, CAN/LIN/TSN, etc., make up 5%-10% of the market.

Power devices have been domestically developed earlier, accounting for 15% of the overall market. Zou emphasized that China's IGBT products are mature and suggested focusing more on silicon carbide in the future.

Power supply chips contribute 10% to the market, while driver chips lag slightly behind due to limited foreign substitution options.

Sensor chips account for 15% to 20% of the market, while information security chips dominate with a share of up to 50%.

"A notable characteristic of China is that leading automakers are widely investing in the automotive chip industry through various means, including in-house research and development, investment, and joint ventures," Zou said. Overall, significant attention is paid to the control, computing, and power sectors.

Zou Guangcai delved deeper into these key sectors.

Data Source: IDCHe noted that the MCU market is still dominated by international giants, particularly Infineon. While domestic low-to-mid-range MCUs have been widely integrated into vehicle bodies and cockpits, automakers remain hesitant about adopting domestic MCUs for powertrains and autonomous driving systems, despite extensive testing and validation.

SOCs are divided into two categories: those for autonomous driving, led by Tesla and NVIDIA (the latter being widely adopted), and those for cockpits, where Qualcomm dominates. Although China boasts many low-to-mid-performance SOC products, high-performance options are scarce, presenting an area for future development.

In the communication chip sector, TSN (Time-Sensitive Networking) chips are gradually being integrated into vehicles, with many Chinese automakers investing in TSN chip companies. SerDes chips are progressing faster than TSN, with domestic SerDes companies already benchmarking their technical indicators against international standards. "These two types of chips are developing rapidly in China and deserve attention," Zou said.

Silicon carbide is also a focal point. "There's always been a perception that silicon carbide is too expensive and has low yield rates," Zou said. However, China has entered a cost reduction cycle for silicon carbide, albeit slower than Moore's Law. The main challenge lies in epitaxial wafers, which significantly impact cost and yield rates.

From Zou's perspective, IDM companies that design and manufacture their own chips have a significant advantage in the industry.

Overall, China's automotive chip landscape is characterized by a wide range of readily available and affordable generic ICs and components. However, high-end chips such as MCUs, smart power devices, and power management chips are still dominated by foreign manufacturers, posing potential 'choking points'.

02 Exploring new technologies for the chip industry's 'lane change' and overtakingIn the face of China's underwhelming performance in the automotive chip market, the country is exploring ways to catch up.

