Mobile phone manufacturers are fiercely competing, but can they boost sales through this competition?

![]() 10/08 2024

10/08 2024

![]() 537

537

In the current and future period, the comprehensive update of chips supporting AI may bring more new ideas to the entire mobile phone industry.

'Golden September' for high-end phones and 'Silver October' for flagship phones, mobile phone manufacturers are fiercely competing this autumn, vigorously using new products to attract users to upgrade their phones and seize more market share.

Just in September, Huawei and Apple, two archrivals, held their new product launches on the same day. In brief, the highlights of each side are Apple's first AI phone, while Huawei leveraged its form factor advantage to unveil its first tri-foldable phone, and the latest Kirin chip is expected to debut on the AI phone Mate70 series in October.

Combining the selling points of major mobile phone manufacturers over the past year, it can be seen that foldable screens and AI have become relatively certain competitive directions for the industry.

A senior industry observer told Lujiu Business Review that although mobile phone manufacturers have almost universally set foldable screens as the entry point for their high-end lines, he believes that the likelihood of manufacturers following Huawei's footsteps and accelerating the launch of tri-foldables is not high. After all, in terms of brand positioning, Huawei is a unique entity. "In the future, manufacturers will likely focus more on the AI direction."

AI-driven, escalation of competition

It is not an exaggeration to describe today's mobile phone industry as a "chaotic battlefield."

In addition to Huawei announcing its first tri-foldable phone and Apple launching its first AI phone in September, the most anticipated new product at the October launch was Xiaomi 15. In particular, Lu Weibing, President of Xiaomi Group and Mobile Phone Division, stated that Xiaomi 15's AI experience is closer to Chinese users, creating a stark contrast with Apple products.

Honor has also been active. While Xiaomi 15 is the first model to use Qualcomm Snapdragon 8 Elite, rumors suggest that the upcoming Honor Magic7 series will also feature Qualcomm Snapdragon 8 Elite. With the launch approaching, both sides are likely on edge.

In Lujiu Business Review's conversations with mobile phone manufacturers, it was found that while most manufacturers will focus on their strategic plans and not deliberately follow Huawei's footsteps to launch tri-foldables, the goal of expanding the mid-to-high-end market with foldable phones is still progressing. In particular, as new products continue to flood the market and prices gradually decrease, foldable phones are transitioning from novelty to everyday use.

Another universally recognized direction in the industry is AI phones. Whether as a preliminary exploration or a formal entry into the market, many mobile phone manufacturers have entered the AI race since 2023.

Reviewing the products currently on the market claiming to be AI phones, it can be seen that the AI phones defined by manufacturers not only possess efficient computing power, strong perception capabilities, self-learning abilities, and creative abilities but also provide continuous inspiration and knowledge support, serving as intelligent assistants for individual users. This may become the ultimate form of AI phones.

However, current AI phones are still in the exploration stage, achieving partial AI intelligence through vision and hearing.

Currently, iPhone 16's primary AI functions focus on collaboration between apps, Siri's intelligent speech recognition, text-to-speech editing, and image and video editing. However, this is merely a glimpse into the true capabilities of AI phones.

Previously, Samsung's AI phone features were not significantly different from those announced by Apple this time. Core functions include real-time translation, voice assistant, smart camera, scene recognition, and health management. Additionally, Samsung's AI phones boast unique features such as instant search, vertical free-hand shooting system, note assistant, and simultaneous interpretation capabilities.

It can be seen that although manufacturers hope to differentiate their AI phones, the homogenization of core functions remains severe.

Sun Yanbiao, Chairman of Chaodian Intelligence, told Lujiu Business Review that from a product perspective, AI phone homogenization is an inevitable trend. Whether it's major phone manufacturers or telecom operators, their product functions are fundamentally similar, differing mainly in whether they emphasize AI processing on the phone side or in the cloud. Consumers will ultimately choose based on which method is more convenient.

At this stage, the manufacturer with more users will be stronger in the future AI phone race. In Sun Yanbiao's view, AI phones ultimately influence consumer usage habits. Therefore, the stronger a manufacturer's ability to influence these habits, the more significant its foothold in the AI phone sector will be. Currently, Xiaomi and Apple appear to have a good chance.

Emphasis on in-house research and development, as well as collaboration

However, it should be emphasized that while the AI direction is clear, mobile phone computing power remains limited. In reality, AI hardware primarily drives cloud servers.

In its recent report titled "The Present and Future of AI Phones," international data analysis firm Canalys predicts that AI phones are leading the mobile communications industry into a new stage of development. As the largest application model for AI phones at this stage, generative AI phones will account for 16% of the global market share in 2024, rising to 54% by 2028.

To capitalize on this trend, manufacturers are collaborating with large model companies.

Samsung is a prime example of benefiting from the "hundred-meal" large model dividend. Taking the sixth-generation foldable phones Galaxy Z Fold6 and Galaxy Z Flip6, launched on July 17, as examples, in addition to previous collaborations with Baidu Intelligent Cloud, Meitu, Kingsoft Office, Samsung has added Volcano Engine to provide smart assistant and AI visual access to Doubao's large model for its latest foldable phones.

After lengthy preparations and negotiations, Apple finally reached a strategic partnership with OpenAI. Rumors suggest that ChatGPT will be integrated into iOS 18 before the end of 2024. Meanwhile, Apple is also rumored to be joining Baidu's Wenxin large model, though sources indicate that Apple is also in contact with other large model providers beyond Baidu.

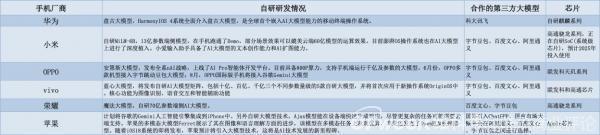

Now, let's turn to domestic mobile phone manufacturers' moves in the large model direction.

Earlier, Huawei integrated its own Pangu large model into its phones, enabling them to perform complex tasks such as text generation, knowledge retrieval, data summarization, intelligent arrangement, fuzzy and complex intent understanding.

Lei Jun revealed in his annual speech that Xiaomi had formed a large model team in April this year, and the large model for mobile phones had been initially operational. Prior to this, Lei Jun had already clarified Xiaomi's direction for developing large models, focusing on lightweight and local deployment.

Almost simultaneously, OPPO also announced the upcoming large-scale experience event for its new Xiao Bu assistant, powered by AndesGPT, a generative large language model built by OPPO Andes Intelligence Cloud Team based on a hybrid cloud architecture.

Following this, vivo launched the Lanxin large model, which is also lightweight and facilitates localized data processing on mobile phones. Honor, on the other hand, introduced its self-developed 7 billion-parameter platform-level AI large model for the end side.

To enhance "intelligence" by expanding training data, major manufacturers have chosen to introduce external large model service providers since 2024.

Earlier this year, Honor integrated YOYO with Wenxin ERNIE Bot, leveraging AI assistants to access large model capabilities. In May, Volcano Engine announced a partnership with OPPO, vivo, Honor, Xiaomi, Samsung, and ASUS to establish the Smart Terminal Large Model Alliance. The following month, Xiaomi's AI assistant "Xiaoai Classmate" also collaborated with Volcano Engine, among others.

According to public data, Xiaomi, OPPO, vivo, and Honor have integrated, to varying degrees, the large model products of Alibaba Tongyi, Baidu Wenxin, and ByteDance Doubao. Industry insiders believe that the direct purpose of mobile phone manufacturers integrating with different service providers is to rapidly improve the AI performance of their phones by leveraging the power of various large models.

The underlying layer is also competitive in 'chips'

As AI becomes the primary direction for mobile phone manufacturers to compete, the chip capabilities behind it are also the core of the competition among manufacturers.

For example, the reason Huawei's tri-foldable phone starts at 19,999 yuan is due to its adoption of the self-developed Kirin 9010 chip. It is reported that the upcoming Mate70 series, not only is expected to be equipped with this latest Kirin chip but also features the new HarmonyOS NEXT system, leveraging AI algorithms to enable functions such as image recognition and voice assistant.

Apple's new iPhone 16, as the company's first AI phone, is powered by the A18 chip, Apple's second-generation 3-nanometer chip. The A18 chip offers a 30% speed increase over its predecessor, a 40% faster GPU, and optimizations for running large AI generative models.

However, with AI's support, questions remain as to whether the iPhone 16 series can help Apple embark on a new "super cycle." Lujiu Business Review noted that during the introduction of iPhone series products and Apple Intelligence, Apple's stock price fell from gains, dropping by more than 1% at one point, before gradually recovering after the event.

In Android flagship phones, as the industry's top-tier chip manufacturers Qualcomm and MediaTek have firmly chosen the "dual super-large core" strategy and launched new products, this confirms Lu Weibing's view that "this year will mark a turning point for the chip industry."

Based on current conditions, Qualcomm and MediaTek have officially announced that they will release their next-generation flagship phone chips in October—Qualcomm will unveil the Snapdragon 8 Gen 4, while MediaTek will release the Dimensity 9400, followed by the immediate launch of the first models by phone brands.

Among them, vivo's X200 series, powered by the Dimensity 9400, will be the first to hit the market with its flagship model, scheduled for release on October 14.

Meanwhile, Qualcomm's Snapdragon 8 Elite has been confirmed to debut on Xiaomi 15 series. Although Xiaomi has not yet announced the release date for Xiaomi 15, the Snapdragon Summit is scheduled for October 21-23, so Xiaomi 15 is sure to be released in mid-to-late October.

The highlight of the Snapdragon 8 Elite lies in its first-ever use of custom "Phoenix" cores, with the CPU's maximum frequency reaching 4.32GHz, even for the large cores, which reach 3.52GHz. Specifically, it consists of two 4.32GHz super cores and six 3.52GHz large cores.

Currently, benchmark scores for the Snapdragon 8 Gen 4 have been exposed online, with a single-core score of 3,216 and a multi-core score of 10,051. The multi-core score surpasses Apple's A18 Pro, and the single-core score is close. If heat dissipation and power consumption can be stabilized, it will become this year's performance champion.

'2024 is a turning point for the chip industry, and in the coming month or so, we will see this turning point unfold,' Lu Weibing bluntly stated in a September tweet about the direction of mobile phone competition this year.

In the current and future periods, the comprehensive update of chips supporting AI may bring more new ideas to the entire mobile phone industry.