Jimi Technology: Struggling in the Darkest Moment

![]() 09/11 2024

09/11 2024

![]() 659

659

Written by Chen Hao

Edited by Hou Yu

Inspired by an iPhone 5 concept video, Zhong Bo abandoned his million-yuan-a-year job in 2012 to found Jimi Technology in Chengdu.

Zhong Bo firmly believes that "the future TV will definitely be screenless." This vision led to the creation of products that successfully carved out a niche in the home projector market, which was still a blue ocean at the time.

In the first three quarters of 2018, Jimi Technology led the domestic projector market with shipments of 400,000 units, ending the 15-year monopoly of foreign brands in the Chinese projector market. For the next six years, Jimi remained the industry leader in China. In 2023, Jimi even topped the global home projector market with a 6.5% market share.

However, as the home projector market transitioned from a blue ocean to a red ocean, Jimi, as the industry leader, struggled to cope with market competition and industry restructuring.

Declining Performance and Shareholder Cash-outs

On August 29, Jimi Technology (688696.SH) released its 2024 half-year report, revealing a sharp decline in performance that sparked widespread industry concern.

According to the report, Jimi Technology's revenue for the first half of the year was approximately 1.6 billion yuan, down 1.66% year-on-year; net profit attributable to shareholders was 4.1 million yuan, down 95.58% from the same period last year; and net profit excluding non-recurring items was -14.84 million yuan, down 125.36% year-on-year.

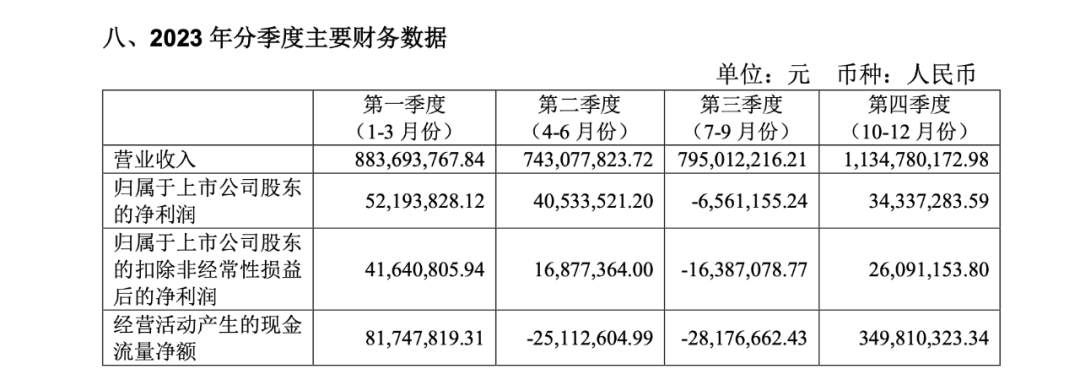

Chart: Jimi Technology's quarterly performance in 2023

In its financial report, Jimi Technology attributed the decline in performance to the macroeconomic environment, inventory reduction, and market competition. In response, the company plans to actively adapt to market changes, introduce new products across high-end, mid-range, and entry-level markets to meet consumer demand, and continue to pursue its brand internationalization strategy.

The poor performance has also eroded investor confidence in Jimi. By the close on September 3, Jimi Technology's share price had fallen to 56.70 yuan, less than one-tenth of its all-time high of 626.98 yuan.

Compounding the problem, major shareholder Baidu's founder Li Yanhong has lost faith in Jimi's prospects. Baidu and its affiliates once held 5.8053 million shares, or 11.61% of Jimi Technology. However, since the lifting of restrictions on share sales in March 2022, Baidu has frequently reduced its stake. By June 18, 2024, Baidu's holding had dropped to 5.53%, indicating that more than half of its shares had been sold off in just over two years.

Declining Prices Amidst Growing Sales in the Home Projector Market

The reasons why Jimi Technology has lost favor with investors and major shareholders are evident in the declining home projector market.

According to IDC, China's projector market shipped 4.736 million units in 2023, down 6.2% year-on-year, with sales of 14.77 billion yuan, down 25.6%. The first half of 2024 also saw a challenging market: according to Runto, sales of home projectors across all channels reached 2.889 million units, up 3.5% year-on-year, but sales revenue fell 10.2% to 4.76 billion yuan.

