Cook Faces Setback: Apple's Revenue, Market Share, and Average Selling Price Decline

![]() 05/07 2025

05/07 2025

![]() 533

533

After the unveiling of the iPhone 16 series last year, optimism was high that the AI capabilities of iOS 18, branded as Apple Intelligence, would propel Apple towards substantial growth. Unlike Android, Apple's AI is deeply embedded within its ecosystem.

However, it transpired that Apple's AI was more of a theoretical promise than a practical reality. When the iPhone 16 series launched, AI functionality was absent. It took considerable time before it was gradually introduced in regions like the Americas, and many other areas still await its arrival.

Furthermore, the iPhone 16 lacked innovative features, boasting only a single new camera button compared to its predecessor, which resulted in underwhelming sales. To compete with Android phones, Apple resorted to significant price reductions, particularly in the Chinese market, where it set a new record for the fastest and largest price drop.

To Cook's embarrassment, despite these steep price cuts and engaging in a price war with Android phones, sales remained sluggish. Domestic phone brands pushed Apple to fifth place in the Chinese market.

On a global scale, Apple's revenue share, market share, and average selling price all witnessed a quarter-on-quarter decline in the first quarter of 2025.

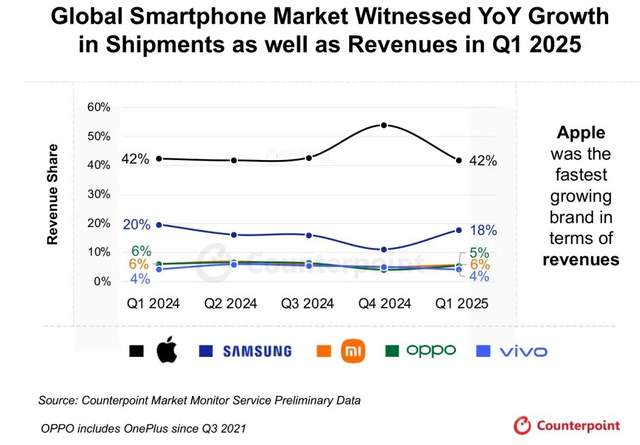

The first image illustrates the global mobile phone market share based on sales. Apple maintains a significant presence with 42%, but this represents a notable drop from the previous quarter's 54%.

In contrast, Samsung, VIVO, Xiaomi, and OPPO have all seen notable increases, eroding Apple's revenue share.

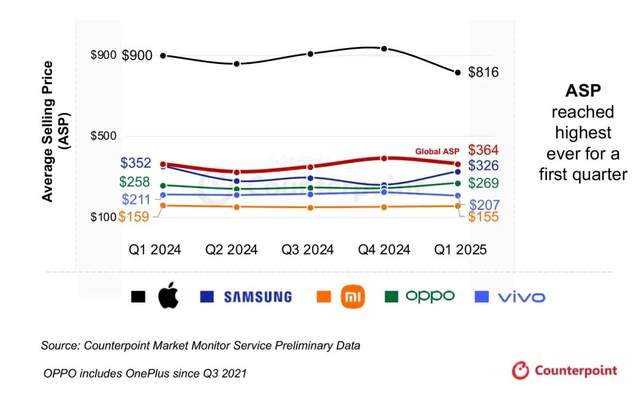

Regarding average prices, Apple's first-quarter average selling price was $816, a decrease from the previous four quarters. This decline is clearly a result of Apple's price war, leading to a substantial drop in phone prices.

On the other hand, Samsung and OPPO appear to have increased their average prices, Xiaomi remains relatively stable, while VIVO has seen a slight quarter-on-quarter decline.

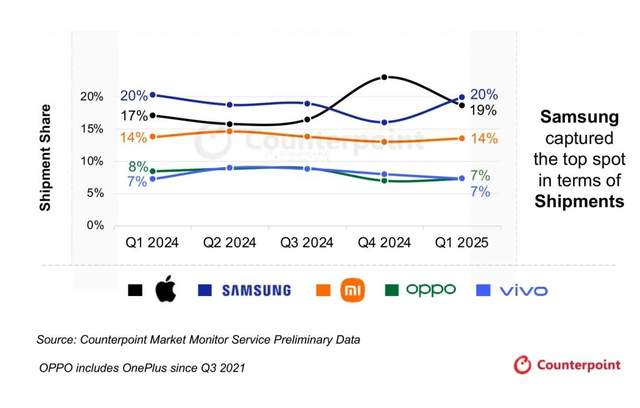

Finally, examining overall market share, Apple has slipped to 19%, falling below Samsung's 20%. Xiaomi holds 14%, while OPPO and VIVO each account for 7%. However, Xiaomi, OPPO, and Samsung have all seen increases, with Apple experiencing the most significant decline.

It is evident that Apple's performance in the first quarter was truly disappointing. All indicators suggest that Apple encountered a significant setback this quarter. The question remains: what steps will Cook take to revive Apple's growth trajectory?

Adding to Cook's frustration, Apple releases a new phone annually, and several months remain until the iPhone 17 is unveiled. Meanwhile, many Android phone brands will continue to push forward in the first half of the year with new model introductions. How will Apple respond to this competitive landscape?