The Resplendent Great Counterattack: The Pivotal Battle of Warrior Li Jian

![]() 10/17 2025

10/17 2025

![]() 425

425

Source | Benyuan Finance

Author | Li Youshan

On October 15th, at the Beijing Water Cube, Nicholas Tse made a dazzling appearance in a sleek black suit at the launch event for the Honor Magic8 series. As a 'Honor Future Tech Experience Officer,' the middle-aged actor exuded an air of sophistication. Honor CEO Li Jian remarked that he could see traces of Honor's spirit reflected in Tse. For Huawei users, this scene was reminiscent of a familiar moment: two years ago, Nicholas Tse, holding the Huawei Mate X5, made a striking impression in Huawei's microfilm 'Fengxing Task,' where he delivered a high-energy action performance as a Huawei ambassador.

It is widely acknowledged that Honor has weathered a tumultuous year. Following Huawei's triumphant return with its self-developed chips and HarmonyOS, Honor's 'substitute dividend' gradually waned. Its smartphone market share plummeted from first to fifth place, relegating it to the 'Others' category and stalling its premium market push. After navigating equity reforms and management transitions, new CEO Li Jian succeeded key figure Zhao Ming, taking on the daunting task of reclaiming a 'top three market position.' To safeguard smartphone sales and justify a 200 billion yuan IPO valuation, Honor needed a fresh narrative capable of captivating capital markets. AI ecosystems emerged as the most promising bet.

In March, Li Jian boldly unveiled the 'Alpha Strategy,' planning a massive $10 billion investment to construct an AI device ecosystem, thereby transforming the company from a smartphone manufacturer into a global AI terminal ecosystem player. In May, Li Jian disclosed internal efforts to establish an 'offensive 433 formation,' adding top-tier departments such as the 'AI and Software Business Unit' and 'New Industry Incubation Unit' to adapt and thrive in a fiercely competitive market.

Survival, however, is no easy feat. Without Huawei's Kirin chips and HarmonyOS, lacking Xiaomi's cost-effectiveness and 'human-car-home' ecosystem, unable to match OV's brand strength and offline channel control, and powerless against Apple's brand premium, Honor faces challenges across branding, technology, channels, and marketing.

As Huawei's former sub-brand, some consumers still perceive Honor as a 'budget alternative' to Huawei. Even long after Honor's independence, market observers noted similarities in UI and design between the two brands. Now, under intense pressure, Li Jian has resorted to using a spokesperson previously associated with Huawei, potentially deepening the 'Huawei shadow.' Perhaps Honor still yearns for the days of 'flying side by side' with Huawei.

01

Breaking Free from the Substitute Narrative

From its inception, the Honor brand carried Huawei's halo while shouldering the mission to rival Xiaomi.

On December 16, 2013, at a factory in Beijing's 798 Art Zone, the Honor brand was launched, with fans chanting, 'Yu Chengdong, we love you!' Priced at 798 yuan, Honor was positioned as 'born to cool down.' In 2014, Honor created a 'wild' festival and a 'bigger this time' theme design competition, echoing Xiaomi's marketing tactics. With the debut of Huawei's Kirin 910 in 2014, Honor gained its strongest weapon, selling 20 million units that year. Leveraging 'cost-effectiveness,' Honor sold another 20 million smartphones in the first half of 2015, shaking the market. As Yu Chengdong put it, Honor and Huawei were 'flying side by side.'

In 2020, Honor fully separated to become Huawei's 'fire brigade.' During Huawei's three-year retreat, Honor naturally inherited some of Huawei's user base, achieving notable success. By 2021, despite supply constraints, Honor ranked fifth in China with an 11.7% market share. Extending the timeline to August 2023, when Huawei's Mate60 series made a full-fledged return, Honor still held second place in China and first among domestic brands.

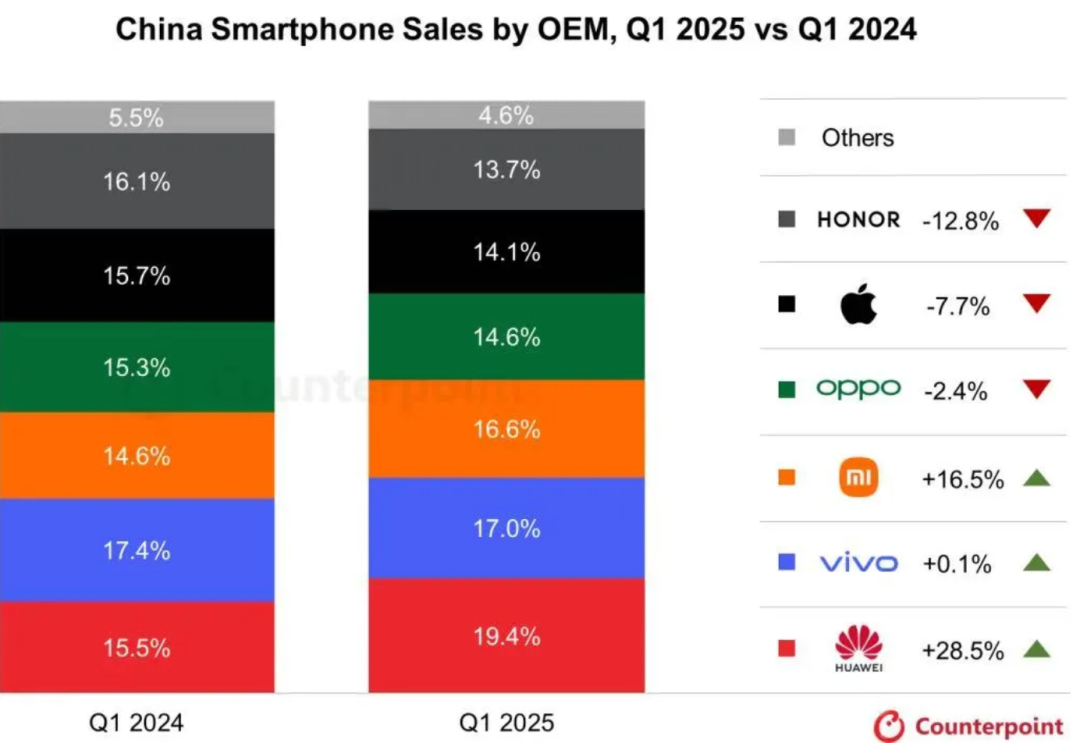

However, the market shifted dramatically in 2024. Canalys data showed Honor's market share in China declining steadily after the third quarter of 2023. In Q1 2024, Honor fell out of China's top five smartphone vendors by shipments, joining the 'others' category. Counterpoint's stats placed Honor sixth in China's domestic market with a 13.7% share, down 12.8% year-over-year.

Hu Baishan, Vivo's Executive Vice President and COO, stated, 'Huawei's smartphone return is the biggest variable in China's market, as it aims to reclaim its rightful share.'

Though Zhao Ming repeatedly claimed in public that Honor wasn't afraid of Huawei's return, the 'golden veil' covering Honor was ruthlessly torn off by its former parent. Honor's market share plummeted, revealing a harsh truth: since independence, Honor's moat wasn't as deep as imagined.

In 2025, Honor stumbled and underwent its biggest personnel shakeup: CEO Zhao Ming, who joined Huawei in 1998 and led Honor's growth, departed. By external accounts, Zhao Ming was pragmatic, rebuilding Honor's brand, product lines, supply chain, and channels during his tenure, launching models like the Honor Magic and GT series, and restoring Honor to China's top five smartphone brands. Before leaving, Zhao Ming completed equity reforms.

Zhao Ming's successor, Li Jian, previously served as Vice Chairman, Director, and HR President, admitted, 'Since late last year, Honor's smartphone sales have faced difficulties.'

Li Jian's first move as CEO targeted organizational restructuring.

For overseas markets, Li Jian launched the 'Head Wolf Plan,' adjusting six of eight regional heads. The Latin America president was reassigned to Europe, while the Middle East and Africa president, Yuan Lin, returned to China as head.

In the domestic market, Honor initiated the 'Eagle Plan,' reshuffling six of eight regional leaders and implementing 're-competition' for 38 key Chinese positions, with 45% of leaders adjusted and 24% being post-90s. Sources close to Honor revealed this was Li Jian's swift, precise internal overhaul, marking the start of Honor's great counterattack.

Internal turmoil and a lack of new releases in Q1 2024 were cited as reasons for Honor's poor market performance.

