High losses, low gross margins, and facing gambling agreements, Shanhui Technology once again rushes towards IPO

![]() 09/24 2024

09/24 2024

![]() 559

559

LAIKA

2024/09/23

Business is tough, and a good man needs many helpers.

Recently, Shanhui Technology Co., Ltd. (hereinafter referred to as "Shanhui Technology"), a second-hand electronic consumer platform invested by multiple star enterprises such as Xiaomi and Zhuanzhuan, has once again launched a sprint towards the Hong Kong Stock Exchange, with TsingKe Capital as the exclusive sponsor. In February of this year, Shanhui Technology also submitted its listing application to the Hong Kong Stock Exchange, but it expired at the end of August.

Public data shows that Shanhui Technology, founded in 2016, is a Chinese company engaged in providing after-market trading services for consumer electronics products, focusing on the mobile phone recycling service market. According to Frost & Sullivan, in terms of the total value of trade transactions recycled from consumers in 2023, the company is China's largest offline trade-in mobile phone recycling service provider and China's third-largest mobile phone recycling service provider, with market shares of approximately 7.4% and 1.4%, respectively.

In terms of financial performance, Shanhui Technology's revenue has continued to grow over the past three years, with a compound annual growth rate of approximately 26%, but it is still suffering from annual losses, and its gross margin hovers around single digits. In the first half of this year, Shanhui Technology achieved revenue of RMB 577 million, a net loss of RMB 40.13 million, gross profit of RMB 25.9 million, and a gross margin of 4.5%.

01

Business from Recycling to Resale

Submitting listing applications twice a year amidst gambling agreements

Regarding Shanhui Technology, it may not be unfamiliar to mobile phone users who prefer trade-ins.

Currently, Shanhui Technology has established and developed two core corporate brands, namely "Shanhui Recycling" and "Shanhui Youpin". Among them, "Shanhui Recycling" is the company's primary brand for conducting offline recycling operations, acquiring second-hand consumer electronics products from individual consumers through upstream procurement partners. "Shanhui Youpin", on the other hand, is the company's main brand for selling procured second-hand consumer electronics products to customers through its own online platform and/or third-party e-commerce platforms.

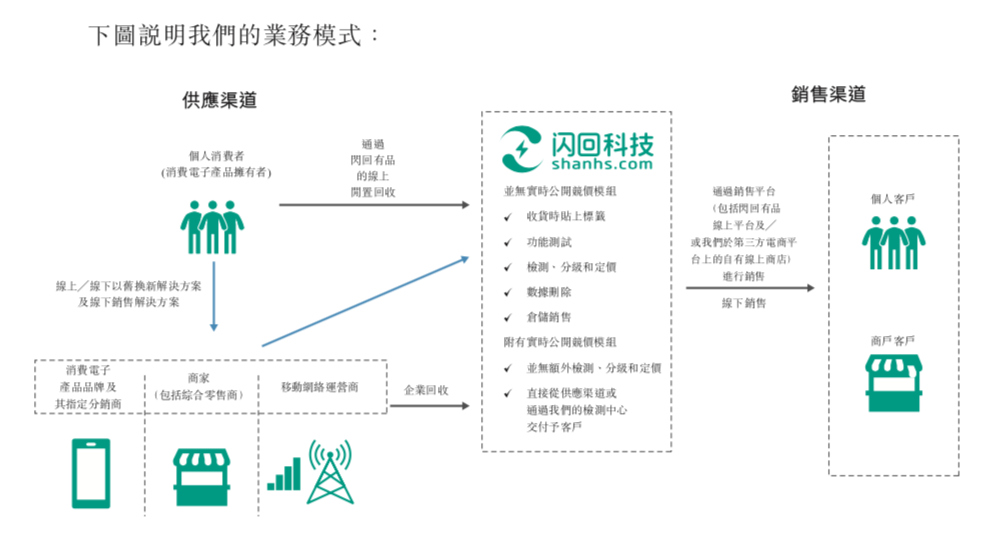

In terms of its business model, based on proprietary inspection, grading, and pricing technologies, as well as recycling and sales platforms, Shanhui Technology primarily obtains second-hand consumer electronics products from upstream procurement partners through offline and/or online stores. Simultaneously, it sells these products to various buyers in the second-hand consumer electronics market through its "Shanhui Youpin" brand and its own online stores operating on multiple third-party e-commerce platforms, achieving standardized resale of second-hand mobile phones through trade-in discounts. To meet customer demand, Shanhui Technology also sells bulk purchases of consumer electronics products offline and provides various value-added and after-sales services.

