Who is the most profitable enterprise among Tencent IMA?

![]() 11/18 2024

11/18 2024

![]() 472

472

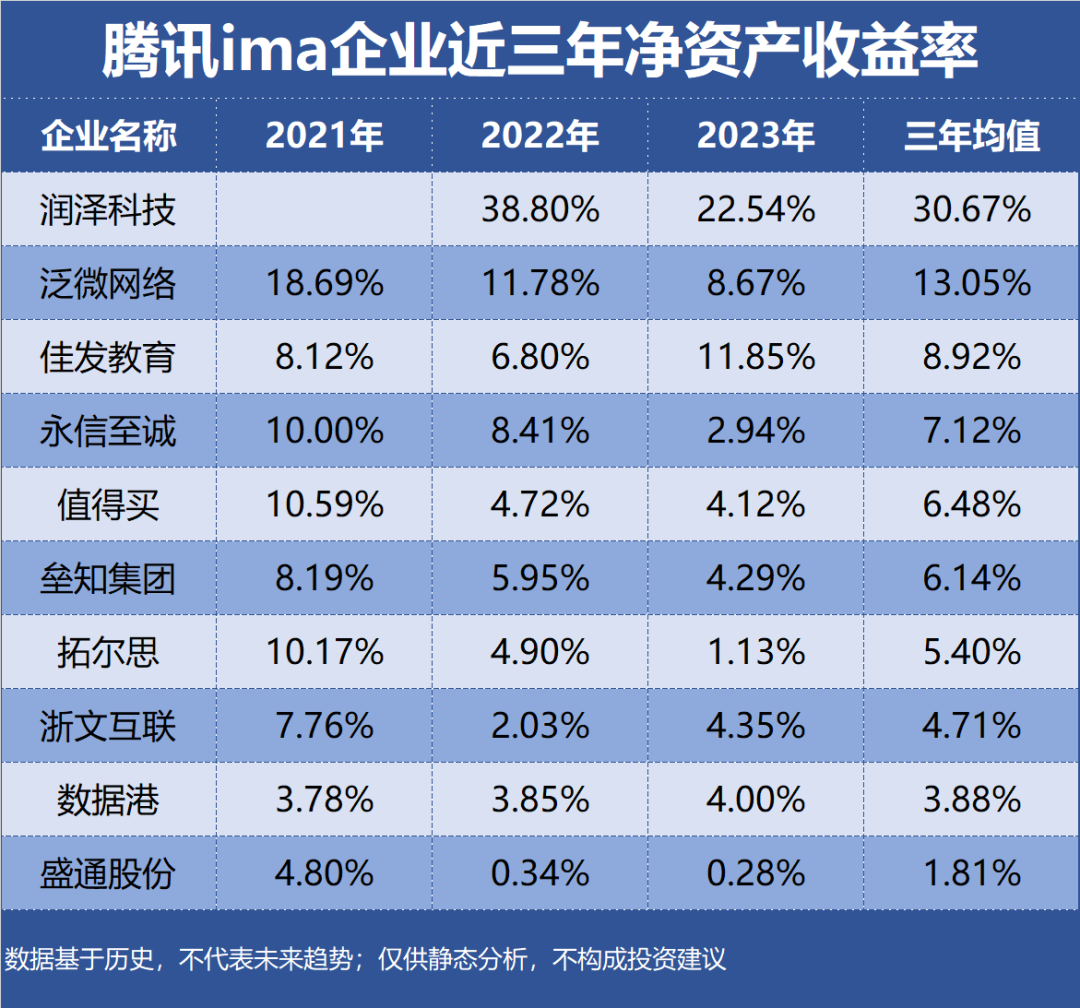

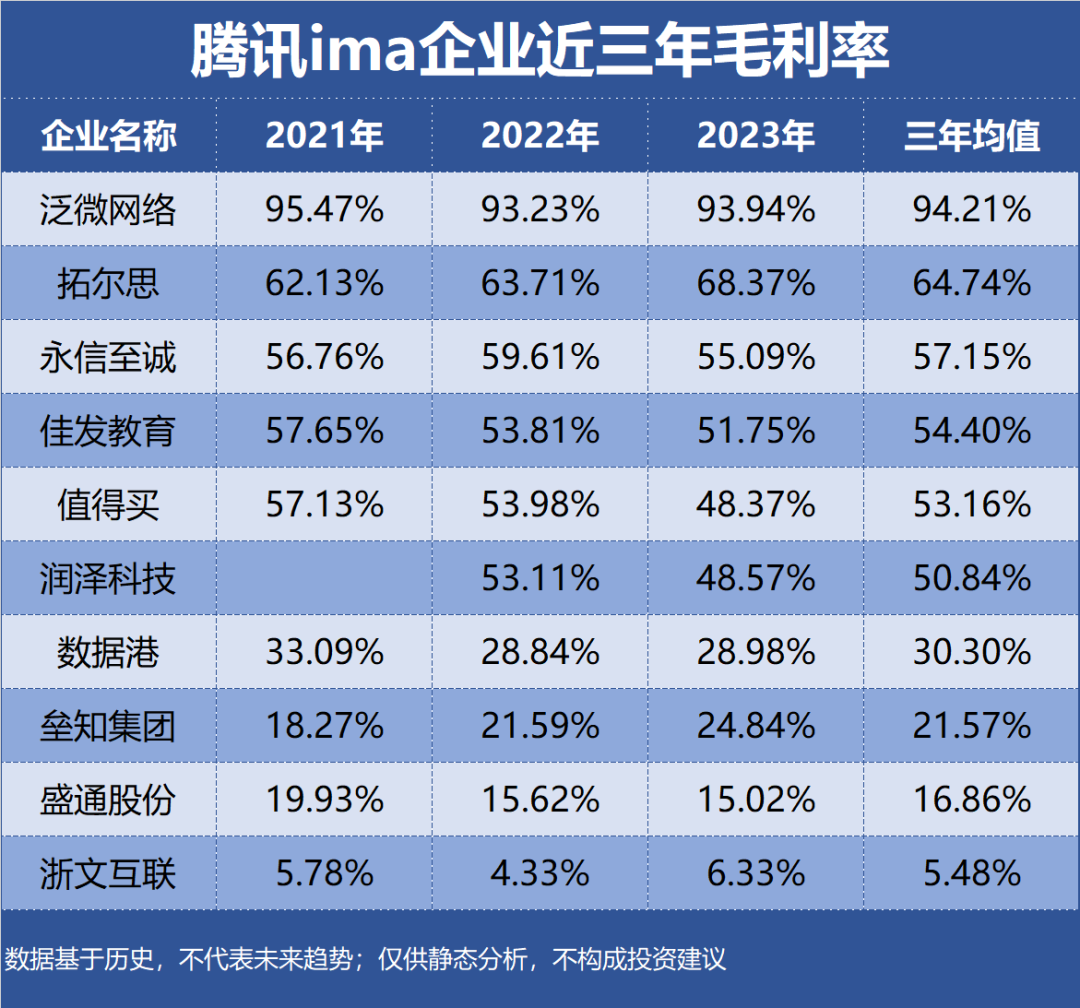

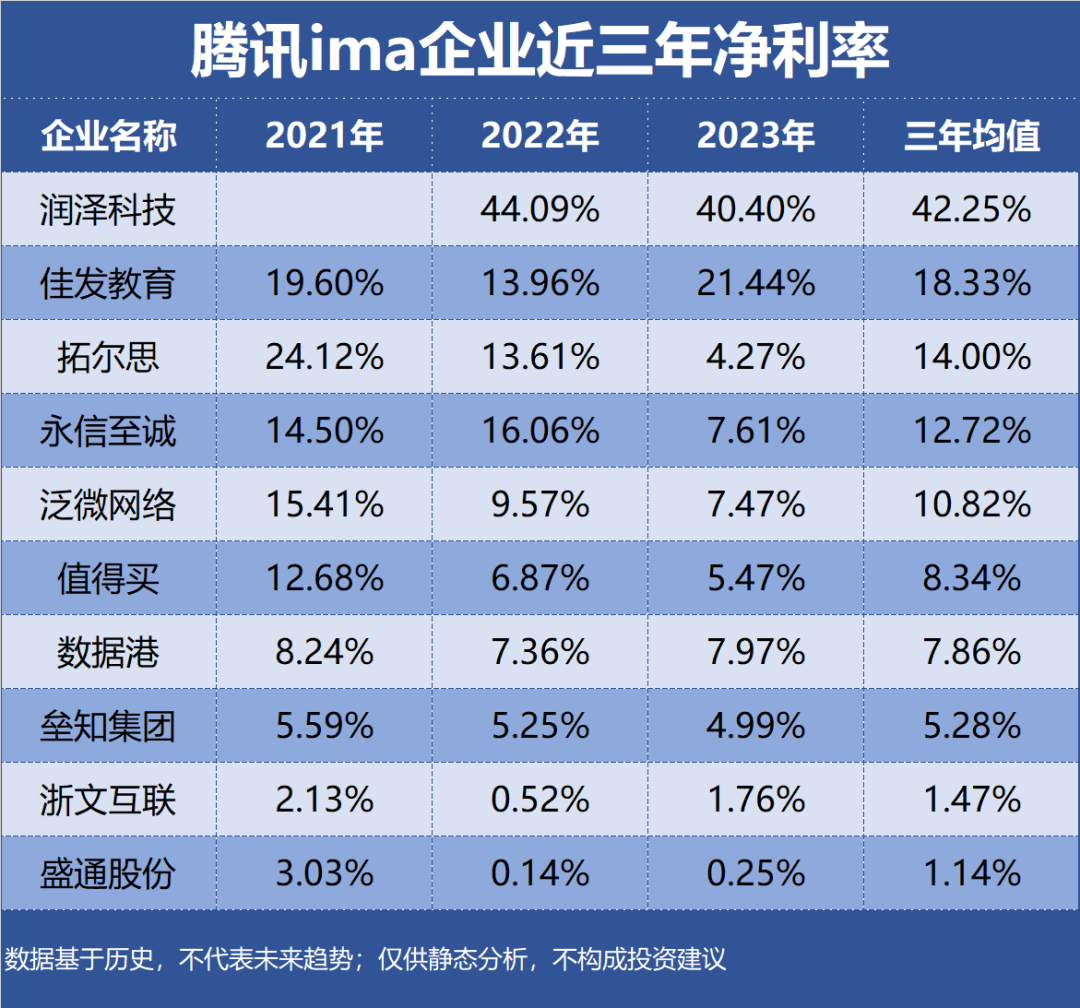

Tencent has launched an AI intelligent workbench called IMA.Copilot, which integrates functions such as information search, long text processing, and text editing. The search function of IMA.Copilot not only covers information across the entire web but also integrates WeChat Official Account articles, enabling users to efficiently obtain the required information. Profitability is usually reflected in the amount and level of a company's earnings over a certain period. The analysis of profitability is an in-depth analysis of a company's profit margins. This article is part of the Enterprise Value series focusing on "Profitability". A total of 17 Tencent IMA enterprises are selected as research samples, and indicators such as Return on Equity (ROE), Gross Profit Margin (GPM), and Net Profit Margin (NPM) are used for evaluation. The data is based on historical information and does not represent future trends; it is provided for static analysis only and does not constitute investment advice.

Top 10 Most Profitable Tencent IMA Enterprises:

10. Shengtong Printing Industry Segment: Printing Profitability: ROE 1.81%, GPM 16.86%, NPM 1.14% Performance Forecast: ROE peaked at 4.80% in the last three years, with the latest forecast average at 1.54% Main Products: Comprehensive printing services, with publication printing as the primary source of income accounting for 68.28% of revenue and a GPM of 11.16% Company Highlights: Shengtong Printing's wholly-owned subsidiary, Beijing Shengtong Zhixing, has signed a Strategic Cooperation Agreement with Tencent Cloud. The two parties plan to cooperate in the field of youth AI education ecology.

9. Leizhi Group Industry Segment: Other Building Materials Profitability: ROE 6.14%, GPM 21.57%, NPM 5.28% Performance Forecast: ROE has declined consecutively to 4.29% in the last three years, with the latest forecast average at 3.91% Main Products: New admixture materials are the primary source of income, accounting for 74.48% of revenue and a GPM of 20.32% Company Highlights: Leizhi Group and Tencent Cloud jointly created a new generation of digital cloud platform with independent intellectual property rights called Leizhi Star.

8. DataHarbor Industry Segment: Communication Application Value-Added Services Profitability: ROE 3.88%, GPM 30.30%, NPM 7.86% Performance Forecast: ROE has risen consecutively to 4.00% in the last three years, with the latest forecast average at 4.48% Main Products: IDC services are the primary source of income, accounting for 98.89% of revenue and a GPM of 27.27% Company Highlights: The data center projects DataHarbor participates in are mostly customized services based on the business needs of large internet companies such as Alibaba and Tencent.

7. Zhewen Interactive Industry Segment: Marketing Agency Profitability: ROE 4.71%, GPM 5.48%, NPM 1.47% Performance Forecast: ROE fluctuated between 2% and 8% in the last three years, with the latest forecast average at 4.55% Main Products: Internet business is the primary source of income, accounting for 100.00% of revenue and a GPM of 6.33% Company Highlights: Zhewen Interactive maintains close cooperation with top media platforms such as Toutiao, Tencent, and Kuaishou. The company has obtained multiple agency identities such as comprehensive agency, marketing science service provider, and KOL procurement cooperation agency.

6. Zhidemai Industry Segment: Portal Website Profitability: ROE 6.48%, GPM 53.16%, NPM 8.34% Performance Forecast: ROE has declined consecutively to 4.12% in the last three years, with the latest forecast average at 4.80% Main Products: Information promotion income is the primary source of income, accounting for 43.43% of revenue and a GPM of 55.90% Company Highlights: Zhidemai's main businesses include consumer content, marketing services, and consumer data. Tencent Cloud has signed a strategic cooperation agreement with the company.

5. TRS Industry Segment: Vertical Application Software Profitability: ROE 5.40%, GPM 64.74%, NPM 14.00% Performance Forecast: ROE has declined consecutively to 1.13% in the last three years, with the latest forecast average at 5.22% Main Products: Big data software products and services are the primary source of income, accounting for 53.57% of revenue and a GPM of 78.36% Company Highlights: TRS and Tencent Cloud have signed a strategic cooperation agreement. Both parties will leverage their respective strengths in cloud computing, big data, AI, and industry services to jointly promote the healthy development of the industrial internet.

4. AEONSEC Industry Segment: Horizontal General Software Profitability: ROE 7.12%, GPM 57.15%, NPM 12.72% Performance Forecast: ROE has declined consecutively to 2.94% in the last three years, with the latest forecast average at 5.57% Main Products: Network security products are the primary source of income, accounting for 52.46% of revenue and a GPM of 52.66% Company Highlights: AEONSEC focuses on technological innovation in network and data security, leading in the fields of cyber ranges and talent development. The company has integrated with 14 AI large models, including Tencent's Hunyuan.

3. Weaver Network Industry Segment: Horizontal General Software Profitability: ROE 13.05%, GPM 94.21%, NPM 10.82% Performance Forecast: ROE has declined consecutively to 8.67% in the last three years, with the latest forecast average at 9.68% Main Products: Technical services are the primary source of income, accounting for 61.59% of revenue and a GPM of 94.92% Company Highlights: Weaver Network has strengthened product cooperation with Tencent Cloud, WeChat Work, Tencent Payment, and Tencent Meeting, with its products entering Tencent's ecosystem of partners.

2. Jafa Education Industry Segment: Vertical Application Software Profitability: ROE 8.92%, GPM 54.40%, NPM 18.33% Performance Forecast: ROE fluctuated between 6% and 12% in the last three years, with the latest forecast average at 11.90% Main Products: Information services, with computer applications as the primary source of income accounting for 100.00% of revenue and a GPM of 51.75% Company Highlights: Jafa Education's cooperation with Tencent in AI technology mainly focuses on the smart speech recognition function in the company's English listening and speaking products.

1. Runze Technology Industry Segment: Communication Application Value-Added Services Profitability: ROE 30.67%, GPM 50.84%, NPM 42.25% Performance Forecast: ROE peaked at 38.80% in the last three years, with the latest forecast average at 23.18% Main Products: AIDC business is the primary source of income, accounting for 57.46% of revenue and a GPM of 22.14% Company Highlights: Runze Technology provides core AI capabilities such as AI search, AI summary, and AI writing for the App "Tencent Yuanbao" based on the Hunyuan large model.

Top 10 Most Profitable Tencent IMA Enterprises: ROE, GPM, and NPM in the Last Three Years: