"Employment storm" brewing, is the United States really heading towards recession?

![]() 09/10 2024

09/10 2024

![]() 432

432

As the most macro variable in U.S. stock trading over this period, the latest employment data was finally released last week. However, it is precisely this number that has sparked panic in the market: is the United States entering a Hard landing mode? Is the employment situation deteriorating rapidly, and is it caused by the supply side or the demand side? Are the employment structure signals also deteriorating?

However, Dolphin believes that there is no need to panic and lose composure.

Specifically, here are some points:

1. Has U.S. employment collapsed?

Last week, the United States released two relatively important employment data: one is the number of job openings in July, and the other is the number of new non-farm jobs in August. These two data points can basically clearly present the current trend of labor supply and demand changes.

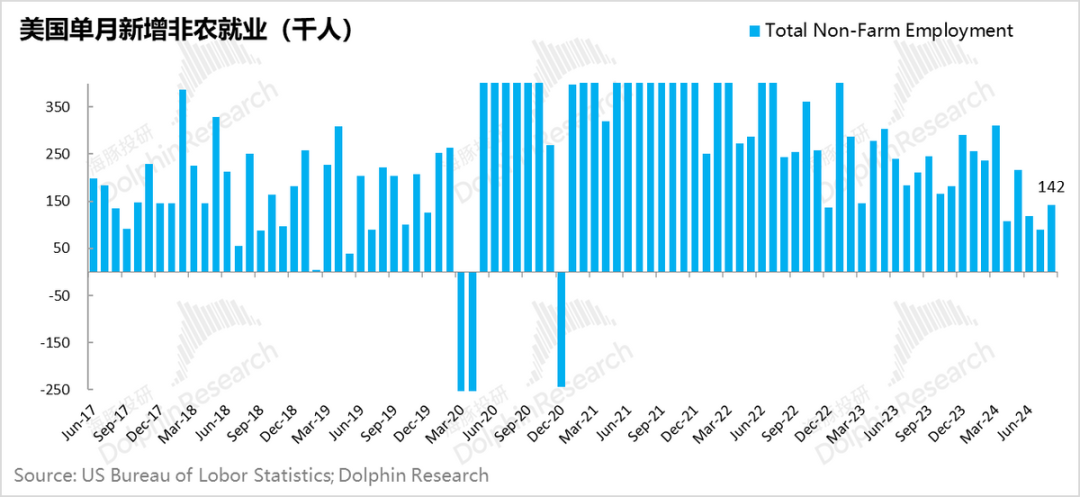

As Dolphin mentioned before, an increase of around 150,000 new non-farm jobs per month is a reasonable monthly increase under steady-state employment. This is based on the average monthly increase of around 180,000 new labor pools (including the labor force and non-labor force) in the United States from 2015 to 2019. Such a monthly increase means that the newly added labor supply can find jobs every month, without increasing the unemployment rate or exhausting the pool of available jobs.

For August specifically, with 210,000 new labor pool additions and 142,000 new non-farm jobs, although there were no unexpected surprises, the situation was relatively balanced; as a result of this balance, the unemployment rate even narrowed slightly from 4.25% to 4.22%.

However, the real issue here is that the August non-farm jobs release was accompanied by significant downward revisions to the previously reported June and July non-farm job gains. The July figure was revised downward from the original 114,000 to 89,000, while the June figure was further revised downward to just under 120,000 after an initial downward revision in July to 179,000. In particular, if the July data shows less than 90,000 new jobs due to exceptional weather conditions, and August only recovers to just over 140,000, the overall picture of non-farm employment appears much weaker.

