Pinduoduo's Fourth Breakthrough

![]() 09/12 2024

09/12 2024

![]() 626

626

This article is based on publicly available information and is intended solely for information exchange purposes and does not constitute any investment advice.

The 2024 mid-year reporting season has come to a close. Amidst the stagnation, the e-commerce sector remains turbulent: as a barometer of overall social demand, competition and evolution never cease. As mentioned in our report "The Fifth Consumption Era," the rise of Pinduoduo and live-streaming e-commerce since 2018 has driven the main battle lines in the e-commerce wars: from skepticism to imitation of Pinduoduo, the battles have continually evolved.

Today, glimpses of the impending conflict between e-commerce giants reveal that a new battle is about to commence: this will be the fourth round of e-commerce wars in nearly six years; in a sense, it will also be Pinduoduo's fourth necessary breakthrough battle.

The show is about to begin. This time, it's a battle for new quality supply.

01

"Target" Pinduoduo

As Nassim Nicholas Taleb once said, "From the days of the old Cato in ancient Rome, people have shown their maturity by scolding the next generation for being 'shallow' and praising the previous generation for their 'value.'" Historically, the latest disruptor in an old era is often seen as a public enemy. This is both Pinduoduo's destiny and a clue to tracking the trend of e-commerce competition in the coming period.

To understand the significance of this current situation and gain insight into the evolution of trends, it is necessary to review the several rounds of e-commerce wars since Pinduoduo's rise:

Round 1: "Either-or" Choice

In 2018, when Pinduoduo completed its IPO during its third anniversary, the platform's main venue merchants suddenly faced an "enforced either-or" choice, forcing many brand merchants to withdraw from activities, delist products, or even request the closure of flagship stores.

Pinduoduo publicly denounced this "either-or" practice and posted nine screenshots of merchant conversations as proof.

Just a year earlier, a similar war had broken out between the two leading e-commerce platforms. Given Pinduoduo's size and influence among merchants at the time, there was little room for counterattack against the "either-or" choice.

Fortunately, with the tightening of antitrust regulations, this round of competition, labeled as unfair competition, eventually subsided.

Round 2: Beyond the "Fifth Ring Road"

Between 2019 and 2020, in response to Pinduoduo's offensive beyond the "Fifth Ring Road" (a metaphor for Beijing's inner city), the two leading e-commerce platforms successively launched targeted low-tier market strategies.

In 2019, JD.com launched the "Jingxi" brand, which was upgraded to an independent business group in 2020. In early 2020, Alibaba introduced Taobao Lite (Taote) and relaunched Juhuasuan.

Contrary to expectations, neither Taobao Lite nor Jingxi has been able to substantially impact Pinduoduo so far.

Round 3: Close Quarters Combat

By the end of 2023, Taobao and JD.com almost simultaneously introduced "refund only" policies.

At the same time, JD.com began aggressively promoting user subsidies and elevating Plus membership privileges, while Taobao underwent organizational restructuring and introduced a five-star pricing evaluation system.

Interestingly, the interfaces of the three platforms were indistinguishable at one point during this process.

Image: User interfaces of the three e-commerce platforms' multi-billion subsidy programs (left: Pinduoduo, middle: JD.com, right: Taobao), Source: Screenshots from e-commerce platform apps

However, due to significant differences in resource endowments among the three e-commerce platforms, the capital markets seem wary of the aggressive low-price strategies: Over a one-year period, Alibaba's market value declined by 5.6%, and JD.com's by 19.4%. As Alibaba and JD.com successively adjusted their "refund only" policies, the third round of e-commerce wars ended anticlimactically.

02

Fourth Battle: The Supply Side

The tentative "refund only" battle actually foreshadowed the germination of a new round of wars.

As elaborated in our report "The Fifth Consumption Era," after continuous iteration and reflection, leading e-commerce platforms are now returning to their core competencies and embarking on ambitious reforms.

From following trends to returning to fundamentals, a new battle centered around "new quality supply" is brewing:

(1) Strategic Level: Supply-side Reform Becomes a Consensus

Let's directly examine the guidance provided by Alibaba and JD.com during their earnings calls:

JD.com: CEO Xu Ran focused on three main aspects: first, explaining the company's performance; second, reiterating price competitiveness since the beginning of the year, with both 1P and 3P prices showing improved competitiveness in the second quarter; and third, highlighting platform ecosystem development achievements and outlining future work, including bringing better investment returns to merchants.

CFO Dan Su also emphasized supply-side construction: the impact of JD.com's past support measures for merchants (including reduced commissions) has gradually faded, further optimizing traffic allocation efficiency. As a result, advertising revenue grew healthily year-on-year, outpacing GMV growth.

