Why Didn't Ora Build Great Wall's Seagull and Starwish?

![]() 12/17 2025

12/17 2025

![]() 481

481

Introduction

Can Ora, standing at a crossroads, regain its former glory under the personal supervision of Wei Jianjun and the leadership of Lv Wenbin?

It is evident that Wei Jianjun is dedicating more energy to the Ora brand.

Wei Jianjun, Chairman of Great Wall Motors, has a habit of attending the launch events for new vehicles under the Great Wall brand, from Haval to WEY, from Tank to Great Wall Cannon. On December 16th, Wei Jianjun even used an interview with CCTV News as a “warm-up” to promote the product advantages of the Ora 5.

During this period, to promote the highlights of the Ora 5, Wei Jianjun even started from the new platform launched by Great Wall Motors, stating that the company aims to adapt to the global market with a comprehensive layout of “one vehicle with multiple powertrains, multiple categories, and multiple postures,” with the Ora 5 being the first mass-produced model from Great Wall Motors' new platform.

Of course, increased energy investment implies higher expectations. The reason Wei Jianjun is working so hard to support Ora is that the brand currently needs his heightened attention and stricter oversight. Data shows that in November 2025, Ora's sales volume was 4,821 units, a year-on-year decrease of 16.97%. In the first 11 months of this year, cumulative sales reached 40,155 units, a year-on-year decrease of 31.40%. Whether in terms of terminal sales or brand influence, the Ora brand urgently needs a turnaround.

Additionally, this entrepreneur known for “making a little progress every day” has personally saved multiple brands in recent years. Previously, he optimized the operations of the Tank brand, solidifying its position in the off-road market. He took charge of WEY again, adjusting its product strategy, which gradually led to a recovery. In the second half of this year, the WEY Gaoshan series even won the MPV sales championship for consecutive months.

Now, after stabilizing the Haval brand, boosting WEY, and consolidating the Tank brand, Wei Jianjun has turned his attention to Ora.

01 What Has Four Years of Strategic Adjustment Brought to Ora?

Let's rewind to 2018 when the Ora brand was born during a critical period of adjustment in China's new energy vehicle subsidy policies.

At that time, Great Wall Motors acute (this Chinese word “ acute ”means “keenly” and doesn't have a direct object here, so it's kept as an adverb to modify “captured”) captured the market gap for urban micro electric vehicles and launched the Ora R1 and Ora R2, later known as the Black Cat and White Cat. These two models quickly opened up the market with their cute exterior designs, practical driving ranges, and affordable prices.

As the saying goes, “Whether a black cat or a white cat, as long as it catches mice, it's a good cat.” Under the leadership of these two models, the Ora brand reached its peak in 2021. Annual sales volume reached 135,000 units, a year-on-year increase of 140%, with the Black Cat and White Cat contributing over 80% of the sales, becoming the preferred choice for many families' second vehicles. They successfully shaped Ora's brand image as “urban boutique electric compact cars” and even once threatened the market position of the Hongguang MINIEV.

The success of that period was no accident. Ora accurately grasped three key elements: first, it seized the market demand for cost-effective electric vehicles after the adjustment of new energy vehicle subsidy policies; second, it designed unique “cute” styling that was especially popular among female users; third, it relied on Great Wall Motors' supply chain system to achieve relatively controllable costs.

However, the good times did not last long. With the reduction of new energy subsidies, supply chain issues such as rising raw material prices and chip shortages erupted, leading to a sharp increase in cost pressures for the Black Cat and White Cat. Reports indicated that the Black Cat model sold a cumulative total of 63,000 units in 2021, but each vehicle sold resulted in a loss of several thousand yuan or even over 10,000 yuan. Dong Yudong, the then-general manager of the Ora brand, once admitted, “Stopping orders for the Black Cat and White Cat was out of necessity, as these two models brought huge losses to the company.”

Faced with this dilemma, the Ora brand made a life-changing decision: to discontinue the Black Cat and White Cat, shift toward the mid-to-high-end market, and explicitly focus on female users. This strategic adjustment sparked intense internal discussions at the time. Supporters believed that elevating the brand positioning was the only way to escape losses, while opponents worried that abandoning the established market foundation and brand recognition carried too much risk.

From the subsequent storyline, it is clear that Ora decided to proceed with the strategic adjustment at that time.

Starting in 2022, Ora successively launched models such as the Good Cat, Ballet Cat, and Lightning Cat, with price ranges extending from 120,000 yuan to over 200,000 yuan. These models continued the rounded and cute styling in their designs, with more refined interiors and richer configurations, but their prices also significantly increased. Meanwhile, brand marketing fully leaned toward female users, creating the label of “a car brand that loves women more.”

However, the market did not seem to embrace Ora's “boutique” route, and the results of the strategic adjustment were disappointing.

