CoreWeave: Can NVIDIA's 'Adopted Son' Really Rise to Prominence Through Paternal Ties?

![]() 12/17 2025

12/17 2025

![]() 650

650

With the increasing GPU content in AI, the U.S. cloud services industry, which has long been dominated by a few oligopolies, has begun to see a surge of emerging cloud companies by 2025. In this piece, Dolphin Research takes CoreWeave, one of these new cloud players, as a case study to understand the business model of foundational cloud services in the AI era, changes in key elements, and whether CoreWeave is a company with long-term value engaged in a good business.

The next installment will adopt a quantitative perspective, assessing the company's revenue potential, cost structure, and capital investment returns to determine its current investment attractiveness.

The following is a detailed analysis:

I. A Perspective on Cloud Computing Business Models

Firstly, the business model of the IaaS industry, to which CoreWeave belongs, primarily derives its value from integrating upstream supply with downstream demand, leveraging large-scale demand to amortize data center construction and R&D costs.

1.1 Demand Integration

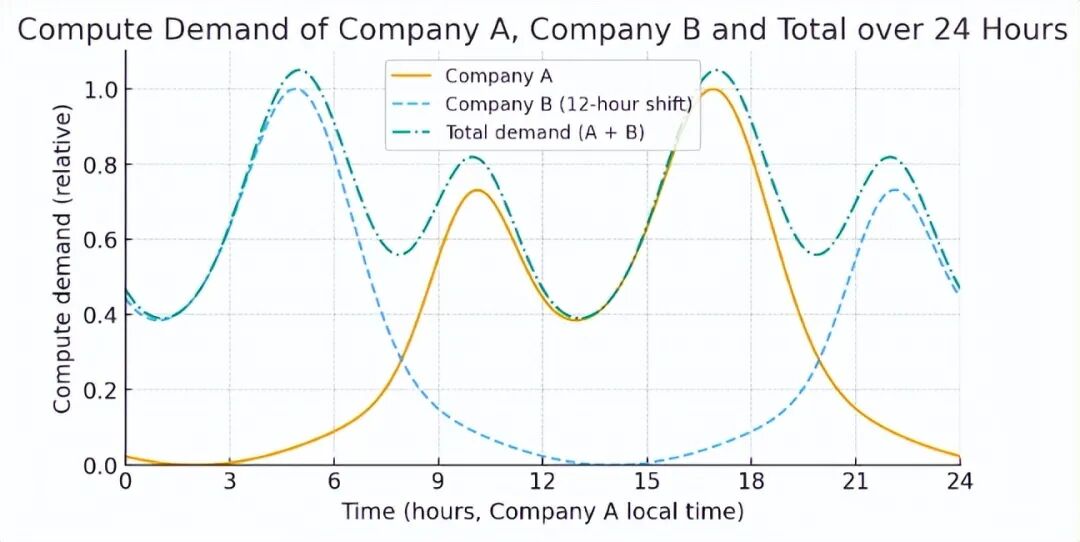

In simple terms, this involves shared data centers. Originally, each enterprise needed its own IT data center, but standalone constructions are not only costly but also inefficient. For example, e-commerce peaks during Double 11, gaming cloud usage surges during summer vacations, video streaming peaks after work hours, and DingTalk sees high usage during work hours.

A public data center can smooth out these peaks and troughs in cloud service usage, thereby enhancing capacity utilization. Moreover, for cloud services, a larger customer base with more diversified demand curves (e.g., from different industries or time zones) is preferable. (Microsoft CEO Nadella has explicitly stated similar views in recent earnings calls.)

1.2 Supply Integration

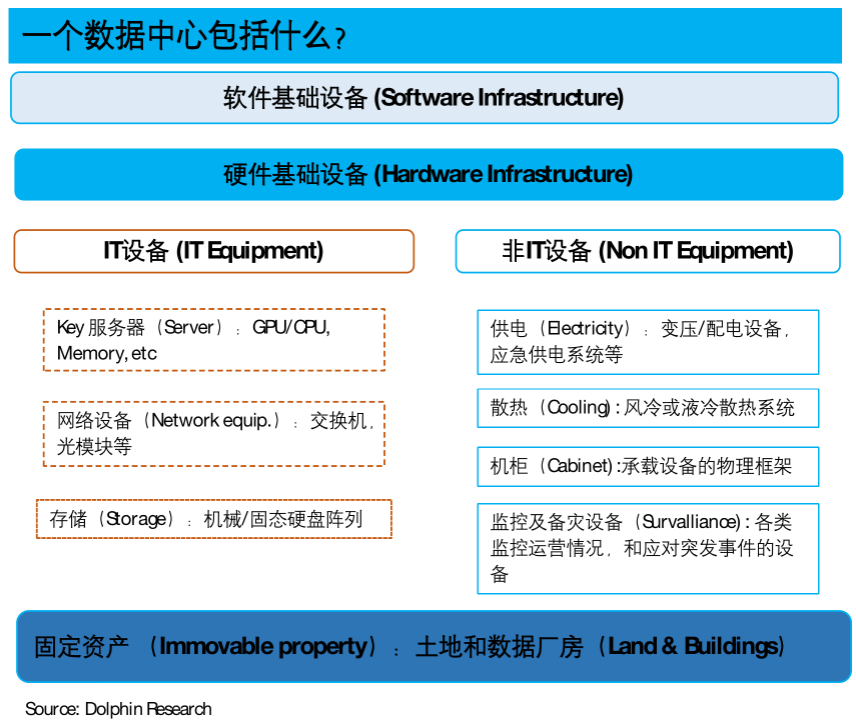

A fully operational IaaS cloud computing center is built on three tiers of software and hardware infrastructure: the first tier involves civil engineering and energy supply, the second tier comprises various IT and non-IT hardware devices, and the third tier encompasses software and engineering capabilities. The third tier primarily involves R&D personnel and less CAPEX investment. The following focuses on the tangible first two tiers:

1) First Tier - Civil Engineering & Energy: This involves acquiring land, constructing buildings, and creating a space for servers. Depending on the size, constructing a new data center (empty building) takes approximately 1-3 years.

Cloud service providers can either build these properties themselves or outsource construction and management to companies like Equinix and Digital Realty, leasing existing facilities directly.

Besides land and buildings, data centers require stable supplies of external energy sources such as electricity, water, and network connectivity, which are currently major bottlenecks for cloud service expansion. However, energy supply primarily incurs ongoing costs post-operation and does not require significant upfront investment.

According to research, land and building construction for the first tier account for approximately 5%-10% of total data center construction investment (excluding software).

2) Second Tier - IT Equipment: Building on land and buildings, the second tier supporting a data center consists of various hardware devices, starting with IT equipment directly related to computing power, including:

a. Servers: The most crucial part of a data center, essentially large-scale computers composed of high-performance chips (GPUs/CPUs), motherboards, memory, and other key components. Currently, high-performance chips and memory are another major bottleneck in the cloud computing center supply chain.

For these core components, cloud service providers can either adopt a 'self-design + ODM manufacturing' approach or directly purchase from suppliers like Dell. Leading providers such as Azure and AWS more commonly use self-designed servers, whereas CoreWeave primarily purchases/leases fully assembled servers directly from upstream suppliers.

b. Networking Equipment: In traditional cloud computing centers, this mainly includes various switching devices for data transmission between servers, routing devices for connecting data centers to external networks, and various linking components such as optical modules, fiber optic cables, or copper cables.

In the AI era, the significantly increased demand for data transmission speed between servers necessitates higher-performance AI-specific switching equipment, such as NVIDIA Quantum.

c. Storage Devices: To store the vast amounts of data generated during operations, cloud computing centers require clusters of mechanical or solid-state drives.

According to research and industry practices, IT equipment accounts for the vast majority of hardware investment in data centers, reaching 60%-70%. Servers, as the core component, account for approximately 40%-50% of total investment.

Moreover, in the AI era, due to the generally higher unit prices of computing chips, memory, and high-performance switching equipment, IT equipment accounts for an even higher proportion of total investment in AI computing centers.

3) Second Tier - Non-IT Equipment: Besides IT equipment directly related to cloud computing, computing centers also require significant non-IT equipment for operations, including:

a. Power Supply Equipment: This includes transformers to convert external high-voltage electricity for internal use, backup generator sets to maintain power during outages, UPS systems for short-term stable power supply during emergencies to prevent server damage, and energy storage systems to balance peak and off-peak power consumption or handle external power outages.

b. Cooling Equipment: Systems for dissipating heat from server clusters or entire data centers, broadly categorized into air cooling and liquid cooling. With the substantial increase in computing power per card and heat generation in the AI era, the adoption rate of liquid cooling is rising.

c. Racks: Various physical frameworks for holding other equipment. Although these 'metal frames' lack technical complexity, their layout and integration with other systems to achieve more efficient heat dissipation and data transmission still involve certain industry 'know-how.'

d. Monitoring & Disaster Preparedness: Devices for real-time monitoring of equipment operation, power supply, cooling, and network conditions, helping to detect and resolve issues such as system crashes, power outages, network disruptions, and fires.

According to some research, non-IT equipment like energy supply and cooling accounts for the remaining approximately 20%-30% of total investment, with a slightly lower proportion in AI data centers.

II. Low Long-Term Certainty

As seen above, the core value of the IaaS cloud service business model stems from integrating demand for computing power with the elements of computing power production to achieve more efficient matching and lower operating costs on a larger scale.

Naturally, for a cloud service provider, its ability to integrate demand downstream and supply chain upstream (resolving industry bottlenecks, controlling and bargaining with suppliers) is one of its core competencies. Beyond these 'hard skills,' the 'soft skills' of cloud service providers (such as software and engineering capabilities) also constitute important factors for differentiated competitive advantages, which will be discussed separately later.

2.1 Highly Dependent Customer Structure on a Few Giants

Firstly, from the perspective of demand integration capability, the customer structure of traditional cloud giants in the 'old era' was highly dispersed, comprising numerous enterprises of different types, with no single customer accounting for a significant revenue share.