Taobao: As Alibaba's relatively underperforming business in the second quarter (contrasted with Cainiao and Alibaba Cloud), Taobao had limited presence during the earnings call, with a focus on the growth disparity between CMR (customer management revenue) and GMV (gross merchandise volume).

Both CEO Wu Yongming and CFO Xu Zhiqiang emphasized that with the growth of orders and GMV, the next stage of work would focus on improving monetization rates. Analyst questions centered around the relationship between GMV and CMR, with the 0.6% technical service fee mentioned again.

In his responses, Jiang Fan was relatively tactful, predicting that the technical service fee model would increase merchant acceptance rates. However, some media estimates suggest that the reform could directly impact Taobao's new revenue by billions of yuan.

Meanwhile, Alibaba introduced a new marketing tool, Quanzhan Push, which is expected to gradually monetize GMV growth. While current performance is not stellar, the earnings call exhibited optimism about future CMR growth.

Summarizing the above guidance, financial reports, and recent initiatives:

From a performance perspective, both JD.com and Taobao fell short of pure revenue growth expectations but still achieved impressive growth rates. Considering revenue growth, all three companies effectively controlled costs to improve profitability, suggesting a consensus on maximizing profits by managing costs.

Expectations-wise, the earnings calls indicated that both JD.com and Taobao are more optimistic about second-half growth rates.

Strategically, both JD.com and Taobao spent considerable time elaborating on their merchant-focused priorities for the second half of the year.

From a cost and market-oriented perspective, it's easy to understand why JD.com and Alibaba are turning their attention to the supply side:

After the third round of battles, it became apparent that the current "low-price" system, fueled by capital expenditures for one-way subsidies, is unsustainable in the long run.

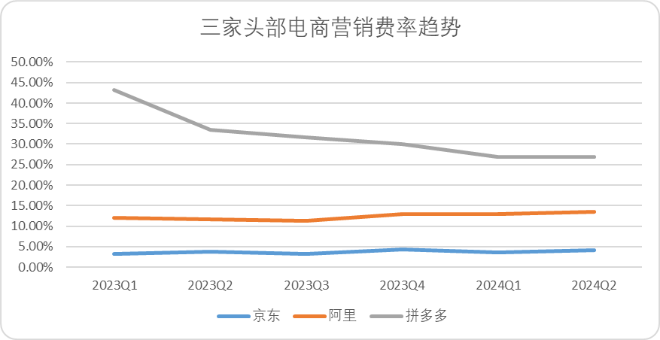

Image: Marketing expense trends of the three e-commerce platforms, Source: Choice Financial Client

In terms of marketing expense trends, JD.com and Alibaba have increased subsidies to establish low-price systems since last year, resulting in a 1-2 percentage point increase in marketing expenses from their lows in the second quarter of this year. In contrast, Pinduoduo has maintained relatively low cost control expenses (higher absolute ratios due to its more straightforward business model and revenue growth).

Before the first quarter, JD.com and Taobao showed notable positive revenue growth rates, with cost increases failing to drive substantial profit growth but contributing to business scale expansion.

However, in the second quarter, both companies' revenue growth rates remained flat year-on-year, while marketing expenses peaked. This underscores the limited potential for growth driven solely by cost increases, which do not create sustainable long-term incremental space.

In this process, e-commerce platforms have gradually found a new balance, shifting from purely subsidy-driven low-price policies on the demand side to supply-side reforms: On the one hand, the supply side directly determines an e-commerce platform's financial performance as its primary revenue source. On the other hand, the scale of the supply side also determines, to a certain extent, the price competitiveness of C-end products on the demand side.

This This indicates that the strategic mainline of the fourth battle of the three major e-commerce platforms will be the supply of new quality products 。

(This indicates that the strategic mainstay of the fourth battle among the three major e-commerce platforms will be new quality supply.)

(2) Tactical Level: Strong Subsidies and Broad Resource Mobilization

Focusing on the narrative of new quality supply, the current logic of leading e-commerce platforms can be summarized in six words: strong subsidies and broad resource mobilization.

First, all players have entered an era of strong subsidies regarding supply thresholds.

Taobao's most notable move has been replacing annual fees with technical service fees, charging merchants based on sales volume rather than a one-time fee. This significantly reduces perceived sunk costs for merchants.

Currently, the revised refund policy for Tmall applies to merchants with annual transaction volumes of ≤120,000 yuan (full refund); from September 1 to December 31, 2024, merchants with transaction volumes between 120,000 and 1 million yuan will receive 50% of their base service fees in the form of Alimama coupons.

These changes are a significant benefit for smaller merchants with annual transaction volumes. For example, software service fees for apparel merchants with annual revenues up to 600,000 yuan have decreased.

On the other hand, small and medium-sized merchants with annual revenues below 600,000 yuan are not the core revenue contributors. Direct fee reductions will enhance Taobao's appeal to small and individual merchants, broadening the platform's long-tail supply.

JD.com, meanwhile, recently announced an upgrade to its "Spring Dawn Plan," offering traffic support, AI efficiency enhancements, and asset-light operations to attract new merchants to the platform.

Second, both Taobao and JD.com are promptly correcting their course. While lowering supply thresholds, they are also actively expanding high-frequency supply sources to ensure business stability.

JD.com has been expanding supply since last year, aiming to increase scale through concessions (reducing commissions for 3P merchants and eliminating platform usage fees). This has led to a 46% month-on-month increase in third-party merchant numbers, with advertising and traffic allocation compensating for commission differences in a more competitive environment, creating a virtuous cycle.

Results show that JD.com exceeded expectations: In the second quarter of 2024, advertising revenue grew faster than GMV, marking a visible improvement in take rates. The market also recognized JD.com's timely pivot, with its market value remaining stable despite zero growth in self-operated revenue.

Taobao's rule changes are even more evident: While lowering entry barriers for small and medium-sized merchants, the 0.6% commission fee, according to third-party research institutions, translates to nearly tens of billions of yuan in commissions for mid-tier merchants. Additionally, the introduction of new promotion tools can gradually offset previous capital expenditures lost in pursuit of order expansion.

Of course, to protect the interests of core merchants, Taobao has made significant concessions on the operational side, including relaxing the "refund only" policy.

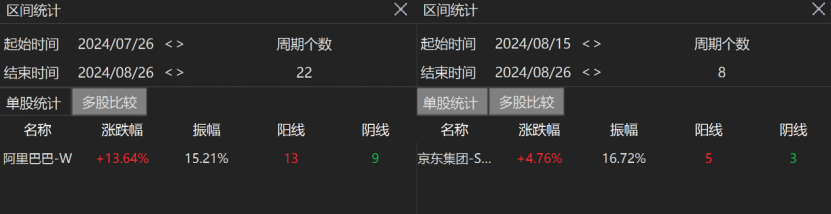

Alibaba's earnings call also hinted at a sustained upward trend in future CMR growth. By lowering entry barriers, high CMR growth in the third quarter is almost certain. Since the policy adjustment announcement a month ago, the stock price has increased by over 10%, earning significant investor recognition.

Image: Alibaba's monthly market value performance after policy adjustments and JD.com's market value performance after its earnings call, Source: Choice Financial Client

These initiatives underscore JD.com and Alibaba's goals of expanding supply while seeking greater earnings certainty.

In summary, both Alibaba and JD.com have chosen strategies centered on supply expansion in this round, aiming to disrupt the market landscape and expand supply share through more complex calculations and business models while ensuring business stability.

After experiencing cycles of growth and decline, the pressure for growth has undoubtedly shifted to Pinduoduo this time around.

03

How Will Pinduoduo Respond?

Facing the new supply-side battle, Pinduoduo has chosen to sacrifice short-term profits, directly subsidizing supply expansion through the most direct means to confront this new battle.

During the second-quarter earnings call, Pinduoduo CEO Lei Chen stated that profit-related figures would decline starting in Q3, with increased investment on the supply side to support innovation and quality improvement for merchants, allocating 10 billion yuan (similar to a merchant-focused "multi-billion subsidy") in the first year.

Chen also noted that Pinduoduo is prepared to sacrifice short-term profits for an extended period, with management reaching a consensus not to engage in buybacks or dividends in the coming years.

Few companies experiencing continuous double-digit growth would describe themselves using phrases like "inevitable profit decline," "sacrificing short-term profits," and "fierce competition" during earnings calls. The primary goal of lowering external expectations is to concentrate efforts on the next phase of strategy.

As a result, we can see Pinduoduo's swift implementation of supply-side subsidies:

On August 13, Pinduoduo offered technical service fee refunds to merchants participating in in-platform promotional activities. For orders generated through promotions like the "Billion Subsidy," "Flash Sales," platform-wide sales, "9.9 Deals," "Trending Good Deals," and "Group Buys," the platform would refund a proportion of the base technical service fee (1% for "Pay Later" orders and 0.6% for others) upon customer refunds.

Subsequently, Pinduoduo upgraded the "Technical Service Fee Refund Benefit," reducing the "Pay Later" technical service fee from 1% to 0.6% for orders generated through promotional activities, in addition to the existing service fee refund benefit.

At the end of August, Pinduoduo officially implemented the "Promotion Service Fee Refund Benefit" for merchants. For orders fully refunded by consumers before shipment, the platform automatically returns the corresponding promotion software service fee in the form of promotion red packets, with no need for merchants to initiate a claim.

