What Does the Future Hold for Mobileye? Financial Analysis and Insights for Q3 2025

![]() 11/10 2025

11/10 2025

![]() 524

524

Produced by Zhineng Zhixin

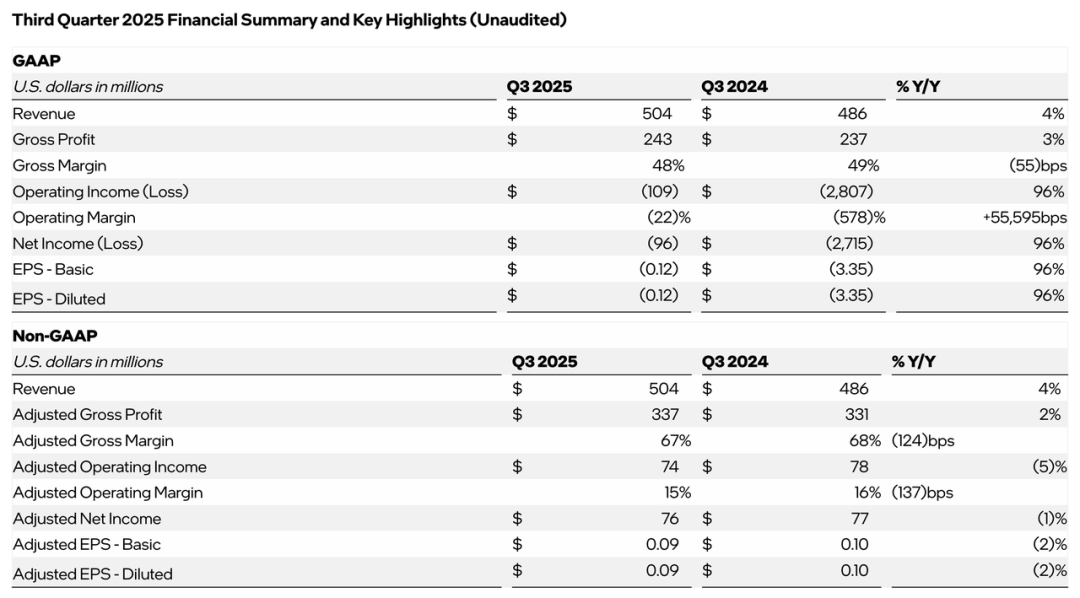

In Q3 2025, Mobileye reported revenues of approximately $504 million, marking a year-on-year increase of around 4%. While its ADAS business for the EyeQ series chips has shown a steady recovery, gross margins and profitability have yet to see a fundamental upturn. The company has revised its full-year revenue forecast upwards to $1.845–1.885 billion, projecting a year-on-year growth of approximately 12%–14%.

Globally and in China, Mobileye is confronting significant structural challenges concerning technology pathways, market competition, product innovation cycles, and ecosystem dynamics.

Part 1: Q3 2025 Financial Report Review

During Q3 2025, Mobileye achieved revenues of $504 million, up 4% year-on-year, with a gross profit of $243 million and a gross margin of roughly 48%, slightly lower than the previous year. Operating losses narrowed significantly to approximately $109 million compared to the prior year. Sales of EyeQ chips rose by about 8% year-on-year, serving as the main revenue driver, while sales of the SuperVision system experienced a year-on-year decline.

The full-year revenue projection for 2025 has been adjusted upwards to $1.845–1.885 billion, reflecting a year-on-year increase of approximately 12%–14%.

This quarter, Mobileye sustained its growth momentum and maintained robust financial health, with no substantial deterioration in its fundamentals. However, if the company halts its progress at this stage, its growth potential and alignment with market expectations will continue to face hurdles.

The history of Mobileye traces back to 1999 when Professor Amnon Shashua of the Hebrew University of Jerusalem founded the company with a vision to empower machines to 'understand' roads. Early on, leveraging a single-camera ADAS solution based on visual algorithms, Mobileye swiftly emerged as a dominant force in the global L0-L2 market.