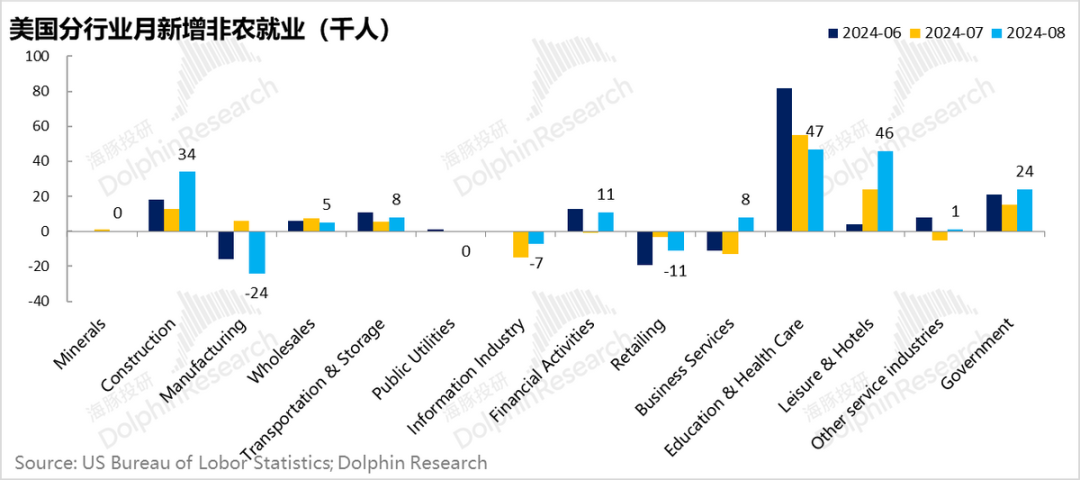

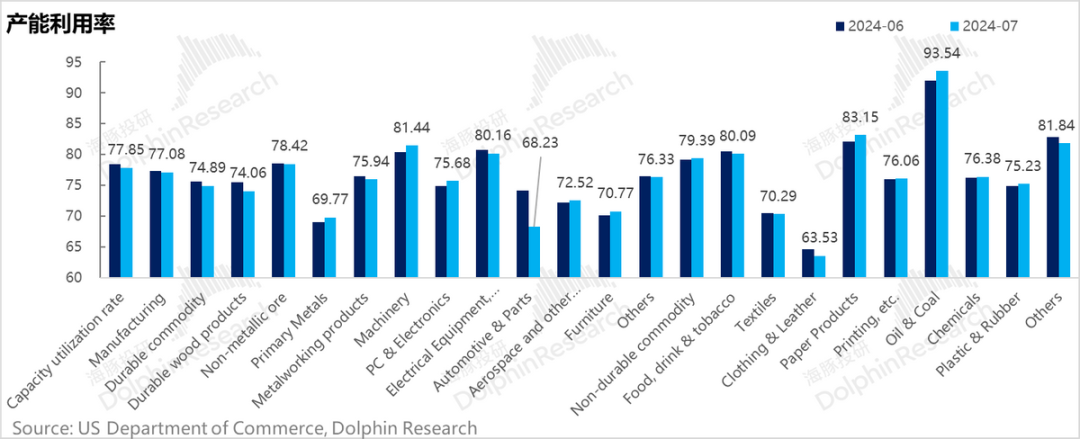

From an employment structural perspective, changes in the construction industry in July and August may be more related to weather conditions, and taken together, the two months still showed good performance. However, the main problem lies in manufacturing, where there was a significant decline in August. The source of this decline, from a sectoral perspective, is mainly in transportation equipment manufacturing, particularly automobiles and parts manufacturing. When combined with the gradual decline in automobile capacity utilization in July (which fell below 70% for the first time), it appears that the U.S. automobile market has shifted from post-pandemic supply constraints to oversupply, and the suppression of automobile demand by high-interest rates has become evident.

In terms of employment in the service sector, a) the retail industry has continued to lay off net employees, indicating pressure on physical consumption to some extent; b) the information industry is mainly comprised of the media sector, which has also been experiencing net layoffs due to the poor performance of traditional media such as cable; c) within the broad category of professional business services, white-collar positions represented by computer technology, scientific research and development, and accounting remain stable, while temporary employment services continue to lay off net employees, performing poorly.

Traditionally, two industries with robust employment demand are: a) healthcare services: although overall employment remains strong, there are some structural differences within the sector, such as negative growth in nursing and home healthcare jobs; b) leisure and entertainment: a peculiar sector where, despite significant declines in the stock prices of many U.S. restaurant companies, restaurant employment accelerated in August. However, given the continuous downward revisions in recent employment data, it is necessary to consider the possibility of further downward revisions to August data as well.

Overall, when these adjusted three-month data are viewed together, the average monthly increase in non-farm jobs is less than 120,000, which, when compared to the recent monthly labor supply of 200,000, suggests that the labor market is tilting towards a state of oversupply.

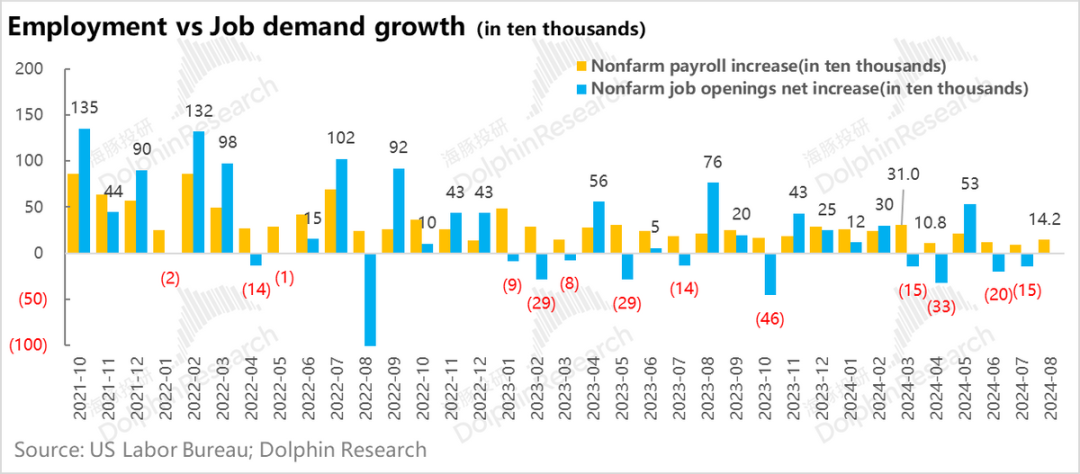

Of course, in addition to the actual increase in employment, another truly important factor to consider is whether corporate hiring demand is indeed shrinking. Unfortunately, the number of non-farm job openings in July did not provide much comfort to the market. Even from the perspective of the Federal Reserve, this number may be the one that truly concerns it.

There were 7.67 million non-farm job openings in July, and when combined with the monthly job gains, this translates to a net decrease of 150,000 job demand by businesses in July, following a net decrease of 200,000 job demand in June.

When these supply and demand figures are combined, it becomes clear that while labor supply continues to increase steadily, corporate hiring demand is decreasing. If these trends continue, the labor market is bound to experience a reversal, shifting from a state of undersupply to oversupply.

While corporate job demand has decreased in the past and then increased significantly months later, the Federal Reserve was not concerned at that time. However, its lack of concern was based on a fundamental premise: at that time, there were still significantly more job openings to be filled in the labor market than there were people actively seeking employment. By July, however, the ratio of 7.67 million job openings to 7.16 million job seekers had reached a 1:1 state.

If corporate job demand in the market continues to decline, the labor market is likely to experience a reversal in supply and demand, with more people seeking employment than there are jobs available. This reversal, in turn, could weaken employment expectations among residents, leading to weaker consumption expectations and causing residents to be hesitant to squeeze savings for consumption. At that point, the economy may also decline rapidly.

