Who is the New "Kingmaker" on Wall Street? How Does OpenAI "Command" the U.S. Stock Market?

![]() 10/13 2025

10/13 2025

![]() 498

498

Written by / Erfeng

Source / Jiedian Finance

OpenAI has taken another step forward in its "ambition."

In the early morning of October 7th, Beijing time, at the Fort Mason Center in San Francisco, OpenAI's CEO Sam Altman took the stage at the "2025 Developer Conference." He did not bring a simple product update but a clear development strategy: OpenAI is accelerating its transformation from a highly regarded research lab and model provider into a fully-fledged platform and ecosystem, with the ultimate goal of becoming the "operating system" of the next computing era.

The confidence behind this strategy stems from a set of astonishing data. Altman announced that the weekly active users of ChatGPT have surged from 100 million in 2023 to over 800 million. Meanwhile, the developer community built upon it has doubled to 4 million, and API calls have skyrocketed from 300 million tokens per minute to 6 billion.

01 Platformization Ambitions: Building an "App Store" for the AI Era

The core of the blueprint revealed by Altman at the conference is to reshape ChatGPT from a conversational tool into a powerful application distribution and development platform through two pillar products: "Apps in ChatGPT" and "AgentKit."

The most eye-catching announcement at the conference was undoubtedly the new Apps SDK (Software Development Kit). It completely replaces the previously limited "plugin" model, allowing developers to build fully functional applications that can run directly within ChatGPT. This means users can experience rich interactive services without leaving the conversation interface.

In a live demonstration, this vision became concrete and vivid. When a user asked ChatGPT to create a weekend party playlist, the system recommended and invoked the Spotify app, directly generating and displaying the playlist within the conversation flow. When the user needed to design a poster for a startup project, Canva's app interface seamlessly embedded, providing design templates and real-time modifications. When planning a trip or searching for real estate, apps like Expedia, Booking.com, and Zillow provided interactive maps and booking options, all in one seamless operation.

Behind this experience lies OpenAI's push for open standards—the Model Context Protocol (MCP), which provides a technical foundation for smooth communication between models and external services. More importantly, OpenAI announced the launch of a dedicated app directory and provided developers with commercialization tools, allowing them to submit apps for review and ultimately monetize them through the platform.

An industry analyst told Jiedian Finance, "This complete closed loop of 'development-review-distribution-monetization' is identical to Apple's App Store and Google's Play Store. Its market intentions are also clear: to establish a new application distribution channel controlled by OpenAI itself in the AI-native era."

If the Apps SDK is the frontend gateway of the platform, then AgentKit is the engine of its backend capabilities.

OpenAI knows that building an AI agent capable of stably and reliably executing complex tasks is a universal pain point in the industry, often requiring weeks or even months of effort and integrating numerous fragmented tools. The launch of AgentKit aims to address this challenge.

It is a complete toolkit integrating a visual builder, a registry of data connectors, and an embeddable chat interface.

At the conference, OpenAI's technicians constructed and deployed a functional AI agent in less than eight minutes using a drag-and-drop module approach, intuitively demonstrating its potential to simplify the development process.

The analyst told Jiedian Finance that the combination of Apps SDK and AgentKit forms a sophisticated strategic "pincer attack." AgentKit significantly lowers development barriers by standardizing the construction of intelligent applications, attracting a massive influx of developers. Meanwhile, the Apps SDK firmly controls the deployment, distribution, and monetization channels of these applications. This creates a powerful, self-reinforcing ecological cycle aimed at deeply locking developers and users into OpenAI's ecosystem.

02 "Turning Stone into Gold": OpenAI's Wall Street Influence

OpenAI's new strategy has not only shaken the tech world but also sent ripples through Wall Street at an unprecedented speed and scale, unexpectedly positioning the pre-IPO startup as a "kingmaker" of U.S. stocks.

