TikTok Refugees Seek Refuge, Xiaohongshu Hastens E-commerce Breakout

![]() 01/15 2025

01/15 2025

![]() 666

666

For Xiaohongshu, expanding its e-commerce scale akin to Douyin is a more critical long-term proposition compared to capturing the short-term surge of TikTok refugee traffic.

By Guoxiaomiao, Edited by Wantiannan

TikTok Stumbles, Xiaohongshu Feasts?

On January 10, local time, the US Supreme Court held oral arguments on the TikTok ban, unfortunately upholding the ban. According to the ruling, if ByteDance does not sell TikTok, the US will order it to shut down on January 19.

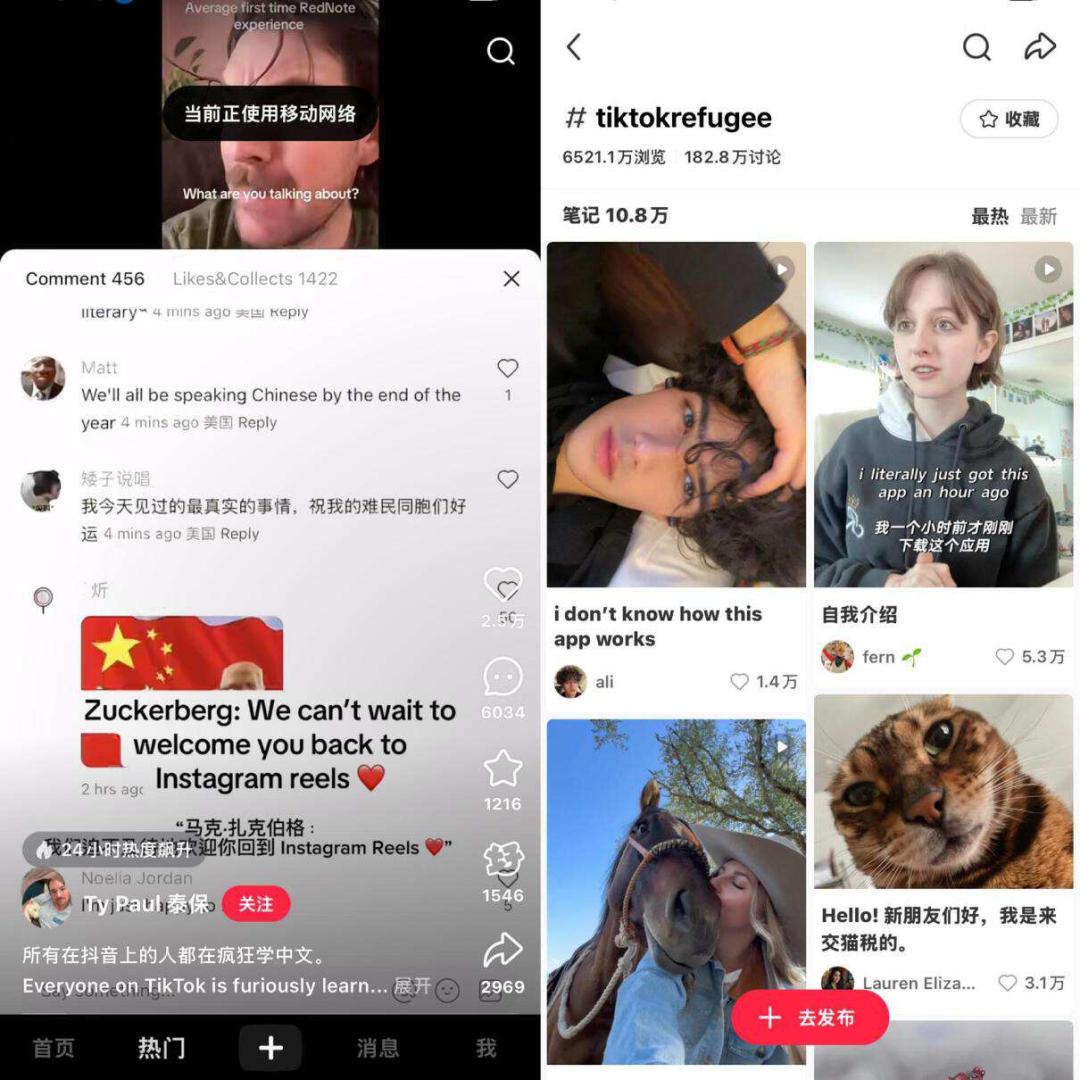

American youth, in search of alternatives, have turned their attention to Xiaohongshu, dubbing themselves TikTok refugees. As of press time, the #TikTokRefugee topic on Xiaohongshu had garnered over 78 million views and over 2 million discussions. Xiaohongshu was suddenly inundated with Americans, with many netizens exclaiming that it felt like they had arrived at Instagram.

