Most of the world's best-selling mobile phones are 4G phones, and 5G seems unimportant in overseas markets

![]() 09/06 2024

09/06 2024

![]() 437

437

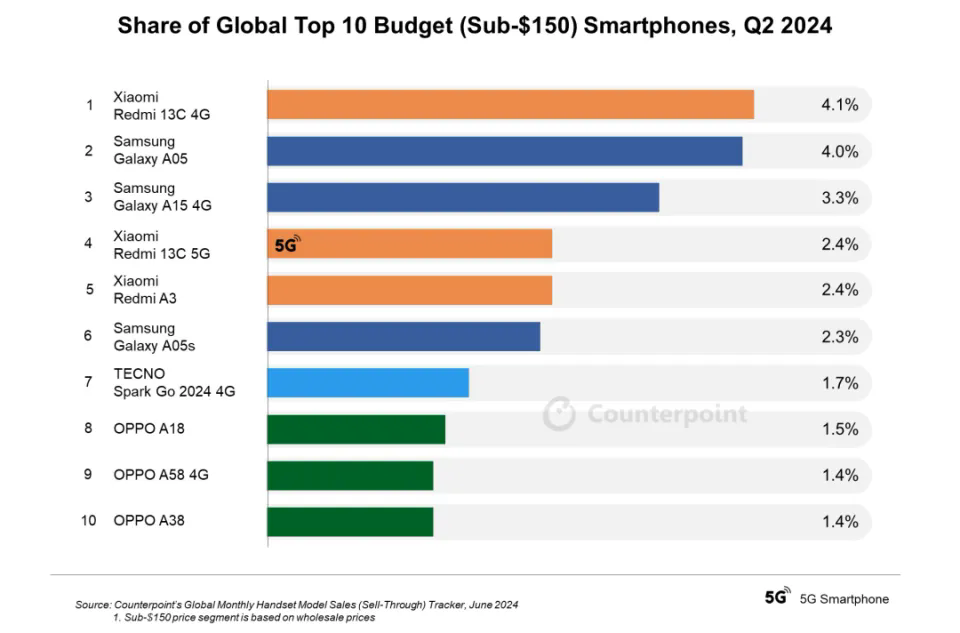

Recently, the market research firm Counterpoint released unique data listing the top 10 best-selling low-end mobile phones globally. Surprisingly, most of these top 10 phones are 4G, with only one 5G model. Naturally, this is primarily due to the sales of these low-end phones in markets outside China.

The mobile phone models that made it into the top 10 best-selling low-end phones globally are mainly from Samsung, Xiaomi, OPPO, and TECNO. Among these, only Xiaomi 13C is a 5G phone, while the rest are 4G, highlighting that consumers in overseas markets do not care much about 5G support.

In terms of specifications, these low-end phones do not boast powerful performance. They often utilize older chips like MediaTek's G85 or Qualcomm's Snapdragon 665, indicating that these older chips may not deliver exceptional performance. The smooth operation of these phones primarily relies on the optimization of the phone manufacturers' systems.

Among these various phone models, Xiaomi 13C may be the only low-end phone sold in the domestic market. On domestic e-commerce platforms, this phone is priced as low as 649 yuan. Its affordability is a crucial factor contributing to its high sales. Meanwhile, the 4G version of Xiaomi 13C is the primary model sold overseas, making it the world's best-selling low-end smartphone.

An interesting observation is that despite Samsung's minimal market share in China, estimated to be around 1%, three of its phones have made it onto the global best-selling low-end phone list, underscoring the popularity of Samsung's low-end phones in markets outside China.

The high global market share of 4G phones can be attributed to several factors. Firstly, many overseas countries have limited 5G network coverage, or even lack 5G networks altogether. It is estimated that while China accounts for 60% of the world's 5G base stations, only 40% of the 5.6 billion people living outside China have access to 5G networks, indicating a low demand for 5G technology in these regions.

Secondly, China's influence on the global mobile phone market has diminished significantly. During its peak, China accounted for 33% of global mobile phone sales, but this figure has now dropped to around 23%. Consequently, 5G phones that sell well domestically struggle to compete with 4G phones globally.

For phone manufacturers, 5G chips are significantly more expensive than 4G chips. Therefore, in overseas markets with low 5G demand, these manufacturers prefer to offer low-cost 4G phones. Low-end phones are particularly sensitive to costs, making 4G phones the natural choice.

It is noteworthy that domestic consumers in China have lost interest not only in low-end phones but also mid-range phones. The 618 shopping festival revealed that consumers prefer older flagship phones priced above 2000 yuan over domestic brands priced below 2000 yuan. This contrast between the domestic market's indifference to low- and mid-range phones and the overseas market's enthusiasm for low-end phones raises questions about the reasons behind such market dynamics.

Five years into its commercialization, 5G's development has fallen short of expectations, particularly given the emphasis on China's dominance in 5G technology. Overseas markets have shown significantly lower acceptance of 5G compared to China, essentially turning 5G into a technology exclusive to China. While this may fulfill some companies' aspirations, is this truly what they had hoped for?