Dandong Discipline Inspection and Supervision Commission initiates an investigation into the financial director of Transsion Holdings! The company just stole Huawei's limelight

![]() 09/10 2024

09/10 2024

![]() 598

598

Source | Deep Blue Finance

Written by | Wu Ruixin

Huawei's tri-foldable phone has not been released yet, but pre-orders have already exploded. However, on the other hand, Transsion Holdings, the world's second-largest mobile phone manufacturer that unveiled a tri-foldable concept phone ahead of Huawei, has once again been embroiled in controversy.

This morning, the share price of "King of African Phones" Transsion Holdings plunged sharply at the opening, with an intraday decline of up to 8.51%, shocking investors.

The direct reason for Transsion's plunge was the news that its financial director was under investigation.

On the evening of September 6, Transsion Holdings suddenly disclosed that it had received a "Detention Notice" and "Case Filing Notice" issued by the Zhen'an District Supervisory Committee of Dandong City on September 6, 2024, deciding to take detention measures and initiate an investigation against Xiao Yonghui, the company's financial director. At present, the company has made proper arrangements for his related work.

It is worth noting that not long ago, Transsion Holdings announced its financial results for the first half of 2024 and achieved solid performance. Both revenue and net profit increased by more than 30% year-on-year.

However, since late April this year, Transsion Holdings' share price has suddenly plummeted, falling continuously from RMB 121.10 to the current RMB 77.05, a decline of over 36%, with a market value evaporation of more than RMB 49.7 billion, and the total market value has also fallen below the RMB 100 billion mark.

What has happened to the King of African Phones?

1

10-year financial director under detention

What's involved?

The detention and investigation of Transsion Holdings' financial director came as a surprise. It's worth noting that not long ago, Xiao Yonghui participated in an investor relations event on August 28 in his capacity as Transsion's financial director.

After the news broke, online discussions about the reasons for Xiao Yonghui's detention flourished, with netizens suggesting two possibilities: money laundering or financial fraud.

Almost three days have passed since the incident, but it is still unclear what exactly is involved. Is it a company issue or an individual issue? The outside world remains confused.

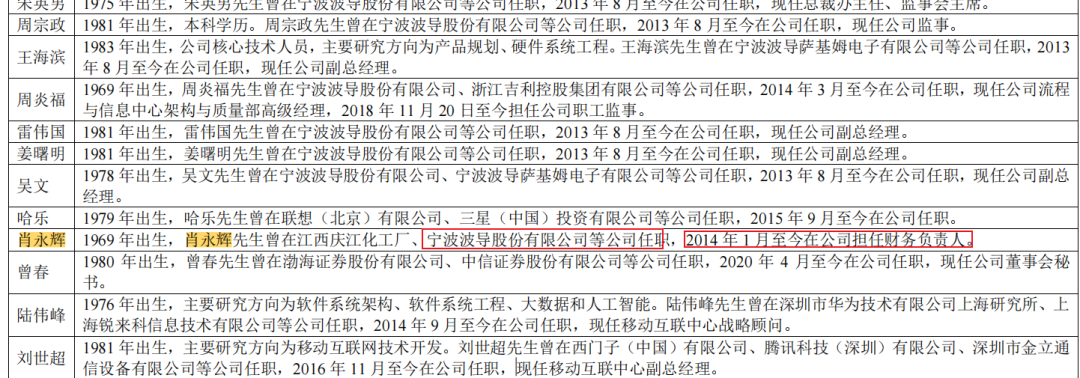

According to public information, Xiao Yonghui has been serving as the financial director of Transsion Holdings since January 2014, holding this position for 10 years.

In terms of his personal background, Xiao Yonghui is also a veteran of Transsion Holdings. According to available information, Xiao Yonghui was born in 1969 and holds a college degree. Before joining Transsion Holdings, he worked at Jiangxi Qingjiang Chemical Plant, Ningbo Bird Co., Ltd., and other companies.

As is well known, the founding team of Transsion Holdings came from Bird Mobile. Zhu Zhaojiang, the actual controller of Transsion Holdings, was once the chief sales officer for Bird Mobile in the Huawei region. Due to his outstanding sales ability, Zhu became responsible for Bird Mobile's overseas market in 2003. In July 2006, Zhu and several former Bird Mobile colleagues founded Transsion Holdings to continue expanding in overseas markets.

Judging by his age, Xiao Yonghui is a few years older than Zhu Zhaojiang. As a senior executive with a clear "Bird Mobile" label, Xiao Yonghui is suspected to be one of Zhu's colleagues who co-founded Transsion Holdings.

According to the 2023 annual report, Xiao Yonghui's salary for that period was RMB 3.8556 million. The recently released 2024 interim report also disclosed that Xiao Yonghui was granted 392,000 restricted shares at the end of the period.

This has piqued outside curiosity about whether Xiao Yonghui's situation is related to Transsion Holdings.

Transsion itself is also in the dark. In its announcement, it stated:

As of the date of this announcement, the company has not been informed of the progress and conclusion of the investigation. The company will continue to monitor the subsequent developments of this matter and fulfill its information disclosure obligations in a timely manner.

It is worth noting that the subject unit that initiated the investigation against Xiao Yonghui is the Zhen'an District Supervisory Committee of Dandong City, Liaoning Province. However, Transsion Holdings is registered in Shenzhen, and its public announcements since going public have not disclosed any industrial layout related to Dandong City.

Xiao Yonghui's personal hometown is unclear, and his previous work experience was mainly in Ji'an, Jiangxi, and Ningbo, Zhejiang, with no connection to Dandong, Liaoning.

According to the Time Weekly, several lawyers stated that supervisory committees have the authority to detain non-public officials. According to the announcement, Xiao Yonghui was personally detained and under investigation, which may indicate an individual issue.

