"Suyuan" and "Biruin" successively IPO, the domestic AI chip listing wave is coming!

![]() 09/14 2024

09/14 2024

![]() 602

602

In recent years, the call for localization of AI chips has remained high, with startups such as Suyuan Technology, Moore Threads, and Biruin Technology already becoming star targets in the capital market.

On September 12, according to the official website of the China Securities Regulatory Commission, Shanghai Biruin Technology Co., Ltd. (Biruin Technology) announced the "Filing Report on Initial Public Offering and Listing Coaching," intending to conduct an initial public offering and list on the STAR Market, marking the commencement of Biruin Technology's IPO coaching on the STAR Market.

On August 28, the CSRC website updated that Shanghai Suyuan Technology Co., Ltd. (hereinafter referred to as "Suyuan Technology") signed an IPO coaching agreement with China International Capital Corporation Limited (CICC) on August 23, 2024, officially launching the A-share IPO process. Following Hanguji, Suyuan Technology and Biruin Technology have successively initiated AI chip IPOs, signaling the advent of a domestic AI chip listing wave?

01

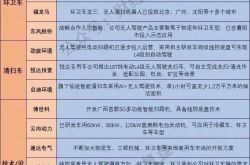

Comparison of Suyuan Technology and Biruin Technology

Biruin Technology

According to Hurun Research's "2024 Global Unicorn Index" released in April this year, Biruin Technology ranked 495th with a valuation of 15.5 billion yuan.

Founded in 2019, Biruin Technology is dedicated to developing original general-purpose computing systems, establishing efficient hardware and software platforms, and providing integrated solutions in the field of intelligent computing.

In terms of development path, Biruin Technology will initially focus on cloud-based general-purpose intelligent computing, gradually surpassing existing solutions in areas such as AI training and inference, graphics rendering, and more.

Biruin Technology's first general-purpose GPU chip, BR100

In March 2022, Biruin Technology lit up its first general-purpose GPU. In August of the same year, it released the first general-purpose GPU chip, setting a global computing power record with over 1000 TFLOPS for 16-bit floating-point computing and over 2000 TOPS for 8-bit fixed-point computing. The peak computing power of a single chip reached PFLOPS level, breaking the previous global computing power record held by international giants in general-purpose GPUs.

In July 2023, Biruin Technology and the Shanghai Artificial Intelligence Laboratory collaborated deeply based on the DeepLink open AI computing system, jointly promoting the construction of the AI hardware and software ecosystem.

Recently, at the 2024 Global AI Chip Summit, Biruin Technology unveiled its original Heterogeneous GPU Collaborative Training (HGCT) solution for the first time, supporting the mixed training of one large model using three or more heterogeneous GPUs for the first time in the industry. A unified solution supports multiple different models and vendors of GPUs, with a single line of code adapting to various frameworks.

Has raised over 5 billion yuan in cumulative funding

In terms of financing, Biruin Technology completed its Series A round in June 2020, raising a total of 1.1 billion yuan. In August 2020, it completed its Pre-B round, raising nearly 2 billion yuan in cumulative funding. In March 2021, it completed its Series B round, with total funding exceeding 5 billion yuan to date.

Biruin Technology has gathered a group of mainstream investment institutions, including Qiming Venture Partners, IDG Capital, Ping An, Walden International, Hillhouse Capital, Country Garden Ventures, New World Group, Source Code Capital, Gaorong Capital, China Merchants Capital, Gree Group, CITIC Securities Investment Co., Ltd., BAI Capital, China Creation Ventures, Huaying Capital, and Cornerstone Capital.

The reason Biruin Technology was able to raise such a significant amount of funding in such a short period, attract so many institutions, and produce products is closely related to its founding team.

Founder is former SenseTime President

Dr. Zhang Wen, the founder of Biruin Technology, graduated from Harvard Law School. He worked for many years at the United Nations and on Wall Street, holding positions such as senior lawyer and senior investor in the Pan-American and Asian markets on Wall Street. With his profound legal, financial, and business expertise, he played a vital role in numerous large mergers and acquisitions.

After years of experience abroad, Zhang Wen decided to return to China for development. In 2011, Zhang Rujing, the founder of Semiconductor Manufacturing International Corporation (SMIC), founded InnoLux Optoelectronics Technology Co., Ltd., and Zhang Wen was invited to serve as CEO. Another well-known identity of Zhang Wen is his previous role as President of SenseTime. In 2018, he became President of SenseTime, leading the company's headquarters to settle in Shanghai.

According to the introduction on Biruin Technology's official website, the team consists of core professionals and R&D personnel in the fields of chips and cloud computing from both China and abroad, with profound technical expertise and unique industry insights in areas such as GPUs, DSAs (Domain-Specific Accelerators), and computer architectures. It will initially focus on cloud-based general-purpose intelligent computing, gradually surpassing existing solutions in areas like AI training and inference, graphics rendering, and more, to achieve breakthroughs in domestic high-end general-purpose intelligent computing chips.

Suyuan Technology

According to Hurun Research's "2024 Global Unicorn Index," Suyuan Technology is valued at 16 billion yuan, ranking 482nd globally.

Founded in March 2018, Suyuan Technology specializes in cloud and edge computing products in the AI field, aiming to build a computing foundation for general AI by providing original and proprietary AI accelerator cards, system clusters, and hardware and software solutions. Its products are primarily used in various industries and scenarios such as the internet, smart computing centers, smart cities, smart finance, scientific computing, and autonomous driving.

Since its inception, Suyuan Technology has developed three generations of AI training and inference products, covering chips, boards, smart computing integrated systems, liquid-cooled computing clusters, and supporting software systems, applied in fields such as the internet, government affairs, finance, and manufacturing.

It is reported that the core competitive advantage of Suyuan Technology's products lies in AI computing power. For example, its inference accelerator cards, such as Suyuan i10 and i20, are highly capable. In the field of inference training, Suyuan Technology's Suyuan T10 is suitable for various training scenarios, while the advanced Suyuan T20 and T21 support higher-performance computing needs, making them ideal for training large-scale AI models.

Has raised nearly 7 billion yuan in cumulative funding

Suyuan Technology, established in 2018, has completed 10 rounds of funding in six years, with cumulative funding approaching 7 billion yuan. Notably, in September 2023, Suyuan Technology announced the completion of its Series D funding round, raising a total of 2 billion yuan, with over 15 institutions participating, making it one of the largest AI chip funding events that year.

Since leading the Pre-A round in 2018, Tencent has invested in Suyuan Technology six consecutive times. The internet company Meitu has also invested in the company, participating in the Series D round in September 2023.

The shareholder lineup is impressive, including national and local state-owned funds, internet companies like Tencent and Meitu, and financial investors such as ZhenFund, CPE China Fund, Sequoia Capital China, and Haisong Capital.

Upon reviewing the shareholders behind Suyuan Technology, it is evident that since leading the Pre-A round in 2018, Tencent has invested in the company six consecutive times, including the subsequent Series A, B, C, C+, and D rounds. According to the official website of Suyuan Technology, through years of continuous investment and business cooperation, Tencent and Suyuan Technology's Zixiao series chips have achieved more than twice the cost-effectiveness of similar products in the industry in areas such as OCR text recognition, intelligent conferencing, and image and voice noise reduction. With the Zixiao chips, Tencent is able to provide inclusive and high-quality AI solutions to customers in industries like finance and transportation.

In addition to Tencent, the internet company Meitu has also invested in Suyuan Technology, participating in the Series D round in September 2023. At the time, Meitu's Chairman and CEO Wu Xinhong mentioned that AIGC is becoming the fundamental driving force and source of transformation for Meitu's development, and high-performance, high-availability, and high-compatibility computing power is becoming an essential element for the company's growth. Suyuan Technology has a continuously advancing AI computing product roadmap, cost-effective systematic solutions, and original hardware and software platforms, which are highly complementary to Meitu's full-stack capabilities in AIGC foundational and vertical large models and diversified applications.

