Internal and external difficulties leave HP little time left

![]() 10/18 2024

10/18 2024

![]() 600

600

Under the pressure of performance, HP's layoffs are an inevitable choice for its strategic transformation and cost control. However, to achieve a flexible turnaround, in addition to personnel adjustments and AI PC bets, more coping strategies need to be found.

Original @ Xinshang

In his magnum opus, "The HP Way," co-founder David Packard of HP constructed a management philosophy centered on "treating employees well" during his twilight years.

However, amidst fierce competition and pressure on performance, the once revered "people-oriented" rhetoric has had to compromise with the reality of the company's need for cost control.

On October 16th, the rumored layoffs at HP Taiwan were finally confirmed: Layoffs will be conducted in two phases starting from October, with the first time involving the R&D department. It is estimated that 20 to 30 employees, including senior executives at the vice president level, will be laid off.

In fact, as early as 2022, HP had announced to the outside world that it planned to lay off 4,000 to 6,000 employees over the next three years to save costs.

This downsizing is undoubtedly a response to performance pressure and a consideration to navigate the challenging industry landscape. Moreover, keywords like "first major move targeting R&D department" and "involving senior executives," coupled with rumors of recruiting 200 engineers to reduce reliance on Taiwan's R&D center, signify that HP's future transformation plans are in full swing.

As a veteran international PC giant, HP has gradually lost its voice in recent years, with its last heated discussion occurring in August this year. At that time, British billionaire Mike Lynch's yacht accident led to an $8.8 billion fraud case of the century.

Setting aside the mysterious "strange death of a billionaire," HP's decline is actually hidden in the subtle developments of the industry.

Behind the layoffs, the twilight of the gods

In 2022, on the same day HP announced its layoff plan, it also released its fiscal fourth-quarter and full-year results for fiscal year 2022.

The financial report showed that net revenue for the fourth fiscal quarter was $14.801 billion, a decrease of 11.2% year-on-year; net loss was $2 million, a turn from profit to loss; and adjusted net profit after excluding non-GAAP items was $900 million, a decrease of 21% year-on-year.

In the years following the announcement of the layoff plan, HP's profitability remained far from ideal. Since the third quarter of fiscal year 2022, its operating revenue has declined continuously.

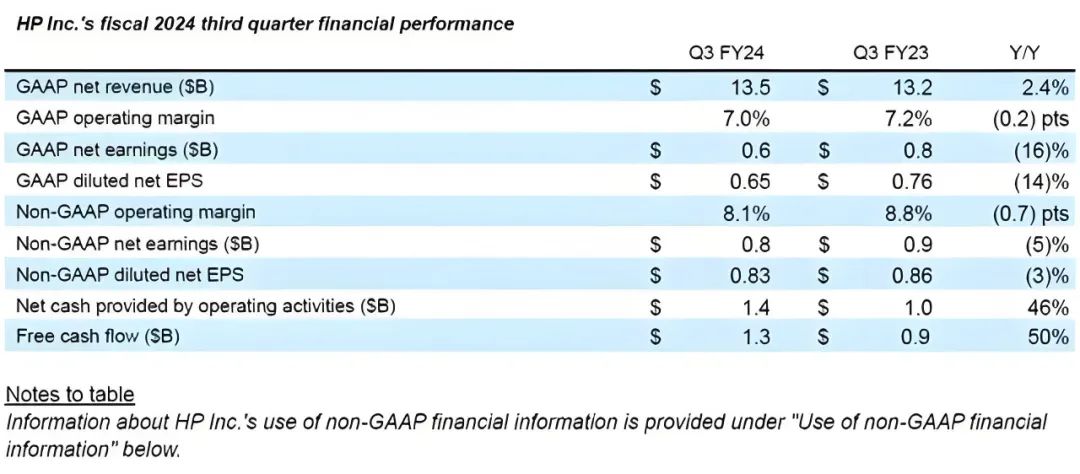

In the third quarter of fiscal year 2024, HP achieved revenue of $13.5 billion, an increase of 2.4% from the third quarter of fiscal year 2023, marking the first year-over-year revenue growth since the third quarter of fiscal year 2022. However, net profit for the quarter decreased by 16% year-on-year.

HP's frequent red flags in its financial situation are closely related to the global PC industry's downturn in recent years.

IDC data shows that from the first quarter of 2022 to the second half of 2023, global shipments of traditional PCs, including desktops, laptops, and workstations, experienced continuous declines.

The reasons for the PC industry's winter can be summarized as follows: the global economic downturn caused by the pandemic, decelerating innovation in the PC market, the partial substitution of mobile devices such as smartphones for PCs, and intensifying competition within the industry.

In fact, HP is not the only one affected by the industry's chill.

Lenovo's smart device revenue fell by 20.77% and 9.67% year-on-year in fiscal years 2023 and 2024, respectively. In the first half of this year, the company's net profit attributable to shareholders was only RMB 285 million, a year-on-year decrease of 57.2%.

Regarding the decline in performance, Lenovo Holdings explained that the complexity and uncertainty of the global economic situation continued to escalate, and the profits contributed by the industrial operations segment decreased year-on-year due to market and industry fluctuations; the investment business in the industrial incubation and investment segment decreased year-on-year due to the adverse impact of the market environment.

Another PC giant, Dell, has also faced revenue growth challenges since 2022, despite its relatively good profitability in recent years.

Intel, which has a monopoly in the semiconductor industry and is a major provider of global PC processors, has even been rumored to be up for acquisition. In September this year, The Wall Street Journal reported that Qualcomm had held talks with Intel about a potential acquisition.

Amidst the industry downturn, layoffs and strategic transformation seem to have become the unified answer for giants to alleviate performance pressure.

In addition to HP, Dell planned to lay off 5% of its workforce in 2023, but ended up laying off 13,000 employees. In early August this year, Dell confirmed a new round of layoffs, expecting to cut up to 12,500 jobs and stated that the company was streamlining operations by reorganizing its sales teams and taking a series of ongoing actions.

In Lenovo's fiscal year 2024 performance report disclosed in May this year, the total number of global employees decreased by 7,500 compared to the same period in fiscal year 2023. In the "expense category" of the financial report, Lenovo stated that due to industry challenges, severance and related expenses amounted to $55 million.

Domestic rise, attacked from all sides

As an essential part of its global operations, the Chinese market has always been a key area for HP. Since entering the Chinese market in 1985, HP China has maintained rapid business growth for nearly 40 years and was once one of HP's fastest-growing subsidiaries globally.

However, with China's industrial transformation, HP is struggling under the squeeze from both established and emerging brands. When disclosing its third-quarter fiscal year 2024 financial results, HP noted a slowdown in sales of PCs and printers in the Chinese market.

In the printer business, Canon, Tsinghua Tongfang, Razer, and Hasee have been gradually eroding HP's market share in recent years. In the PC business, which accounts for more than 60% of HP's revenue, the pressure on HP is even greater.

On the one hand, Lenovo, rooted in China, has a stronger Chinese presence compared to HP due to its global market influence, thus consistently ranking first in domestic market shipments. On the other hand, new-generation domestic brands represented by Huawei are also accelerating their pursuit.

While international brands are declining, domestic brands are accelerating their rise, undoubtedly putting HP in a vulnerable position from all sides.

One data point shows that the sales share of international brands has fallen from 22.4% in the second quarter of 2023 to 15.7% in the third quarter of 2024. Taking Canalys' report on PC shipments in mainland China in the second quarter of 2024 as an example, Lenovo ranked first with shipments of 3.071 million units and a market share of 34%, while HP ranked behind Huawei with 817,000 units and a market share of only 9%.

In this report, Huawei surpassed HP in market share, while Tsinghua Tongfang, although ranking slightly behind by 1%, demonstrated strong growth momentum with an 86% year-on-year increase.

In addition to the above brands, domestic brands such as Xiaomi, MECHREVO, and Honor have also launched high-performance laptops equipped with self-developed chips in recent years, attracting considerable consumer attention and demonstrating robust growth momentum due to their powerful performance and reasonable pricing.

Among domestic PC brands, Huawei and Xiaomi, both primarily known for their mobile phone business, are particularly noteworthy. Based on their sales dominance in mobile phones and tablets, they possess unique advantages in the interconnected office ecosystem. In Huawei's HarmonyOS PC promotions, slogans like "breaking barriers" and "enabling a full-scenario smart life" often appeal to tech-savvy new middle-class groups and Generation Z.

While Huawei and Xiaomi's PC products have faced criticism regarding their hardware and software, it is undeniable that new variables are attempting to reshape the domestic market landscape.

Another crucial reason for HP's decline in the Chinese market may be related to declining market trust in the brand.

Due to geopolitical factors, there have been ongoing discussions about "decoupling" US technology companies in recent years. In August this year, HP was rumored to be seeking to relocate more than half of its PC production out of China, primarily to Thailand.

Although HP denied these rumors, the layoffs at its Taiwan subsidiary and the decision to open an R&D center in Singapore have never stopped market speculation. This has led to a decrease in brand trust, which, although difficult to quantify, may become a stumbling block for HP's development in the Chinese market.

It can be said that time is running out for HP.

AI PC, difficult to become the key to breaking the deadlock

With the increasing application of AI large models in technology products, AI is becoming a new economic growth point for manufacturers to compete for, and the same is true for the PC industry.

Compared to mobile phone products, PC manufacturers have not been early adopters of AI.

In September 2023, Intel was the first to propose the concept of AI PC and simultaneously announced the launch of the industry's first AI PC acceleration program. In October of the same year, Lenovo showcased its AI PC products to the market and introduced several new AI PC models, including Lenovo Legion and Lenovo XiaoXin, in January this year. In April, Lenovo further launched a commercial AI PC, Lenovo Zhaoyang AI PC, specifically designed for government and enterprise customers.

Dell also launched the Inspiron 13 Pro equipped with Intel's AI PC processor in December last year. In February this year, it introduced commercial AI laptops and mobile workstations, including the Latitude AI PC series and Precision workstations.

In May this year, HP announced its entry into the AI PC market competition with the launch of its EliteBook high-end AI business laptop for large enterprise users, the War series AI business laptop for small and medium-sized enterprise customers, the ZBook mobile workstation for compute-intensive users, and the new Z series AI all-in-one PC.

Compared to Lenovo and Dell, HP's layout of AI PC was slightly slower. When the market expected it to accumulate strength and catch up later, it was found that its AI PC products did not bring about a revolutionary freshness compared to its peers.

In fact, while manufacturers have been hyping up AI PC as an infusion of vitality into the industry, there have also been doubts about the concept's influence: it has yet to offer many technical highlights to the market, AI PC functions are not frequently used by consumers, and there are cost issues.

Similar to AI phones, the AI PCs pursued by HP and others offer more of an added bonus rather than a necessity. Even so, the competition for AI PC remains fierce among both established and emerging players, and HP, amidst this fray, does not have many chips to play.

For HP, layoffs are a necessary pain in optimizing costs and strategic transformation, reflecting the performance anxiety of this veteran PC giant. However, to solve the problem of turning the elephant around, HP needs to find new answers beyond personnel adjustments and AI PC layout .

As a behemoth enterprise, HP's transformation is no easy feat, and every move impacts the whole, meaning that its reforms cannot move too quickly. Amidst the ever-changing industry landscape, careful navigation and continuous fine-tuning will be the norm. This further underscores that for HP to find a new growth engine, it will have to fight a protracted battle.