Sweep business cards to IPO: How does an AI company with a gross margin of 84% make money

![]() 09/12 2024

09/12 2024

![]() 469

469

Author|Yao Li

Source|Lingyi Think Tank

Recently, Shanghai Hoho Information Technology Co., Ltd. (hereinafter referred to as "Hoho Information") announced its intention to issue shares and launched an IPO on the STAR Market. It has been nearly three years since it first published its prospectus.

In September 2021, Hoho Information submitted its prospectus to the STAR Market; in August 2023, it successfully passed the review; and in September 2023, it received approval from the China Securities Regulatory Commission. After nearly 11 months of long wait, Hoho Information announced that it would officially open subscriptions on the STAR Market on September 13.

Unlike AI companies listed in recent years, Hoho Information started from the C-end and contributed most of its revenue from the C-end; it has achieved stable profitability with growing performance year by year; it has expanded into the global market through cooperation with international internet giants; and the downstream financial industry has contributed revenue growing to hundreds of millions of yuan annually.

01

IPO from "Sweeping"

Founded in 2006, Hoho Information has its roots in Motorola, where its founder and chairman Zhen Lixin previously worked. Many of the company's senior executives also come from Motorola.

Early on, Hoho Information's products were mainly focused on intelligent text recognition. Three years after its establishment, its flagship product, Business Card Reader, was launched at the end of 2009, but this C-end product contributed only 2.11% of revenue in 2022. In 2014, Hoho Information launched the Enterprise Edition of Business Card Reader, which serves as the front end of the enterprise management system (CRM) and manages corporate customer business cards.

Hoho Information's main product, CamScanner, was launched in 2010, with the overseas version introducing a VIP membership payment model in 2014 and the domestic version in 2017. In 2022, CamScanner contributed over 60% of the company's revenue.

With technological advancements, Hoho Information's intelligent text recognition technology has evolved into AI applications. Since 2019, it has launched document processing robots, financial report robots, contract robots, intelligent configuration robots, and intelligent document classification robots for the B-end market. These robots offer functions such as information collection, classification, verification, ratio analysis, and other scene-based services for enterprises.

In August 2015, the State Council issued the "Action Plan for Promoting the Development of Big Data." In the same year, Hoho Information began to layout the business big data segment of its big data products. In May 2015, Hoho Information launched Qixinbao, which provides corporate credit information inquiry services. In 2018, its self-developed enterprise knowledge graph solution began commercial deployment. In 2022, the commercial big data business contributed 17.59% of revenue.

In its prospectus, Hoho Information introduces the synergies between its expansion from intelligent text recognition to commercial big data. Technical accumulations such as NLP (Natural Language Processing) can be applied across both areas. In addition to technology sharing, some clients also overlap between the two segments.

02

Gross margin exceeds 80%

Hoho Information breaks the conventional impression of IPO companies on the STAR Market being in their startup phase and unprofitable. Its financial figures are quite impressive:

First, performance has grown year by year. In 2021, 2022, and 2023, revenue was 806 million yuan, 988 million yuan, and 1.187 billion yuan, respectively; net profit was 144 million yuan, 284 million yuan, and 323 million yuan, respectively; and non-GAAP net profit was 139 million yuan, 265 million yuan, and 297 million yuan, respectively. In the first half of 2024, revenue was 688 million yuan, up 21.85% year-on-year; net profit was 220 million yuan, up 18.15% year-on-year; and non-GAAP net profit was 206 million yuan, up 15.74% year-on-year.

Second, the overall gross margin remains stable, at 84.33%, 83.44%, and 83.7% from 2020 to 2022, respectively.

Hoho Information's expense ratio is also relatively stable, with expense ratios of 64.17%, 69.53%, 58.76%, and 61.27% from 2020 to 2023, respectively; the R&D expense ratios were 28.87%, 29.57%, 28.32%, and 27.3%, respectively.

In addition, cash flow is abundant. From 2020 to 2023, net operating cash flow was 250 million yuan, 290 million yuan, 380 million yuan, and 450 million yuan, respectively, all higher than net profit for the corresponding period.

Compared with other AI companies listed in recent years, Hoho Information's C-end revenue dominates, avoiding the issue of accounts receivable constraining cash flow. As of the end of 2023, accounts receivable were 90.15 million yuan, accounting for less than 10% of annual revenue.

