vivo Defends Its Territory: Battling in the Mid-range Market

![]() 06/04 2025

06/04 2025

![]() 620

620

As major smartphone manufacturers compete fiercely to showcase their premium offerings with advanced technology, the mid-range market remains the primary battlefield for shipments. Among China's nearly 1 billion smartphone users, 500 million opt for mid-range devices priced between 2k and 4k.

In the past couple of months, new product launches by smartphone manufacturers have underscored the ongoing intense competition in the mid-range market. Public data reveals that following the launch of the OPPO Reno14 on May 15, the Huawei nova 14 series, Xiaomi Civi 5 Pro, and Honor 400 series have swiftly followed suit. The introduction of the vivo S30 series on May 29 further escalated this competition to new heights.

Interestingly, both Honor and vivo's new models will go on sale for the first time on June 6, showcasing lively competition on the same stage but also revealing the pressure faced by mid-range smartphone manufacturers at present.

For vivo, there are underlying concerns about its current situation, including a prolonged replacement cycle, maximized efficiency in the smartphone supply chain, and Huawei's strong comeback.

Indeed, vivo's challenges stem from the decline in the fundamental market. IDC data shows that in the Q1 2025 market share ranking in China, vivo ranked fourth with 14.6%, a stark contrast to its position as the domestic market leader last year. Despite slight deviations in data statistics among different research institutions, vivo's declining trend remains difficult to conceal.

Given the scale of mid-range smartphones in overall industry sales and vivo's own product distribution structure, it is evident that the mid-range market is a core area that vivo cannot afford to lose.

I. Breakthrough

Over the decade-long development of the smartphone industry, mid-range smartphones initially pursued cost-effectiveness, meeting consumers' basic needs in terms of processors, heat dissipation, photography, and more.

Against this backdrop, brands such as Coolpad, Meizu, Gionee, Redmi, Honor, and Lenovo all made the mid-range market their core business strategy. Back then, the smartphone market was a blue ocean, and each manufacturer achieved growth through model creation and segmented multiple series to enrich their product lines.

Over the years, vivo emerged as the first player to break through the encirclement and join the mainstream camp. This achievement is attributed to vivo's deep cultivation in product strategy, technology, and channel resilience.

First, there's the model proliferation strategy.

In the early stages of industry development when parameters were paramount, vivo launched dozens of models, forming a low-to-mid-end product system with different price ranges like the Y series, S series, and IQ series, catering to different consumption levels. For instance, iQOO focuses on the performance needs of gamers, continuously bringing cooler and more hardcore technology. As a result, vivo stood out among competitors by relying on quantity.

Second, there's continuous investment with a focus on imaging.

Public data shows that in 2019, vivo established four long-term development tracks: design, imaging, system, and performance, and set up a Central Research Institute to focus on cutting-edge technology research and development over a three-year period. Exploration in these areas has made vivo's products stand out in the domestic smartphone hierarchy. Taking the imaging track as an example, vivo has assembled a research and development team of over a thousand people, from the "micro gimbal" anti-shake technology to the self-developed imaging chip V1, accumulating multiple technological generations of differences, allowing vivo to maintain a cost-effectiveness advantage in the mid-to-low-end market.

Third, precise channels have greatly improved distribution efficiency.

vivo's channel advantage stems from its rapid occupation of the sink terminal operator market, which significantly enhances channel capacity and product standards, building a relatively solid scale barrier. This objectively drives an increase in vivo's mid-range smartphone coverage and activation volume.

Stores reaching into towns and cities are the key to vivo's sales volume. In the downmarket, vivo has far more offline stores than Huawei and Xiaomi.

As of 2024, vivo had over 250,000 offline stores, covering direct stores, agent experience stores, and dealer franchise stores, supporting its sales volume.