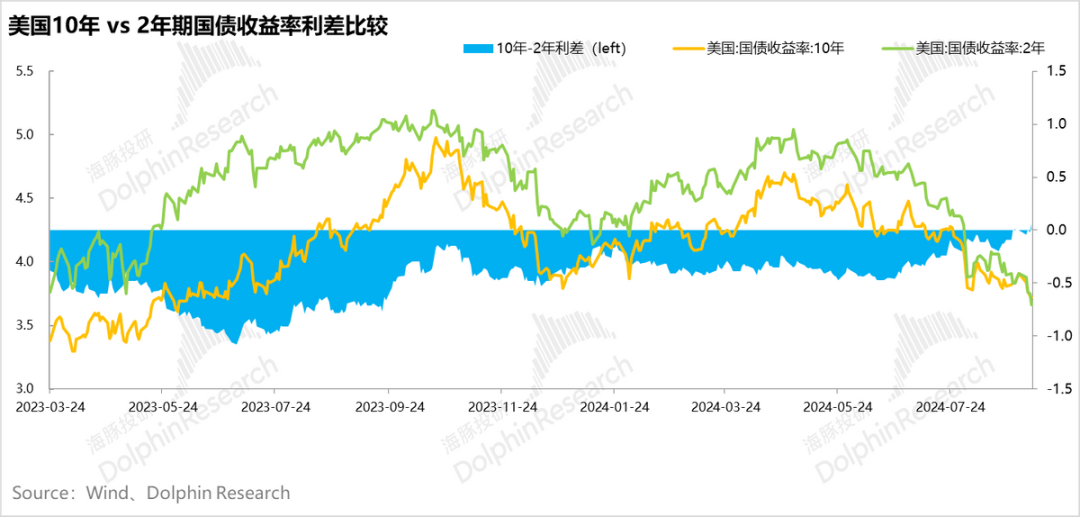

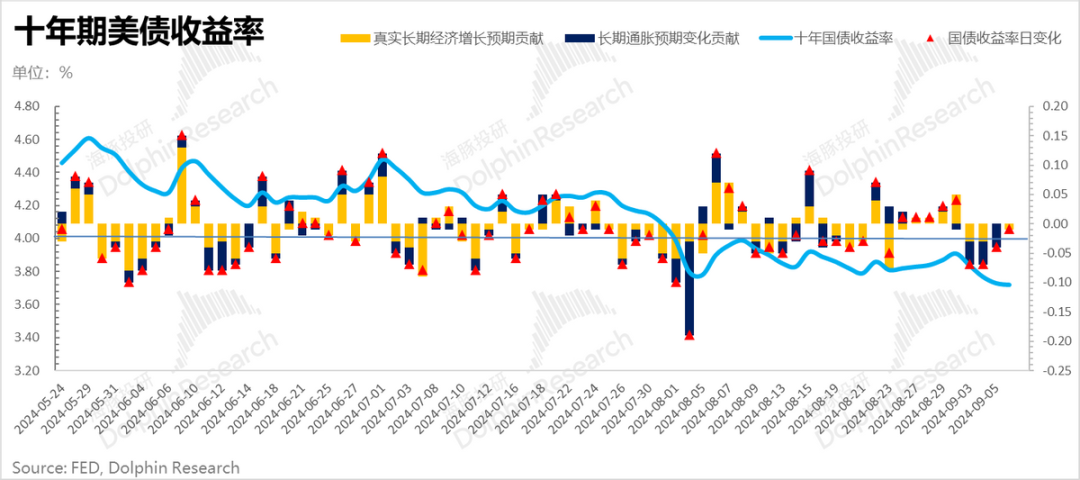

This is precisely why the market has begun to worry that the U.S. economy may be heading towards recession. Currently, the yield on 10-year U.S. Treasury bonds has fallen below 3.7%, and the yield on 2-year Treasury bonds, which is more sensitive to short-term interest rate expectations, has fallen even more significantly, suggesting that the market may already be pricing in a recession.

Given the shift in labor supply and demand, it is expected that the Federal Reserve will rapidly shift its balance between employment and inflation towards stabilizing employment. In particular, given the policy choices made by various countries, deflation is seen as a more daunting prospect than inflation.

At the same time, given that household balance sheets are in good shape in this cycle, consumption is weakening but not as slowly as anticipated, and the government is still increasing leverage. Taken together, the likelihood of a larger interest rate cut this year has indeed increased significantly. However, it is not necessarily the case that a 50 basis point cut will be implemented immediately in September. Moreover, given that the three major employment sectors are still relatively secure, there is no need to panic at short-term changes in high-frequency data.

2. Chinese Assets: Balancing Interest Rate Cut Expectations and Foreign Recession Expectations

Currently, the underlying drivers of the Chinese economy are twofold: one is domestic demand (government, enterprises, and households) leveraging up, essentially driven by debt; the other is reliance on external demand for exports and foreign exchange earnings. On these two drivers, domestic demand has been deleveraging and is not expected to improve significantly. In the absence of positive changes in domestic fundamentals, only marginal changes in external factors can be relied upon. In other words, without significant government leveraging, Chinese assets have limited self-rescue capabilities. Although valuations are currently cheap, low valuations alone are not sufficient; there must be marginal improvements. These marginal changes depend on expectations in the external market. If there is a soft landing and external demand remains stable, while interest rate cuts can boost valuations, this would be a positive scenario. However, if the external market also experiences a recession and external demand falters, the situation becomes more challenging.

Correspondingly, if the external market experiences a soft landing, it means that external demand remains stable, and interest rate cuts can also alleviate valuation pressures, creating a relatively favorable situation. However, if there are recession expectations in the external market, the earnings per share (EPS) of Chinese assets may face further pressure. In this case, relying solely on interest rate cuts to boost valuations would be akin to missing the forest for the trees. With no hope for EPS improvements through beta exposure, investors must seek out companies with exceptional alpha potential.