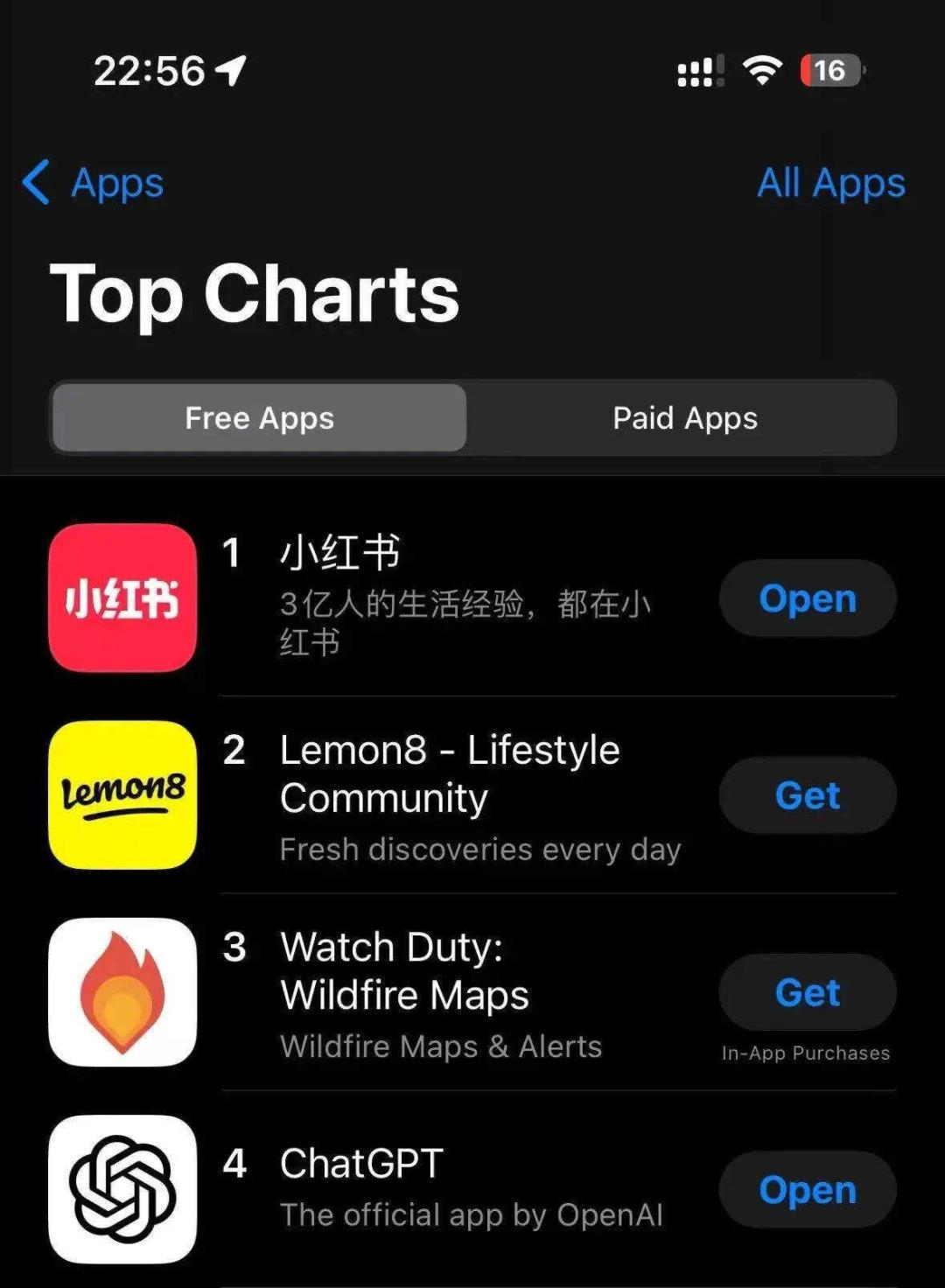

With the help of these "refugees," Xiaohongshu topped the US AppStore's free app download chart at 10 PM on January 13. On January 14, it also topped the free app download charts in Australia, the UK, and the Netherlands' AppStores, ranking third in Germany. A British user who joined Xiaohongshu stated that although TikTok is not banned in the UK, if Americans flock to Xiaohongshu, TikTok will lose its appeal, so they might as well join too.

This influx of traffic was somewhat coincidental. After nearly two years of back-and-forth, Xiaohongshu recently changed the second tab at the bottom of many users' screens from shopping to TikTok's iconic single-column short videos.

According to Caijing Story Hui, compared to the sudden influx of wealth brought by cyber refugees, whether Xiaohongshu can more firmly push forward its video strategy may hold far greater value for its commercialization.

Of course, Xiaohongshu's commercialization is not as simple as just altering its product form.

In the second half of 2024, Xiaohongshu actively introduced merchants from industrial belts and also turned its gaze towards the sinking market and the elderly for user acquisition.

These changes are not difficult to understand. According to the Financial Times, as early as 2023, Xiaohongshu had already become profitable, with estimated net profits of around $1 billion in 2024. However, Xiaohongshu is far from reaching the ceiling of commercialization, and its path to gold mining is still long.

A Firmer Commitment to Video

In the past two days, TikTok "refugees" from the US have flooded into Xiaohongshu, with many "refugees" even posting six or seven short videos within just a few hours, demonstrating their enthusiasm.

This contrasts sharply with some Chinese users who are "not used to" Xiaohongshu's single-column feed redesign. Currently, there are over 2,000 notes on Xiaohongshu with users asking how to close the "Popular" section and change it back to "Shopping." In the comments, some users complain about "not wanting Xiaodoushu."

In fact, Xiaohongshu's shift towards short videos can be traced back to the beginning of 2023. The "Video" section appeared in the second tab at the bottom of the homepage, replacing the original "Shopping." Clicking on the "Video" section automatically plays short videos, with an interface layout similar to Douyin, although after a brief attempt, it was changed back to "Shopping."

Last July, Xiaohongshu once again conducted an internal test of single-column short videos. Only recently has Xiaohongshu taken a bigger step, officially changing the second tab at the bottom of the homepage of more users to single-column short videos, although the name was changed to "Popular."

For the shift towards short videos, Xiaohongshu had to accelerate.

In the second half of 2024, COO Conan clearly stated that Xiaohongshu's e-commerce is a "lifestyle e-commerce," further clarifying the company's positioning of its e-commerce business after "buyer e-commerce." At the 2025 Xiaohongshu WILL Business Conference, the platform's ability to integrate planting and harvesting was also emphasized, with e-commerce becoming the focus of Xiaohongshu's next stage of development.

As long as Xiaohongshu wants to make e-commerce its main engine of growth, it must embark on the path of short videos.

YANN BOUTIQUE is a women's clothing supply chain service platform deeply rooted in Xiaohongshu. Its founder Xue Yan told Caijing Story Hui that the problem facing Xiaohongshu lies in the low input-output ratio and the lack of a mindset for live streaming and e-commerce, which is related to the logic of the double-column feed.

The reason is straightforward. Live e-commerce is essentially a funnel model, requiring a sudden influx of large amounts of traffic to push up GMV. This requires the platform to have a strong media attribute, namely a single-column feed. If the feed pushing live streaming rooms is double-column, users will face a choice of four content options, ultimately diverting traffic to different content. Compared to a single-column feed, the traffic loss in the chain leading to live streaming is higher.

From this perspective, as a content platform diving into e-commerce business, Douyin and Kuaishou are pioneers that Xiaohongshu can learn from.

However, in the view of Caijing Story Hui, Xiaohongshu's video shopping logic can actually prioritize learning from Kuaishou. Although Xiaohongshu and Kuaishou have different product forms, both have strong community attributes, with the first tab on the homepage being a double-column feed.

Kuaishou entered its first full-year profit cycle in 2023, with a key factor being the connection of its main site and commercialization through e-commerce, directly driving growth in transaction and advertising revenue.

In the second half of 2019, Kuaishou made multiple adjustments in products, technology, and operations, including launching a Lite version, changing the double-column feed in the second tab of the main site to a single-column, and sponsoring the Spring Festival Gala, ultimately achieving a DAU of over 300 million during the 2020 Spring Festival.

