Who is leading the collective price increase of Android phones, and are consumers footing the bill?

![]() 11/21 2024

11/21 2024

![]() 702

702

Image Source: Visual China

Lanjing News, November 13 (Reporter: Zhai Zhichao) - In the past, Android phones have always occupied an important position in the smartphone market due to their high cost-performance ratio. However, recently released new flagship Android phones have begun to increase their prices collectively, a phenomenon that has attracted widespread attention in the market.

Since October this year, domestic mobile phone brands have released their flagship models, including vivo, OPPO, Xiaomi, Honor, OnePlus, Realme, and other brands, triggering a "war" of mobile phones at the end of the year.

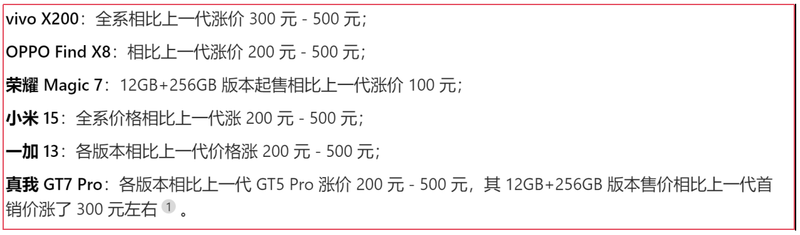

Lanjing News reporters noticed that the price increase of this wave of new mobile phones is relatively significant, with most price increases ranging from 100 yuan to 500 yuan. Some mobile phone manufacturers have even displayed the words "price increase" on the large screens of their press conferences. This straightforward approach further highlights the high-profile nature of this round of price increases.

Compiled by Lanjing News based on public information

Regarding the reasons for the price increase, major mobile phone manufacturers have pointed the finger at processors and memory. Wang Teng, Deputy General Manager of Xiaomi's China Marketing Department and General Manager of the Redmi brand, pointed out that the price increase of flagship mobile phones this year is mainly due to two factors: Firstly, the flagship mobile phone processors have been upgraded to the latest 3-nanometer process, which has significantly increased process costs; secondly, memory prices have reached a high level after a year of continuous increases.

In fact, the above-mentioned price increase phenomenon is not only related to the costs and profits of mobile phone manufacturers but is also closely linked to consumers' willingness and ability to spend. So, are consumers willing to foot the bill for this? Let's delve into this using the latest data from Double 11.

Logic behind the price increase of processors and memory

In recent years, due to factors such as generative AI and industry cycles, the prices of products in the entire mobile phone supply chain have increased significantly, with the most notable increases in the prices of key components such as processors (system-on-a-chip) and memory.

In mid-October, TF Securities analyst Guo Mingkui revealed on social media that the unit price of the Snapdragon 8 Ultimate processor increased by approximately 15% to $180 (approximately RMB 1,282) compared to the Snapdragon 8 Gen3.

"Due to the increase in Qualcomm chip prices, mobile phones using this chip will subsequently increase in price," which is also logical. However, observant individuals may notice a question here: If it's Qualcomm chip prices that have increased, why have vivo X200 series phones, which use MediaTek SoCs, also seen a price increase? This leads us to a deeper reason: the increase in chip manufacturing costs.

According to media reports, starting from January 2024, TSMC plans to increase its quotes for advanced processes by 3% to 6%. The specific increase will vary by process, order size, and the closeness of cooperation among different manufacturers. It is understood that a recent batch of flagship models released by domestic mobile phone manufacturers have adopted Qualcomm Snapdragon 8 Ultimate and MediaTek Dimensity 9400 processors, both of which use a 3-nanometer process technology and enhance their performance in running AI on the client side, with high costs.

It can be seen that the increase in chip manufacturing costs has led to a certain degree of increase in the prices of Qualcomm Snapdragon 8 Ultimate and Dimensity 9400 chips. To maintain a similar profit margin as previous products, mobile phone manufacturers will naturally choose to increase prices. As for TSMC's confidence in raising prices, it stems from its "irreplaceability" in the market. According to TrendForce data, TSMC accounted for 62.3% of the global foundry market in the second quarter of 2024.

In addition, the increase in memory prices is also the result of multiple factors.

Affected by the sharp drop in memory chip prices earlier, starting from 2022, the global "storage trio" of Samsung, Micron, and SK Hynix have reduced production to adjust inventory. Subsequently, as supply and demand gradually balanced and consumer electronics gradually recovered, memory product prices began to stop falling and rebound in the second half of 2023, continuing to rise thereafter. TrendForce analyst Huang Yuxuan said that due to the reduction in memory production by original equipment manufacturers to adjust inventory, memory prices increased by more than 50% from the second quarter of 2023 to the first quarter of 2024.

"From the perspective of raw materials, memory production relies on materials such as silicon, and the global supply of silicon materials is facing challenges. Silicon mining is restricted by environmental policies, and the closure of some small mines has led to a reduction in supply. Moreover, the development of the technology industry has greatly increased the demand for silicon materials. Industries such as photovoltaics are also consuming silicon resources, leading to a rise in silicon material prices and an increase in memory production costs," said a senior industry insider to the reporter.

In addition, the reporter also found that in this round of flagship models, the memory configuration has changed, with no longer an option for 8GB of RAM but a comprehensive upgrade to 12GB. This change will inevitably increase the cost of mobile phone RAM.

Will consumers foot the bill?

Before Double 11, the phenomenon of price increases in Android phones also sparked widespread discussion among consumers. Among them, many consumers questioned whether Android phones were no longer affordable, and some even felt that the market would find it difficult to accept the higher prices. However, judging from the mobile phone sales data during Double 11, this is not the case.

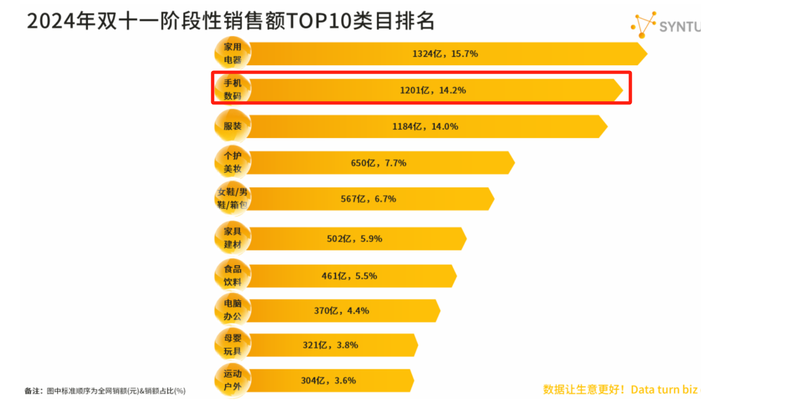

According to Xingtu data, as of October 30, the cumulative sales volume across the entire network has reached 845 billion yuan, with mobile phone and digital product sales amounting to 120.1 billion yuan, accounting for 14.2% and ranking second among the top 10 sales categories during the Double 11 period. This shows the high demand and strong sales of mobile phone and digital products during Double 11.

Image Source: Xingtu Data

In addition, according to statistics, since the event began on October 21, transactions of domestic Android flagship phones priced above 4,000 yuan have increased by 57% year-on-year compared to the same period last year. This also shows that high-priced Android flagship phones still have a certain demand in the market, and consumers are still willing to pay higher prices for high-quality Android phones.

Specifically, during Double 11, Xiaomi's new flagship 15 series achieved the double first in cumulative sales volume and sales amount in the 4,000-4,999 yuan price range (4,000-5,999 yuan on Tmall) on Tmall, Pinduoduo, and Douyin, and the first in cumulative sales volume in the 4,000-5,999 yuan price range on JD.com.

The new vivo X200 series performed outstandingly during Double 11, elevating its position in the market to the top four, following Apple, Huawei, and Xiaomi. From 8 PM to 11:59 PM on November 10, the Honor Magic7 won the championship in new mobile phone sales on platforms such as Tmall, JD.com, Douyin, and Kuaishou. Its first-day sales broke all previous first-day sales records for new Honor phones, and offline store sales were extremely popular.

Regarding this, the reporter randomly interviewed two consumers on the street and asked them about their views on the above-mentioned consumption phenomenon.

One consumer said, "Nowadays, the costs of key components such as chips and screens are increasing, and the price increase of Android phones is also an unavoidable measure. If the phone's performance and configuration are indeed significantly improved, I think an appropriate price increase is acceptable." However, there are also consumers who are dissatisfied with the price increase, saying, "Android phones used to be cost-effective, but now the prices have increased so much that they are almost on par with Apple phones. So why shouldn't I just buy an Apple phone?"

In fact, since the beginning of this year, the domestic mobile phone market has already shaken off the downward trend that persisted for many years. According to data from the China Academy of Information and Communications Technology, from January to September, domestic mobile phone shipments reached 220 million units, an increase of 9.9% year-on-year.

Communication expert He Gang told the reporter that an important reason for the market recovery is the arrival of a new round of replacement cycles, coupled with the launch of new products such as AI mobile phones, foldable mobile phones, and 5G mobile phones, which cater to consumer demand. Generally speaking, the replacement cycle for Android phones is 3 to 5 years. Judging from the peak shipment volume in the previous cycle, the market entered a new replacement cycle at the end of 2023, and the pent-up demand for replacements accumulated over the years has gradually been released.

At the same time, a series of favorable policies have also created a good development environment for enterprises in the mobile phone industry chain. It is understood that during Double 11, many consumers pay attention to mobile phone discounts and trade-in allowances, using these methods to reduce the cost of purchasing mobile phones.

"Inverse growth" of price and sales volume

From the mobile phone sales data during Double 11, we can see that in today's consumer electronics market, a special phenomenon is emerging: mobile phone prices are rising, but sales of some high-end models are still booming. Although it seems that prices and sales volumes are moving in opposite directions, in reality, the mobile phone industry has undergone new changes, namely, the gradual deepening of premiumization in the global mobile phone market.

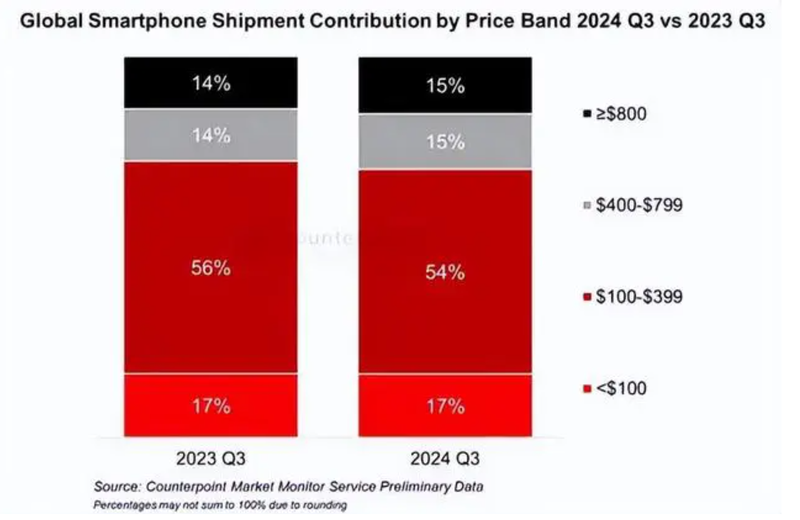

According to agency data, global smartphone shipments increased by 2% year-on-year in the third quarter of 2024, while revenue growth reached 10%, setting a record high for the third quarter. This is mainly due to the driving force of premiumization trends, especially a 2% year-on-year increase in the net share of the segment with a price of ≥400 USD.

Image Source: Counterpoint Research

According to a report by International Data Corporation (IDC), smartphone shipments in the Chinese market were approximately 68.78 million units in the third quarter of 2024, an increase of 3.2% year-on-year. In this quarter, the market share of high-end mobile phones priced above 600 USD (approximately RMB 4,200 and above) reached 29.3%, an increase of 3.7 percentage points compared to the same period last year, indicating an increase in consumer demand for high-end smartphones.

In addition, the domestic smartphone market has been sluggish in the past, but the high-end market has shown a trend of countercyclical growth. According to Counterpoint Research data, sales in the Chinese high-end mobile phone market experienced a "comeback" in 2023, with a year-on-year increase of 37%.

In fact, consumers' pursuit of high-end mobile phones with rising prices is not a blind move.

A mobile phone industry practitioner told the reporter in an interview that as living standards improve, consumers are increasingly willing to pay higher prices for high-performance, high-quality products. For example, high-end mobile phones usually have better cameras, faster processors, longer battery life, and superior design, attracting users with high demands on mobile phone performance.

adv

-->