These figures indicate that while projector sales volumes are still growing, declining sales revenue means that average selling prices have dropped significantly. Based on these figures, the average selling price of projectors in the Chinese market was approximately 3,118.6 yuan in 2023, falling to approximately 1,648.85 yuan in the first half of this year.

This demonstrates a clear trend towards low-end products in the projector market, with consumers becoming increasingly price-sensitive.

More concerning than price sensitivity is a shift in consumer sentiment: they seem less interested in projectors.

A recent Sina Tech survey of 759 respondents found that 48.9% believed projectors were inferior to TVs and had never purchased one, while 22.8% had purchased a projector but rarely used it. Only 15.7% used their projectors daily.

For years, home projector manufacturers have hoped to replace TVs in consumers' living rooms, but TVs remain firmly entrenched in consumers' minds.

One reason consumers prefer traditional TVs to projectors is that projectors have not truly fulfilled their promise of replacing TVs. Compared to TVs at similar price points, projectors struggle to match their color accuracy, brightness, and contrast, and they also suffer from installation inconvenience.

Moreover, the home projector market remains niche compared to TVs. According to Runto, the Chinese mainland TV market shipped 16.39 million units in the first half of 2024, down 4.2% year-on-year, with retail sales of 52.2 billion yuan, up about 10% year-on-year. In contrast, home projector shipments and sales in the same period were only 2.889 million units and 4.76 billion yuan, respectively.

The rapid growth of the home projector market in recent years was fueled by consumer curiosity about this niche product category. However, niche markets are prone to saturation, and recent sales data indicate that the home projector market is rapidly approaching this point.

Difficulties for Specialists in a Competitive Market

Faced with a saturating and low-end market, manufacturers often resort to price cuts to maintain sales, but price wars significantly compress profit margins, as evidenced by Jimi's half-year report.

For a company of Jimi's size, how long it can sustain a price war is concerning. According to the half-year report, Jimi currently has a cash flow of approximately 170.9 million yuan, up 201.78% year-on-year, one of the few bright spots in the report. However, this growth is attributed to reduced procurement payments due to inventory build-up in the previous quarter.

Specialists often lead the market during its early stages but are later overshadowed by well-funded generalists with greater resources and influence. If Jimi cannot withstand intense price competition and deteriorating financial conditions, its early market development and education efforts may ultimately benefit competitors like Hisense, a TV giant that has ventured into the projector market. (For more details, see: Texas Instruments, with pricing power, upends China's projector market)

Jimi's small size not only hinders its ability to compete in price wars but also limits its bargaining power in component procurement. In contrast, companies like Hisense, with their substantial business volumes, can better sustain high costs in price wars, obtain lower component costs through bulk procurement, and launch more competitive products. Jimi, on the other hand, faces disadvantages in both price wars and supply chains, making it difficult to effectively resist market pressures from generalist brands.

However, being small should not be seen as a company's original sin. Many smaller businesses have successfully maintained long-term competitiveness by establishing unique competitive advantages.

For example, Dyson, a cleaning brand, has established a strong technical barrier through continuous innovation in bagless vacuum technology and high-efficiency motor design. This technological advantage gives Dyson products high market recognition and customer satisfaction, enabling them to compete with household appliance giants like Philips. Leica is another classic example. With a century-long reputation and exceptional optical technology, Leica enjoys an almost unshakable position in the high-end camera market. Despite facing industry giants like Sony, Leica attracts a loyal base of high-end users with its superb craftsmanship and luxury positioning.

Jimi itself is a company committed to refining its products. To reduce the thickness of a product's body by 1 mm, Jimi was willing to delay its launch by several months and test thousands of materials. This demonstrates founder Zhong Bo's dedication to product quality, stemming from his technical background.

While projectors may not require highly specialized technology, and upstream components are readily available, the question remains whether Jimi has the capability and willingness to change this status quo. Following the examples of Dyson and Leica, Jimi still has the opportunity to find its own competitive advantage by delving into niche markets, continuously innovating, and differentiating itself to create a unique brand value.

Rather than engaging in price wars, Jimi should focus on becoming "small but refined" and carving out its own unique competitive advantage as a long-term development goal.