Who is the most profitable company in Huawei Consumer Electronics?

![]() 10/15 2024

10/15 2024

![]() 750

750

Huawei's Consumer Electronics business covers a wide range of products, including smartphones, tablets, PCs, VR devices, wearable devices, smart screens, smart audio devices, smart speakers, and in-car devices. Smartphones are one of the core products of Huawei's Consumer Electronics business, occupying a significant market share.

Profitability is typically measured by the amount and level of earnings generated by a company over a specific period. The analysis of profitability involves a deep dive into a company's profit margins.

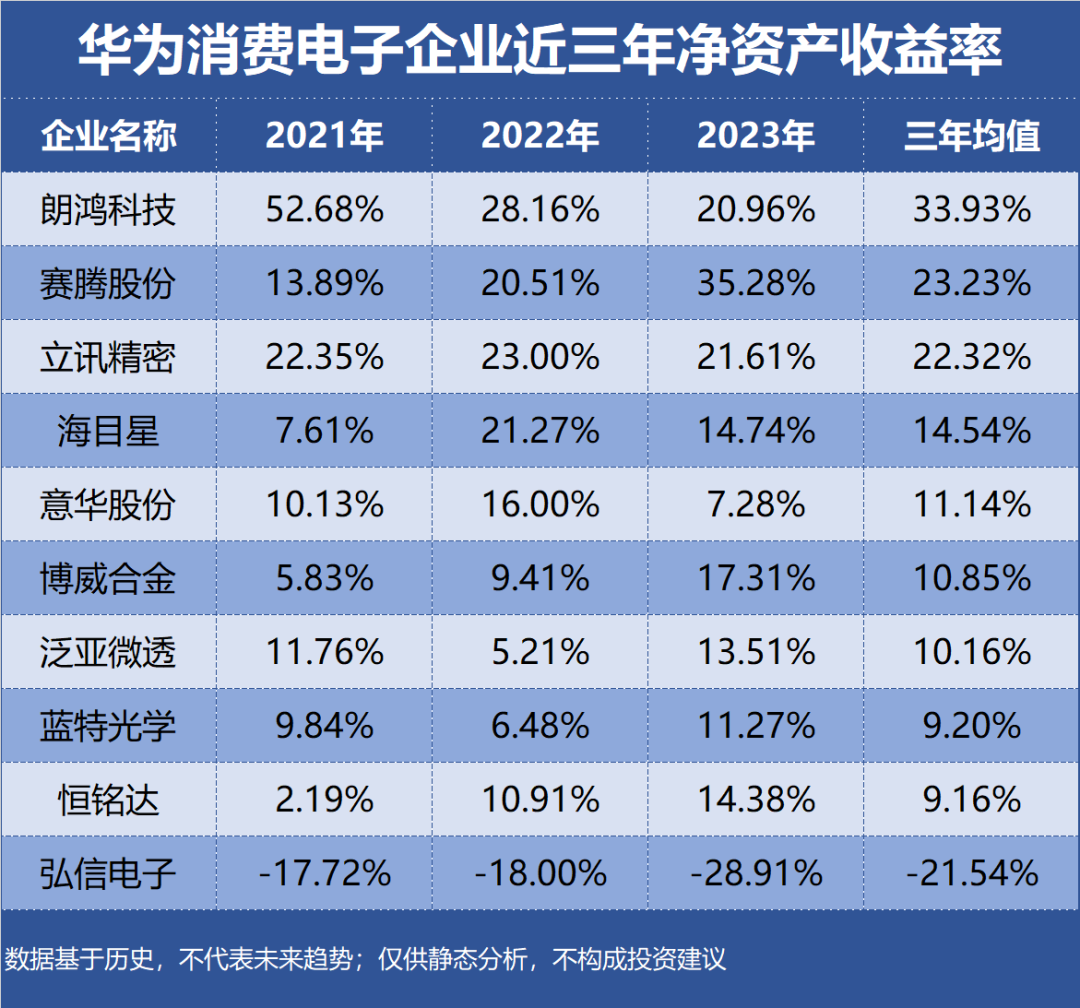

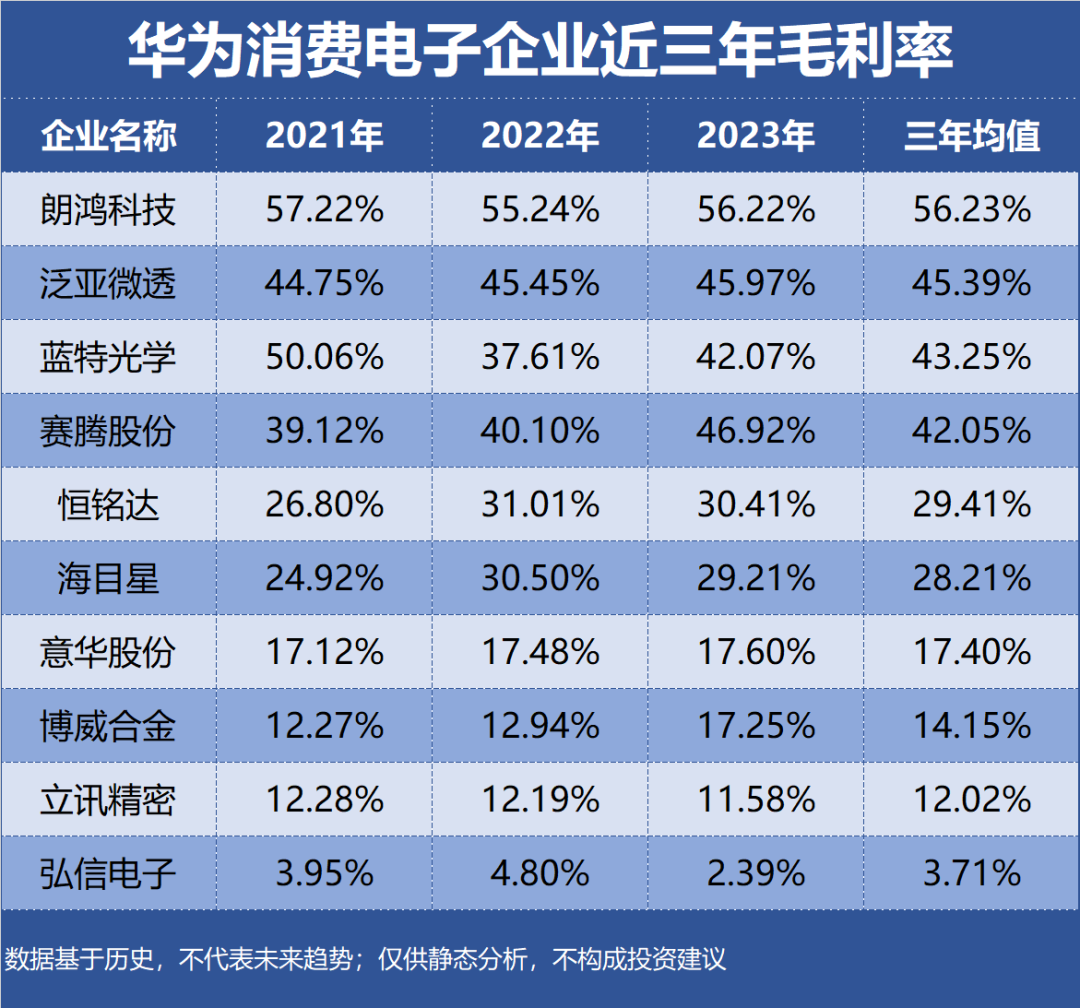

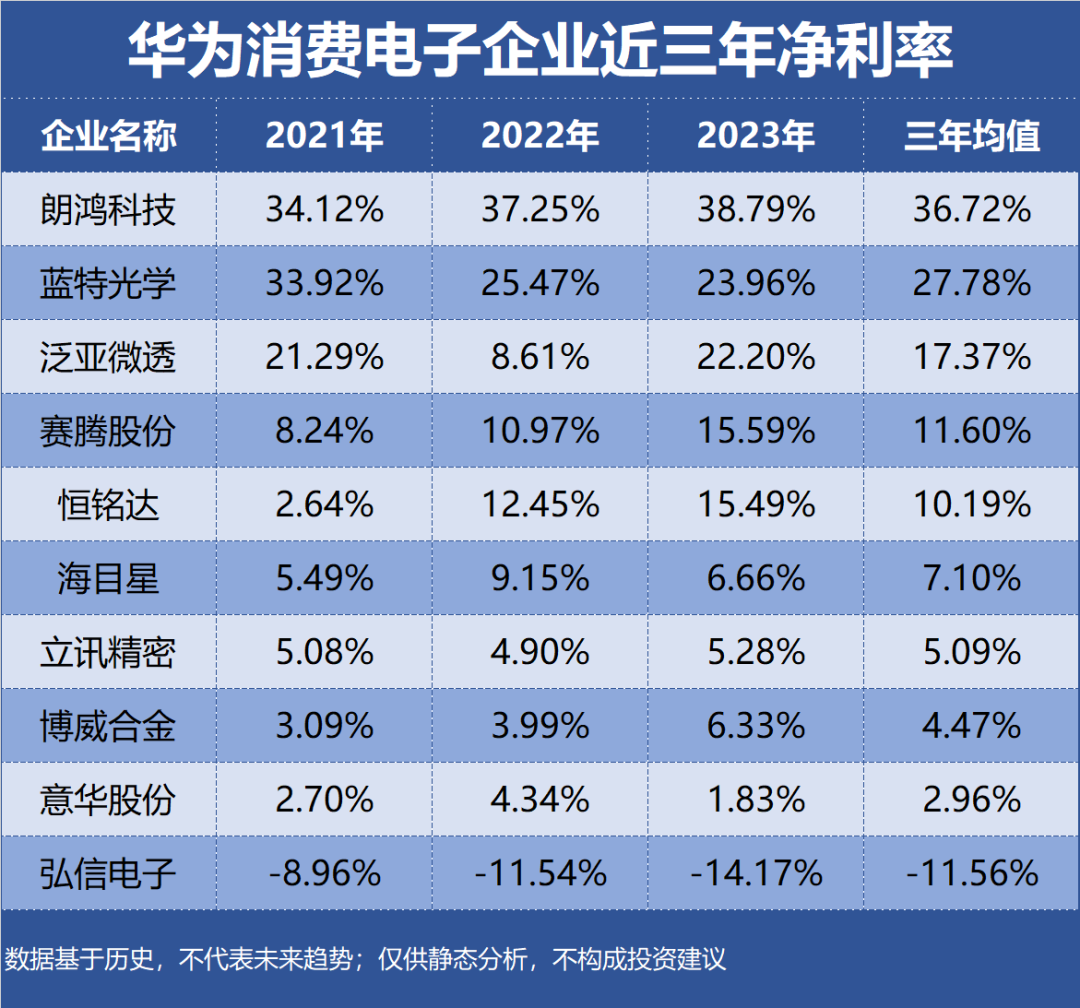

This article is part of our Corporate Value Series, specifically focusing on 'Profitability.' We have selected 90 Huawei Consumer Electronics companies as research samples, evaluating their performance