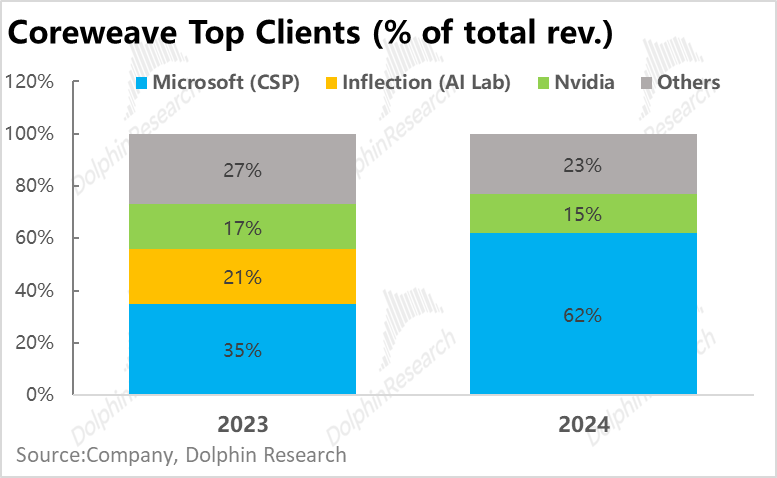

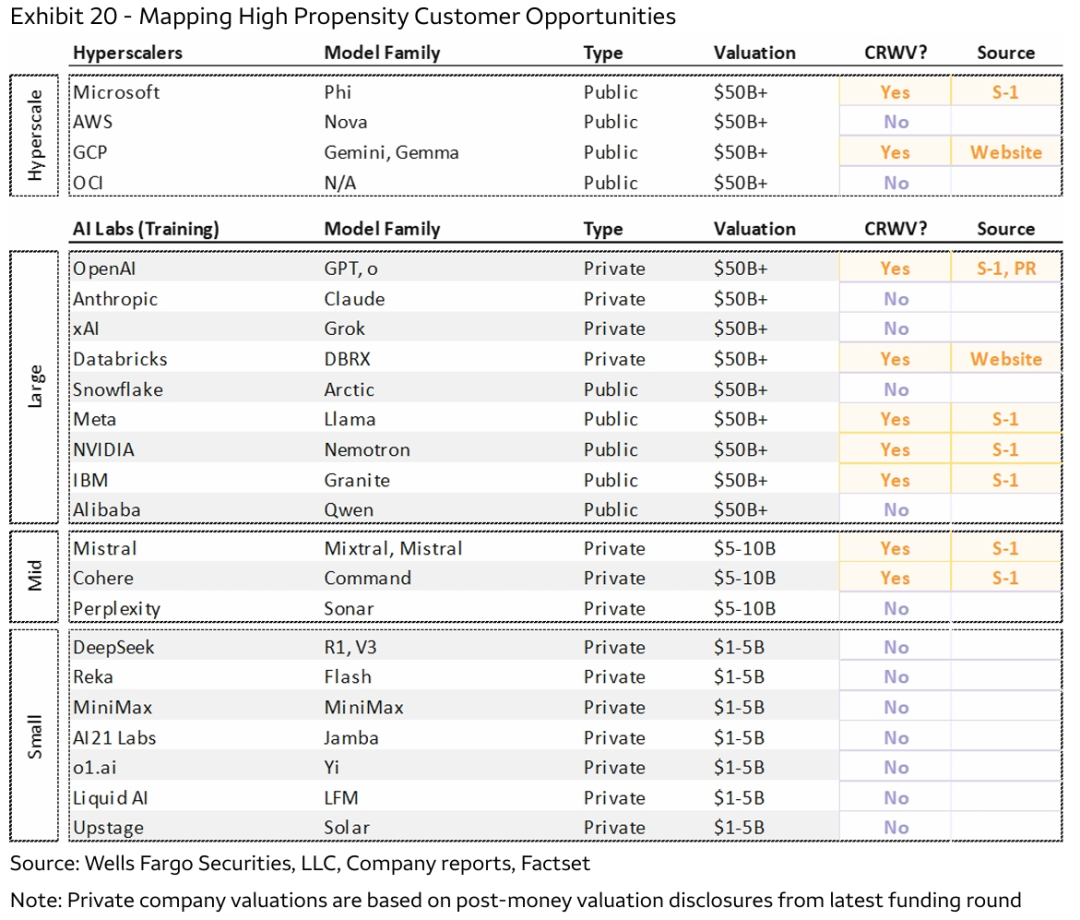

CoreWeave's customer structure is highly concentrated, currently consisting mainly of AI model unicorns and large technology companies capable of independently developing/optimizing AI models.

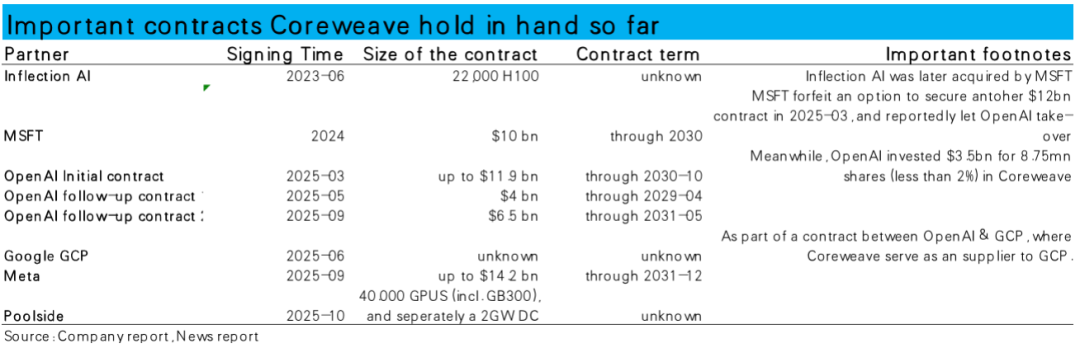

In FY2024, nearly 80% of CoreWeave's total revenue of approximately $1.9 billion came from just two customer companies - Microsoft and NVIDIA, with Microsoft alone accounting for 62% of total revenue that year.

The 'more current' picture reflected in active contracts also shows a concentrated customer base: of the $55.6 billion in unfulfilled contract balances disclosed in 3Q25, contracts from OpenAI, Microsoft, and Meta totaled nearly $47 billion.

Since most of the contracts with Microsoft are also to meet OpenAI's demands, there may be some double-counting, but it still indicates that the company's ultimate demand is actually even more concentrated on OpenAI.

Additionally, CoreWeave has reportedly collaborated with Google (whose ultimate demand is also OpenAI), as well as technology companies like Databrick, IBM, Cohere, and Poolside.

However, on the whole, most of CoreWeave's business is highly dependent on a few leading companies (primarily OpenAI), with the remaining 'aggregated' customers mainly consisting of a single type of company in the AI/technology sector.

Therefore, from a business model perspective, unlike traditional clouds that can fully smooth out demand fluctuations and reduce risks from industry downturns through a large number of diverse customers across different industries, AI-focused new clouds like CoreWeave, which are highly concentrated in a few enterprises and limited industries, undoubtedly face greater demand risks (e.g., losing major customers) and logically have little bargaining power with leading customers that contribute the majority of their revenue.

2.2 Soft Skills After Hard Skills

Another area where cloud service providers can easily form differentiated competitiveness lies in 'soft skills' such as software and engineering capabilities. According to research, CoreWeave's main advantage in 'soft skills' is its ability to rapidly (e.g., within 3-5 months) plan and bring a cloud computing center from zero to online, but it relatively lacks capabilities in software/programming.

1) CoreWeave's Technical Services

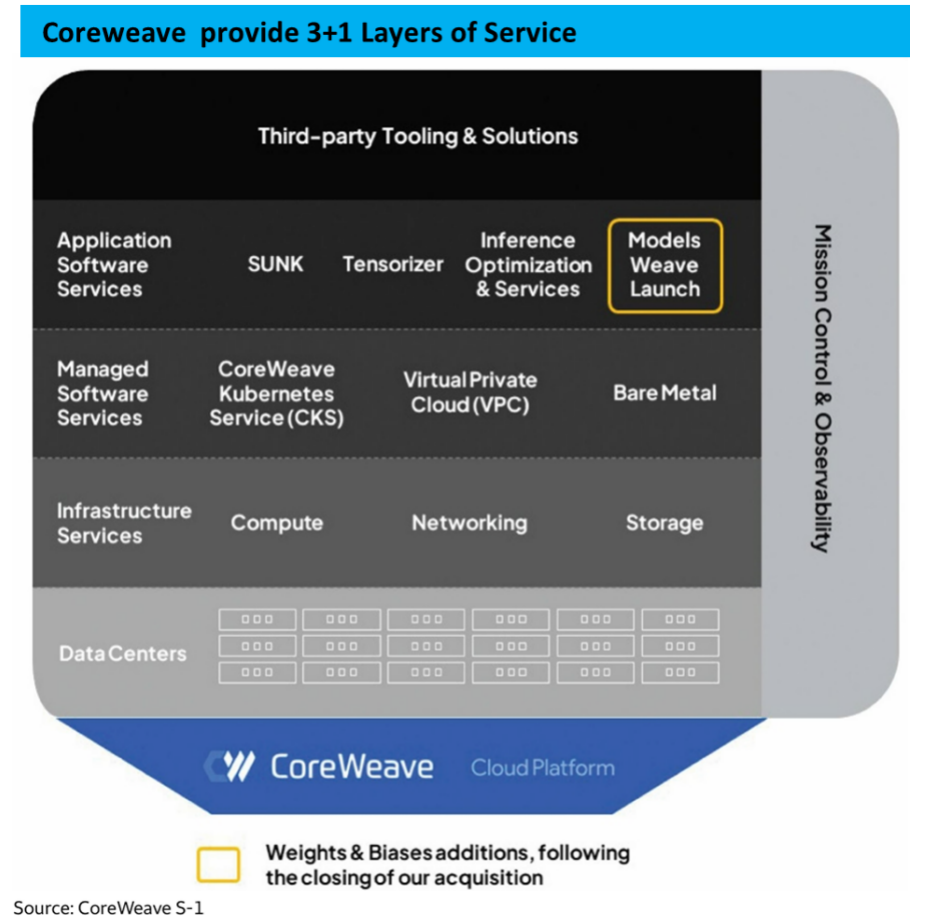

Briefly introducing the types of services CoreWeave offers, as disclosed in its prospectus, they can be categorized into 3+1 major types:

a. Infrastructure Service: The simplest and most direct approach of leasing high-performance chips, storage drives, and other pure hardware facilities to customers without any accompanying software services. According to reports, this purely hardware leasing business accounts for a very small portion (no official disclosure, only a rough qualitative reference).

b. Managed Software Service: Building on hardware, this includes some basic software management and invocation tools. A key point is the Bare Metal model - traditional cloud services lease virtual machines, but Bare Metal users have 100% exclusive use of their leased physical servers, deciding how to use/allocate these resources themselves. According to reports, Bare Metal is currently the service model commonly adopted by the company's major customers (at least Microsoft).

This is also one of the main differences between AI clouds and traditional clouds: under traditional clouds, demand for computing power is generally fluctuating, allowing service providers to dynamically allocate the same physical computing power to different users to improve utilization and generate more revenue and profits.

In the AI era, particularly for AI training, demand for computing power is generally massive and continuously concentrated. For example, each new AI model training may require a large-scale cluster of over 10,000 GPUs, operating at nearly 100% utilization for several weeks or even months. AI inference demands for computing power are less concentrated than training but are still likely more so than traditional scenarios.

Therefore, this computing power usage model determines that demand for computing power in AI (especially training) is more exclusive and exclusionary. In this context, cloud service providers have little room to dynamically allocate physical computing power to different customers.

Besides Bare Metal, this tier also includes virtual machine-like services such as CKS and VPC, largely similar to the leasing models of traditional cloud businesses.

c. Application Software Service: This tier of services can be roughly compared to PaaS-type services. Besides simply providing virtual machines or other basic software services, the company offers more advanced and diverse software functionalities at this level. For example, it helps customers optimize resource or task allocation and provides pre-loaded AI models or other functionalities for direct customer use.

d. Mission Control & Observability: This helps users monitor hardware usage, task execution progress, and provides channels for customers to view. It ensures normal hardware and task operation during the runtime, promptly resolving issues such as errors and downtime.

2) How Does CoreWeave Fare in Software Capabilities?

According to some market sources, CoreWeave does not have an advantage in programming/software but excels in rapidly and effectively deploying and implementing data center engineering capabilities.

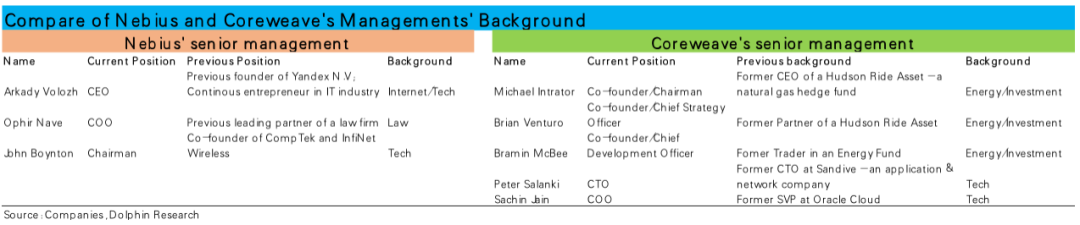

In contrast, Nebius, reportedly one of CoreWeave's main competitors in the new cloud sector, has a stronger advantage in software/programming capabilities. As a side piece of evidence, the different backgrounds of the founders and core management teams of the two companies also offer a glimpse into their differing orientations.

As seen in the table below, Nebius's CEO is the founder of Yandex, Russia's largest internet technology company. Its chairman is one of the co-founders of CompTex (a leader in Russian telecommunications and network equipment) and InfiNet (a leader in Russian wireless broadband technology).

All three of CoreWeave's core co-founders hail from the energy investment sector, and the company initially engaged in Bitcoin mining operations, indicating a lack of experience or background in technology or cloud computing.

Among the senior management team, only the CTO and COO, who are external professional managers, possess a background in the technology industry, with the COO previously serving as Senior Vice President of Oracle Cloud.

From the perspective of the core management team's background, CoreWeave does not appear to have accumulated significant technological capabilities. Instead, it holds a certain advantage in securing energy supplies, a critical bottleneck.