[Illustration: Shanhui Technology's business model, sourced from the prospectus]

According to the prospectus, Shanhui Technology has comprehensive official cooperation qualifications with mainstream mobile phone brand manufacturers such as Xiaomi, Samsung, Honor, vivo, and Apple. It has also established in-depth cooperation with China Mobile, China Unicom, and China Telecom, the three major telecom operators in China. Simultaneously, it has established good cooperative relationships with leading mobile phone retailers across provinces, cities, and counties nationwide, with over 130,000 partner stores spread across 32 provinces and cities in China.

The founder and chairman of Shanhui Technology is Liu Jianyi, who has 18 years of experience in the telecommunications industry. Back in 2003, Liu Jianyi joined Tianyin Holding, the largest mobile phone distributor in China, where he was primarily responsible for expanding and managing business relationships with mobile network operators in the telecommunications sector. After leaving Tianyin Holding, Liu Jianyi served as a supervisor at Shenzhen Huishoubao Company in 2015, overseeing channel strategy and operations. Subsequently, he founded Shanhui Technology. The CEO of Shanhui Technology is Yu Hairong, who was appointed in January of this year.

From its inception to the present, Shanhui Technology has completed five rounds of funding. In 2018, Shanhui Technology received nearly RMB 100 million in Series A funding from Xiaomi Group and Shunwei Capital. In 2019, it received Series B funding from Qingtong Capital. In 2020, it received Series B+ funding from GanYue Fund Management Co., Ltd. In 2021, it received Series C funding from Shenzhen Guarantee Group, Cowin Capital, and Shenzhen Zhicheng Investment, while Zhuanzhuan also participated in the investment of Shanhui Technology through equity acquisition. In December 2023, Shanhui Technology completed its Series D1 funding of USD 8 million, accounting for 2.33% of the shares. Based on this round of funding, the latest valuation of Shanhui Technology reached USD 343 million (approximately RMB 2.432 billion).

According to the prospectus, in Shanhui Technology's pre-IPO shareholder structure, founder Liu Jianyi holds 31.71% of the shares through ShanHuiShou BVI. Lei Jun's Shunwei Technology and Hangzhou Shunying hold 3.90% of the shares through Shanghai Wenwei. Xiaomi holds 6.83% of the shares through Shanghai Jiaozeng. Cowin Capital holds 8.50% of the shares through Shanghai Xiuhui.

According to Caixin Global reports, during various funding rounds, Shanhui Technology signed redemption rights and gambling agreements with investors in Series A, Series A-1, and Series C. Judging from the terms, Shanhui Technology has failed to meet the requirements regarding the deadline for going public. For instance, in the latest Series C funding, the terms stipulated that Shanhui Technology must complete a qualified initial public offering by December 31, 2023. The prospectus mentions that all parties agreed to suspend the redemption rights from the date of submitting the listing application. However, if the listing application is withdrawn, rejected, or not completed within the specified period, the rights will automatically resume.

02

High Losses and Low Gross Margins

The Business of Second-hand Price Differences is Challenging

As the third-largest mobile phone recycler in China, Shanhui Technology has once again demonstrated the difficulties of the second-hand business through various financial data.

According to the prospectus, from 2021 to 2023, Shanhui Technology achieved revenues of approximately RMB 750 million, RMB 920 million, and RMB 1.16 billion, respectively, with a compound annual growth rate of approximately 26%. However, the company incurred losses of approximately RMB 48.7 million, RMB 99.1 million, and RMB 98.3 million during these three years.

The primary reason for consecutive losses over the past three years stems from increased sales costs, encompassing three aspects: Firstly, the increase in procurement volume due to continuous business growth and the expansion of supply channels through new strategic partnerships with more mainstream consumer electronics brands; secondly, the continuous upgrading of new mobile phone models, resulting in higher procurement costs compared to older models; thirdly, intensified competition in the mobile phone recycling service market, leading to an overall increase in procurement costs.

