Has the Turning Point in China-US Trade Relations Arrived After Trump's "Productive Dialogue"?

![]() 10/31 2025

10/31 2025

![]() 441

441

On the morning of October 30 (local time), the leaders of China and the United States convened a meeting in Busan, South Korea. The two heads of state reached an agreement to bolster cooperation in fields such as the economy, trade, and energy, and to foster greater people-to-people exchanges.

Several days prior, economic and trade delegations from both nations engaged in a round of negotiations in Kuala Lumpur, where the atmosphere during the high-level discussions was as cordial as anticipated. During a press conference on the 28th, Trump publicly declared his willingness to discuss chip-related matters with China, including NVIDIA's latest Blackwell chips. The self-styled "Dealmaker-in-Chief" even hinted that a downgraded version of NVIDIA's Blackwell chips might be permitted for entry into China in the future.

US President Trump (Photo credit: CCTV)

Nevertheless, both sides remained tight-lipped regarding the specifics of the Kuala Lumpur discussions. Over the course of two days, China and the United States arrived at a fundamental consensus on issues such as maritime logistics, tariff suspension periods, and fentanyl cooperation. While some verbal sparring did occur, both parties expressed a commitment to advancing domestic procedures to finalize the details.

From chips to soybeans, trade disputes and negotiations between China and the United States have once again intensified in October 2025. Amidst the back-and-forth, global stock markets and the gold market have responded with fluctuations to the trade talks between the two powers. Will the outcome of the Kuala Lumpur talks continue to show improvement? Could this signify the end of the China-US trade dispute? What impact will Trump's statement on negotiating chip issues have on capital markets?

Chips, rare earths, and soybeans have emerged as key bargaining chips—has the "Dealmaker-in-Chief" softened his stance?

Based on the available information, following this round of Kuala Lumpur talks, the United States has abandoned its plan to impose 100% tariffs on Chinese goods, marking a preliminary breakthrough in China-US trade negotiations.

Photo credit: AI-generated

During his visit to Malaysia, Trump expressed confidence in reaching a comprehensive agreement with China. Despite the generally positive news, neither side has disclosed specific details about the cooperation to be achieved.

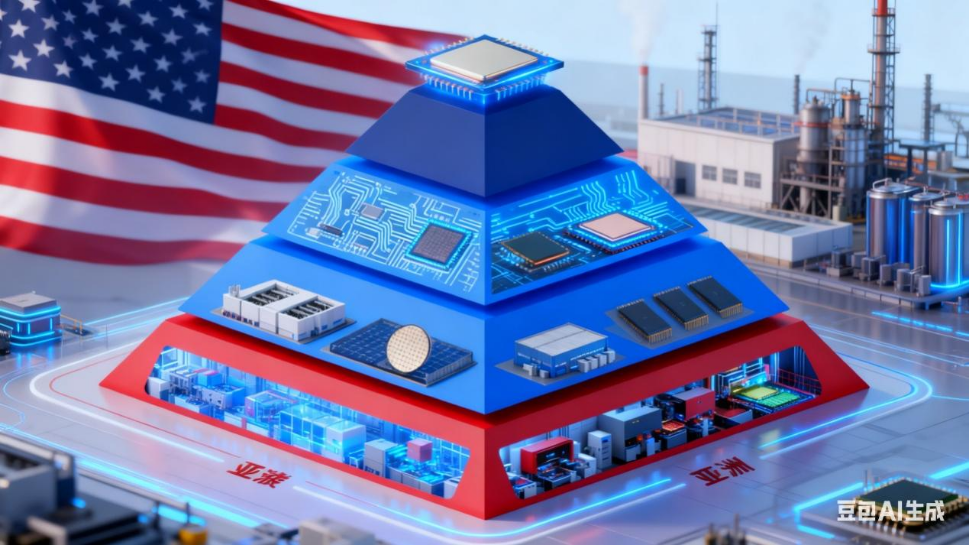

Some commentators point out that chips are central to China-US negotiations. The trade conflict between the two countries has persisted for years, with both sides acknowledging that complete decoupling is unfeasible. However, decoupling in high-tech sectors remains a viable option. Particularly in advanced chips, the United States has imposed a total ban on supplies to China, leading China to halt purchases, including a complete stop on NVIDIA's H20 chips. The US has not only cut off advanced chip supplies to China, blocked photolithography equipment, and prohibited TSMC from manufacturing chips but has also orchestrated behind-the-scenes maneuvers, such as pressuring the Netherlands to seize control of Nexperia.