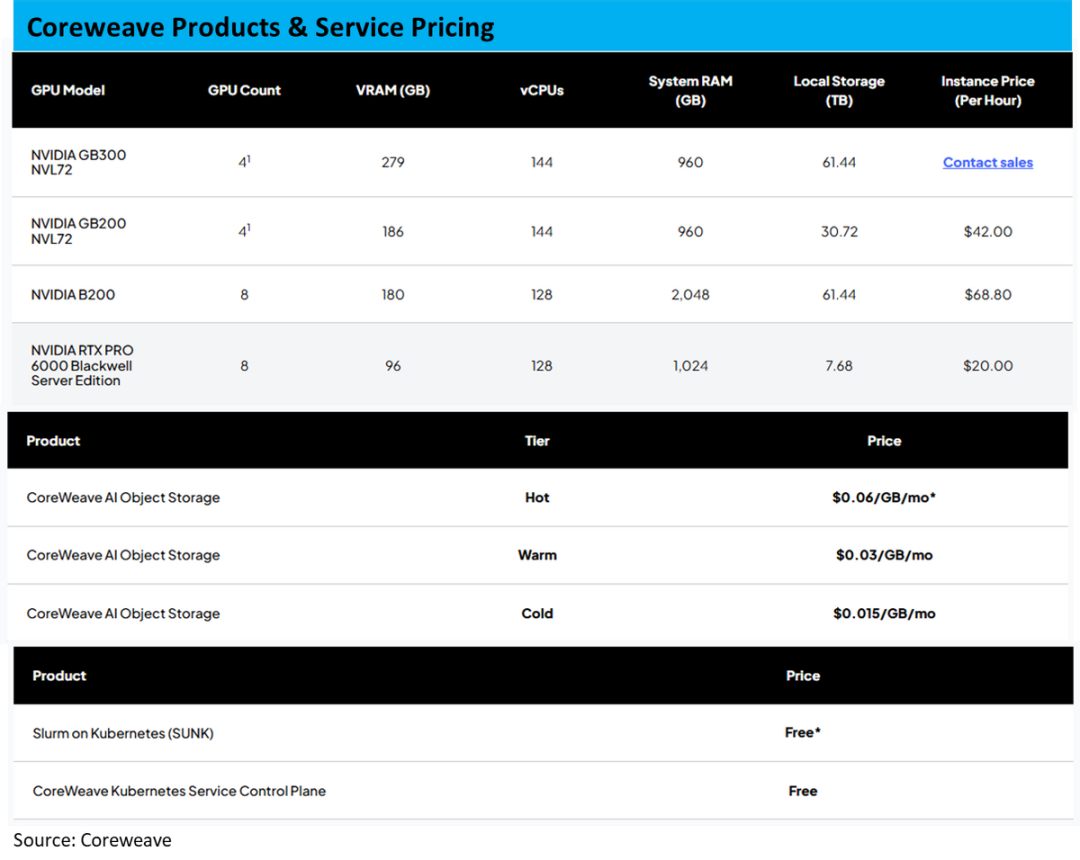

Currently, the company's pricing is primarily based on the hardware rented, with services such as Slurm and monitoring provided as complimentary add-ons, as mentioned earlier.

3) What is the impact of the level of “soft power”?

So, what potential impact could a situation like CoreWeave's, characterized by strong engineering capabilities but relatively weak software technology, have on the company's medium- and long-term development?

First, from a strength perspective, the contemporary factor driving CoreWeave's rapid development is the severe shortage and rapid iteration of computing power in the AI era.

CoreWeave's exceptional and efficient engineering capabilities enable it to complete the assembly and operational launch of a data center in approximately three months (assuming relevant equipment and energy supplies are in place), making it one of the fastest among all cloud service providers. This well aligns with the rapid iteration of computing power demands from leading technology companies or AI unicorns.

From another angle, CoreWeave's primary clients include Microsoft, OpenAI, Meta, Google, and other leading technology companies. These giants possess strong technical capabilities and generally opt for Bare Metal services to maintain better control over the underlying hardware, thereby reducing their need for software-layer services from CoreWeave.

However, from a medium- to long-term perspective, if CoreWeave aims to maintain its unique competitiveness in the industry, optimize its customer and revenue structure, and reduce dependence on major clients, it must attract a substantial number of traditional or small-to-medium-sized enterprise clients. These clients typically lack strong technical capabilities, necessitating that CoreWeave, as a service provider, offer superior technical/software services.

Therefore, the key is whether CoreWeave can strengthen its relatively weak technological capabilities before the window of dividend (which could be translated as "bonus period" or "favorable period")—characterized by a shortage of computing power and dependence on a few major clients—closes, after initially scaling up its business.

2.3 How strong is CoreWeave's bargaining power on the supply side?

From the above analysis, partly due to the characteristics of the AI era and partly because of CoreWeave's own "flaws" in customer structure and technological capabilities, CoreWeave's demand aggregation capability is volume-oriented with average quality. So, how does CoreWeave fare in terms of supply chain integration capability?

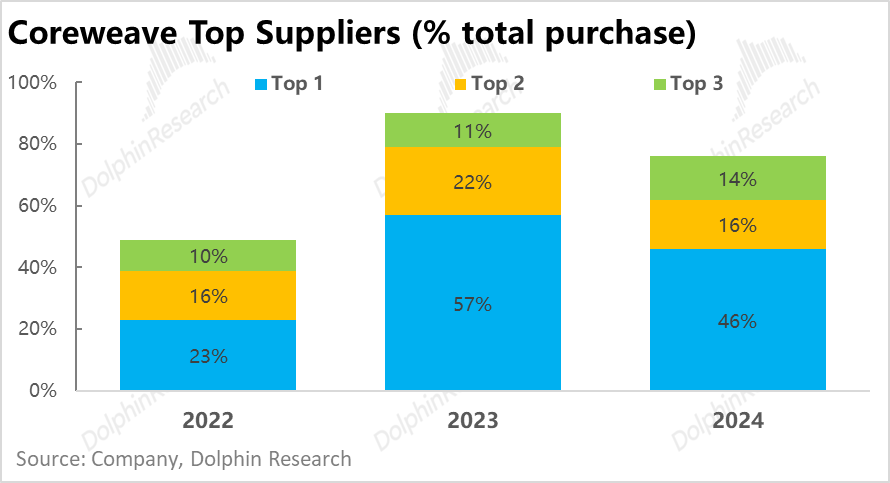

According to company disclosures, its main suppliers are also highly concentrated. In 2023 and 2024, just the three largest suppliers accounted for 80-90% of the company's total procurement. Based on the approximate investment proportions in different sectors of data center investment and relevant news reports, the following inferences can be made:

a. Largest Supplier - NVIDIA: It is speculated that NVIDIA, accounting for approximately 50-60% of the company's total procurement in 2023-2024, is the largest supplier, providing the largest single hardware component, GPUs, and high-performance connectivity systems/hardware (NVIDIA Spectrum-X and Quantum-X).