Data shows that from 2021 to 2023, Shanhui Technology procured approximately 1.033 million, 1.173 million, and 1.505 million second-hand consumer electronics products (primarily mobile phones) through upstream procurement partners using trade-in methods. The total procurement transaction values were approximately RMB 538 million, RMB 659 million, and RMB 839 million, respectively.

In the first half of this year, Shanhui Technology's loss amounted to RMB 40.1 million, primarily due to a decrease in gross profit. This decrease was attributed to the increase in the recycling prices of second-hand mobile phones of similar models and quality under the trade-in solution compared to previous years, as well as the increase in commissions paid to front-desk sales staff at upstream procurement partner stores to cope with the increasingly competitive market environment and challenging macroeconomic conditions.

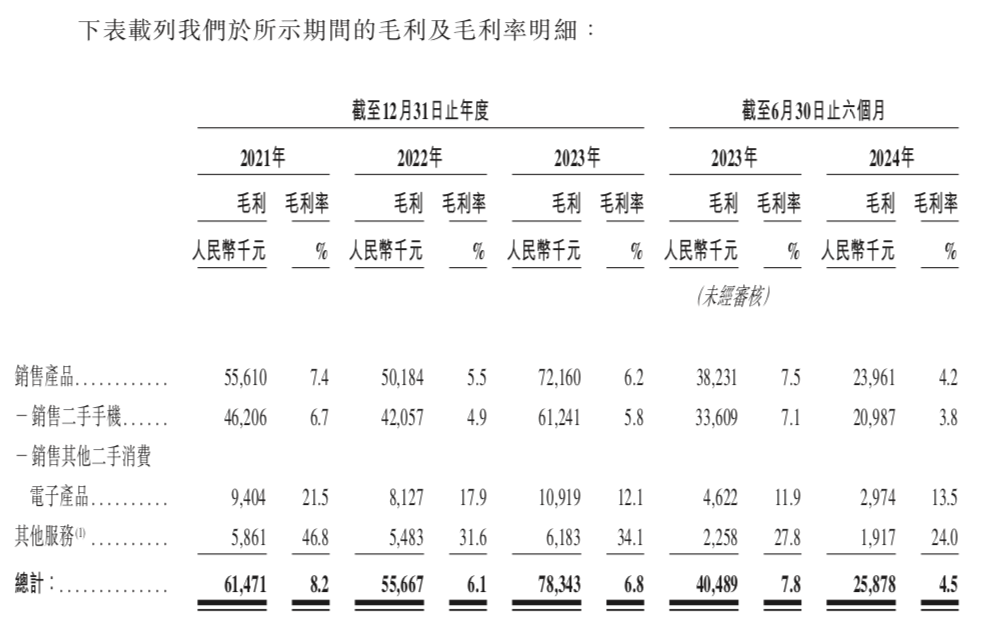

In terms of gross profit performance, from 2021 to 2023, Shanhui Technology's gross profits were RMB 61.47 million, RMB 55.67 million, and RMB 78.34 million, respectively, corresponding to gross margins of 8.2%, 6.1%, and 6.8%. In the first half of this year, Shanhui Technology's gross margin plummeted to 4.5%. This change in gross margin primarily reflects the difference between the price paid by Shanhui Technology to procure second-hand consumer electronics products from supply channels and the resale price on its sales platform.

[Illustration: Gross Profit and Gross Margin Breakdown of Shanhui Technology, sourced from the prospectus]

For comparison, the gross margin of a similar second-hand consumer electronics trading platform, Wanwu Xinsheng (Aihuishou), has consistently remained at around 20%. Data shows that from 2021 to 2023, Wanwu Xinsheng's gross margins were 26.3%, 23%, and 20.3%, respectively, with a gross margin of 20% in the first half of this year.

To stabilize and improve its gross margin, Shanhui Technology has consistently strived to maintain supply sources and expand supply channels through strategic cooperation with upstream procurement partners. It has also expanded sales channels to increase sales and customer base. However, Shanhui Technology has also mentioned that it cannot guarantee the ability to maintain or increase its gross margin in the future.

The prospectus also shows that as of December 31, 2021, 2022, and 2023, as well as June 30, 2024, Shanhui Technology recorded net current liabilities of approximately RMB 237 million, RMB 336 million, RMB 631 million, and RMB 672 million, respectively. Its net liabilities were approximately RMB 235 million, RMB 333 million, RMB 622 million, and RMB 662 million, respectively.

According to the prospectus, Shanhui Technology intends to use the net proceeds from its IPO primarily to further strengthen strategic cooperation with upstream resource partners to continuously expand its transaction service coverage and national reach, consolidating its market position in China's offline mobile phone trade-in recycling services. It also plans to increase technical and R&D capabilities to continually enhance business product and operational efficiency, intensify marketing efforts and explore new sales channels to steadily increase sales and profit margins, and make strategic investments or potential acquisitions of companies whose products or services complement its current offerings and align with its growth strategies. Additionally, the funds will be used for working capital and general corporate purposes.

03

Market Optimism, Intense Competition, and Industry Challenges to be Addressed

In terms of the overall consumer market and policy support, the trading market for second-hand consumer electronics in China is still rapidly developing, with mobile phones accounting for the majority of the market share, at approximately 75% in 2023.

According to Frost & Sullivan's report, China's market for mobile phone trade-ins has grown rapidly, from RMB 4 billion in 2019 to RMB 14.2 billion in 2023, with a compound annual growth rate of approximately 37.3%. It is projected to further increase to RMB 56.5 billion by 2028. In terms of idle mobile phone recycling transactions, the figure has risen from approximately RMB 18.8 billion in 2019 to RMB 48.7 billion in 2023 and is expected to further increase to RMB 132.9 billion by 2028.

Regarding mobile phone recycling rates, in 2023, China's mobile phone recycling rate was approximately 32.1%, compared to approximately 55% to 75% in developed countries such as the United States and Japan. This indicates significant room for growth in China's mobile phone recycling industry.

In March of this year, the State Council issued a notice on the "Action Plan for Promoting Large-scale Equipment Renewal and Trade-ins of Consumer Goods," requiring the improvement of the recycling network for used products and equipment and supporting the circulation and trading of second-hand goods. Currently, relevant departments and local governments are successively introducing a series of supporting measures to effectively promote the implementation of the "two new" actions.

Despite the promising market outlook, there are numerous participants and intense competition. According to Frost & Sullivan data, in terms of total transaction value, the market share of the top five mobile phone recycling service providers in 2023 was only 21%, with Wanwu Xinsheng, Zhuanzhuan, and Shanhui Technology ranking first, second, and third, respectively, with market shares of 9.1%, 8.4%, and 1.4%.

Simultaneously, changes in the consumer environment and inherent industry issues pose challenges to the second-hand mobile phone market. For instance, as consumers may take longer than expected to purchase and sell second-hand mobile phones, the turnover rate of recycled devices decreases. Additionally, the lack of unified inspection and recycling standards in China's mobile phone recycling industry, with different recycling companies using their own standards, not only affects the overall efficiency of the industry but may also confuse and inconvenience consumers.

Recently, the topic "#Your Old Phone May Betray You When You Sell It" trended on social media, sparking concerns about the ease with which privacy can be compromised in second-hand mobile phones.

Regarding privacy issues related to the collection, storage, and use of personal information in second-hand consumer electronics and personal data, Shanhui Technology states in its prospectus that due to the nature of its business, it may inevitably collect, store, and use personal information during its service process. However, it also maintains a data purging policy, including mandatory data deletion after obtaining second-hand consumer electronics products from upstream procurement partners' offline stores and before resale from its operation centers. Nevertheless, consumers remain concerned about the improper handling of their personal information, leading to a general lack of confidence in the privacy security of second-hand consumer electronics.

Furthermore, disputes related to second-hand mobile phone transactions continue to emerge. On HeiMao Complaints, there are tens of thousands of complaints against various second-hand mobile phone trading platforms, with common issues including discrepancies between inspection reports and actual product conditions, poor quality of purchased products, and malicious price reductions. Media reports have indicated that multiple consumers have pointed out that their mobile phones were in perfect condition before shipping but were subsequently subject to price reductions by platforms due to reasons such as screen scratches or device damage, resulting in price differences of hundreds or even thousands of yuan.

Amidst this second-hand industry characterized by a lack of standards and a highly fragmented market, it remains to be seen whether Shanhui Technology can successfully navigate the listing process on the Hong Kong Stock Exchange.