The company went public on the New York Stock Exchange in 2014, was acquired by Intel for $15.3 billion in 2017, and regained independent listing status in 2022. In July 2025, it completed a $949 million refinancing round.

The cornerstone of Mobileye's success lies in its 'black box model'—a turnkey solution that deeply integrates hardware and software, bundling SoCs, algorithms, cameras, imaging radar, and high-definition maps into a unified module. Automakers can deploy this solution with minimal need for algorithm development or low-level tuning. This model proved highly appealing in the early days when intelligent driving technologies were not yet mainstream.

For traditional automakers lacking in-house R&D capabilities, Mobileye's solution offered a 'plug-and-play' gateway to autonomous driving.

As a result, Mobileye's ecosystem flourished. The company has had a long-standing collaboration with STMicroelectronics on the EyeQ series chips, utilized Intel's advanced packaging technology and radar R&D resources, and partnered with Quanta Computer for ECU production. By 2024, its technology had been integrated into over 1,200 vehicle models globally, with cumulative SoC shipments surpassing 200 million and partnerships established with more than 50 automakers.

This expansive ecosystem has rendered Mobileye nearly indispensable in the traditional ADAS sector.

As the industry entered the 2020s, structural shifts began to accelerate. With the widespread adoption of L2+ and L3 functionalities, automakers grew increasingly dissatisfied with standardized 'black box' solutions and began favoring more flexible and scalable alternatives. This transition has emerged as the most significant growth bottleneck for Mobileye.

Part 2: In-Depth Analysis: Technology, Market, and Strategy

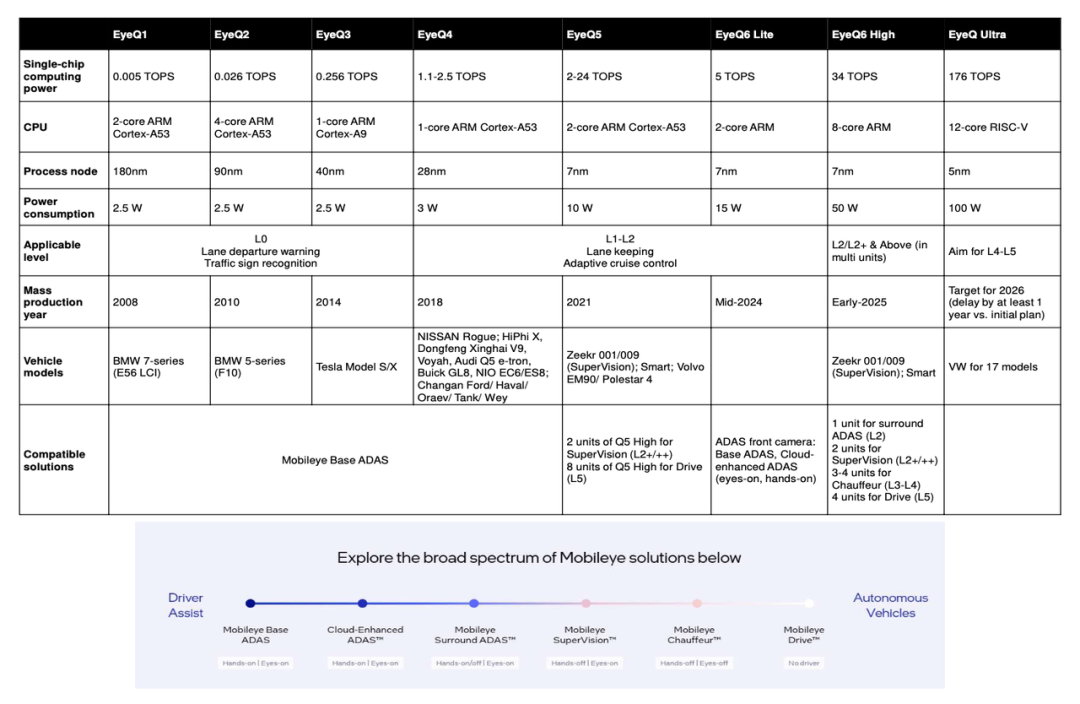

On the hardware front, Mobileye's EyeQ series SoCs have undergone six generations of evolution.