Photo credit: Internet

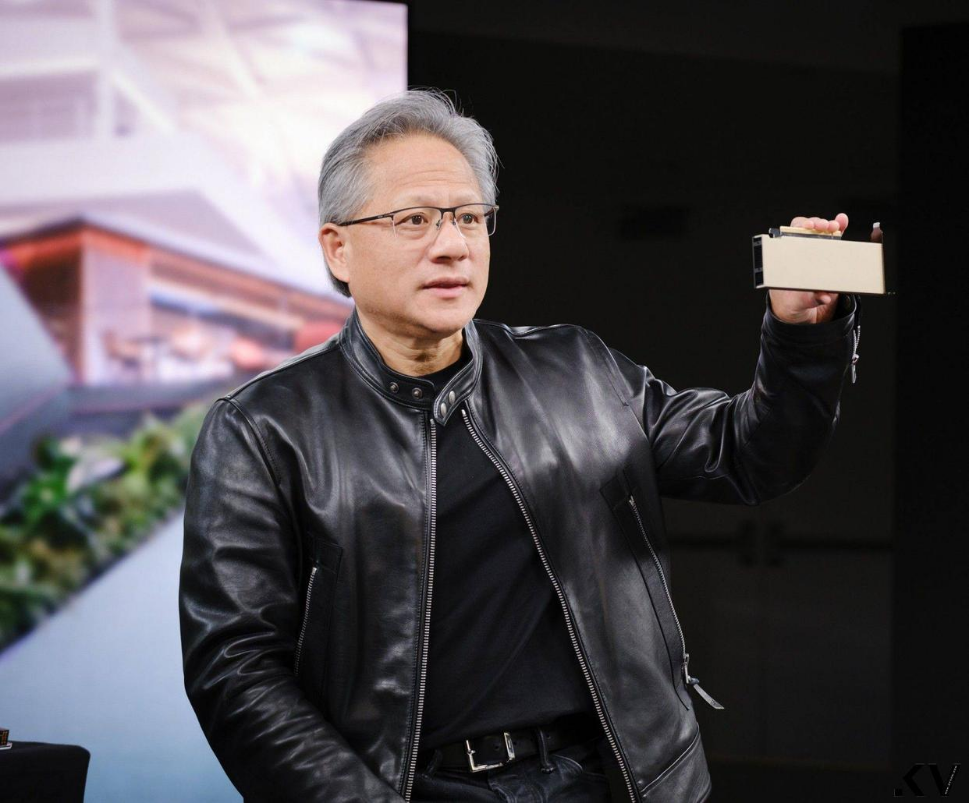

For China to achieve a breakthrough in chip technology, it must rely on both independent innovation and continued negotiations. Judging by the "Dealmaker-in-Chief's" latest statements, these issues are not entirely off the table—after all, NVIDIA CEO Jensen Huang has publicly lamented that his company's market share in China has plummeted from 100% to zero.

Thus, the "Dealmaker-in-Chief's" willingness to "negotiate and engage" suggests more than meets the eye, implying another round of strategic maneuvering.

Next, we turn to rare earths. Some commentators argue that "chips are to the US what rare earths are to China." In response to US chip restrictions, China has leveraged rare earth export controls as a bargaining tool. Data indicates that in 2024, US rare earth consumption reached approximately 53,800 tons, but domestic production could only supply 1,300 tons of high-end products, with 97% relying on imports—70% of which came directly from China. Even when considering potential sources like Ukraine and Greenland, US rare earth procurement costs would rise significantly, making rare earth controls a potent bargaining chip.

Photo credit: Internet

Additionally, soybeans may be the easiest item to negotiate in this round of China-US trade talks. After halting purchases of US soybeans, Brazil raised prices, making its soybeans more expensive than those from the US. Brazil now dominates the Chinese market. For China, the simplest solution is to negotiate with the US and resume imports through mutual compromise, thereby suppressing Brazilian soybean prices and creating a balanced import structure where both the US and Brazil act as checks on each other.

Photo credit: Internet

US Economy Relies on 80% Consumption, China Holds 90% of Global Rare Earths—Cooperation and Competition Coexist

In late October, the A-share index broke through 4,000 points for the first time in a decade. Some analysts argue that economic liquidity comprises investment, consumption, and imports/exports. While domestic consumption remains sluggish, imports and exports have performed strongly, closely tied to the progress of China-US trade negotiations. Thus, current tariff talks with the US are crucial, affecting not only direct trade flows but also indirectly influencing market sentiment.

In contrast, the US economic structure differs significantly from China's: consumption accounts for over 80% of US GDP, driving asset inflation through spending. These assets are reflected in the stock market, encompassing both tech concept stocks led by OpenAI and established tech giants like NVIDIA. Whether in hardware or software, transactions generate profits, continually expanding stock market asset values.

Thus, China and the US are vital trade partners for each other. Restricting transactions among tech companies would ultimately harm the US stock market more severely. For the "AI narrative" to persist until related companies generate real profits, China-US trade negotiations must continue to progress favorably.

Moreover, rare earths are a critical component in AI hardware. Over 90% of global rare earth supplies come from China, meaning tighter Chinese controls would place immense pressure on the US AI industry.

China is the world's largest supplier of goods, while the US is the largest consumer market. The top supplier and the top demander should deepen cooperation to address their respective challenges.

In the short term, a bilateral negotiation and consensus between China and the US are highly likely. For China, this would positively impact both real economic development and financial liquidity. The same holds true for the US: if core issues are resolved, related companies could see profits from the AI industry materialize.

Photo credit: Internet

Overall, cooperation between China and the US is the inevitable choice at this stage, but long-term strategic competition will persist. The US's initially aggressive stance toward China stems partly from recognizing China's unstoppable rise and partly from domestic conservative pressures.

Long-Term Dynamics: Strategic Competition and Market Volatility

From a broad perspective, while short-term negotiations between China and the US after the leaders' meeting show signs of cooperation, such collaboration is insufficient to ease US vigilance toward China—after all, the US pursues global hegemony.

In the short term, positive interactions between major powers have formed, and financial markets will respond accordingly. Cooperation is a mutual need for both sides at present. However, in the long run, strategic competition will remain the dominant theme. For the foreseeable future, amid intense China-US competition, markets are likely to exhibit an "overall upward trend with intermittent volatility."

NVIDIA CEO Jensen Huang

One notable detail is that Jensen Huang of NVIDIA accompanied Trump on his visit to South Korea. Huang's movements reflect not just corporate-level cooperation but also US strategic considerations in the AI supply chain—leveraging South Korea (Samsung, SK Hynix) to strengthen chip manufacturing advantages while gauging China's response to chip policies through corporate interactions. Huang remarked that the visit "made the Korean people happy and truly delighted President Trump." Whether he and the Chinese market will have reasons to celebrate remains to be seen.

Samsung Chairman Lee Jae-yong (left), Jensen Huang (center), SK Group Chairman Chey Tae-won (right)

In the short term, phased achievements such as tariff exemptions and cooperation in soybeans from this round of China-US trade talks will inject warmth into both economies, strengthening China's import and export resilience. Stock markets will rally on positive sentiment, with A-share import/export sectors and US tech stocks likely to see temporary boosts. However, long-term uncertainties remain: core disagreements in high-tech areas like chips are unlikely to be resolved quickly. If competition escalates, it could disrupt global tech industry layouts and intensify market volatility. Post-Trump policy uncertainties will also persist, bringing new risks to capital markets. Whether in China, the US, or the gold market, the trend will likely feature "short-term sentiment-driven fluctuations and long-term competition-driven trends."

References

1. "A-shares Break 4,000 Points! How to View the Impact of China-US Negotiations" (Huang Shiquan's World Perspective)

2. "The US Compromises: What Other Cooperation Could China and the US Achieve?" (Li Shuyong's Forum)