In-depth Revelation: How This Optical Giant Quietly Rose to Become the 'Invisible Boss' Behind Huawei and Apple

![]() 11/15 2024

11/15 2024

![]() 670

670

In China, there is such an enterprise that, despite its low-key demeanor, possesses extraordinary strength.

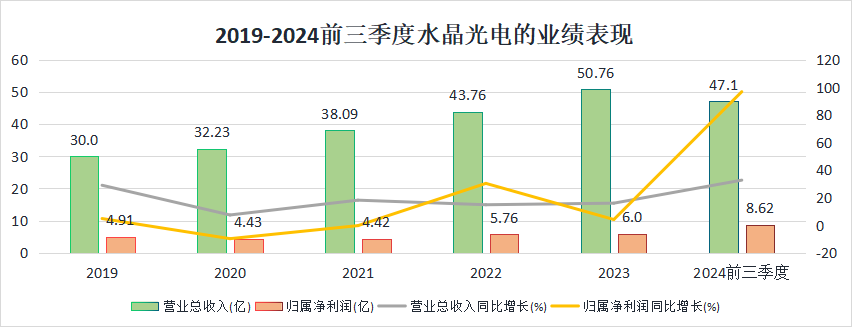

Media has revealed that out of billions of mobile phones worldwide, one in every four uses optical components produced by Crystal Opto-Electronic. Recently, Crystal Opto-Electronic announced its Q3 2024 performance: in the first three quarters, the company achieved a revenue of 4.71 billion yuan, up 32.69% year-on-year; net profit was 862 million yuan, up 96.77% year-on-year. In Q3 alone, net profit reached 435 million yuan, up 66.99% year-on-year, demonstrating a robust growth momentum.

At a time when many consumer electronics companies are still struggling to recover to their 2021 peaks, Crystal Opto-Electronic has not only stabilized its position but also set new highs in both revenue and net profit.

In July this year, renowned analyst Ming-Chi Kuo revealed on social media that Apple would introduce quad-prism (periscope) camera technology starting with the iPhone 15 Pro Max and had planned upgrade routes for future years. As the leading beneficiary in the relevant supply chain, Crystal Opto-Electronic, the first prism supplier, stands out. Additionally, recent supply chain investigations indicate that iPhones will continue to use glass prisms in the coming years, further solidifying Crystal Opto-Electronic's position as a major winner in this supply chain transformation.

So, how did this 'Invisible Boss' from Taizhou, Zhejiang, grow from a small team into an industry giant with a market value of tens of billions? What magic does it possess to convince global mobile giants to pay for its products?

The Transformation from a Humble Workshop to an Industry Giant

The development of Crystal Opto-Electronic seems more like an inspirational movie.

Back in 2002, Crystal Opto-Electronic was still in its infancy, starting with optical devices and focusing on the R&D and manufacturing of precision thin-film optical products. Initially, they produced OLPF products for security surveillance in a small-scale production line in the Xingxing Plastic Park, Hongjia Street. The factory was rudimentary, equipment was outdated, and technology was immature, making every step exceptionally challenging. In their Shenzhen office, there was only one desk, one computer, and one telephone; business personnel relied on a "China Yellow Pages" directory, making calls and visiting companies one by one.

Fortunately, their persistent efforts finally bore fruit. Crystal Opto-Electronic surpassed Taiwanese competitors in the market share of OLPF products for security surveillance, emerging as a dark horse in the South China market.

However, Crystal Opto-Electronic's ambitions did not stop there. They had a long-standing collaboration with Kodak. After multiple sample evaluations, in July 2003, Crystal Opto-Electronic officially became a qualified supplier for Kodak, laying a solid foundation for the company's development. Four months later, even Japanese peer NDK came for a visit, indicating that Crystal Opto-Electronic had already gained some fame in the industry.

After becoming a qualified supplier for Kodak, Crystal Opto-Electronic turned its attention to Sony in Japan. Their efforts paid off, and in February 2004, they secured an opportunity to produce samples for Sony. After several months of hard work, Crystal Opto-Electronic finally met Sony's on-site requirements, and Sony's products entered mass production.

By 2005, the trend of "built-in camera phones" emerged, and Crystal Opto-Electronic received an opportunity to produce samples of mobile phone camera filters for Samsung. Although they were unfamiliar with this product at the time, the technical team immediately dove into R&D. Although large-scale production didn't materialize due to unclear market conditions and lack of mass production capability, this experience provided valuable lessons and laid a solid foundation for the subsequent explosive growth of mobile phone filters.

After years of accumulation, Crystal Opto-Electronic finally gained a firm foothold in the filter market and successfully entered the supply chains of major clients like Yujing and Dali. By this time, Crystal Opto-Electronic had entered a period of rapid development, with market performance doubling year after year. Sony in Japan became their largest client, solidifying their market position in Japan and laying a solid foundation for the company's listing.

On September 19, 2008, Crystal Opto-Electronic officially issued shares on the Shenzhen Stock Exchange, marking a new milestone in the company's development.

Today, as a global leader in optical components, Crystal Opto-Electronic covers three major areas: metaverse optics, automotive optoelectronics, and consumer electronics. Additionally, through mergers and acquisitions at home and abroad, the company has achieved rapid development, gradually expanding its industrial layout to include reflective materials and coating equipment, with offices established in Japan, Singapore, South Korea, and other regions worldwide.

The 'Invisible Boss' Behind Tech Giants

Crystal Opto-Electronic's legend continues, becoming increasingly fascinating.

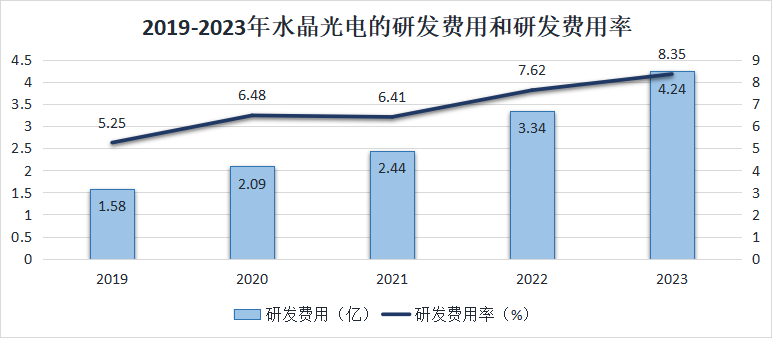

In terms of R&D investment, Crystal Opto-Electronic has been generous in recent years. From 2021 to 2023, the company's total R&D investment exceeded 1 billion yuan, demonstrating not only their emphasis on innovation but also their thoughtful planning for the future. In talent development, Crystal Opto-Electronic has also invested heavily, establishing a corporate university with a Leadership Academy and an Engineering Academy to cultivate and manage the company's management team and senior engineering team, ensuring a talent pool for the company's long-term development.

Regarding revenue, filters and micro-prisms are the two major product lines that contribute significantly to Crystal Opto-Electronic's income. With the rapid development of mobile phone camera technology, micro-prisms, as a key component of periscope lenses, have quickly made Crystal Opto-Electronic a core supplier to tech giants like Apple and Huawei.

Crystal Opto-Electronic's success is inseparable from its powerful client base. They are not only a major supplier of iPhone camera modules but also exclusively supply certain specific products to Huawei. Simultaneously, they have established deep cooperation with brands like vivo and Honor. Huawei's Pura 70 series became an instant hit upon launch, with Crystal Opto-Electronic, as a key partner, once again proving its prowess. Their filters and micro-prisms are ubiquitous in major smartphone brands, significantly enhancing mobile phone photography performance.

As the world's first mass producer of quad-prism modules, Crystal Opto-Electronic's revenue and net profit have repeatedly hit new highs. From 2019 to 2023, Crystal Opto-Electronic's revenue grew from 3.223 billion to 5.076 billion yuan, with a compound annual growth rate of 14.05%. The compound annual growth rate of net profit was approximately 4.9%, both showing a steady upward trend. By Q3 2024, benefiting from the upswing in the consumer electronics industry and the mass production of the company's micro-prism products, Crystal Opto-Electronic achieved a total revenue of 4.71 billion yuan in the first three quarters, a year-on-year increase of 32.69%.