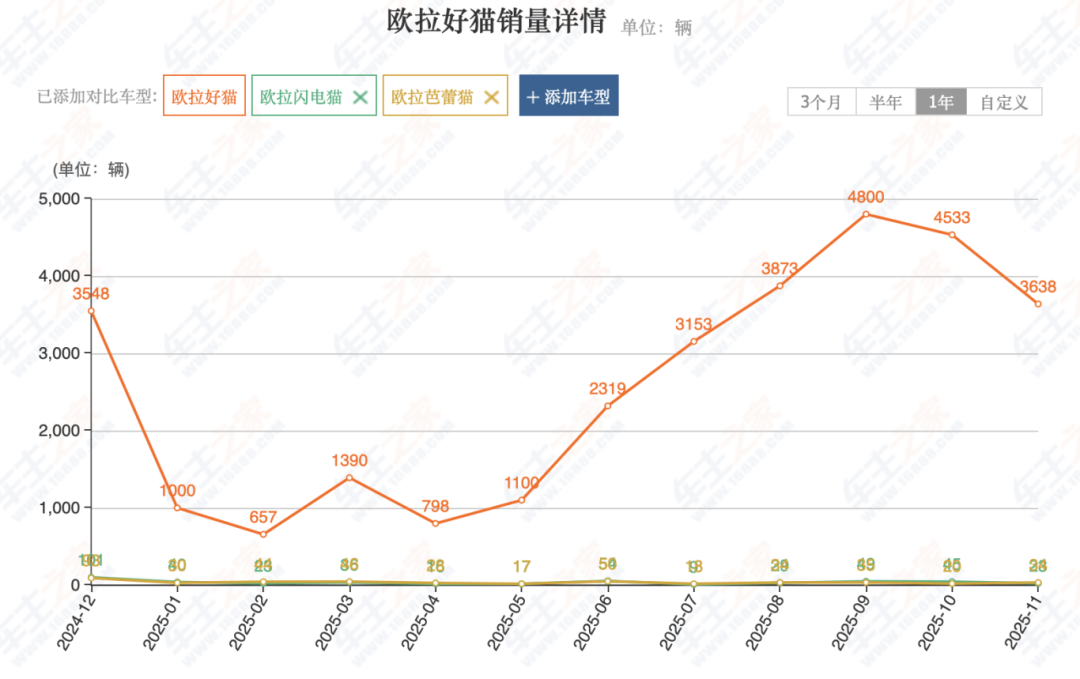

After the withdrawal of the Black Cat and White Cat, which once accounted for 80% of the brand's sales, the new products failed to fill the market gap. Although the Good Cat achieved some success, it was insufficient to support the entire brand. The Ballet Cat and Lightning Cat received a lukewarm market response, with monthly sales volumes lingering in the triple digits for a long time. Ora's sales volume also plummeted from 135,000 units in 2021 to 63,300 units in 2024 and continued to decline in 2025.

If we analyze the reasons for Ora's failed transformation, they are undoubtedly multifaceted. For example, overly emphasizing the label of “exclusive for women” narrowed the brand positioning excessively; the product cost-performance balance was lost; the product lineup was single and updates were slow; market opportunities were missed... Clearly, the “desperate move” of discontinuing the Black Cat and White Cat did not bring about a brand rebirth but instead plunged Ora into a deeper predicament.

Worse still, just as Ora abandoned the micro electric vehicle market, models such as the BYD Seagull, Wuling Bingguo, and Geely Starwish achieved great success in this market segment. In 2024, the BYD Seagull maintained a stable monthly sales volume of over 30,000 units. In 2025, the Geely Starwish even reached a peak monthly sales volume of 50,000 units. The success of these models proves that the micro electric vehicle market and the derived boutique compact car market have not shrunk but instead place new demands on products.

02 Can Ora 5 Become a Turning Point Under Wei Jianjun's Supervision?

Faced with changes in the market landscape and the situation of the Ora brand, Wei Jianjun did not continue to let things slide.

In June 2025, Wei Jianjun did personally participate in appointing Lv Wenbin as the general manager of the Ora brand, who is responsible for overall management. After the appointment was announced, Wei Jianjun posted videos of store visits and new car test drives on his personal social media platform, endorsing the Ora brand and the 2025 Ora Good Cat, highlighting the importance he places on the Ora brand.

The choice of Lv Wenbin was not accidental. This manager who grew up within the Great Wall system has both a technical background and familiarity with marketing. He has been involved in the construction of multiple brands such as Haval and WEY. At the appointment ceremony, Wei Jianjun emphasized, “Ora is an important part of Great Wall's new energy strategy. We cannot afford to lose this brand.”

The challenges Lv Wenbin faces after taking office are daunting—how to reposition the Ora brand? How to plan the product lineup? How to rebuild dealer confidence? How to regain consumer trust?

From a product perspective, the newly launched Ora 5 is highly anticipated. This model adopts a more neutral design language, with a price range of 100,000-150,000 yuan, targeting the mainstream family market. It will also be equipped with Great Wall's latest electric platform, with significant improvements in driving range and intelligent configurations. With this model, Ora has adjusted its product positioning, changed its naming system, diversified its technical routes, and increased its product competitiveness. Additionally, entering the vast SUV market, in principle, provides greater opportunities for market competition.

However, time is running out for Ora. Competitors such as Wuling, BYD, Geely, and Changan have already established strong market positions, while new force brands like Leapmotor are continuously encroaching on market segments. This means that the Ora 5 must not only have strong product competitiveness but also needs to excel in marketing, channels, services, and other aspects. The road to reviving the Ora brand will undoubtedly be challenging.

But this does not mean it has no chance. The Chinese new energy vehicle market is still growing rapidly, and the market segments are large enough. If Ora can accurately position itself in the mainstream market of 100,000-150,000 yuan and leverage Great Wall Motors' technological accumulation and manufacturing capabilities, there is still a possibility of a comeback.

In an era where product excellence reigns supreme, the performance of the Ora 5 will determine the fate of this brand and also affect Great Wall Motors' overall layout in the new energy sector. For Lv Wenbin and the Ora team, this is a battle they can only win, not lose.

Between the glory of the Black Cat and White Cat era and the obscurity of the Ballet Cat period, the Ora brand has experienced the most dramatic transformation in China's new energy vehicle market. Now, standing at a crossroads, can Ora regain its former glory under the personal supervision of Wei Jianjun and the leadership of Lv Wenbin? The market is waiting for an answer, and this answer may determine Great Wall Motors' final position in the era of electrification.

Editor-in-Chief: Cui Liwen Editor: Chen Xinnan

THE END