Xiaohongshu invested in Zhu Xiaohu? This is a misunderstanding

![]() 09/02 2024

09/02 2024

![]() 528

528

Written by She Zongming

Xiaohongshu's "investment" in its own investor, GSR Ventures, has been one of the hot topics in the TMT circle in recent days.

The story began when Hangzhou GSR Venture Capital (hereinafter referred to as "GSR Venture Capital") underwent recent industrial and commercial changes, with the addition of Xingyin Information Technology (Shanghai) Co., Ltd. as a shareholder.

Key points: The former is a fund under GSR Ventures, while the latter is the parent company of Xiaohongshu.

In other words, Xiaohongshu, acting as a limited partner (LP), invested in GSR Ventures - its investor since its early days and through several subsequent rounds of funding.

Against the backdrop of frequent tensions between founders and investors due to repurchase clauses and gambling agreements in venture capital, the story between Xiaohongshu and GSR Ventures, where "you stood by me today, and I'll be your LP tomorrow," can be considered a beautiful tale.

When it comes to GSR Ventures, some people instinctively think of Zhu Xiaohu. Some media outlets have interpreted this as Xiaohongshu investing in Zhu Xiaohu.

However, after communicating with friends in the investment circle who are informed, I learned that contrary to previous media reports, Xiaohongshu's "investment" in GSR Ventures did not occur in 2024 and had little to do with Zhu Xiaohu.

01

Xiaohongshu's investment in GSR Venture Capital actually first took place in 2022, when the fund was first established, not recently.

The reason it has recently been in the news is due to recent changes in the fund's industrial and commercial information, which now includes Xiaohongshu's investment information.

In other words, as early as 2022, Xiaohongshu began "giving back to its Bo Le " (patron).

Why did Xiaohongshu make such a move? The answer lies in the background information of GSR Venture Capital.

GSR Venture Capital was an angel fund established in 2022 by Zhang Yutong, another managing partner of GSR Ventures at the time, specifically targeting startups in cutting-edge technology fields.

At that time, GSR Ventures was known primarily for its investments in the mobile internet sector. Venturing into an angel fund for cutting-edge technology was not initially well-received, as such investments tend to have long return cycles.

Zhang Yutong had to turn to familiar institutions and friends for support, including Xiaohongshu, which had invested in and supported her for nearly a decade, FunPlus, where she had previously invested and worked, and various funds and individual friends she had collaborated with. These entities and individuals made up the diverse list of partners for GSR Venture Capital.

GSR Venture Capital did not disappoint, investing in 11 startups in less than two years, spanning artificial intelligence, data infrastructure, robotics, chips, and other fields. Among them were notable startups such as Wuwenxinqiong, Liblib AI, Gravitation, and Xinghai Map.

▲Wuwenxinqiong is a popular startup at present.

In the tech industry, these companies are all renowned -

Wuwenxinqiong is a general artificial intelligence infrastructure company established by the Department of Electronic Engineering at Tsinghua University. It has received investments from renowned institutions such as Tencent, Baidu, Sequoia China, Northern Light Venture Capital, and ZhenFund.

Liblib AI is an AI image creation platform and model sharing community that has completed three rounds of funding in the past year, totaling hundreds of millions of Chinese yuan. Investors include Source Code Capital and Gaorong Capital.

Xinghai Map, which focuses on creating embodied AI with "one brain and multiple models," is considered the "strongest startup team" in the embodied AI space.

Interestingly, most of the founding teams behind these companies come from Tsinghua University.

02

Some may ask: After all this, why did Xiaohongshu participate?

The reason is not complicated: Xiaohongshu's willingness to participate in GSR Venture Capital in 2022 was not only to repay its early investors as it grew but also because it saw itself, once undervalued, in a new light.

Flashback to 2013.

At the time, Zhang Yutong was the chairperson of the Stanford Chinese Entrepreneurship Club, organizing numerous entrepreneurial events. During a travel-themed event, Mao Wenchao participated in a discussion alongside his future COO Conan.

With a revised business plan, Mao Wenchao later participated in another summer innovation program evaluation organized by Zhang Yutong. The competition had several restrictions: returning to China to start a business, creating a mobile internet app, having at least one Stanford alumnus involved, and having at least one product engineer.

Among over 20 projects, Mao Wenchao's project was the only angel-funded project.

The project had a romantic name, "Escape to China," which served as a prequel to the Xiaohongshu project.

At the time, Richard Lim, the managing partner of GSR Ventures, and Zhang Yutong invested in this project, which lacked both a product and a product name.

However, the entrepreneurial journey is rarely easy. In the following years, Xiaohongshu faced countless doubts and challenges: in 2014, investors questioned its differences from communities like Mogujie and Meilishuo; in 2016, they asked how it differed from cross-border e-commerce platforms like Yimama and Kaola.

Founded in 2013, Xiaohongshu had been operating for four years by 2016, yet its daily active users (DAU) were less than 1 million. At the time, few could have imagined that Xiaohongshu's DAU would exceed 100 million today.

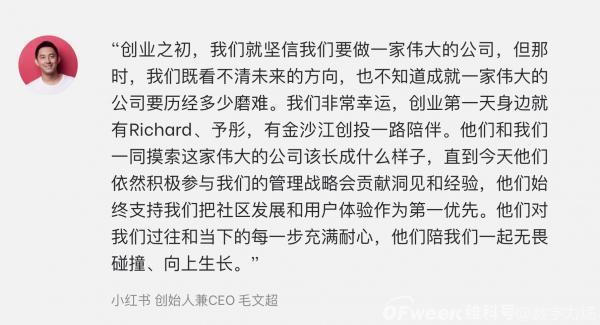

"From the beginning of our venture, we were convinced that we wanted to build a great company. However, at that time, we had no clear vision of the future or the hardships we would face in achieving greatness. Fortunately, we had Richard and Yutong by our side from day one, with GSR Ventures accompanying us every step of the way. Together, we explored what a great company should look like..." These words were written by Mao Wenchao and featured on the official website of GSR Ventures.

▲Xiaohongshu's founder and CEO Mao Wenchao expressed gratitude for GSR Ventures' continued support.

'Ten years' in Eason Chan's song signify emotional changes and new chapters in life.

But for Xiaohongshu, ten years represent a journey of constantly climbing over hills to reach new heights.

This journey has naturally been fraught with twists and turns, but fortunately, Xiaohongshu has had companions along the way.

03

An investor once explained what constitutes a successful investment: true success goes beyond short-term financial returns; it is about trust and mutual support over the long term.

The allure of Xiaohongshu's story with its investors lies not only in their mutual success but also in their decade-long companionship.

Whether investors fund angel-stage startups or entrepreneurs give back to their investors, both point to a shared belief in each other's potential.

Only with such confidence can all parties navigate economic cycles together and nurture the next industry giant.

In today's shifting venture capital landscape, such confidence is invaluable.

It is well-known that the past two years have seen an increase in lawsuits arising from venture capital's "rigid redemption" clauses. Behind this is the fact that almost all parties are facing difficulties: entrepreneurs have their own challenges, and so do investors.

Regardless of the difficulties, it is crucial not to forget that in the face of hardships, all parties need patience, foresight, courage, and determination. They must believe that truly valuable opportunities often arise during the toughest times...

It is hoped that in the future, more entrepreneurs and investors can jointly nurture the strength to overcome difficult times, keeping China's tech sector vibrant and full of confidence.