3. Portfolio Rebalancing and Returns

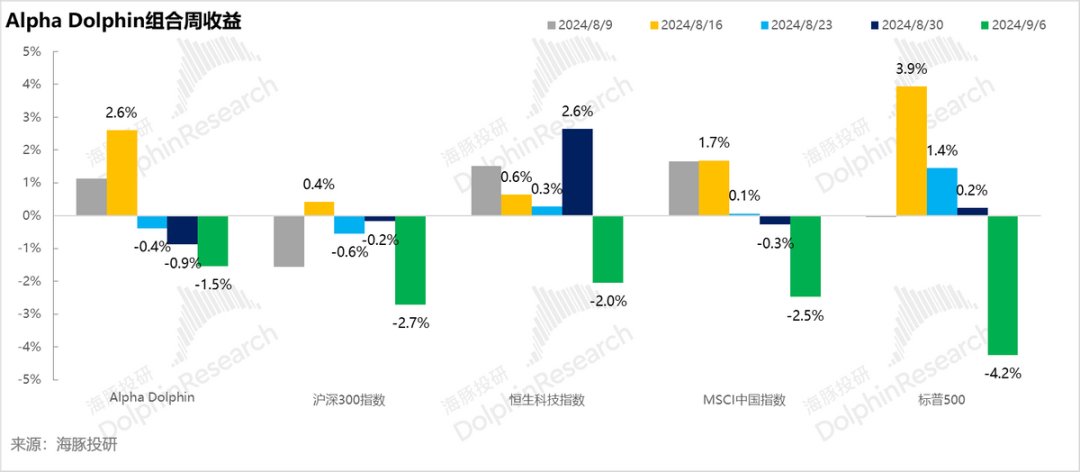

There was no rebalancing in the portfolio last week, and portfolio returns declined by 1.5%, outperforming Chinese asset indices such as the MSCI China (-2.5%), Hang Seng Tech Index (-2%), CSI 300 (-2.7%), and S&P 500 (-4.2%). This was primarily due to the gains from U.S. Treasury bonds in the Alpha Dolphin portfolio, which offset the decline in stock prices. The weekly decline in equity assets alone was 3.5%.

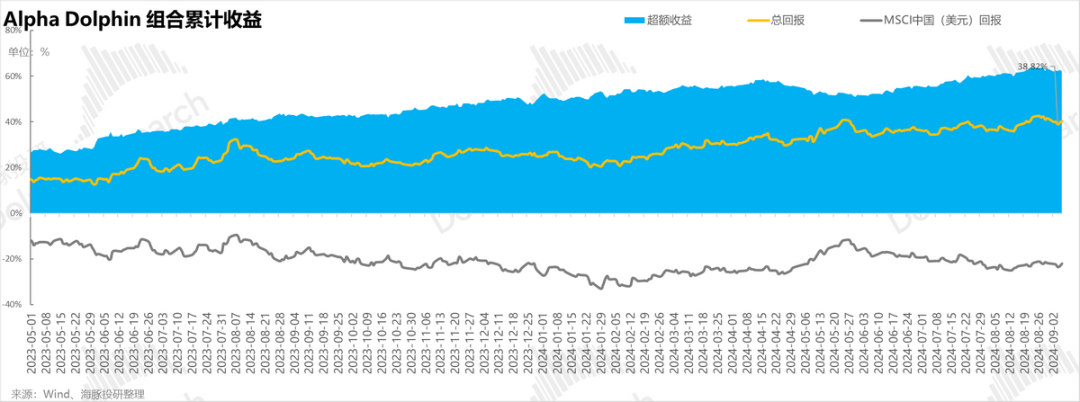

Since the inception of the portfolio test until last weekend, the absolute return of the portfolio was 38%, and the excess return over the MSCI China Index was 62%. From a net asset value perspective, Dolphin's initial virtual assets of $100 million have fallen to $140 million.

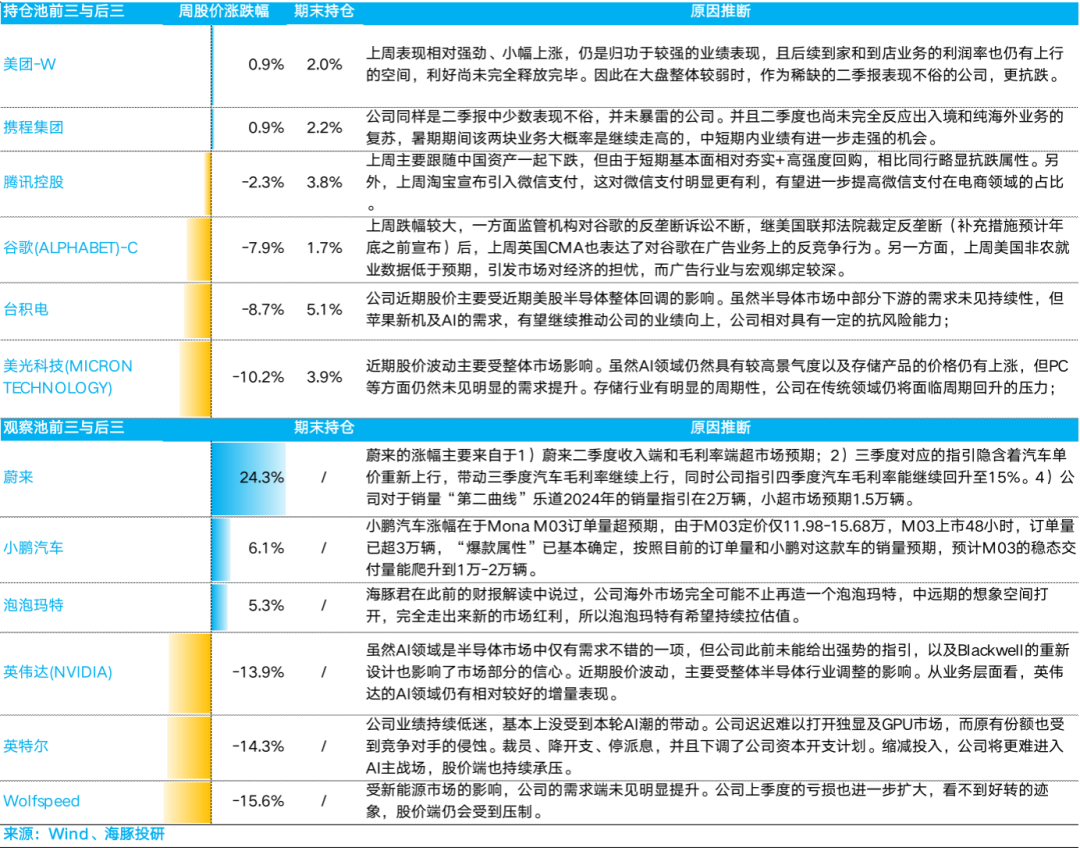

4. Individual Stock Profit and Loss Contributions

The significant declines last week were mainly concentrated in U.S. stocks, especially AI stocks such as TSMC and Micron. Currently, with industry leader NVIDIA facing difficulties in delivering further upside surprises, and tech giants acknowledging excessive investment in AI, investors are concerned that current linearly extrapolated valuations may face downside risks. Moreover, as the market begins to trade on the possibility of the U.S. economy flirting with recession, the risks associated with growth stocks like AI are increasing. Compared to the overall valuation decline in U.S. stocks, Chinese stocks have fared better due to their already cheap valuations, although occasional earnings reports that are less pessimistic than current stock prices can still provide some upside potential, as evidenced by companies like NIO.