Founders hail from the "Dream Class" of Chips

According to the filing report, Zhao Lidong and Zhang Yalin directly hold and jointly control 32.5087% of the voting rights of the company through Shanghai Suyuan Huizhi Information Technology Consulting Partnership (Limited Partnership) and Shanghai Suyuan Chongying Information Technology Consulting Partnership (Limited Partnership). As the general manager and deputy general manager, they have signed a unanimous action agreement and are the company's joint actual controllers. There is no single shareholder with a direct holding of more than 30% of the company, and there is no controlling shareholder.

Suyuan Technology's founder Zhao Lidong graduated from the prestigious "Dream Class" of chips at Tsinghua University's Department of Wireless Communications, Class of 1985 EE85. This class has produced industry giants like Yu Renrong, the founder of WellLead Semiconductor and China's richest chipmaker, and Zhao Weiguo, Chairman of Yangtze Memory Technologies Co., Ltd. Zhao Lidong worked for many years at AMD, a multinational semiconductor company in the United States.

After graduating from the "Dream Class" at Tsinghua University, Zhao Lidong furthered his studies in electronics and computing at Utah State University in the United States. Upon graduation, he worked in Silicon Valley for over two decades. In 2007, he joined AMD as Senior Director of Product Engineering. In 2014, he joined Unisplendour Communication Technology Group Co., Ltd. as Vice President, overseeing semiconductor investment-related work. In 2018, after resigning from Unisplendour, Zhao Lidong teamed up with his former AMD colleague Zhang Yalin to establish Suyuan Technology in Shanghai, with the company's name derived from the phrase "igniting the spark that ignites the prairie fire." Zhao Lidong has stated that Suyuan Technology aims at the blue ocean market of technological competition rather than price wars.

02

Four trends behind successive IPOs

Four trends can be discerned behind the successive IPOs of two domestic AI chip companies:

First, in terms of the market, the future development of AI chips has become a major trend.

Compared to the past when AI was often just a PowerPoint presentation, AI has now become a clear and established trend. The impact of ChatGPT is significant, with both cloud-based large-scale data processing and intelligent applications for edge devices requiring powerful AI chips to provide computing support. For example, the demand for high-performance AI chips continues to rise in areas such as intelligent security, autonomous driving, and cloud computing. The development of AI can be considered a tidal wave of the times.

Second, in China, the development of AI chips is imperative.

In recent years, China has continuously increased its support for the AI industry, providing a solid foundation for industry development through a series of policies and measures. From national-level strategic planning to local government implementation details, these policies cover various aspects such as financial support, tax incentives, innovation platform construction, talent cultivation and introduction.

In July this year, the Ministry of Industry and Information Technology and three other departments jointly issued the "National Artificial Intelligence Industry Comprehensive Standardization System Construction Guide (2024 Edition)," systematically constructing the standard system for the AI industry, including basic commonalities, basic support, key technologies, smart products and services, providing more comprehensive guidance for industry development. By the end of 2023, the scale of China's core AI industry had approached 600 billion yuan.

Currently, China faces certain external pressures in the chip field. With the country's high priority and strong support for scientific and technological innovation, as well as domestic enterprises' continuous investment in technology research and development, the progress of domestic chips is accelerating. The development of domestic AI chip companies such as Suyuan and Biruin is a reflection of this trend in China's AI chip industry.

Third, in terms of chips, competition in the AI chip market is intensifying, accelerating the survival of the fittest.

The IPOs of Suyuan and Biruin indicate that competition in the AI chip market will become more intense. As more funds and resources pour into this field, competition among enterprises will unfold across various aspects such as technology, products, and markets.

To date, multiple domestic enterprises have established a presence in the AI chip field. Notable players in this sector include Hanbo Semiconductor, Tianshu Zhixin, Moore Threads, Denglin Technology, Aichip Microelectronics, Muxi, Haifei Technology, Moxin AI, Tianshu Zhixin, Yixin Technology, and more.

Baidu Kunlun Chip 2 is China's first general-purpose AI chip using GDDR6 memory, with deployments in finance, industry, education, and other fields. Since its inception, Kunlun Chip has undergone four rounds of funding, attracting well-known investors such as CPE China Fund, IDG Capital, Legend Capital, Primavera Capital, Linx Capital, HF Investment, and General Atlantic. Last year, BYD quietly invested in Kunlun Chip and announced plans for deeper cooperation in the future.

Tianshu Zhixin has officially launched its fully self-developed high-performance cloud-based 7-nanometer chip, BI, and product cards. BI is China's first fully self-developed, truly GPGPU cloud-based high-end training chip based on a general-purpose GPU architecture. Adopting industry-leading 7-nanometer manufacturing technology and 2.5D CoWoS packaging, it accommodates 24 billion transistors, supports mixed-precision data training such as FP32, FP/BF16, INT32/16/8, integrates 32GB HBM2 memory with a storage bandwidth of 1.2TB, and can perform 147 trillion FP16 calculations per second (147 TFLOPS@FP16) per chip.

Moore Threads has also released KUAE, China's first large-scale smart computing cluster solution capable of supporting up to 10,000 cards. For KUAE, it has introduced a complete solution, including the KUAE Cluster Management Platform and KUAE ModelStudio, a large model service platform. It has also signed contracts for projects such as the Qinghai Zero-Carbon Industrial Park 10,000-card cluster, Qinghai Plateau KUAE 10,000-card cluster, and Guangxi-ASEAN 10,000-card cluster.

Fourth, in terms of capital, tech giants like ByteDance and Ant Group are "competing" in the chip sector.

The current capital market has a high degree of interest in technology companies, particularly those related to AI. Investors are generally optimistic about the development prospects of the AI chip industry and are willing to provide financial support to promising enterprises.

ByteDance and Ant Group made their first investments in the chip sector this year. Tech giants like Tencent, Alibaba, and Meitu have also invested heavily in the chip sector, with internet giants backing unicorns like Suyuan Technology, ChangXin Memory, and Hanguji.

At the end of last year, Qingchun Semiconductor, a developer of high-end SiC power devices, raised hundreds of millions of yuan in its Pre-B round, led by Meitu Dragonball and co-invested in by Meitu Strategic Investment. In the upstream of the chip manufacturing industry, Meitu has a deeper involvement. Its venture capital arm has invested in optoelectronic chip developer Changxinsheng, analog-digital mixed-signal chip developer Xingeno, single-photon sensor chip developer Lingming Photonics, AI vision processor chip developer Aichip Microelectronics, and wafer manufacturer Rongxin Semiconductor.

Tencent's investment in the chip sector tends to focus more on "continuous betting." For example, as mentioned earlier, since leading the Pre-A round of funding for Suiyuan Technology in 2018, Tencent has invested in the company six consecutive times. Tencent has made similar substantial investments in the chip sector on multiple occasions. In 2022, Tencent invested in the DPU startup Yunbao Intelligence's new round of funding, amounting to hundreds of millions of Chinese yuan, with a post-investment valuation of nearly 9 billion Chinese yuan.

03

Conclusion

The successive initial public offerings (IPOs) of Suiyuan and Biren for AI chips represent a significant event. This move not only reflects the thriving development of the AI chip industry but also embodies the strategic planning and development needs of the companies themselves. Whichever company succeeds in going public will become the "second AI chip stock" after Cambricon's listing.

However, Cambricon, currently known as the "first AI chip stock," has not been able to shake off its losses even four years after its listing. According to the latest financial report, Cambricon incurred a net loss of over 600 million Chinese yuan in the first half of 2024, and the company's cumulative non-recurring profit and loss deduction has reached 5.001 billion Chinese yuan over the past four years.

Currently, it faces multiple challenges, including reduced research and development expenses and the challenges posed by the US "Entity List," issues that Suiyuan Technology and Biren Technology will also have to contend with after going public.