03

C-end contributes 70% of revenue

Unlike AI companies listed in recent years, Hoho Information started with C-end business and later expanded to the B-end, with the C-end currently being the main source of revenue, accounting for over 70%. In 2022, C-end products, including CamScanner, Business Card Reader, and Qixinbao, contributed a combined 73.86% of revenue, with CamScanner alone accounting for 64.03%.

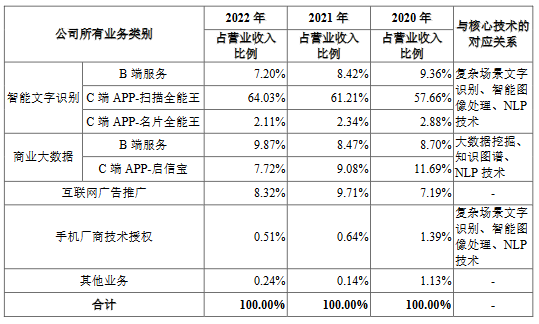

Table 1: Revenue Structure of Hoho Information

Hoho Information discloses its revenue by four business segments: intelligent text recognition, commercial big data, internet advertising promotion, and technology licensing to mobile phone manufacturers. Both intelligent text recognition and commercial big data involve both C-end and B-end businesses.

Financial reports show that between 2020 and 2022, the two businesses with consistently rising revenue contributions were CamScanner for the C-end in intelligent text recognition and B-end services in commercial big data. Their revenue contributions increased from 57.66% to 64.03% and from 8.70% to 9.87%, respectively. According to financial reports, there have been no significant changes in CamScanner's pricing, and its revenue growth is mainly attributed to an increase in the proportion of annual fee-paying users.

According to financial reports, the development trends of the three C-end apps vary:

The number of paying users, monthly active users, and new paying conversion rates for CamScanner, the flagship product, increased year by year from 2020 to 2022.

Affected by social media apps like WeChat, the monthly active users of Business Card Reader declined slightly, but customer stickiness remained high, and paying users continued to increase.

The number and proportion of paying users of Qixinbao decreased, and the corresponding revenue contribution dropped from 11.69% in 2020 to 7.72% in 2022.

04

Expanding Globally with a 'Casting a Wide Net' Strategy

Amidst China's economic slowdown and the competitive pressure brought about by 'internal competition,' corporate overseas expansion has become a focus of market attention. Hoho Information's C-end and B-end businesses have already established a presence overseas, contributing over 30% of revenue, becoming one of its highlights.

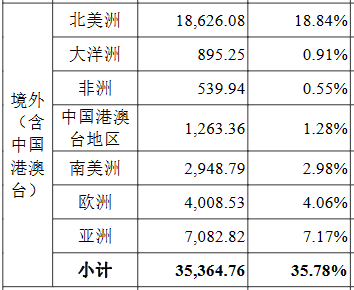

In 2020, 2021, and 2022, Hoho Information's overseas business revenue (including Hong Kong, Macao, and Taiwan) was 183 million yuan, 306 million yuan, and 354 million yuan, respectively, accounting for 31.67%, 38.03%, and 35.78% of total revenue, respectively.

Hoho Information's overseas business has a wide reach across five continents, with the highest revenue contributions from North America and Asia, accounting for 18.84% and 7.17%, respectively, in 2022.

Table 2: Hoho Information's Overseas Revenue by Region (in ten thousand yuan) and Proportion in 2022

For the C-end, Hoho Information promotes its app products through direct sales. According to the prospectus, Hoho Information's app products account for over 50% of sales through the Apple and Google app stores. In 2022, revenue from these two platforms was 330 million yuan and 95.17 million yuan, respectively, contributing 45.63% and 13.04% of C-end revenue.

However, Hoho Information does not disclose sales figures specifically for the overseas market. The development of B-end customers overseas relies on local distributors' channels and customer resources.

According to the prospectus and other public information, Hoho Information cooperates with international giants like Google and Oracle to leverage their market coverage to expand overseas advertising and B-end businesses.

Hoho Information's advertising business is conducted through partnerships with third-party platforms, and the expansion of its C-end app user base lays the foundation for its advertising business.