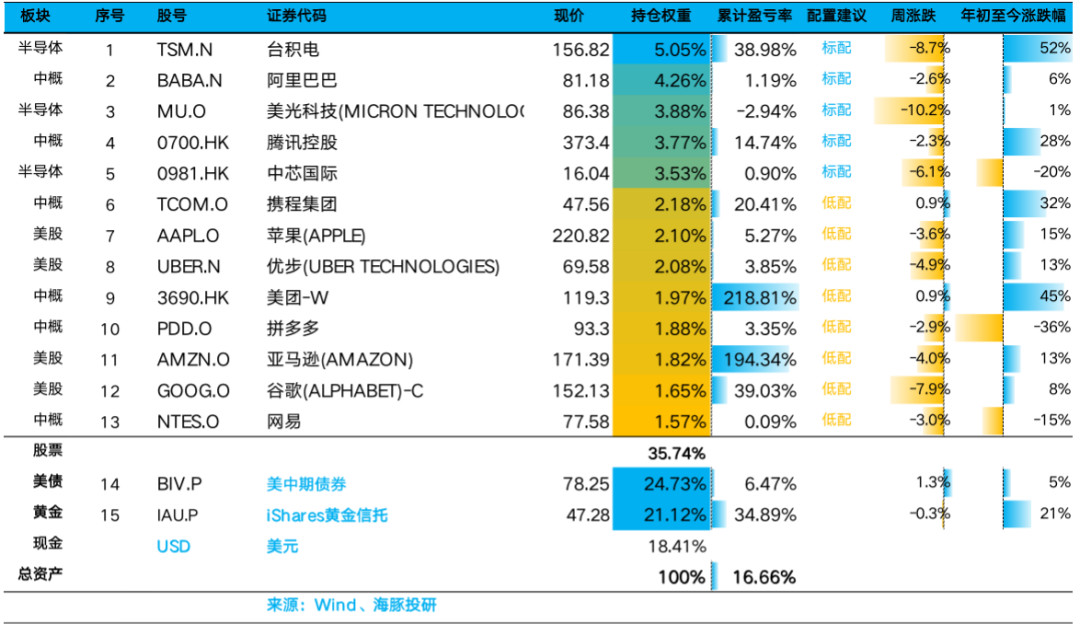

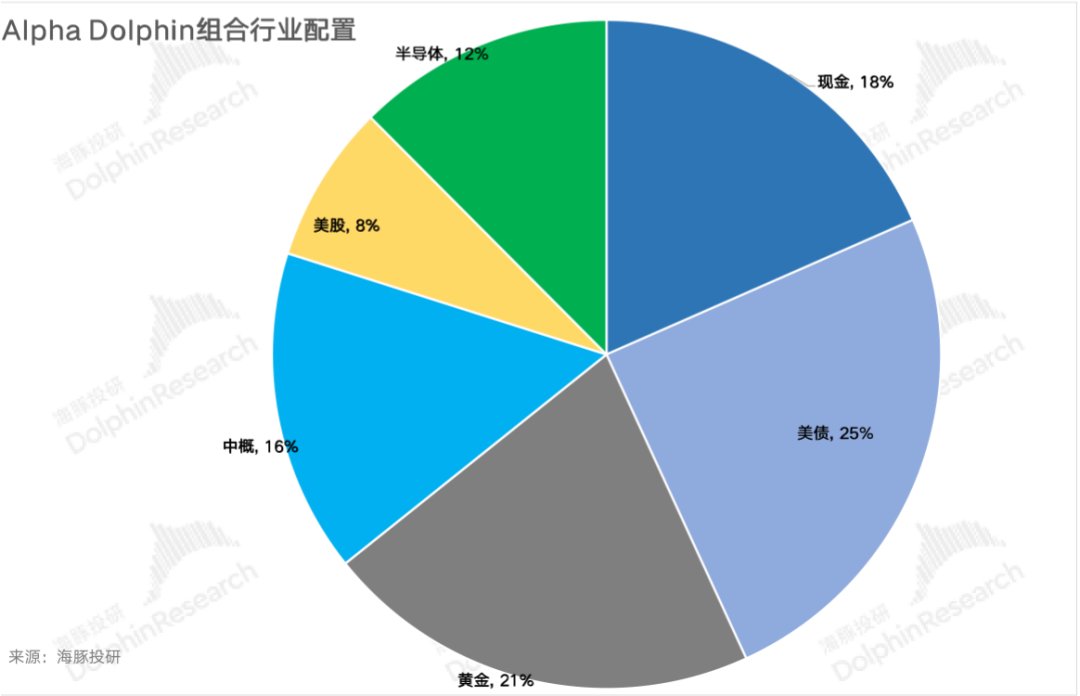

5. Portfolio Asset Allocation

The Alpha Dolphin virtual portfolio holds a total of 13 stocks and equity ETFs, with 5 at standard allocations and 8 equity assets at underweight allocations. The remainder is distributed among gold, U.S. Treasuries, and U.S. dollar cash. Currently, there is still a significant amount of cash and cash equivalents, which will be gradually increased based on earnings performance after the earnings season ends. As of last weekend, the Alpha Dolphin asset allocation and equity asset holdings weights were as follows:

- END -

// Reprint Authorization

This article is an original work of Dolphin Investment Research. For reprinting, please obtain authorization.