China Mobile: revenue growth slows down in the first half of the year, C-end market suffers a setback

![]() 09/03 2024

09/03 2024

![]() 547

547

At present, the results of the three major domestic operators -- China Mobile (600941.SH), China Unicom, and China Telecom for the first half of 2024 have been announced. China Mobile not only achieved profit growth in the first half of the year, but also outperformed the other two in terms of revenue scale and profitability, with a remarkable performance.

Stockstar notes that there are still hidden concerns behind China Mobile's impressive performance. Facing an increasingly saturated telecommunications market, the company's revenue growth is slowing down significantly, and it has now entered an era of single-digit growth.

In the first half of this year, China Mobile's growth momentum in messaging and wireless internet services has been noticeably insufficient. As the company's main battleground, the C-end market is currently facing issues such as slowing growth in the number of 5G package subscribers and declining Average Revenue Per User (ARPU). These factors have collectively led to a decline in C-end revenue. Moreover, the company's accounts receivable have shown an increasing trend year by year, which has resulted in a decrease in the company's cash flow due to the growth in accounts receivable.

01. Slowdown in the growth rate of telecommunications services business

According to public information, China Mobile's main business covers mobile voice, SMS/MMS, wireless internet, wired broadband, and other computing services, as well as platforms, applications, and solutions based on new-generation information technology capabilities such as artificial intelligence, big data, and security.

According to the 2024 half-year report, the company's operating revenue reached 546.7 billion yuan, a year-on-year increase of 3%, and net profit attributable to shareholders of the parent company was 80.2 billion yuan, a year-on-year increase of 5.3%, achieving both profit and revenue growth.

Stockstar notes that there are still many hidden concerns behind China Mobile's revenue growth.

Over time, both the company's revenue and net profit have shown a slowdown in growth rates. From the first half of 2022 to the first half of 2024, China Mobile's revenue was 496.934 billion yuan, 530.719 billion yuan, and 546.7 billion yuan, respectively, with year-on-year growth rates of 12.01%, 6.8%, and 3%, respectively. Net profit attributable to shareholders of the parent company was 70.275 billion yuan, 76.173 billion yuan, and 80.2 billion yuan, respectively, with year-on-year growth rates of 18.87%, 8.39%, and 5.3%, respectively. It can be seen that the growth rates of the company's revenue and net profit have entered an era of single-digit growth.

Regarding this, Yang Jie, Chairman of China Mobile, said at the mid-year performance exchange meeting that the slowdown in revenue growth is mainly due to the transmission effect brought about by many external environmental changes. At the same time, as the company has entered a new stage of transformation and upgrading, it still needs time to adjust, cultivate, and improve.

Secondly, the company's accounts receivable have been increasing year by year, and the growth rate is much higher than that of revenue. In the first half of 2022, 2023, and 2024, China Mobile's accounts receivable were 42.757 billion yuan, 54.881 billion yuan, and 84.342 billion yuan, respectively, with year-on-year growth rates of 14.98%, 28.36%, and 18.26%, respectively, all higher than the revenue growth rates of 10.49%, 7.69%, and 3%, respectively.

The growth in accounts receivable has led to a decrease in the company's cash flow. In the first half of 2024, the company achieved a net cash flow from operating activities of 131.377 billion yuan, a year-on-year decrease of 18.2%.

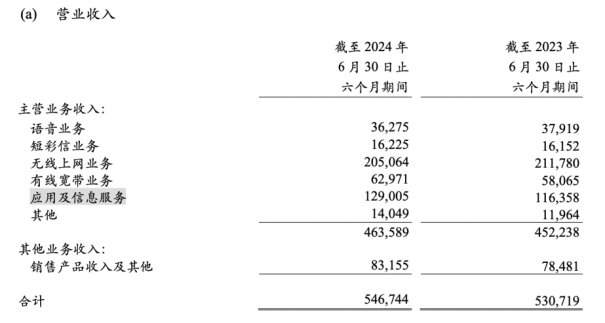

In terms of individual businesses, the telecommunications services business, which comprises mobile voice, SMS/MMS, wireless internet, wired broadband, and other services, remains China Mobile's core business, accounting for over 80% of total revenue. In the first half of this year, China Mobile's telecommunications services revenue was 463.6 billion yuan, a year-on-year increase of 2.5%, which is a slowdown compared to the 6.1% growth rate in the same period last year.

Among them, the wireless internet business, as the company's largest source of revenue for telecommunications services, contributed over 40% of the company's revenue. Stockstar notes that in the first half of this year, revenue from this business has declined, with 205.1 billion yuan in revenue, a year-on-year decrease of 3.2%. Meanwhile, the company's voice business has also declined, with 36.3 billion yuan in revenue during the reporting period, a year-on-year decrease of 4.3%.

02. Unbalanced development across four major markets

From a market perspective, China Mobile's telecommunications business primarily targets four major markets: the consumer market (C), the home market (H), the business-to-business market (B), and emerging markets (N). The company is vigorously promoting all-round development and integrated growth across CHBN.

In terms of revenue composition, the development of the company's CHBN markets is unbalanced. In the first half of this year, China Mobile's cumulative revenue from the HBN markets was 208.4 billion yuan, accounting for 45% of its main business revenue; while revenue from the C-end market accounted for 55% of its main business revenue, making it difficult for the HBN markets to compete.

Stockstar notes that while the C-end market is China Mobile's main battleground, its revenue fell short of expectations. In the first half of this year, the company's C-end market revenue was 255.179 billion yuan, a year-on-year decrease of 1.6%.

The reasons for the decline in the company's C-end market can be attributed to factors such as the saturation of the traditional telecommunications market and the decline in ARPU.

Firstly, the consumer telecommunications market is becoming increasingly saturated, and the company's net customer growth rate is slowing down significantly. In the first half of 2024, mobile subscribers exceeded 1 billion, with a net increase of 9.26 million, including 514 million 5G network subscribers, with a net increase of 49 million. Compared to the same period last year, there was a net increase of 10.38 million mobile subscribers, including a net increase of 108 million 5G package subscribers. These figures indicate that individual users are less motivated to upgrade to 5G packages, and the growth rate of 5G package subscribers is slowing down.

Secondly, the decline in ARPU is also an important factor contributing to the decline in C-end market revenue. ARPU represents the average revenue per user, and its decline means a reduction in average spending per user, directly affecting operators' revenue.

In today's era where traffic is king, people rely heavily on internet traffic for their daily lives and work. To compete for users, the three major operators have also engaged in price wars, launching low-cost high-traffic cards and high-traffic tariff packages. According to incomplete statistics, low-cost high-traffic packages range from 80GB to 188GB, with monthly rental prices ranging from 19 to 29 yuan.

It should be noted that price wars have also affected operators' ARPU to a certain extent. Additionally, situations such as multiple SIM cards per device can further dilute ARPU. According to China Mobile's 2024 half-year report, the company's mobile ARPU was 51 yuan, a year-on-year decrease of 2.7%.

In this regard, Guosen Securities noted in a research report that China Mobile is expected to stabilize its ARPU in the second half of the year by strengthening personalized operations for to-C customers, deploying whole-home Wi-Fi and gigabit broadband in the home market, and launching new services such as 5G and AI products. (This article was originally published on Stockstar, written by Li Ruohan)

- End -