b. Second or Third Largest Supplier - Dell and Super Micro: Based on company disclosures and related reports, it can be inferred that the other two suppliers, accounting for approximately 10-20% of total procurement, are likely Dell and Super Micro, both server suppliers.

c. Other Important Suppliers: Besides the top three, CoreWeave also has two publicly disclosed suppliers for infrastructure such as land, construction, and power supply—Core Scientific and Applied Digital.

Among them, Core Scientific is a company engaged in Bitcoin mining machines and data center hosting (similar to CoreWeave in its early years). CoreWeave originally leased infrastructure such as civil engineering from Core Scientific but fully acquired it in 2025 for $9 billion, marking a partial shift from a pure asset-light leasing model to self-operation.

Logically, does CoreWeave excel in bargaining power with upstream suppliers? Simply put, not really. First, the fact that three suppliers account for 80-90% of the company's total procurement means that the cessation of supply from any major supplier could significantly disrupt the company's supply chain.

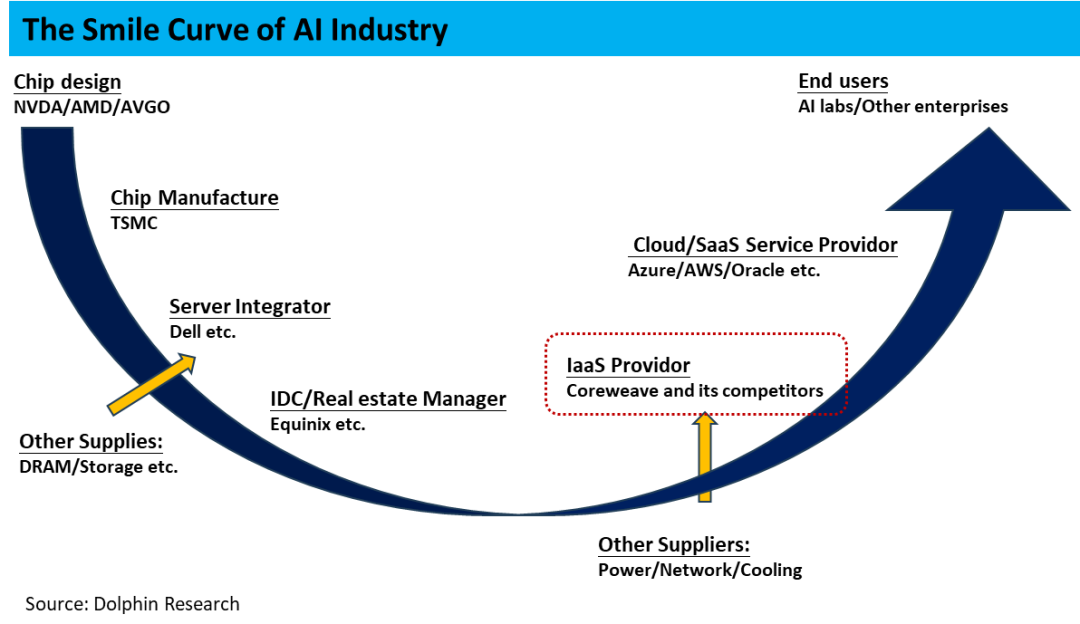

The following diagram provides a general overview of the cloud service industry chain from upstream to downstream, resembling the well-known "Smile Curve." Dolphin Research believes that the two ends of the computing power industry chain—the more upstream design and the more downstream engagement with end-users—represent relatively stronger bargaining power within the industry chain.

Currently, CoreWeave is positioned in a relatively intermediate and "low-value" segment of the industry chain, relying on multi-tier suppliers upstream and primarily serving as a supplier to the three major cloud vendors downstream, with limited direct contact with dispersed end customers.

More specifically, facing its largest supplier, NVIDIA, CoreWeave clearly lacks significant bargaining power due to its absence of self-developed chip technology and financial strength comparable to industry giants (even though CoreWeave is considered NVIDIA's "favorite child," this represents unilateral support rather than CoreWeave's inherent capability).

Regarding the second and third largest suppliers, such as Dell, although both CoreWeave and Dell have significant mutual dependence—after all, CoreWeave is one of Dell's important clients for AI servers—the key point reflecting CoreWeave's relative disadvantage is that CoreWeave directly purchases integrated solutions from Dell, including racks, cooling systems, entire server equipment, and some basic software functionalities.

This, to some extent, indicates that CoreWeave does not possess the capability to design entire server systems independently, unlike the three major cloud giants or even domestic companies like Alibaba. The simple logic is that greater dependence on suppliers necessitates conceding more profit margins to them.

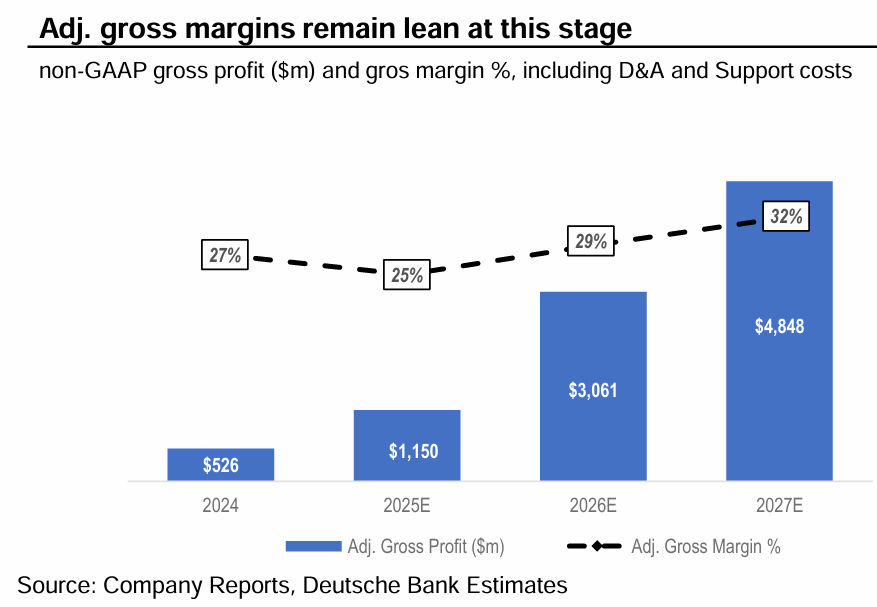

Consequently, the market consensus is that CoreWeave's true gross profit margin is only around 25-30%, significantly lower than Microsoft's Intelligent Cloud segment's gross profit margin of over 60%. This reflects CoreWeave's weak bargaining power within the industry chain.

2.4 Summary of Viewpoints - Limited Value Contribution in the Industry Chain:

Summarizing the above analysis, from the perspective of cloud services as the ultimate integrator of computing power demand and supply, CoreWeave does not appear to be a company that can maintain unique competitiveness and a certain market position in the cloud service market dominated by giants with strong certainty in the next 3-5 years. It is difficult to envision CoreWeave competing head-on with the three major cloud giants after supply and demand stabilize.

Its main issues include:

a. The customer base is currently highly concentrated among a few major companies and industries, making the loss of any major client significantly impactful (one of its largest clients, Microsoft, has explicitly stated a long-term preference for building its own data centers rather than leasing from external suppliers like CoreWeave).

b. The services currently provided are primarily "basic" hardware leasing with limited added value, which is neither conducive to retaining existing clients nor beneficial for subsequent expansion to smaller downstream clients or more profitable PaaS-layer businesses.

c. Similarly, over-reliance on a few major suppliers and relatively weak customization capabilities, coupled with its current scale not being substantial enough to become a pivotal client for top suppliers, result in a limited value contribution within the industry chain.

Of course, the lack of high certainty in the medium to long term does not disprove the company's high growth potential and considerable certainty in the medium term. In the next section, Dolphin Research will examine, from a short- to medium-term perspective, the factors that have helped the company stand out among new cloud providers.

- END -

// Reproduction Authorization

This article is an original piece by Dolphin Research. Reproduction requires authorization.

// Disclaimer and General Disclosure

This report is intended solely for general comprehensive data purposes, providing users of Dolphin Research and its affiliated institutions with general browsing and data reference. It does not consider the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any individual receiving this report. Investors must consult with independent professional advisors before making investment decisions based on this report. Any person making investment decisions using or referring to the content or information mentioned in this report assumes full risk. Dolphin Research shall not be held responsible for any direct or indirect liabilities or losses arising from the use of data contained in this report. The information and data in this report are based on publicly available sources and are intended for reference purposes only. Dolphin Research strives to ensure but does not guarantee the reliability, accuracy, and completeness of the information and data.

The information or viewpoints mentioned in this report shall not be regarded or construed as an offer to sell securities or an invitation to buy or sell securities in any jurisdiction, nor shall they constitute advice, solicitation, or recommendation concerning securities or related financial instruments. The information, tools, and materials in this report are not intended for distribution to, use by, or provision to individuals in jurisdictions where such distribution, publication, provision, or use contradicts applicable laws or regulations, or where Dolphin Research and/or its subsidiaries or affiliates are required to comply with any registration or licensing requirements.

This report solely reflects the personal viewpoints, insights, and analytical methods of the relevant authors and does not represent the stance of Dolphin Research and/or its affiliated institutions.

This report is produced by Dolphin Research, with copyright reserved solely by Dolphin Research. Without prior written consent from Dolphin Research, no institution or individual shall (i) produce, copy, duplicate, reproduce, forward, or distribute in any form or manner whatsoever, copies or replicas of this report, and/or (ii) directly or indirectly redistribute or transfer it to other unauthorized individuals. Dolphin Research reserves all relevant rights.