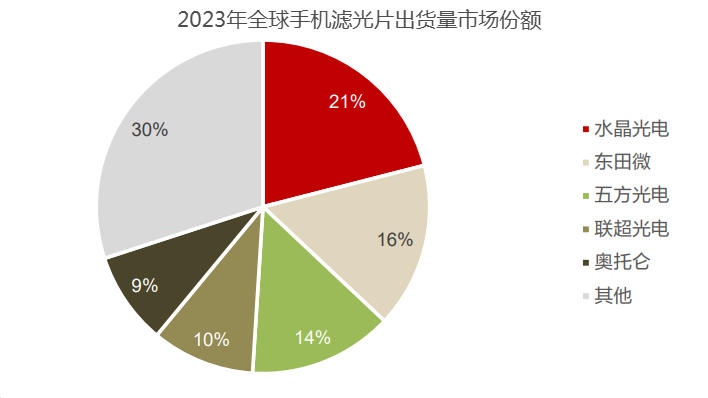

Among global filter suppliers, Chinese, Japanese, and Korean enterprises dominate the landscape. However, Japanese and Korean enterprises mainly supply their local markets, leaving the global market almost monopolized by Chinese enterprises, with a market share of nearly 90% in 2023. Crystal Opto-Electronic ranks first in global shipments with a market share of 21%, far exceeding competitors like Dongtian Micro (16%) and Wufang Optoelectronics (14%).

In summary, with its outstanding R&D investment, talent development, technological innovation, and robust client network, Crystal Opto-Electronic occupies an unshakeable leading position in the global optical component industry. This is not only the pride of Crystal Opto-Electronic but also the pride of Made in China.

A Hidden 'Trump Card'

With its solid technical foundation and keen market insight, Crystal Opto-Electronic has firmly established its place in the optical component industry. However, their ambitions do not stop there. Through continuous technological innovation, active cooperation and investment, and precise market layout, Crystal Opto-Electronic is vigorously promoting the leapfrog development of VR/AR technology.

As early as 2009, Crystal Opto-Electronic demonstrated its foresight by establishing Jingjing Opto-Electronic, focusing on the R&D and production of micro-projection modules, providing solid technical support for the visual experience of AR/VR devices.

In 2016, Crystal Opto-Electronic further expanded its layout in the AR field by acquiring shares in Israeli AR company Lumus, accelerating product development. Public data shows that Lumus, with over a decade of industry experience, has products spanning military, medical, construction, manufacturing, transportation, and other market sectors, particularly leading in the military sector by providing optical modules for US F-16 and A10 fighter pilot helmets, recognized globally as a leading provider of AR devices and services.

Additionally, since 2020, DigiLens has collaborated with Crystal Opto-Electronic to bring the most advanced and cost-effective AR waveguide technology to market.

Entering 2024, the cooperation between Crystal Opto-Electronic and DigiLens has further deepened, with the two sides jointly completing a comprehensive optimization of the waveguide production line. This technological breakthrough is considered key to meeting the growing demand for AR devices from both consumers and enterprises. The close collaboration between Crystal Opto-Electronic and DigiLens has laid a solid foundation for the premium manufacturing of various AR optical solutions, providing AR developers with low-cost device manufacturing pathways, including smart glasses and heads-up displays, further promoting the development and application of AR technology.

This hidden 'trump card' of Crystal Opto-Electronic is leading the innovation and development of VR/AR technology with its strength and innovative spirit.

Conclusion

Crystal Opto-Electronic's journey is like an exciting adventure, filled with wisdom and sweat at every step. From initial OLPF products for security surveillance to becoming a global leader in the optical market and making a daring leap in VR/AR technology, Crystal Opto-Electronic has always held awe for technology and an endless pursuit of innovation.

With every technological innovation and market breakthrough, Crystal Opto-Electronic has added luster to Made in China while injecting fresh blood into the global optical component industry. This is not just the growth of an enterprise but also repeated explorations and challenges to the future of technology.

It is believed that in the near future, Crystal Opto-Electronic will bring us more surprises.

References:

https://www.jj.gov.cn/art/2018/12/13/art_1311043_27211644.html

https://paper.cnstock.com/html/2024-10/23/content_1980822.htm

Written by Vivi

All uncredited images in this article are sourced from the internet