Plunging 264.92%! "Sweeping Mao" Ecovacs, excluding non-recurring gains and losses, incurred a loss

![]() 11/01 2024

11/01 2024

![]() 628

628

"Sweeping Mao" Ecovacs has not yet emerged from the "valley".

Since the beginning of this year, the white goods industry has collectively rebounded, with Gree, Midea, and Haier all achieving good results. The small home appliance industry, on the other hand, has shown a divergent trend, with representative companies being Roborock and Ecovacs.

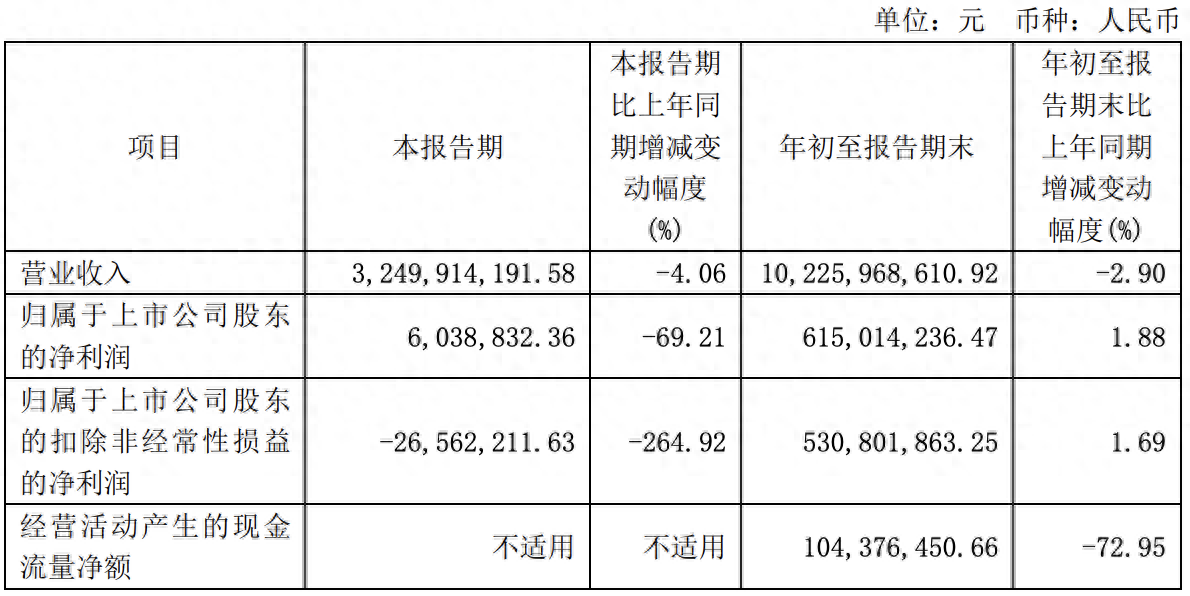

On the evening of October 29, Ecovacs announced its performance report for the first three quarters of 2024. The financial report shows that for the first three quarters of this year, Ecovacs achieved operating revenue of 10.226 billion yuan, a year-on-year decrease of 2.9%; net profit was 615 million yuan, a year-on-year increase of 1.88%; and non-recurring profit after tax was 531 million yuan, a year-on-year increase of 1.69%.

At first glance, this financial report does not seem too bad, as revenue has only declined slightly and net profit has increased slightly. However, when it comes to the third quarter specifically, the situation for Ecovacs is not so optimistic.

According to the financial report, in the third quarter, Ecovacs achieved revenue of 3.25 billion yuan, a year-on-year decrease of 4.06%; net profit was only 6.0388 million yuan, a year-on-year decrease of 69.21%; and non-recurring loss after tax was 26.5622 million yuan, a year-on-year decrease of 264.92%.

The sharply declining net profit has filled Ecovacs with uncertainty.

In contrast, Roborock, which came from behind, performed much better.