Strengthening the single-column feed is also something that Xiaohongshu is doing—as mentioned above, more and more Xiaohongshu users are finding that the second tab at the bottom has become "Popular."

Of course, the single-column feed is not only conducive to the development of the e-commerce business but is also key to driving the advertising business with the help of e-commerce, namely the internal cycle advertising often mentioned by Kuaishou.

In September 2022, Kuaishou CEO Cheng Yixiao concurrently took on the role of head of Kuaishou e-commerce, connecting the traffic of the main site, live e-commerce, and commercialization from a full-site perspective, mobilizing full-site traffic to serve merchants' full-site transaction ROI, namely the "full-site ROI" concept, helping Kuaishou realize the improvement of advertising revenue driven by e-commerce.

Now, Xiaohongshu is also trying to connect different content fields. Securities Star reported in December 2024 that Xiaohongshu had integrated the algorithm departments of commercialization, community, and e-commerce to form a new application algorithm department. On January 14, Xiaohongshu launched nine new measures focused on algorithmic goodness, including establishing an algorithmic communication mechanism, improving governance system construction, enhancing recommendation diversity, and optimizing traffic distribution mechanisms.

Currently, the "Popular" section on Xiaohongshu does not yet push live streaming rooms, but it can be predicted that if Xiaohongshu wants to expand its commercialization scale, it needs to use the single-column feed to cultivate the mindset for live streaming and e-commerce, and then leverage e-commerce to drive growth in the advertising business.

A Two-Way Rush Between Merchants and Users

To expand the scale of e-commerce, sufficient supply and a large number of users are necessary.

The development of Xiaohongshu's e-commerce is insufficient. According to Xue Yan's analysis, "The main reason is the insufficient match between user scale and commodity supply."

It seems to be a consensus in the industry that Xiaohongshu users have strong purchasing power and pursue high-end quality goods. The platform was previously filled with beautiful but useless "small trash," such as "3D-printed crafts costing hundreds of yuan" and "designer pants costing 800 yuan."

However, Xue Yan believes that Xiaohongshu just has some differences in tone, and the user group is indeed of higher quality. However, from the perspective of clothing categories, the return rate on Xiaohongshu is not significantly lower than the overall market, and the average order value is only slightly higher. These advantages are somewhat insignificant for small and medium-sized merchants.

"For example, the return rate on Xiaohongshu may be lower than on Douyin and Pinduoduo, but it's not low enough for merchants to feel relaxed."

Especially in the current economic downturn, when e-commerce platforms focus on price competitiveness, Xiaohongshu's introduction of merchants from industrial belts is more of a two-way rush between the platform and users rather than a lowering of tone.

Since April last year, Xiaohongshu has established cooperative relationships with industrial belts in more than ten regions including Jiangsu, Shanxi, Guangdong, and Fujian, covering categories such as women's clothing, bags, shoes, and children's clothing. According to Tech Planet, in some to subdivide categories of outdoor sports, merchants with low customer orders below 100 yuan were not encouraged to open stores in 2023, but in 2024, products with a unit price of less than 80 yuan were welcomed.