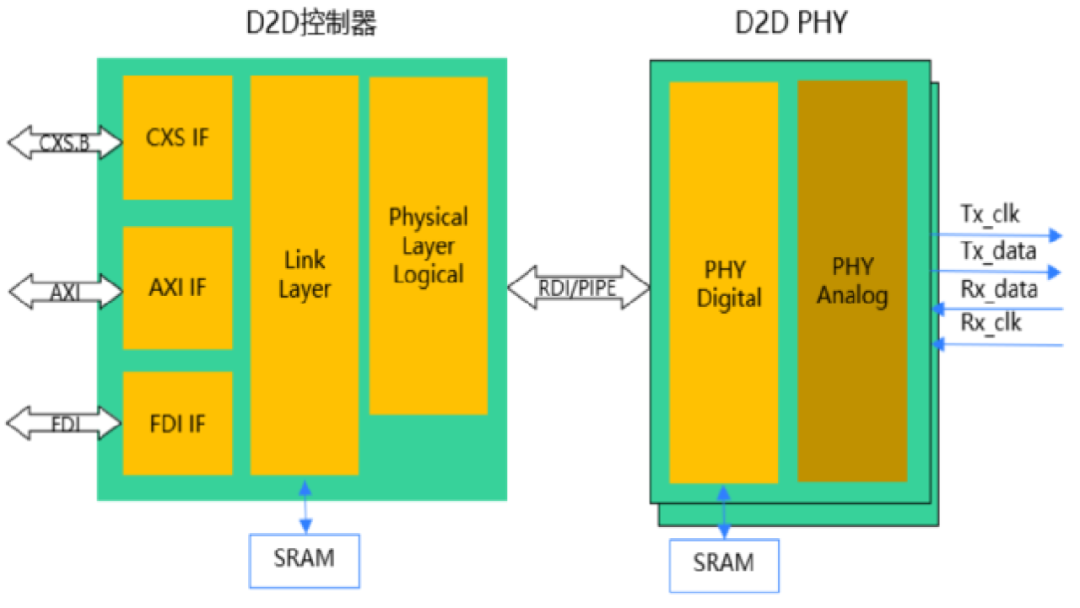

"Automotive chips cannot escape the influence of the integrated circuit industry's foundation, which remains relatively weak in China, particularly in terms of advanced process wafer fabrication," Zou noted. As a result, discussions are underway on how to leverage Chiplet technology to meet the demands of high-performance autonomous driving chips in the future.

Chiplet, also known as small chip or dielet, involves packaging multiple functional dies together with a base chip through die-to-die interconnect technology to form a system-on-chip (SoC), enabling a new form of IP reuse. It can be likened to gluing smaller chips together to form a more powerful larger chip.

D2D Hierarchical ArchitectureChiplet's key feature is its ability to package independent functions into separate modules, reducing the SoC's footprint and allowing for combination and packaging using relatively mature processes. This approach can substitute for product innovation and performance enhancement while helping to control development cycles and costs. However, Zou cautioned that while Chiplet represents a promising direction, it faces challenges in interface protocols and reliability, as it has yet to undergo automotive-grade validation.

Open-source architecture chips are another technological direction being promoted in light of China's industrial characteristics.

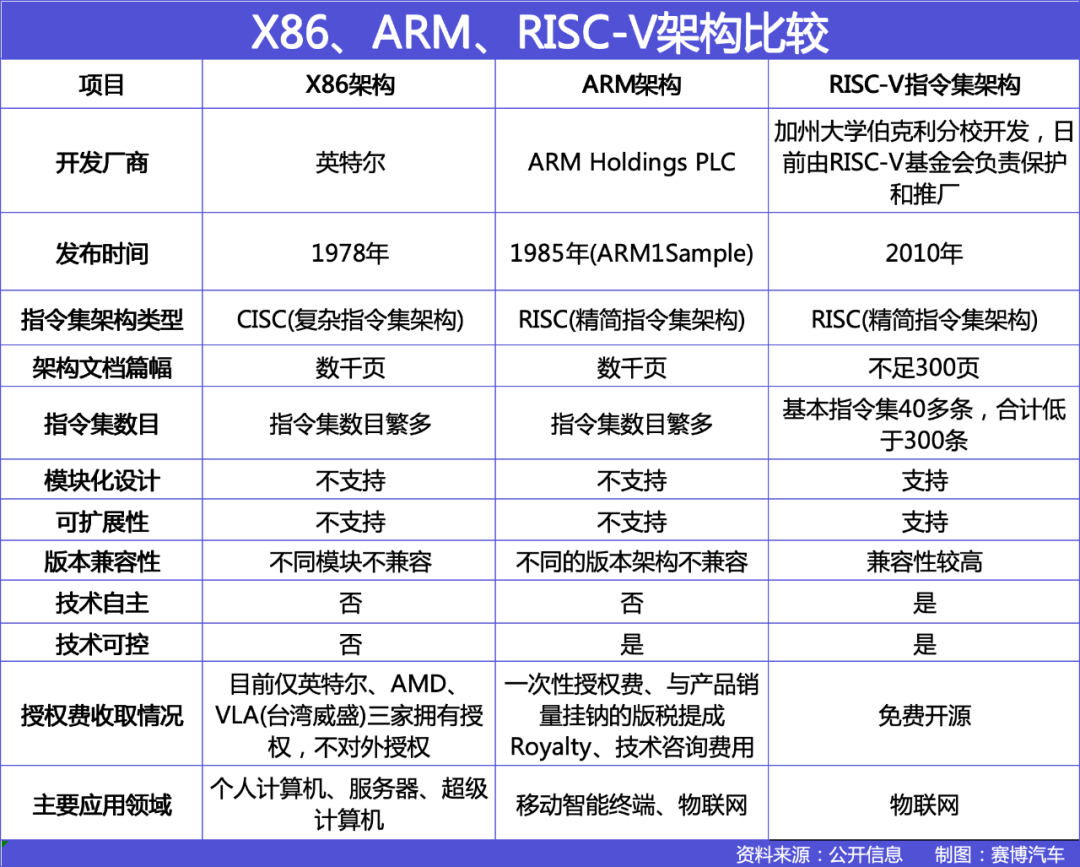

The CPU is a crucial technology for automotive development, and its architecture underpins the chip supply chain and ecosystem. For decades, the CPU market has been dominated by just two architectures: X86 and ARM.

Open-source architecture is seen as a potential disruptor to this duopoly, offering openness that is particularly suited for IoT applications. China is integrating this approach into the development of intelligent and connected vehicles.

At last year's TEDA Forum, Ni Guangnan, Academician of the Chinese Academy of Engineering, highlighted the potential of the open-source RISC-V (Reduced Instruction Set Computer) architecture to empower China's chip industry. RISC-V, the fifth-generation RISC, is an open-source instruction set architecture based on the RISC principle.

As the name suggests, instructions are tasks assigned to chips. A processor is a chip that requires external input to function, specifying what operations it should perform. For instance, telling a chip to perform a multiplication is an instruction, and a collection of such instructions forms an instruction set.

As a relatively new architecture, RISC-V boasts several advantages, including advanced design, broad application potential, cost-effectiveness, and resilience. In Ni Guangnan's view, China's pursuit of RISC-V offers three unique strengths.

Firstly, it aligns with China's strategy of technological self-reliance and innovation, while also driving global technological progress. Historically, the CPU market has been dominated by X86 and ARM architectures, leading to a highly monopolized chip industry. The emergence of open-source RISC-V disrupts this monopoly, providing a powerful impetus for global chip industry development and fostering a rapidly evolving ecosystem.

Secondly, China's vast market serves as fertile ground for nurturing next-generation information technologies. Furthermore, China boasts the world's largest pool of engineers, providing a talent advantage crucial for technological innovation and development. However, Zou acknowledged that RISC-V development involves fragmentation, and while RISC-V-based automotive chip products have emerged, their integration into vehicles remains a work in progress.

03 Chip enterprises must prepare for a long-term battleDespite uncertainties, Zou believes that China's automotive chip industry has long-term potential, akin to the development of the new energy sector, which has inevitably encountered constraints and fluctuations.

