Meituan, Taobao, and JD.com Intensify Efforts, Instant Retail Ushers in a New Battle for E-commerce

![]() 09/20 2024

09/20 2024

![]() 556

556

E-commerce giants intensify efforts in instant retail, and Meituan embarks on a new battle! @FinanceNews Original Author | Grape Editor | Fern Shadow

Recently, many users have noticed that in JD.com's instant delivery section, the product categories available for delivery have expanded beyond fresh produce, flowers, supermarkets, and pharmaceuticals to include coffee and milk tea, all at affordable prices with free shipping. Could this be an attempt to compete directly with Meituan?

Not just JD.com, but e-commerce platforms like Taobao and Douyin have also intensified their efforts in instant retail over the past six months. Faced with this rapidly growing market, which is expanding at an annual rate of over 50%, e-commerce giants eager for growth are eyeing it up hungrily.

In fact, JD.com and Taobao's entry into instant retail was not later than Meituan's. Unfortunately, instant delivery is not their forte, and both platforms have long regarded instant retail as a supplement to their traditional e-commerce operations. However, amidst a period of weakening consumer spending and increasingly scarce traffic, this business model, which has already proven successful for Meituan, Sam's Club, and Dingdong Maicai, has once again caught the attention of industry leaders.

And as the leading player in instant retail, Meituan, which has just emerged victorious in the local lifestyle battle against Douyin, now finds itself embroiled in a new battle.

In the second quarter, Meituan's performance was formidable, with profitability significantly improved, achieving stability beyond expectations. As a vertical extension of Meituan's delivery services, instant retail is undoubtedly the next focus of the company's efforts.

With instant retail gaining momentum, the giants have found a new arena to compete in, and Meituan will rally its troops to defend its territory.

01 New Growth Opportunities for E-commerce

Although it has only gained popularity in recent years, instant retail has indeed brought new growth opportunities to offline entities and brands, transforming from an optional feature to a necessity in the retail industry.

'Instant retail' refers to a business model where customers place online orders, and the products are delivered within an hour or half an hour. Since its inception in 2015, it has gone through three stages of development: free growth, explosive growth, and refined operations.

Currently, instant retail has evolved into three main forms: the warehouse-store integration model represented by Hema and Yonghui Life; the small front-end warehouse model represented by Dingdong Maicai and Meituan Maicai, as well as the large front-end warehouse model represented by Pupu Supermarket; and the platform model represented by JD.com and Meituan.

As consumer habits rapidly evolve, users are migrating from shelf e-commerce, live streaming e-commerce, and community group buying towards instant delivery. The demand for instant delivery continues to rise. According to the "Instant Retail Industry Development Report (2023)," the instant retail market reached 504.286 billion yuan in 2022, with an average annual growth rate of around 50%. It is projected that by 2025, the market size will triple that of 2022, indicating significant growth potential.

It is said that instant retail will gradually achieve the vision of "everything can be delivered instantly," making an online "7-Eleven convenience store" a tangible reality.

Currently, the leading players in China's instant retail market are Meituan and Sam's Club. Since launching its Flash Sale business in 2018, Meituan has been active in instant retail for over six years. Its Flash Sale business now boasts approximately 9,000 Lightning Warehouses, with a total transaction value of 200 billion yuan in 2023. Meanwhile, Sam's Club operates around 400 front-end warehouses in China, contributing over 40 billion yuan in transaction value in 2023.

In the fresh produce e-commerce sector, Hema, Dingdong Maicai, Pupu Supermarket, and Meituan's Little Elephant Supermarket are the primary players in instant retail. In 2023, Hema announced that its main business had achieved profitability; Dingdong Maicai recorded a GMV of 21.97 billion yuan, turning its first profit; and Little Elephant Supermarket (formerly Meituan Maicai) reported a year-on-year increase of approximately 30% in transaction value.

For e-commerce platforms, entering the instant retail market is not just about competing for business but also about capturing user engagement time, enhancing user experience, and securing mobile entry points. Amidst slowing growth in traditional B2C e-commerce, instant retail represents a new frontier.

02 A New Battlefield for the Giants

JD.com, Taobao, and Douyin, leading players in the e-commerce industry, have all intensified their efforts in instant retail. Taobao Hourly Delivery, JD.com Instant Delivery, and Douyin Hourly Delivery have all increased their investments this year.

Taobao has ventured into the hourly delivery business through Tmall Supermarket and deepened its cooperation with Ele.me, addressing its shortcomings in instant retail delivery. With Ele.me's support, Taobao Hourly Delivery has expanded its supply range and enhanced traffic inflow.

In July this year, Taobao officially launched "Hourly Delivery," giving it prime real estate on the app's homepage, placing it alongside the "Recommendations" section. This means that merchants within the Hourly Delivery channel will benefit from a significant influx of public domain traffic from the Taobao app.

Since then, Hourly Delivery has been open to all brands and merchants on Taobao and Tmall, as long as they have local warehouses and can fulfill instant delivery demands.

Rival JD.com is not far behind. Even before Taobao's intensified efforts, JD.com Retail set three key battles for 2024 at the beginning of the year: content ecosystem, open ecosystem, and instant retail.

Relying on its eight major warehouses nationwide, over 1,500 cooperating supermarkets, and robust last-mile logistics capabilities, JD.com's instant retail boasts hourly delivery for all product categories since its inception in 2015.

In May this year, JD.com integrated its "Hourly Delivery" and JD Daojia services to launch "JD Instant Delivery," claiming the ability to deliver products within nine minutes. This service is prominently featured next to the homepage on the JD.com app, demonstrating its strategic importance. Literally, "Instant Delivery" upgrades the delivery time from "hours" to "seconds," emphasizing speed over "Hourly Delivery" and "JD Daojia."

Data shows that JD Instant Delivery has experienced rapid growth in user numbers, repurchase rates, and GMV, with monthly average order users and order volume surging by over 70% year-on-year in the first quarter.

Latecomer Douyin granted independent access to its "Hourly Delivery" business in October 2023. This year, Douyin launched the "Douyin Mall Edition" app, featuring Hourly Delivery on its homepage. Douyin has also introduced a new "Live Streaming + Instant Retail" model, combining real-time broadcasts with instant delivery services, enabling users to enjoy hourly delivery upon placing orders during live streams.

In the instant retail arena, Douyin's approach appears relatively cautious, akin to a tentative explorer. This may be related to its profitability pressures in the local lifestyle business.

Facing a market worth over a trillion yuan, every player aims to secure a larger market share as soon as possible, driving rapid growth in performance. The reason why e-commerce giants like JD.com and Taobao are sparing no effort to compete with Meituan is that this is not just a battle for business but also for the future landscape of e-commerce. The more money they make, the better stories they can tell.

03 Meituan's New Battle

The common opponent for e-commerce giants in instant retail is Meituan, a seasoned player deeply entrenched in the local lifestyle sector.

For JD.com and Taobao, instant retail represents a new growth area beyond their traditional B2C e-commerce businesses. However, for Meituan, whose core lies in the local lifestyle sector, instant retail is a "lifeline" that must be secured.

Wang Xing has repeatedly emphasized that Meituan aims to expand its physical retail offerings, with instant retail serving as a crucial path to achieve this goal. In 2018, Meituan launched Flash Sale and established a dedicated Flash Sale Division, positioning it as an instant retail platform.

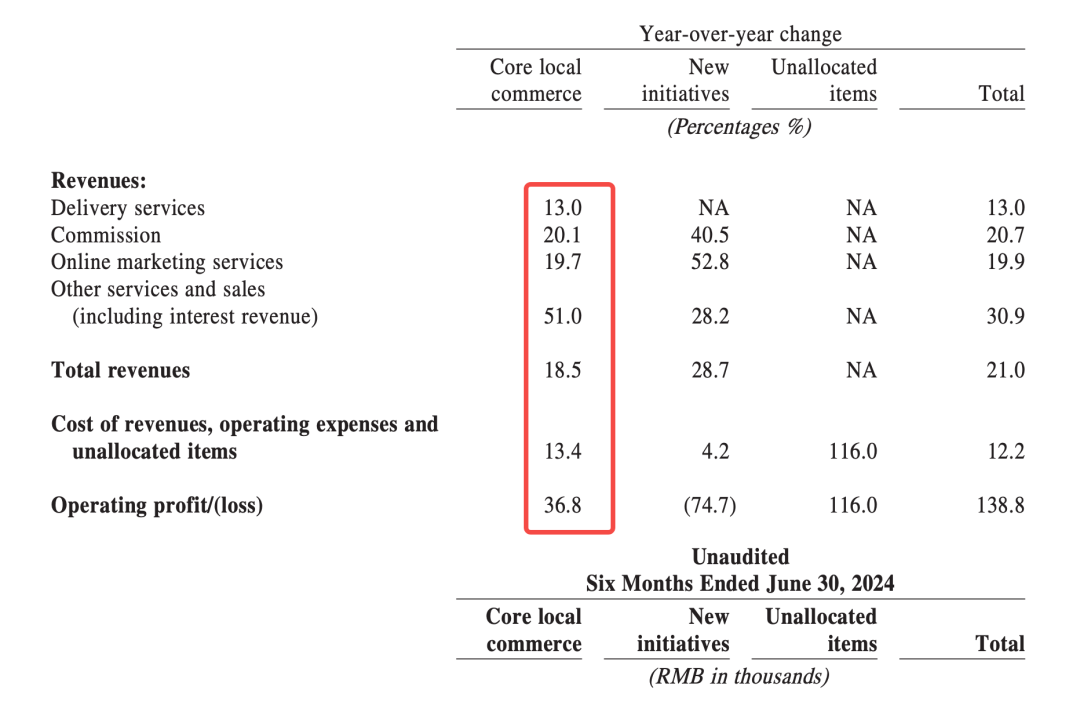

From Meituan's financial reports, it is evident that Flash Sale, along with food delivery, in-store dining, hotel and travel, homestays, transportation ticketing, and other services, form the core of Meituan's local business. In the second quarter of 2024, Meituan's core local business revenue reached 60.7 billion yuan, accounting for approximately 74% of total revenue.

Although the direct contribution of instant delivery to Meituan's revenue is not specified, the business grew by 13% year-on-year in the second quarter, with 6.2 billion delivery orders, averaging over 68 million orders per day, underscoring its importance within the company.

As e-commerce giants enter the fray, traditional offline supermarkets and daily necessities stores have also been active. In the first quarter of 2024, Yonghui's online business revenue reached 4.1 billion yuan, up 1.99% year-on-year, accounting for 18.92% of the company's total revenue. After a four-year hiatus, Hema has recently relaunched its instant retail front-end warehouse model. Miniso launched a new format, "24-Hour Superstore," catering to consumers within a 3-10 km radius who can place online orders and receive one-hour delivery, with over 200 stores already operational.

Many third-party service providers and express delivery companies have also joined the fray. S.F. Express SameCity, with its efficient delivery services, has successfully integrated with platforms like Douyin Hourly Delivery and Oriental Selection Hourly Delivery. Courier companies like YTO Express and Cainiao have further enriched delivery options in the instant retail market by introducing time-sensitive products like "Same-City Express" and "Same-City Half-Day Delivery."

Facing cross-industry competitors, Meituan faces considerable pressure. Despite years of organizational restructuring and business streamlining, Meituan has gradually found its rhythm in the local lifestyle business, which encompasses instant retail. However, as rivals descend upon it like hungry wolves, Meituan is bound to be embroiled in another arduous battle. As an internet giant seasoned by countless skirmishes, Meituan must remain vigilant at all times.