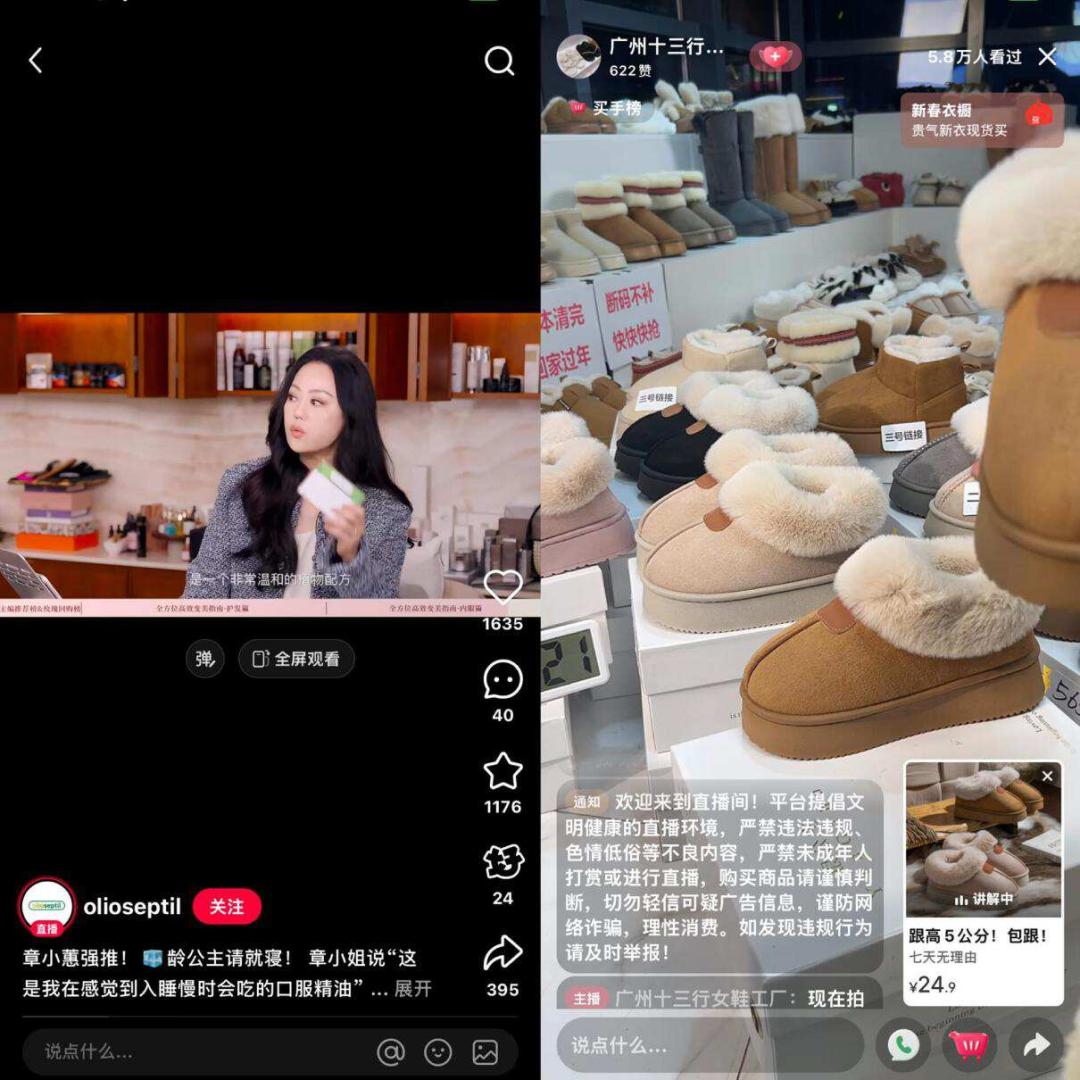

Now, many live streaming rooms of merchants from industrial belts on Xiaohongshu are quite different from the previous styles of Zhang Xiaohui, who introduced products leisurely, and Li Dan, who attracted users by being an electronic confidante. Instead, they are quite similar to Taobao and Douyin live streaming rooms.

"Link number one, order now for 24.9 yuan. The whole snow boot is very thick, and the price will rise to 30 after it's sold out. Countdown, 3, 2, 1!" On January 13, the live streaming room of "Guangzhou Shisanxing Women's Shoes Factory" used the factory workshop as the background, with the camera only focusing on the product itself, highlighting its appearance and usage effects. The anchor used familiar sales tactics, skillfully counted down, and cumulatively sold over 80,000 pairs of thick cotton shoes.

Xiaohongshu's seeding notes have a good long-tail effect. In terms of note creation, these merchants from industrial belts have tried to cater to Xiaohongshu's text style, choosing the phrase "high-end brand alternatives," such as Korean original orders, anchor/celebrity same styles, etc.

Taking Jimo Xingzhinuo Sweater Factory as an example, it conducts simultaneous live streaming and e-commerce on both Xiaohongshu and Taobao. However, Caijing Story Hui found that the promotional copy on the Taobao live streaming room was "factory clearance," while Xiaohongshu focused on "hard-to-find purchasing agents," "Korean orders," and "foreign trade goods." The selling prices on the two platforms were the same.

According to NewRed data, among the top five accounts in Xiaohongshu's December store broadcast viewership rankings, two were merchants from industrial belts: "Lanyi Zhilu High-end Women's Clothing Wholesale" and "Sangpo Enen Yilinsha Footwear." The average order values were 88 to 188 yuan and 30 to 400 yuan, respectively. The top-selling product on the December live streaming sales chart was "Youyu Home"'s 24.9 yuan winter plush cotton shoes, with a cumulative sales of 42,800 pairs.