The prospectus reveals that Hoho Information improved the monetization of overseas advertising through innovations such as ad placement in the first three quarters of 2020. From 2021 onwards, it significantly enhanced monetization through bidding strategies and refined operations, resulting in a substantial year-on-year increase of 30.85 million yuan in revenue from Google ads in that year, which further increased to 40.03 million yuan in 2022. Google's advertising business is primarily for CamScanner's overseas advertising.

In addition to Google, Hoho Information also cooperates with Facebook.

According to media reports, in March 2022, Hoho Information partnered with Oracle to develop an intelligent document management system using Oracle Cloud Infrastructure and Oracle Fusion ERP Cloud. This system integrates high-speed scanners and an automatic email receipt module, enabling image input and content extraction of paper invoices, business documents, and electronic invoices. Through this collaboration, Hoho Information expanded its market reach to Oracle ERP Cloud users.

In November 2022, Tencent Cloud and Hoho Information jointly launched an intelligent digital identity authentication risk control solution, which helps enterprises improve the accuracy and efficiency of business reviews in cross-border operations. Tencent Cloud operates in over 70 availability zones in 26 regions worldwide, laying the foundation for convenient and rapid access to Hoho Information's intelligent text recognition product modules in some overseas countries and regions.

The prospectus discloses investment projects including the "international upgrade of intelligent text recognition C-end products" and the "construction of a global technical support center and marketing network," indicating that Hoho Information will increase investment in overseas business.

05

B-end focuses on 'pan-finance'

Hoho Information's B-end downstream customers are concentrated in two areas: the financial industry and the software and information technology services industry, which together accounted for 77.43% of B-end revenue in 2022.

Among them, financial industry revenue was 54.39 million yuan, 94.57 million yuan, and 107 million yuan in 2020, 2021, and 2022, respectively, accounting for 35.15%, 42.88%, and 41.45% of B-end revenue, respectively. In 2021 and 2022, revenue from financial customers increased by 73.86% and 13.27%, respectively, year-on-year.

Hoho Information introduced in its response to the Shanghai Stock Exchange's inquiry that customers in the pan-financial sector primarily include banks, insurance companies, securities firms, fund companies, and other financial institutions. Financial institutions themselves have a large amount of accumulated data, and their business operations have higher demands for risk control and big data applications, with a particular focus on data value mining. The pan-financial sector is one of the company's advantageous B-end industries, where it holds a leading position in banking, securities, payments, and other financial sub-sectors.

Hoho Information discloses its B-end business through basic technical services, standardized services, and scenario-based solutions.

In terms of intelligent text recognition, basic technical services include smart text recognition of licenses, bank cards, business cards, etc. Representative financial customers include China UnionPay, China Pacific Insurance, and Dongfeng Peugeot Citroen Automobile Finance. B-end standardized services are primarily aimed at Japanese customers and contracted somewhat in 2022. Scenario-based solutions include intelligent text recognition AI robots, with financial customers such as People's Insurance Company of China, and AI training platforms, with representative customers like Chongqing Rural Commercial Bank and GF Securities.

In the commercial big data business, one aspect involves basic data services provided through data APIs or data packages, with a representative financial customer being Shenwan Hongyuan Securities. The other aspect is vertical industry SaaS solutions tailored for different banks and securities customers – financial institution risk control and marketing SaaS, which provides solutions for due diligence, risk warning, and customer management. A representative financial customer is Industrial and Commercial Bank of China. The third aspect is scenario-based financial risk knowledge solutions, with customers including China Merchants Bank, Haitong Securities, Bank of Zhengzhou, Kunshan Rural Commercial Bank in Jiangsu, among others. China Merchants Bank began introducing Hoho Information's risk knowledge graph solution in 2018, becoming its first benchmark customer.

Additionally, according to Hoho Information's response to the Shanghai Stock Exchange's inquiry, its subsidiary Shanghai Shengteng obtained credit filing registration from the Shanghai Branch in July 2020. Prior to this, there were instances of engaging in corporate credit business without undergoing credit filing registration, which have since been rectified.

From January to September 2021, Hoho Information's credit inquiry business revenue was 98.08 million yuan, accounting for 17.13% of total revenue, with unfiled credit inquiry business revenue accounting for 4.46% of total revenue.