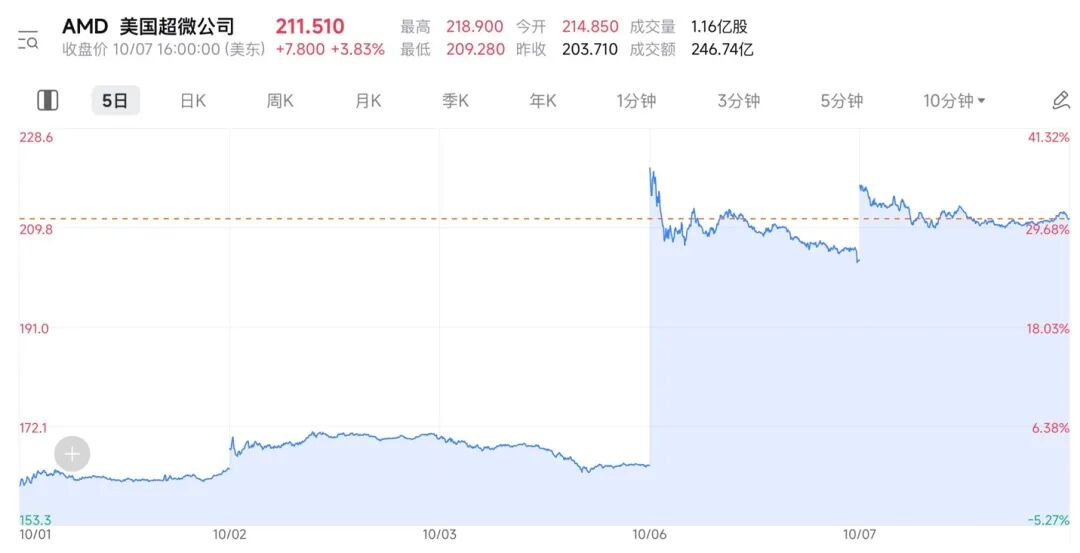

During the developer conference, the most dramatic market reaction came from chipmaker AMD. OpenAI announced a multi-billion-dollar cooperation agreement with AMD, purchasing its next-generation Instinct MI450 series high-performance AI chips to build future computing infrastructure.

The real explosive point of this deal lies in its unique structure: AMD granted OpenAI a warrant allowing the latter to acquire up to 160 million AMD common shares in the future, equivalent to approximately 10% of its total share capital. This deep binding means OpenAI's success will directly translate into shareholder value for AMD.

The news instantly ignited the capital market. AMD's stock price surged over 34% at one point during the day's trading, ultimately closing up 23.71%, with its market value skyrocketing by nearly $80 billion in a single day—the largest one-day gain in more than nine years.

AMD's stock surge was just the beginning. During Altman's speech, any publicly traded company mentioned seemed to acquire the magic power of "turning stone into gold."

As one of the first application partners, design software company Figma saw its stock price jump 7.4%. Online travel companies Expedia, Booking.com, and real estate platform Zillow also experienced significant short-term rallies. This wave even spread to the broader industrial chain, with Wall Street analysts noting that AMD's cooperation with OpenAI sent positive signals to its server and networking partners like Supermicro and Dell, driving up the entire AI infrastructure sector.

Interestingly, Altman himself seemed somewhat puzzled by the market frenzy he had created. During a press conference, he admitted, "This is a novel phenomenon just starting to happen. We're trying to figure out how to adapt to this world, but it's strange."

Behind this phenomenon lies a profound market paradigm shift. OpenAI, a privately held company in the legal sense, now wields market influence comparable to publicly traded tech giants like Apple or Nvidia. Its strategic decisions—or even just a "mention" during an event—can instantly create or erase hundreds of billions of dollars in public market value.

Jiedian Finance analyzed that the market's reaction was not based on the actual revenue these collaborations could generate in the short term. After all, the direct profits from Figma's integration are negligible. What has changed is an investment logic driven by a new narrative: standing with the leader of the AI revolution is equivalent to obtaining a "ticket" to the future. While this frenzy driven by "fear of missing out" (FOMO) has boosted valuations for partners, it has also created enormous market volatility and laid the groundwork for potential asset bubbles.

03 Navigating the "Computing Power Desert" for the Future

All the blueprints OpenAI outlined at the developer conference are built on a simple yet harsh reality—an insatiable demand for computing power.

OpenAI President Greg Brockman and CFO Sarah Friar have publicly stated that the entire industry is facing an "absolute scarcity of computing power," while the company itself is "continuously in a state of insufficient computing power." To escape this "computing power desert," OpenAI is launching an unprecedented global resource competition, which has evolved from a software algorithm contest into a capital-intensive "industrial arms race" centered on its multi-pronged chip supply strategy.

First is the $100 billion alliance with Nvidia. OpenAI and Nvidia have already established a deep partnership, previously reaching a strategic cooperation agreement worth up to $100 billion to jointly deploy at least 10GW of AI computing systems. This is the cornerstone of OpenAI's computing power roadmap, ensuring its continuous access to the market's top AI chips.

Left: AMD CEO Lisa Su; Right: OpenAI CEO Sam Altman

Second is the balancing strategy with AMD. The 6GW chip agreement with AMD marks a crucial step in OpenAI's supply chain security. This move not only breaks Nvidia's monopoly but also wins valuable bargaining power and supply flexibility for OpenAI, sending a clear signal to the market: the future of AI will not be defined by a single supplier.

Finally, there is the collaboration with Broadcom on self-developed chips. According to The New York Times, OpenAI is working with chip design company Broadcom to invest $10 billion in jointly developing custom AI chips optimized for its models, to be manufactured by TSMC. This is OpenAI's long-term vision: to ultimately achieve complete control over core hardware through vertical integration, gaining unparalleled advantages in cost, performance, and iteration speed—similar to Google's self-developed TPU and Amazon's self-developed Graviton chips.

Jiedian Finance analyzed that this series of costly hardware deployments signifies OpenAI's complete transformation from a light-asset tech company into a heavy-asset giant requiring massive industrial investments. Including the "Stargate" supercomputing project in cooperation with cloud vendors like Oracle, its total infrastructure investment commitments have exceeded $1 trillion. Such enormous capital expenditures have completely reshaped the competitive threshold in the AI field. Today, competing in the most cutting-edge large model arena requires not just top algorithms and talent but also capital strength in the hundreds of billions of dollars and global supply chain integration capabilities.

The analyst also told Jiedian Finance that the "moat" constructed by OpenAI through capital and computing power is almost insurmountable, blocking most potential competitors at the door. The endpoint of this race is no longer just AGI but a strategic monopoly over the global core resources necessary to achieve AGI.

The sober voices on Wall Street, particularly represented by Goldman Sachs analyst James Schneider, have directly questioned the unusual transaction structures between OpenAI and its suppliers.

Schneider's core argument targets OpenAI's $100 billion investment agreement with Nvidia. The deal structure—where Nvidia invests in OpenAI, and OpenAI uses the funds to purchase Nvidia's chips—has been labeled "circular revenue" by Goldman Sachs. This model essentially involves suppliers providing customers with funds to buy their own products, creating a false sense of prosperity on the books.

This tactic is not unfamiliar in financial history. Around 2000, telecom equipment giants like Cisco and Lucent used similar methods to provide loans or equity investments to their customers to stimulate equipment sales. History has proven that this approach ended "not well" for all participants. A Morgan Stanley trader bluntly pointed out, "When a company pays customers to buy its own goods, it's usually not a good sign."

However, market bulls offer a starkly different interpretation from a strategic perspective. They argue that this is not merely a financial gimmick but a necessary move by Nvidia to secure long-term orders from its most important customer and consolidate the absolute dominance of its GPU technology roadmap in a severely supply-constrained market.

Behind this bull-bear debate lies OpenAI's staggering financial situation. According to disclosed financial documents, the company is burning cash at an alarming rate, potentially facing annual losses of up to $14 billion by 2026. Its massive infrastructure investment plans could create a funding gap of up to $62 billion in 2026 alone. Training the next-generation model like GPT-5 could cost up to $2.5 billion, according to HSBC estimates.

All of this points to a core question: Is OpenAI's business model sustainable?

Jiedian Finance analyzed that the "circular revenue" controversy is essentially a referendum on the entire AI investment logic. Bulls believe that AGI will create incalculable future value, making any unconventional investments to win this ultimate race justified. Bears argue that this is a house of cards supported by cheap capital and market frenzy, with a unit economic model that cannot achieve profitability, ultimately leading to collapse.

Epilogue

Looking back at the developer conference in San Francisco, the future Sam Altman described is undoubtedly thrilling: an omnipresent, deeply personalized AI that is not just a productivity tool but a "life advisor" run through (chuan4guan4: run through throughout) personal growth, career development, and every aspect of life.

This revolutionary vision underpins all of OpenAI's bold moves. However, the path to this vision is fraught with challenges.

OpenAI not only has to face continuous challenges from well-funded and ecologically complete competitors such as Google Gemini, but it must also navigate a globally tightening regulatory environment and handle copyright lawsuits arising from data scraping. Fundamentally, there is the ultimate question of profitability. While bearing astronomical infrastructure and research and development costs, whether OpenAI can establish a sustainable business model remains an unknown.

Therefore, when the dust settles, what remains for the market and the entire world is a grand question with no simple answer: Are we witnessing OpenAI successfully building a disruptive operating system for the age of intelligence? Or is this scenario, driven by unprecedented investment scale, non-traditional financial transactions, and irrational market exuberance, merely a glamorous facade of a historic tech bubble before it bursts? The answer to this question will not only determine the fate of a single company but will also define the future trajectory of the economy in the age of artificial intelligence.

*The cover image is generated by AI