The coordination of these strategies rapidly propelled a surge in vivo's market share, driving vivo to continuously rank first in China's smartphone market share for the past four years. Considering that vivo's share in China's premium smartphone market is not high, this also proves in reverse that the mid-range market is crucial to vivo's absolute shipment scale.

vivo's past achievements fundamentally benefited from the continuous release of dividends from the smartphone industry and vivo's strategic investment determination in the mid-price range based on its cultural principles. However, today, the market competition landscape, product definition, and channel sales models have all entered a new stage.

II. Pressure

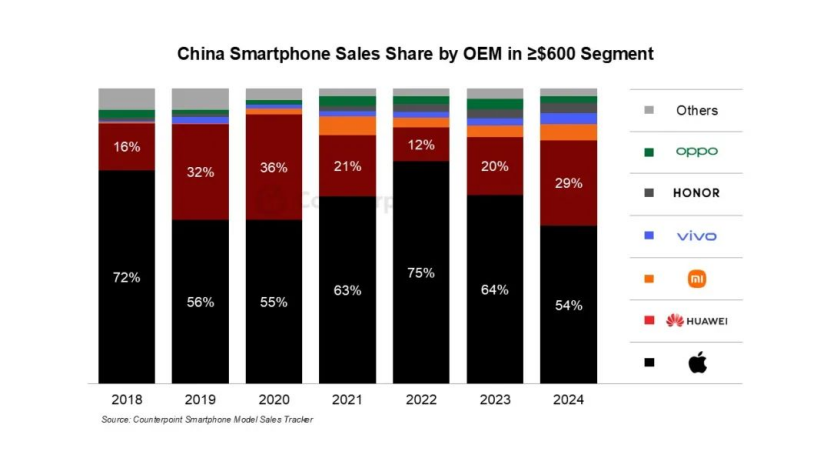

Over the past five to six years, China's smartphone market has exhibited two characteristics: one is premiumization, with the market share of smartphones priced at $600 or more than 4,000 yuan increasing from 11% to 28%; the other is the transition from an incremental era to a stock era.

These two factors pose even more dangerous signals for mid-range smartphones, indicating that the differentiation trend among smartphone manufacturers in the mid-range field will become more pronounced.

Taking 2024 as an example, there were as many as 396 new models launched in the Chinese market, with mid-range smartphones accounting for the majority. In the stock era, industry players are fighting even more fiercely at this price range, leading to performance surplus in parameters and designs such as batteries, processors, imaging, and appearance. For instance, some manufacturers' early pride in lightweight design, satellite communication, drop resistance, AI eye protection, and other functional selling points in the 2k+ price range have almost become industry standard features.

Fortunately, the national subsidies starting from the fourth quarter of last year have become an important driving force for consumers to replace their smartphones, with the low-to-mid-end market benefiting more, giving mid-range smartphones a breather. However, combined with the frequent launch of new mid-range models mentioned earlier, the competition remains intense.

Performance homogenization is just one aspect. To gain more market share, major brands have also increased their online channel layout and offline retail construction in recent years, trying to enhance their brand voice. But these actions have led to issues of price and territorial involution.

Taking 618 as an example, statistics show that in the first phase of Tmall 618, over 2,000 mobile phone models supported the superimposition of Tmall 618 discounts and national subsidies, with additional subsidies and discounts starting at 50%, covering mainstream smartphone brands such as Huawei, Xiaomi, OPPO, vivo, Honor, Samsung, and OnePlus. Not a few mid-range models have seen their prices drop significantly from their launch prices.

Compared to other manufacturers with more diversified products and businesses, vivo has a lower safety margin, and the profit impact from price involution will be greater.

In terms of territories, as the mobile phone industry has gradually shifted from extensive sales over the past years to a trend of placing more emphasis on experiential purchasing, many manufacturers have set separate channel expansion targets offline. This is achieved by giving channel partners certain incentives and rebates to promote them to open their respective brand experience stores. With limited high-end commercial space in cities, the speed of brand territory construction has become a touchstone for testing manufacturers' operational efficiency.

However, compared to some other competitors, vivo's offensive on its own brand stores is insufficient, which can be seen from the number of vivo brand stores in some third- and fourth-tier cities.

Additionally, some enterprises with ecological industrial chains even attempt to break through industrial boundaries and form a rich matrix of "smartphones + cross-border products," bringing greater brand potential. This view can also be confirmed from the shipment data results among manufacturers.

According to previous reports by some technology media, third-party data shows that as of the 20th week of 2025, the total shipment of the Huawei nova 13 series reached approximately 6.563 million units; while the vivo S20 series sold approximately 2.769 million units. In other words, although the nova 13 series was launched nearly a month earlier than the S20 series, vivo's gap is still relatively obvious.

In other words, under the industry situation of technology popularization, price and territorial involution, vivo's early competitive barriers in hardware and software technology and channels are beginning to be broken, and the risk of declining market share is increasing.

As competition intensifies in the "ranking race" in the low-to-mid-end market, some manufacturers have begun to bring flagship technologies down to the mid-range. However, against the backdrop of shorter smartphone iteration cycles and increasingly smaller product differentiation, how to break through the involution and build new product increments has become a major challenge for vivo.

III. Differentiation

Consumers' choice of premium smartphones is often influenced by factors such as brand reputation, premium preservation rate, and disruptive innovative technology. However, mid-range smartphones are constrained by costs and cannot provide similar selling points to premium smartphones. Consumers, constrained by budgets, cannot have it all.

Therefore, in an environment where the growth dividends of smartphones are gradually coming to an end, some smartphone manufacturers have begun to refine users' needs to accurately address a specific user need, thereby bringing differentiated advantages and incremental opportunities in that price range.

The most obvious example is that Honor launched the new Honor GT Pro, focusing on the e-sports track with comprehensive upgrades in performance, battery life, and eye protection, and achieved sales championship in the 3-5K price range across all platforms during its first sale. Simultaneously, Honor Power was the first to break the industry's 8000mAh barrier, driving Honor's brand to rank first in the 2-2.5K share, returning to the top five domestically within that period. Redmi used a "super large cup" battery in the Redmi Turbo 4 Pro to ignite the market, while vivo expanded its coverage relying on e-sports optimization and fast charging technology.

This shows that amplifying the advantages of mid-range smartphones in a certain niche area may become a useful exploration for smartphone manufacturers in enhancing their competitiveness in that price range.

Furthermore, due to the limitations of costs such as research and development and supply chains, mid-range products are inherently difficult to occupy market commanding heights based on general advantages. This also provides opportunities for manufacturers that dare to create extreme scenarios and selling points, and also promotes the industry to accelerate its evolution towards deep scenario exploration. Essentially, products that accurately match user needs and solve user pain points are more competitive.

vivo's past success is largely based on segmented advantages, especially in imaging. From vivo's recent launch of the top talent recruitment project "Blue Polar Star Plan," it can be seen that vivo's strength in imaging is the area with the most recruitment quotas, further confirming vivo's solid foundation in this field and the possibility of continuously building differentiated blockbuster competitiveness in the future.

Hu Baishan, Executive Vice President of vivo, once clearly stated that vivo's current investment in AI and imaging is the largest among smartphone brands, with over a thousand personnel invested in each area. In January of this year, Shen Wei, the founder, president, and CEO of vivo, proposed that "looking back at the 30-year development journey of the enterprise, the technological essence we pursue has always been to explore meaningful changes for users."

Considering the real impact of Huawei's return and its moat advantages in chips, systems, ecology, etc., for vivo, the strategies it has formed in the mid-range market over the past decade, including channels, prices, and product structure, have gradually faded their original advantages.

Through systematic technology ecosystem reserves and extreme breakthroughs in differentiated product selling points, it may be the key move for vivo to form its unique competitiveness.