In addition to expanding supply, Xiaohongshu is also accelerating its user acquisition efforts.

According to China Entrepreneur, after September 2024, Xiaohongshu launched a ground promotion user acquisition campaign in Beijing. A ground promotion staff member can receive a maximum reward of 32 yuan for each new registered user they acquire; if it is an already registered user who has not logged in for over 28 days and re-downloads and logs in, they can also receive a maximum reward of 17 yuan. Unlike the previous pursuit of a "refined" mainstream user image, service providers described the characteristics of this user acquisition target as sinking and aging.

A ground promotion company of Xiaohongshu revealed that in the next four years, Xiaohongshu will maintain high-intensity ground promotion. According to Aurora Data, as of November 2024, Xiaohongshu's monthly active users had reached 330 million.

On January 13, Xiaohongshu also officially announced that it would become the exclusive note-sharing platform for the CCTV "2025 Spring Festival Gala." This is the second consecutive year that Xiaohongshu has partnered with the CCTV Spring Festival Gala. Previously, in 2024, Xiaohongshu created the accompanying live stream "Everyone's Spring Festival Gala" for the first time, watching and chatting about the gala with users, with over 170 million interactions in the live stream room. According to QuestMobile data, on February 9, 2024, Xiaohongshu's daily active users reached 97.81 million, a year-on-year increase of 43.8%.

If in the 2024 Spring Festival Gala cooperation, Xiaohongshu's goal was to boost user activity, then in the 2025 Spring Festival Gala cooperation, Xiaohongshu also aims to cultivate consumers' consumption mindset towards short videos and live streaming content.

A relevant person in charge of Xiaohongshu said that as a content community, Xiaohongshu hopes to leverage the CCTV Spring Festival Gala, a national IP, to continuously enrich its content ecosystem and continue to explore new ways of cooperation with CCTV's converged media, creating an industry innovation model.

It is reported that during the 2025 Spring Festival, Xiaohongshu will introduce a series of vibrant activities, including diverse online markets and engaging lottery games. These will encompass over 130 live streams featuring surprise appearances by film and television creators, popular variety show "watch and chat" segments, and free access to numerous high-quality short dramas, among other attractions.

Behind this ambitious undertaking lies Xiaohongshu's aspiration to become a nationally renowned app with a daily active user base of 300 million.

Can a late entrant in the market catch up with the leaders?

Adjusting product strategies, onboarding merchants from industrial belts, and intensifying user acquisition efforts do not guarantee Xiaohongshu's success. Numerous challenges still lie ahead.

Currently, merchants from industrial belts and small to medium-sized enterprises have become key battlegrounds for industry giants.

E-commerce titans have collectively increased their investments in industrial belts. Pinduoduo has embarked on the "new quality supply" transformation in collaboration with various industrial belts. JD.com has bolstered its support for industrial belt merchants and launched the "factory goods with billions of subsidies" program. Taobao continues to invest heavily in branded goods and industrial belt products. 1688, highly valued by Xiaohongshu for its "high-end brand alternatives," claims to be deeply embedded in 1,000 industrial belts across China. In 2024, Douyin e-commerce sold 170 million products from industrial belts nationwide, generating 15.4 billion orders, a 39% year-on-year increase.

To support merchants, weakening celebrity broadcasts and strengthening store broadcasts has emerged as a new development trajectory for both Douyin and Taobao.

36Kr reported in July 2024 that Douyin is reducing the allocation of traffic to celebrity live broadcasts and shifting focus towards high-quality short videos and brand store broadcasts. At the 2024 Tmall Double 11 conference, Meng Xin, general manager of Taobao Live Store Broadcasting, announced that live e-commerce has evolved into a new era of "quality live broadcasting," moving away from the entertainment celebrity model. The synergistic model of professional anchors, brand inventories, and platform quality service guarantees will become the industry mainstay.

Xueyan has interacted with numerous physical clothing merchants, approximately 20% of whom aspire to achieve success on Xiaohongshu. However, in reality, less than a quarter of those who have attempted it have seen significant results. "Occasionally, there are merchants with exceptionally strong content creation abilities who can launch popular products through their content, but the likelihood is low."

Due to insufficient traffic dividends, fierce competition for merchant resources, and disparities in marketing tools, for many industrial belts, Xiaohongshu remains a secondary channel.

"If you frequently visit live streaming rooms, you'll notice that many merchants engaged in live streaming sales barely respond to interactions on Xiaohongshu. Descriptions like 'Link number X' for product showcases clearly mimic Douyin's style. Even though they broadcast simultaneously on multiple platforms, their primary focus remains on Taobao and Douyin."

Moreover, traffic, scale, and community atmosphere are recognized as an impossible triangle for community platforms. Between maintaining the community's tone and expanding its scale, Xiaohongshu will inevitably confront a choice: if the community atmosphere is robust, spending money to attract new users will either primarily target those who align with the tone or risk diluting the tone and losing some original users.

As early as 2021, Xiaohongshu launched the "Male Content Incentive Plan" to expand pan-entertainment vertical content, such as games and digital products, aiming to attract more male users. However, according to 36Kr, although there were some effects, most of those who stayed were males who already had good rapport with females. While this ground promotion targets elderly users to attract new ones, how many of them will stay remains uncertain. 36Kr reports that Xiaohongshu has always had an "Old Red Book" project team, catering to elderly users' preferences by engaging in content related to artifact appraisal for a long time, even before "Tingquan Artifact Appraisal," but it failed to gain popularity.

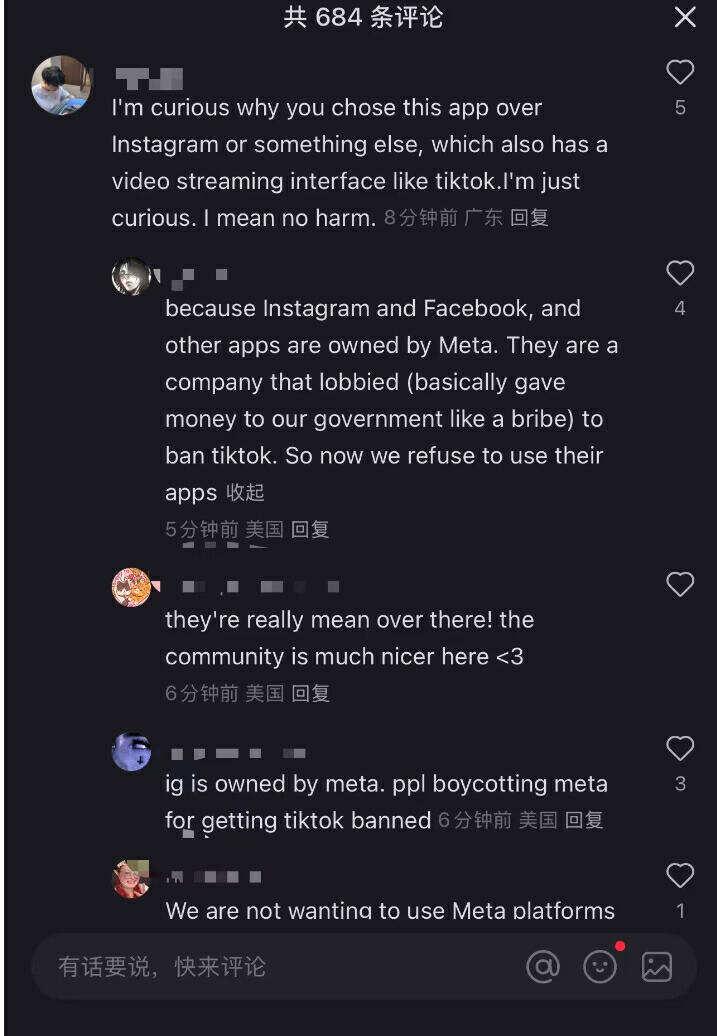

The same principle applies to American users who have flooded in due to TikTok's "ban if not sold" policy. Most of them joined Xiaohongshu out of rebellion against Meta and the US government rather than genuine affection for the platform, making their long-term stay uncertain.

Given the differences between Chinese and American cultures and content supervision, retaining users in the future, navigating potential regulatory red lines due to overseas users, and avoiding "overwhelming traffic" turning into "unforeseen disasters" pose significant challenges.

Furthermore, according to Xiaohongshu personnel speaking to "Caijing Story Collection," the influx of TikTok refugees over the past few days, compared to Xiaohongshu's overall user base, "is very limited in scale and proportion."

For Xiaohongshu, rather than focusing on capturing the overwhelming traffic of TikTok refugees momentarily, how to expand its e-commerce scale in the long run, akin to Douyin, is a more critical and long-term proposition.