Lawyers noted that if the relevant actions are suspected of bribery or related personnel are involved in joint crimes (under the jurisdiction of the supervisory committee) during the performance of their duties, there is also the possibility of detention measures being imposed. Therefore, based on the brief information in the announcement, it is impossible to determine whether Xiao Yonghui is only suspected of individual crimes without posing a risk to the company.

2

Good performance cannot hide anxiety

Although Xiao Yonghui's detention and investigation may not be related to the company, Transsion Holdings has faced numerous troubles in recent months.

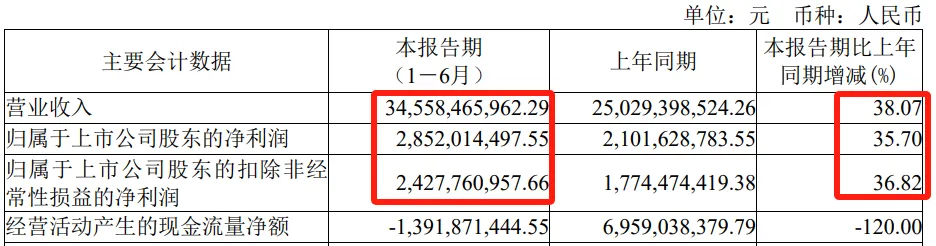

Not long ago, Transsion Holdings announced its financial results for the first half of 2024. In the first half of this year, Transsion Holdings achieved revenue of RMB 34.56 billion, an increase of 38.07% year-on-year; net profit attributable to shareholders was RMB 2.852 billion, an increase of 35.70% year-on-year.

Both revenue and net profit increased by more than 30%, indicating outstanding performance.

Even more impressive is Transsion Holdings' ranking among global mobile phone brands. According to IDC data, in the first half of 2024, Transsion Holdings held a 14.4% market share in the global mobile phone market, ranking second among global mobile phone brands; its smartphone market share was 9.1%, ranking fourth in the global smartphone market.

However, despite the promising performance, Transsion Holdings' anxiety remains evident.

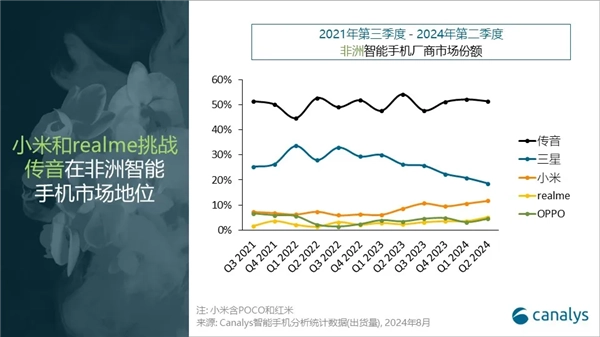

Firstly, Transsion's growth in the African market has shown signs of fatigue. The latest report from market analysis firm Canalys shows that in Q2 2024, Transsion's market share in African smartphones declined slightly from Q1 2024. Meanwhile, Xiaomi, OPPO, and realme's market shares have gradually increased.

For investors, the most concerning issue remains Transsion's share price.

Starting on April 19 this year, Transsion Holdings' share price suddenly ended its upward trend that had lasted for more than a year, plummeting sharply. In just over two months, the share price fell from RMB 121.10 per share at the close on April 18 to below RMB 80. As of the close on September 9, the share price had fallen to RMB 77.05 per share.

In just over four months, Transsion Holdings' share price has fallen by more than 36%, with a market value evaporation of over RMB 49.7 billion. The total market value has also fallen below the RMB 100 billion mark.

As Transsion's share price continued to decline, shareholders began to reduce their holdings.

On May 23, Transsion Holdings announced that its controlling shareholder, Shenzhen Transsion Investment Co., Ltd., had reduced its shareholding in the company by 8,065,652 shares, accounting for 1% of the company's total share capital, through a price inquiry transfer. Based on the transfer price of RMB 125.55 per share at the time, Transsion Investment realized a cash-out of RMB 1.013 billion through the reduction.

According to Wind data, the shareholding ratios of Transsion Holdings' employee stock ownership platforms, Chuanli Enterprise Management, Chuancheng Enterprise Management, and Transsion Enterprise Management, fell from 2.76%, 2.13%, and 2.61% in the second quarter of 2023 to 2.12%, 1.53%, and 1.47% at the end of the first quarter of this year, respectively. It can be estimated that the aforementioned three shareholding platforms realized a total cash-out of approximately RMB 2.47 billion over the past few months.

Zhu Zhaojiang holds shares in the above four companies. In other words, Zhu is the biggest beneficiary of the multiple share reductions mentioned earlier. Specifically, Zhu, who holds a 20.68% stake in Transsion Investment, received RMB 209 million from this reduction alone.

As the capital market cooled, Transsion Holdings has also been embroiled in controversies in its business operations.

In July this year, media reported that Qualcomm filed a lawsuit in the Delhi High Court in India against Transsion Holdings Group for allegedly infringing on four non-standard essential patents. Qualcomm stated that while Transsion Holdings had recently signed a licensing agreement with Qualcomm for some of its products, the vast majority of its products remained unlicensed and continued to infringe on Qualcomm's valuable patent portfolio.

In response, Transsion stated that it had signed a 5G standard patent license agreement with Qualcomm and was fulfilling the agreement. However, considering that in over 70 emerging markets such as Africa and South Asia, some patent holders do not own or only own a small number of patents but demand uniform global licensing fees, ignoring regional development differences, patent holdings differences, and different fee rates in precedents.

So far, Qualcomm's lawsuit has not yet received a ruling, and its impact on Transsion Holdings remains uncertain.