On September 5, Pinduoduo's latest merchant notice indicated that the basic deposit for merchant stores had been reduced from 1,000 yuan to 500 yuan, with new store deposits also lowered to 500 yuan, covering 70 categories and directly impacting millions of merchants, further broadening the supply base.

Image: Pinduoduo's announcement on reducing merchant deposits, Source: 36Kr

These initiatives demonstrate Pinduoduo's commitment to supply-side reform, ensuring the platform's appeal to merchants. Analyzing the corresponding data from the perspective of merchant operating costs, we can see the following:

It's important to note that JD.com's advantage stems from the economies of scale in its self-operated categories, with relatively high entry barriers for merchants. The primary reason is that its business model differs significantly from the other two, so the following data is for reference only.

Entry threshold:

Tmall: The store deposit for a shop with a trademark registration acceptance notice is RMB 100,000, and the store deposit for a shop with a registered trademark is RMB 50,000. The store deposit for a flagship store is RMB 150,000.

Taobao: Both individuals and enterprises can join, and a consumer protection deposit of RMB 1,000 is required.

JD.com: Taking POP merchants as an example, according to data from Shunqi, the deposits for R-trademarks and TM-trademarks in beauty and skincare products are RMB 50,000 and RMB 100,000, respectively; for medical aesthetics, the deposit for super-tier 1 cities is RMB 20,000, and RMB 10,000 for other cities; for liquor and 3C products, the deposit is RMB 200,000, and around RMB 10,000 to RMB 100,000 for other categories.

Pinduoduo: The latest store deposit has been reduced to RMB 500, with price differences between individual and enterprise stores, but the overall difference is not significant.

Transaction costs:

The basic comprehensive service fee, consisting of Taobao commissions, credit card fees, and Tmall points, accounts for approximately 6% of total revenue, with a technical service fee of 0.6% (currently, there are refund policies for some small and medium-sized merchants).

JD.com POP merchants: Transaction commission is approximately 5%.

Pinduoduo's "Billion Subsidy" program charges a commission of 1-3%, with a commission of 1-5% for special categories such as prescription drugs and jewelry. Technical service fees have been eliminated.

Operating costs:

Taobao: The categories are relatively complete, so merchants need to rely on traffic promotion to expand revenue. Taobao has many traffic tools, and the overall marketing investment is between 10% and 30%.

JD.com POP merchants: Marketing expenses account for approximately 10%, and the comprehensive cost including fulfillment and third-party logistics is approximately 25%.

Pinduoduo: Natural traffic (price, keywords) is free, and the live streaming technical service fee is 0.4%-3.4%.

In summary, Pinduoduo has a lower entry threshold, and has more natural traffic on the operational side, resulting in lower overall comprehensive costs compared to other platforms at present.

Whether it is commission charges or reduced entry thresholds, both will inevitably affect Pinduoduo's monetization rate and bring fluctuations in market value (falling by nearly 30% after earnings announcements). However, the signal that Pinduoduo is sending to the outside world is: Don't compare me with others in terms of supply scale. I can compress costs to the extreme to drive supply and can even sacrifice short-term profits to subsidize, thereby relying on supply scale to form price competitiveness.

In the third quarter, we are likely to see significant impacts from the different choices made by leading e-commerce platforms:

JD.com is likely to achieve impressive growth in performance; Taobao can almost certainly expect exaggerated growth in CMR (new revenue from technical service fees); while Pinduoduo's CMR revenue is likely to be lower than its overall growth rate, resulting in slower profit growth or even a decline.

However, in the long term, Pinduoduo is likely to achieve large-scale growth in supply-side merchants, thereby establishing a supply-side advantage and potentially resolving conflicts from both inside and outside the industry.

04

Conclusion

In summary, facing new supply, major e-commerce platforms have made different initial choices based on their own endowments and current circumstances: Established platforms have chosen to "defend" the supply-side profit algorithm logic, seeking a balance point for maximizing profits based on their existing scale; while upstarts have chosen to sacrifice medium- and short-term profits to "attack" the absolute supply scale.

All choices have their reasons that are specific to the era and the characteristics of the choices themselves, and we cannot simply "predict" the rationality of the decisions made by various enterprises from a single dimension.

However, from a broader perspective, the industrial competition model that best aligns with long-term development is one that can keep pace with social progress. While we cannot arbitrarily speculate on the superficial characteristics of economic cycles, the social contradictions buried beneath them will not easily change, namely:

Resolving the contradiction between the people's ever-growing need for a better life and unbalanced and inadequate development will remain a common historical mission for all e-commerce platforms in the future.

In this new battle, let's wait and see how the market and consumers will make their choices.