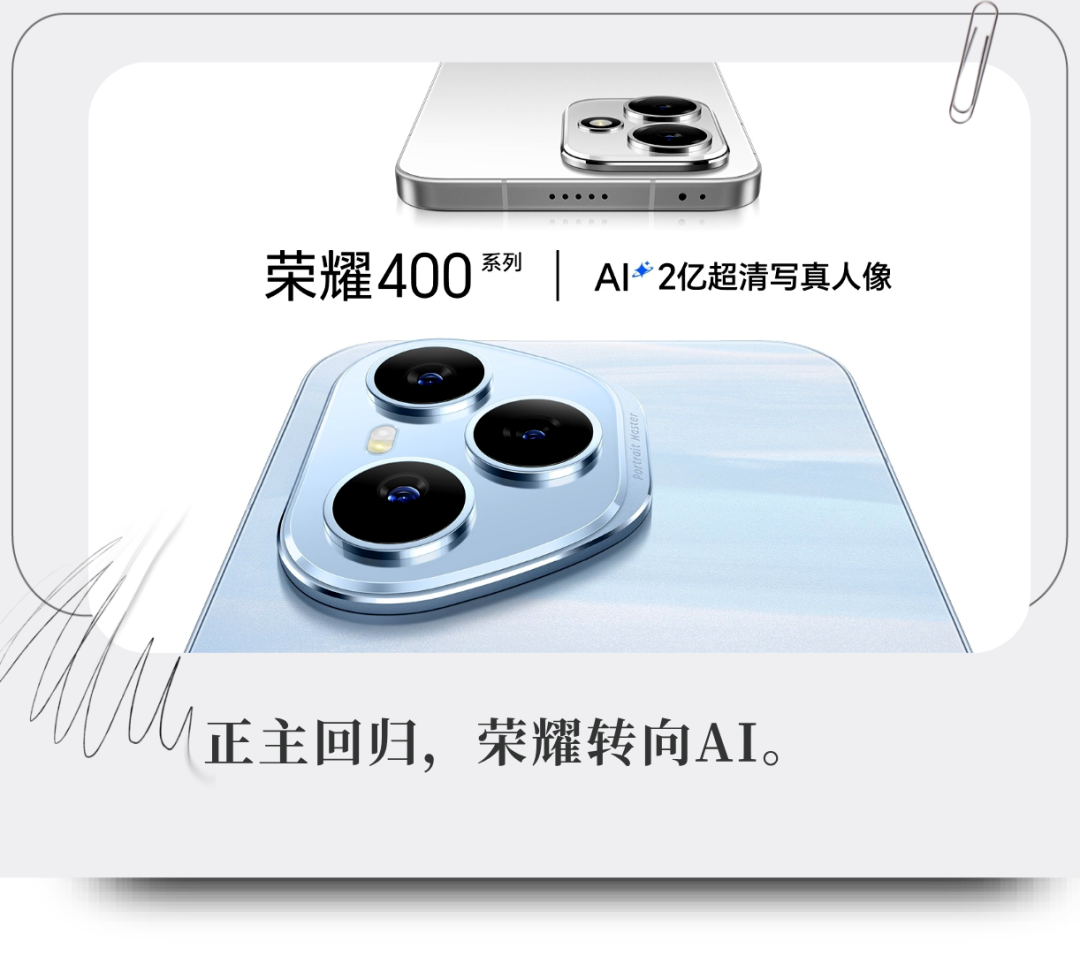

By late May, Li Jian re-entered the market with the Honor 400 series, choosing popular celebrity Xiao Zhan as spokesperson. The mid-range Honor 400 helped Honor regain ground, with official reports showing global activations surpassing 1 million units by late June 2025, breaking Honor's three-year record. In the 2.5K-4K price range, the Honor 400 series topped first-sale charts during 618 and early 2025.

'Some say Honor is dying... it's not; Honor is reborn,' Li Jian remarked with relief. Wang Ban, Honor's Sales and Service President, highlighted overseas strengths, with over 50% growth in Latin America, Middle East and Africa, and Asia-Pacific regions in the past year, 'buying time for domestic adjustments.' He hopes Honor will reclaim China's top three by year-end.

After the Honor 400, Honor launched the foldable Magic V5 in early July, priced from 8,999 yuan, placing new hopes on traditional strengths. Mid-July saw the Honor X70 debut, priced at just 1,189.15 yuan after subsidies, targeting mid-to-low-end markets. While Xiaomi pursues premium markets with self-developed chips, Honor focuses on cost-effectiveness, flooding the market with new releases to boost brand presence and stabilize its terminal business.

Premium markets remain Honor's dream, with foldable V series and straight-screen Magic series carrying high-end, brand-elevating missions. Interestingly, the recent Honor Magic 8 series, positioned against Xiaomi's 17 series, was dubbed the 'strongest self-evolving AI native smartphone.' Both feature the fifth-gen Snapdragon 8 Ultimate Edition, but while Xiaomi competed with Apple, Honor targeted Xiaomi, sparking controversy.

02

Is AI the Ultimate Solution?

According to Caixin, citing buyer channels, Shenzhen's state-owned assets acquired Honor from Huawei for around $40 billion (260 billion yuan) in late 2020. In under five years, Honor's value shrank by approximately 35%, necessitating a fresh narrative ahead of its IPO.

During critical periods of business transformation, technological judgment guides the way, while strategic resolve stabilizes the ship.

As major smartphone players intensify 'involution' in imaging, battery, systems, and foldables, Honor's strategy is both fragmented and forward-looking. Beyond the 'flood of new models,' it bets on AI ecosystems.

AI's commercial potential is vast. According to UNCTAD's '2025 Technology and Innovation Report,' the global AI market could reach $4.8 trillion by 2033, comparable to Germany's economy.

'The digital age is nearing its end; the AI era has arrived. Honor stands at the crossroads,' Li Jian stated. Amid growth challenges, his 'Alpha Strategy'—transitioning from a smartphone maker to a global AI terminal ecosystem leader—has drawn attention and high hopes, with Honor's AI and software teams now numbering 2,600.

The Alpha Strategy unfolds in three phases: Phase 1, the AI Agent Era, co-creating new AI terminal paradigms; Phase 2, the Physical AI Era, building cross-system smart ecosystems through operations; Phase 3, the AGI Era, pushing human potential boundaries and co-creating new civilizational paradigms.

Progress is visible: beyond smartphones, Honor is deploying smart agents, with the self-evolving AI OS Honor MagicOS10 already launched and the world's first end-side large model deployed (set for Honor's overseas products).

Additionally, Honor is venturing into embodied intelligent robots, with its motion control algorithms enabling robot running speeds exceeding 4m/s, a record. While new sectors may enhance its appeal, actual smartphone sales and profits remain key to sustaining Honor's valuation.

So, how much does AI boost smartphone sales? The industry is uncertain.

First, AI large model applications are still in their infancy, with immature technology. End-side models may suffer accuracy and precision losses offline, posing risks.

Second, as envisioned by manufacturers, AI phones could become personal intelligent assistants, bringing innovation and fresh experiences. With Apple, Huawei, Xiaomi, and OV all launching AI Agents, this core selling point lacks uniqueness. Due to missing ecosystems and delayed technology rollouts, Honor's edge over competitors is even weaker.

Third, AI phone market acceptance is still in its early stages. Translating new concepts into consumer upgrade drivers requires time.

Current mobile AI must balance large model parameters, AI experience, and device energy consumption, requiring substantial investment. For Honor, Li Jian announced a future $10 billion AI investment. While his commitment is commendable, this sum equals a third of Honor's 200 billion yuan valuation, and its robotics ventures also demand significant capital. Currently, Honor's core profits rely on digital and mid-to-low-end models. Balancing short-term profits and long-term investment is a persistent challenge for Li Jian and his team.

Second, China's smartphone market is fiercely competitive. With Huawei's strong return, and HTC's strategic collapse as a cautionary tale, Honor has little time. Seizing this one-to-two-year window is critical.

In a recent interview, Li Jian described AI phones, robotics, and high-definition imaging equipment as Honor's 'three engines,' combining them with 'love, wisdom, and joy' to create emotionally resonant, valuable products.

Regaining confidence and reversing sales declines is the first step. AI terminals, smart robots, and overseas expansion are packaged into Honor's new narrative. To thrive, technical prowess and hardcore products must deliver.