using indicators such as Return on Equity (ROE), Gross Margin, and Net Profit Margin. These data are based on historical performance and do not represent future trends; they are intended for static analysis only and do not constitute investment advice.

Top 10 Most Profitable Huawei Consumer Electronics Companies:

10th: Haimuxing

Industry Segment: Laser Equipment

Profitability: ROE 14.54%, Gross Margin 28.21%, Net Profit Margin 7.10%

Performance Forecast: ROE fluctuated between 7%-22% in the past three years, with the latest forecast average at 12.95%

Main Products: Lithium-ion battery lasers and automation equipment, accounting for 54.10% of revenue with a gross margin of 19.72%

Company Highlight: In the Consumer Electronics sector, Haimuxing serves clients such as Apple, Huawei, and Foxconn.

9th: Bowei Alloy

Industry Segment: Other New Metal Materials

Profitability: ROE 10.85%, Gross Margin 14.15%, Net Profit Margin 4.47%

Performance Forecast: ROE has risen consecutively to 17.31% in the past three years, with the latest forecast average at 16.34%

Main Products: New material products, accounting for 72.23% of revenue with a gross margin of 12.06%

Company Highlight: Huawei has been an important partner of Bowei Alloy, with in-depth cooperation in multiple areas such as communication base stations, mobile phone and laptop coolers, and mobile phone and communication connectors.

8th: Yihua Shares

Industry Segment: Communication Network Equipment and Devices

Profitability: ROE 11.14%, Gross Margin 17.40%, Net Profit Margin 2.96%

Performance Forecast: ROE fluctuated between 7%-16% in the past three years, with the latest forecast average at 16.11%

Main Products: Solar mounts, accounting for 60.92% of revenue with a gross margin of 11.94%

Company Highlight: Yihua Shares supplies USB, HDMI, and high-speed connectors to Huawei, a key client, and is a major supplier of connector products to the company.

7th: Lantuo Optics

Industry Segment: Optical Components

Profitability: ROE 9.20%, Gross Margin 43.25%, Net Profit Margin 27.78%

Performance Forecast: ROE fluctuated between 6%-12% in the past three years, with the latest forecast average at 15.79%

Main Products: Optical prisms, accounting for 53.76% of revenue with a gross margin of 23.24%

Company Highlight: Lantuo Optics' products have been integrated into the end products of renowned companies such as Apple and Huawei.

6th: FanYa Micro-porous

Industry Segment: Membrane Materials

Profitability: ROE 10.16%, Gross Margin 45.39%, Net Profit Margin 17.37%

Performance Forecast: ROE fluctuated between 5%-14% in the past three years, with the latest forecast average at 15.64%

Main Products: ePTFE micro-porous products, accounting for 29.47% of revenue with a gross margin of 71.80%

Company Highlight: FanYa Micro-porous has successfully entered the Consumer Electronics industry with its water-resistant and sound-transmitting membrane products, which are now used in smart wearable devices from Xiaomi, Huawei, and Google.

5th: Luxshare Precision

Industry Segment: Consumer Electronics Components and Assembly

Profitability: ROE 22.32%, Gross Margin 12.02%, Net Profit Margin 5.09%

Performance Forecast: ROE fluctuated between 21%-23% in the past three years, with the latest forecast average at 19.21%

Main Products: Consumer electronics, accounting for 85.03% of revenue with a gross margin of 10.60%

Company Highlight: Luxshare Precision specializes in the production and supply of connectors, cables, acoustic components, wireless charging solutions, motors, and antennas, providing products and services to Huawei in the telecommunications and consumer electronics sectors.

4th: Hengmingda

Industry Segment: Consumer Electronics Components and Assembly

Profitability: ROE 9.16%, Gross Margin 29.41%, Net Profit Margin 10.19%

Performance Forecast: ROE has risen consecutively to 14.38% in the past three years, with the latest forecast average at 18.55%

Main Products: Consumer electronics products, accounting for 79.02% of revenue with a gross margin of 33.38%

Company Highlight: Hengmingda primarily serves manufacturers and component producers upstream in the supply chain of consumer electronics brands. Its products are ultimately used by renowned brands such as Apple, Huawei, and Xiaomi.

3rd: Hongxin Electronics

Industry Segment: Printed Circuit Boards (PCBs)

Profitability: ROE -21.54%, Gross Margin 3.71%, Net Profit Margin -11.56%

Performance Forecast: ROE has been negative in the past three years, with the latest forecast average at 10.76%

Main Products: PCBs, accounting for 49.98% of revenue with a gross margin of 1.51%

Company Highlight: Hongxin Electronics, a leading domestic FPC manufacturer, indirectly supplies its products to well-known electronics manufacturers such as Huawei, OPPO, VIVO, Xiaomi, Meizu, and Samsung through display modules, touch modules, and fingerprint recognition modules.

2nd: Saiteng Stock

Industry Segment: Industrial Control Equipment

Profitability: ROE 23.23%, Gross Margin 42.05%, Net Profit Margin 11.60%

Performance Forecast: ROE has risen consecutively to 35.28% in the past three years, with the latest forecast average at 27.47%

Main Products: Automation equipment, accounting for 78.60% of revenue with a gross margin of 46.64%

Company Highlight: Saiteng Stock's products are primarily used in the Consumer Electronics industry, suitable for smart assembly and testing of smartphones, tablets, laptops, and wearable devices. The company has a partnership with Huawei.

1st: Langhong Technology

Industry Segment: Security Equipment

Profitability: ROE 33.93%, Gross Margin 56.23%, Net Profit Margin 36.72%

Performance Forecast: ROE has declined consecutively to 20.96% in the past three years, with the latest forecast average at 23.47%

Main Products: Burglar alarms, accounting for 99.56% of revenue with a gross margin of 61.68%

Company Highlight: Langhong Technology has entered the supplier lists of multiple smart terminal clients and collaborates with core mobile phone brands such as Huawei, Xiaomi, and OPPO.

ROE, Gross Margin, and Net Profit Margin of the Top 10 Most Profitable Huawei Consumer Electronics Companies in the Past Three Years: