Tesla's More Affordable Variant Sees $40,000 Price Cut; $20,000 Model 3 May Be on the Horizon

![]() 10/13 2025

10/13 2025

![]() 583

583

The Market Reaction is Somewhat Lukewarm

Author | Zaizhou

Chinese automakers are embroiled in a fierce price war, with sales skyrocketing. It's hard to imagine Tesla isn't feeling a twinge of envy.

Hence, the lower-spec, more budget-friendly versions of the Model 3 and Model Y have finally made their debut.

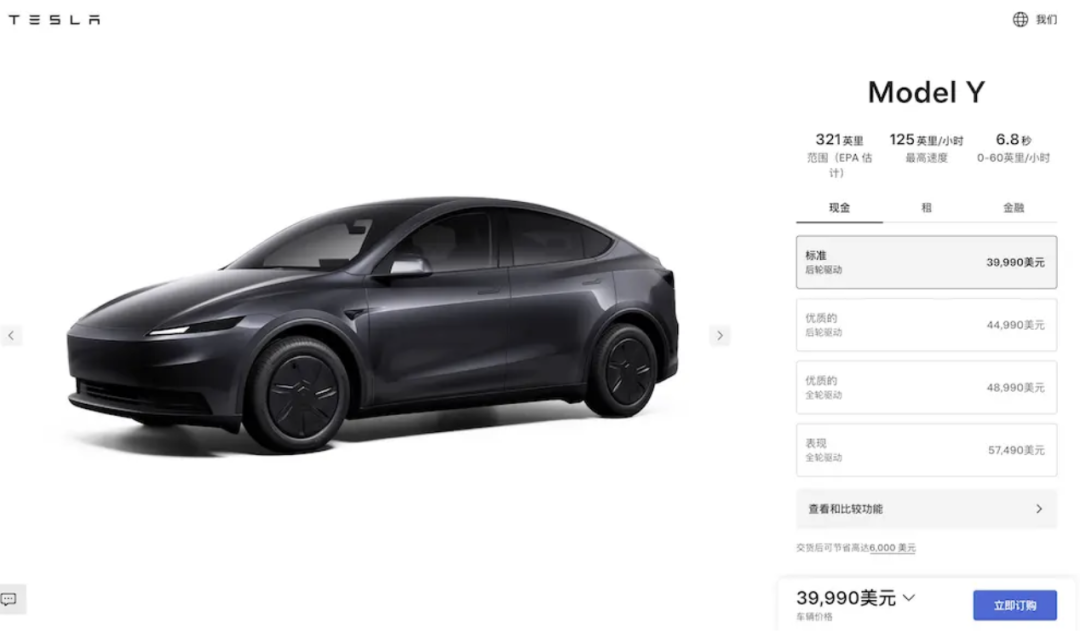

On October 7th, Tesla unveiled the Standard versions of the Model Y and Model 3 in the United States. The Model Y's price has been slashed to $39,990 (approximately RMB 284,700), a $5,500 reduction from the current model. The Standard Model 3 is now priced at $36,990 (approximately RMB 263,400), $5,000 cheaper than before.

This price reduction is significant, with a drop exceeding 10%, potentially widening its market reach and capturing a larger share.

However, the reality has unfolded quite differently.

Following the release of the more affordable models, Tesla's stock price took a hit, plummeting 4.45% on the day to $433.09, with its total market value shrinking to $1.44 trillion, a staggering $65 billion (approximately RMB 460 billion) loss overnight.

Unlike domestic automakers who reluctantly offer discounts, Tesla has consistently priced its vehicles based on costs. This price cut comes with notable downgrades in specifications, and suppliers have also felt the impact.

Judging by market reactions, Tesla's strategy for market expansion seems to be missing the mark.

01. Significant Downgrades in Specifications

The Model Y is Tesla's flagship seller, and the cheaper variant is expected to carry a significant sales load. However, the specifications are notably lacking.

From the front, it's immediately apparent that this is a downgraded model. The new car has done away with the front through-type light strip, and the iconic front of the new Model Y is replaced by a simpler design and a more straightforward front bumper.

The wheel size has also been reduced, with 18-inch wheels as standard, and the rear through-type light strip has been removed.

Luxury features in the exterior design, such as electric rearview mirror folding and welcome lights, have also been eliminated.

The paint color options have been streamlined, offering only black, white, and gray, with gray being free and other colors incurring an additional fee.

Inside, the budget feel is palpable. For instance, the compartment lights and ambient lights have been removed, and the rear 8-inch touch screen has been replaced by manual air vents.

The HEPA filter, adaptive high beams, and more have all been removed. The sound system has been reduced from 16 speakers to 7, with the subwoofer and radio functions eliminated.

Additionally, the panoramic glass roof has been replaced by a traditional metal roof with interior lining and soundproofing materials. While it lacks the tech feel, the sunshade effect has indeed improved.

The seats now feature a leather + fabric splice material, and the steering wheel has been changed from electric adjustment to manual.

Besides the cancellations of exterior and comfort features, the most significant changes in the cheaper Model Y are the reductions in power and range.

It adopts a single-motor drive, with horsepower reduced to 300, and the zero-to-100 km/h acceleration time extended from 5.4 seconds to 6.8 seconds.

The battery capacity has been reduced from 75 kWh to 69.5 kWh, with the corresponding range decreasing from 357 miles to 321 miles. The maximum charging speed has also decreased, with the charging power reduced from 250 kW to 225 kW.

As for intelligent driving assistance, the Standard Model Y only retains traffic-aware cruise control, with the automatic steering function removed. FSD requires an additional fee, priced at a hefty $8,000 (approximately RMB 57,000).

The Standard Model 3 follows the Model Y's approach, with most of the configurable features removed, such as the 18-inch wheels, ambient lights, and rear touch screen. The electric vehicle and charging specifications are also aligned with the Standard Model Y, and it has reverted to using a traditional turn signal stalk.

However, the Standard Model 3 retains its iconic glass roof, and from the exterior, it doesn't differ much from the current Model 3.

02. Why Analysts Remain Pessimistic

Judging by the feedback from the capital market, the market seems unenthusiastic about the more affordable Tesla.

After all, expectations were high for Tesla to launch a game-changing product. The previous buzz about a $25,000 new car has now faded, and the cheaper Model Y/3 clearly falls short of expectations.

For instance, Dan Ives from Wedbush, a long-time Tesla advocate, couldn't conceal his disappointment, stating that he was relatively let down by this launch because the prices were only $5,000 lower than the previous Model 3 and Y.

Ives said that the market had high hopes for Tesla's lower-priced models, but this pricing is still relatively steep compared to other vehicles on the market.

Ross Gerber, CEO of Gerber Kawasaki Wealth and Investment Management, stated that consumers are extremely price-sensitive. If the same car is offered in two, three, or even four variants, most people will opt for the cheapest one.

In his view, Tesla is becoming more akin to Toyota and less like Mercedes, as Tesla had previously been categorized as a luxury brand.

Of course, the most crucial point is that the downgraded models haven't dropped to the $35,000 threshold, meaning the new cars may not have the same sales-driving effect as lower-priced vehicles.

For example, Hyundai's electric vehicle IONIQ 5 has seen an average price reduction of over $9,000 in the United States, with a starting price of $35,000. The starting prices of the General Motors Chevrolet Equinox and the 2026 Nissan Leaf are both below $35,000.

Next, General Motors will resume production of the Chevrolet Bolt, and Ford will even launch a $30,000 four-door electric pickup truck. In the Chinese market, Chinese automakers are veterans of price wars, and even electric vehicles priced at around $15,000 can be equipped with advanced driving assistance systems.

Can Tesla, at this juncture, lure away price-sensitive user groups from these lower-priced products?

03. Greater Potential for Price Reductions in Domestically Produced Teslas

Perhaps Tesla had already anticipated the market's reaction before launching the Standard models.

Previously, Tesla had been positioned as a luxury brand, and people were willing to pay a premium for its technological allure. However, as a specialist, it's challenging to maintain stable competitiveness when facing a group of rising stars.

The Model Y is a typical product being benchmarked against, with its battery electric vehicle technology and intelligent driving assistance systems being scrutinized by competitors.

Thus, configurations like refrigerators, large TVs, and comfortable sofas have emerged in the Chinese market. Leveraging the advantage of "Chinese people understanding Chinese people better," Chinese automakers have pushed comfort features to the extreme. This cross-dimensional attack precisely avoids Tesla's strengths and begins to address the needs that Chinese people care about the most.

Most importantly, almost every product has its unique selling points, which Tesla cannot replicate.

For instance, the LeDao L60 offers battery swapping, the Xiaomi YU7 has the support of Xiaomi fans, and models like the XPENG G6 and SERES M7 boast impressive driving assistance capabilities.

However, from another perspective, Tesla's launch of these new products may not be to satisfy people's appetites but simply to expand market coverage.

Musk didn't elaborate much on this launch but mentioned the update of Tesla's FSD software and the progress of the Grok model developed by his artificial intelligence company, xAI. His focus is also on FSD, Robotaxi self-driving taxis, and Optimus humanoid robots.

From this perspective, the new Model Y/3 models also shoulder some of the responsibilities of the $25,000 model.

Back in China, Tesla China has not yet confirmed whether it will launch the Standard models, but it's highly likely to follow suit.

Given the completeness of China's supply chain and the cost control capabilities of the Shanghai Gigafactory, there is significant potential for price reductions in the cheaper Model Y/3.

Based on the price reduction ratio in the United States, the current starting price of the domestically produced Model Y is RMB 263,500. It should not be a problem for the entry-level model to drop to around RMB 230,000, and the Model 3 could be even lower, possibly dropping to around RMB 200,000.

If so, Tesla will truly engage in a head-to-head battle with Chinese electric vehicles. Returning to the ultimate question, would you spend RMB 200,000 on a Tesla with lower configurations or a Chinese brand electric vehicle with richer features?