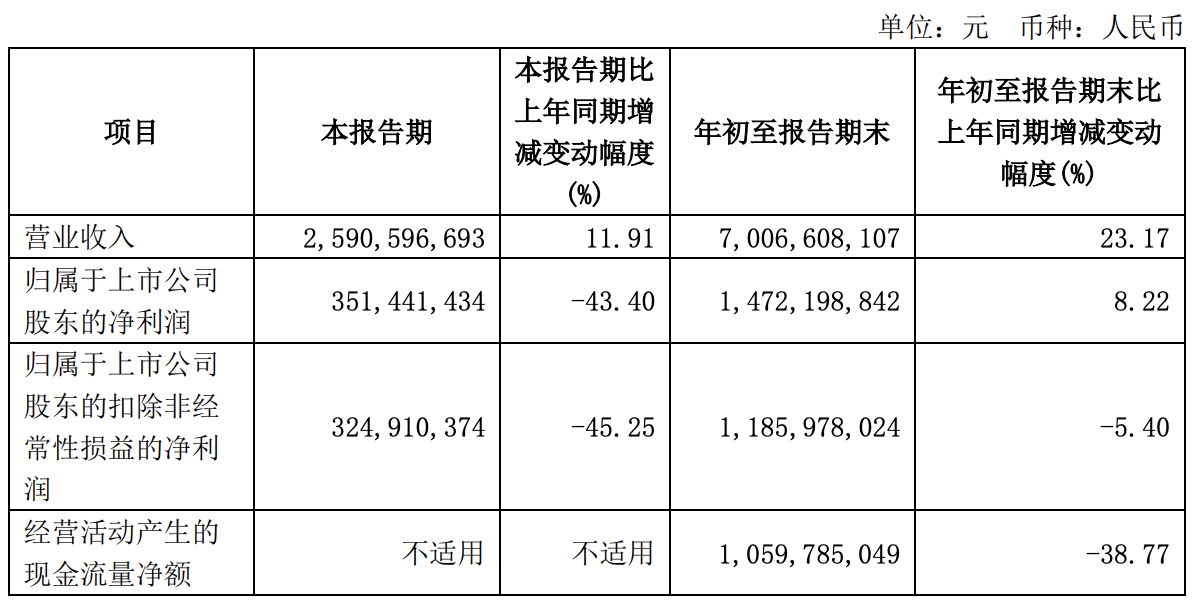

On the evening of October 30, Roborock released its financial report for the first three quarters of 2024. The report shows that for the first three quarters of this year, the company achieved operating revenue of 7.007 billion yuan, a year-on-year increase of 23.17%; net profit was 1.472 billion yuan, a year-on-year increase of 8.22%; and non-recurring profit after tax was 1.186 billion yuan, a year-on-year decrease of 5.40%.

Specifically for the third quarter, Roborock's revenue was 2.591 billion yuan, a year-on-year increase of 11.91%; net profit was 351 million yuan, a year-on-year decrease of 43.40%; and non-recurring profit after tax was 325 million yuan, a year-on-year decrease of 45.25%.

From the financial report, although Roborock's net profit in the third quarter also showed a significant decline, the situation is much better than that of Ecovacs.

Of course, the reason why Ecovacs was overtaken by Roborock is not only due to external factors but also largely due to its own problems. In 2020, due to restrictions at the time, most people had difficulty going out and there was a surge in demand for solving household chores. As a result, robot vacuum cleaners, as a powerful tool for cleaning, quickly became popular in the market and became a hit product in the small home appliance industry. Against this background, Ecovacs became a market star stock overnight.

Unfortunately, despite Ecovacs' strong performance, it did not seize the opportunity to take the company to the next level but was further surpassed by Roborock.

According to the financial report, from 2020 to 2023, Ecovacs' revenues were 7.234 billion yuan, 13.086 billion yuan, 15.325 billion yuan, and 15.502 billion yuan, respectively. Net profits were 641 million yuan, 2.01 billion yuan, 1.698 billion yuan, and 612 million yuan, respectively. In terms of revenue, Ecovacs' revenue has stagnated since 2022, and its net profit has declined year by year since peaking in 2021, with a significant decline.

In contrast, from 2020 to 2023, Roborock achieved revenues of 4.53 billion yuan, 5.837 billion yuan, 6.629 billion yuan, and 8.654 billion yuan, respectively; net profits were 1.369 billion yuan, 1.402 billion yuan, 1.183 billion yuan, and 2.051 billion yuan, respectively. The contrast is striking.

Although Roborock's current revenue level is only half that of Ecovacs, its net profit level is much higher. It is worth noting that as Roborock continues to consolidate its leading position in cleaning appliances, its global market share is also further increasing. In addition, Roborock is intensifying efforts to promote growth in its second growth curve, the washing machine segment, which will contribute more profit points to the company's future performance.

Earlier this year, in response to the severe decline in corporate performance, Ecovacs proposed four improvement plans, including focusing on its core business, enriching its product matrix, and increasing cost reduction efforts; expanding into the international market and promoting overseas development. Judging from Ecovacs' current performance, it has not brought good results.

According to data from AVC Cloud, in the online market for robot vacuum cleaners in the first eight months of this year, Ecovacs ranked first with a market share of 22.22%, Roborock ranked second with a market share of 20.29%, and Xiaomi ranked third with a market share of 15.80%.

In the offline market, Ecovacs ranked first with a market share of 53.91%, and Roborock ranked second with a market share of 18.12%. From the perspective of market share, although Ecovacs still dominates the offline market, its online market share has been largely caught up with by Roborock.

Kanjian Caijing believes that Ecovacs is currently facing obvious difficulties, and its main business is also being eroded by peers such as Xiaomi and Roborock. Faced with its own decline, Ecovacs must demonstrate greater determination to change its current situation; otherwise, the gap between it and Roborock will widen. In addition, facing the decline in growth, it should also cultivate a second growth curve to leave room for future development.