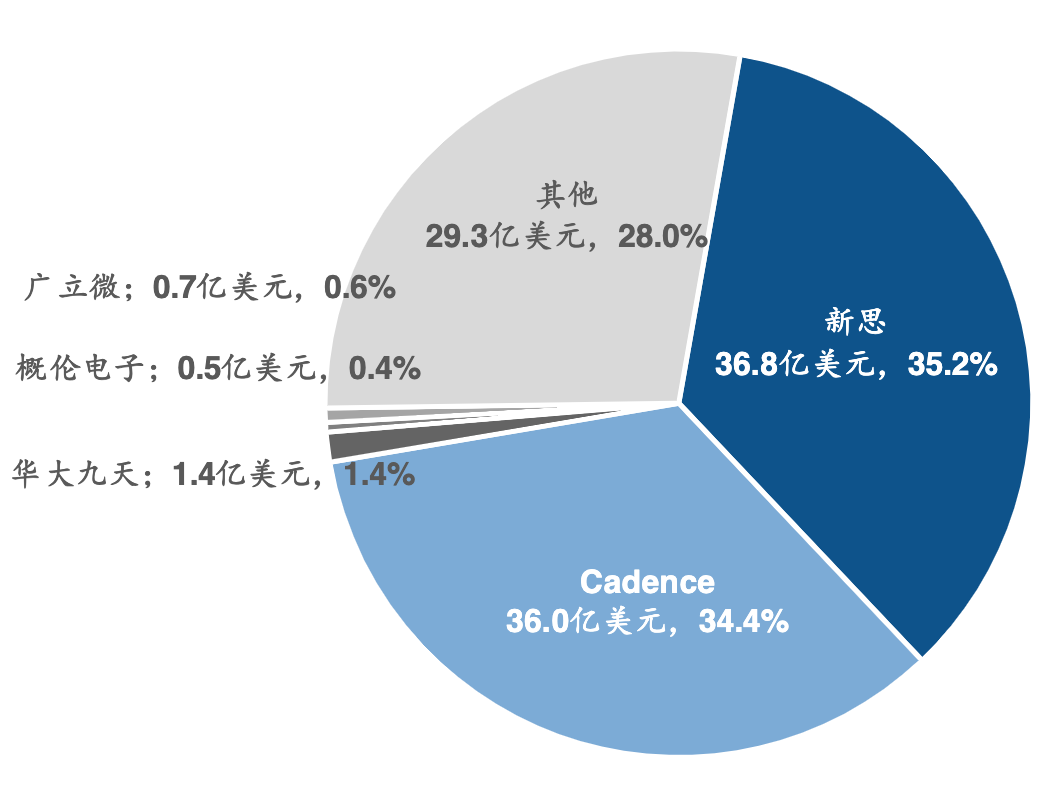

For instance, there are shortcomings in product development capabilities, IP/EDA, automotive-grade wafer fabrication processes (yield rates and advanced processes), and high-security application scenarios. Additionally, with numerous automotive chip enterprises in China, market capacity may not guarantee the healthy development of all these companies. Over the next three years, a process of survival of the fittest is anticipated, with chip enterprises needing to demonstrate a commitment spanning over a decade to succeed in the automotive chip market.

EDA Market Share by Company in 2023Moreover, Zou pointed out that the convergence between the automotive and chip industries is becoming increasingly evident, particularly as traditional industry roles are being blurred. Traditionally, automakers focused on vehicle management, Tier 1 suppliers on controller development, and chip manufacturers on chip production. However, many automakers are now developing their own chips or specifying Tier 1 suppliers to select specific chips, disrupting traditional roles and compressing Tier 1 suppliers' development space, particularly in terms of development rights and cost control. How this new mechanism will unfold remains to be seen, requiring collaboration across the industry's upstream and downstream players.

Zou emphasized that China's automotive chip supply chain remains relatively weak, closely tied to the foundation of the integrated circuit industry. While China has made rapid progress in product design, integration, and testing, there are still significant gaps with international counterparts in areas such as IP/EDA and automotive-grade processes.

"Recently, many fabs have been established in China, with automotive chip production plans included in their strategies. However, most of these plans are scheduled for later phases, as companies prioritize profitability through consumer electronics before turning to automotive chips," Zou noted. In his view, it will take four to five years for these fabs to produce automotive chips and serve the industry. "So, we may have to wait a while longer. But I believe that within four to five years, our automotive chip production capacity will increase significantly." In light of this, he offered some suggestions for the industry.

Firstly, it is crucial to clarify China's vision for the future development of its automotive chip industry. Over the next 5 to 15 years, domestically produced chips should form a series of products targeting different applications and market segments, from mid-to-high-end. High-end products must reach world-class standards, while mid-to-low-end products should integrate into the global market and strive for a favorable development ecosystem.

In Zou's opinion, China's automotive chip industry cannot operate in isolation but must integrate with the global supply chain to create cost and supply chain advantages for certain automotive chip products, which must also be recognized and adopted internationally. This necessitates efforts across the supply chain, industry landscape, ecosystem, and integrated development.

Secondly, the industry must focus on products as its core. When selecting chips, automakers prioritize price, performance, and reliability as the core competitiveness of products, rather than the most advanced technology. They also value stable quality and supply, which are the core competitiveness of chip enterprises.

He hopes that chip enterprises will avoid homogenization and instead find their niche, collaborating with automakers to conduct product definition research and focus on the development of high-end, unique, and innovative products to establish long-term competitiveness, though he acknowledges this is challenging.

Lastly, he recommends establishing a comprehensive ecosystem as the foundation for sustainable and healthy development. "Integrating domestic chips into vehicles is not merely a technical issue but an industrial challenge, particularly concerning the ecosystem. It requires collaboration across design, manufacturing, testing, standards, testing and certification, electronic controller development, and vehicle certification. Only through joint efforts and risk-sharing can we share the benefits."-END-