From the initial EyeQ1 (0.005 TOPS) to the EyeQ6 High (34 TOPS) mass-produced in 2025, computational power has seen a substantial increase. However, its pace of advancement has lagged behind industry benchmarks.

Although the EyeQ Ultra is projected to reach 176 TOPS, its mass production has been delayed by at least a year. Meanwhile, NVIDIA's Orin and Horizon Robotics' Journey series have already exceeded 500 TOPS, placing Mobileye's chips at a performance disadvantage in L2+ and L3 advanced driving scenarios. A deeper issue lies in its architectural strategy.

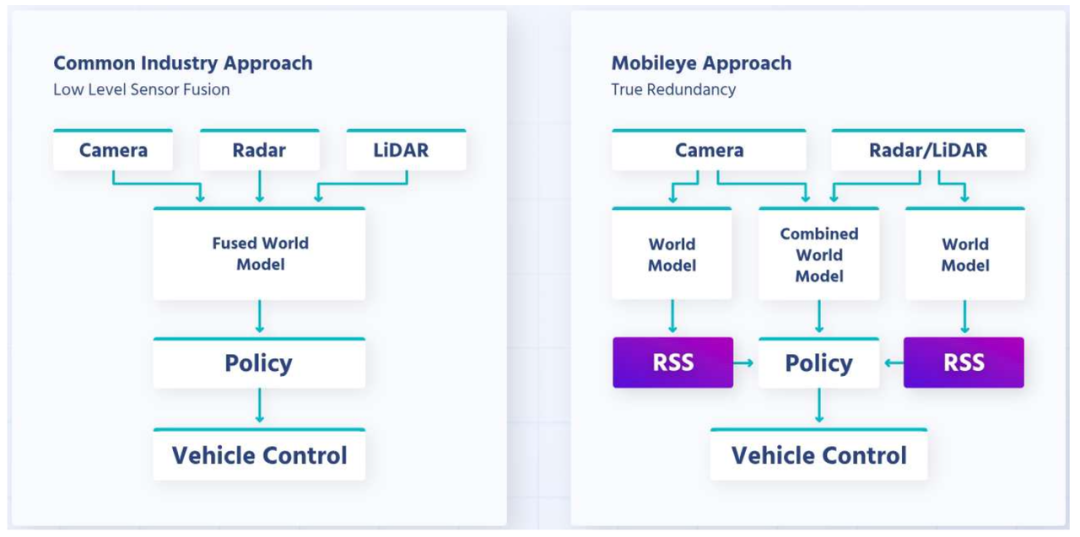

Mobileye continues to adhere to its 'True Redundancy' system, where cameras and radar operate independently for perception, decision-making, and cross-validation.

While this redundancy logic enhances safety, it falls short in computational efficiency and energy consumption compared to the industry's mainstream 'sensor fusion' approach, which processes multi-sensor inputs through a single AI model, significantly reducing system complexity and latency. Mobileye's architecture, while stable, appears cumbersome by comparison.

Mobileye's conservative technology approach has left it in a precarious position. While its accumulated strengths in safety and robustness cannot be overlooked, it has gradually fallen behind industry trends in terms of flexibility, computational efficiency, and openness.

More critically, its multi-chip architecture necessitates the collaborative operation of 4 to 8 EyeQ chips in advanced autonomous driving scenarios, increasing power consumption and communication latency compared to single-chip solutions from competitors, while also reducing system integration efficiency.

Resource allocation issues have further exacerbated this lag.

Over the past five years, Mobileye has invested approximately $3.7 billion in R&D, but these funds have been dispersed across multiple areas, including radar, mapping, Robotaxi platforms, and shared mobility systems. While this diversification may appear strategically forward-looking, it has diluted its competitiveness in core SoCs and algorithms.

In contrast, China's Horizon Robotics has concentrated nearly all its R&D efforts on automotive AI chips and algorithms, achieving breakthroughs in performance and cost in the L2+ and L3 markets within just a few years.

On the market front, structural pressures in China are particularly pronounced.

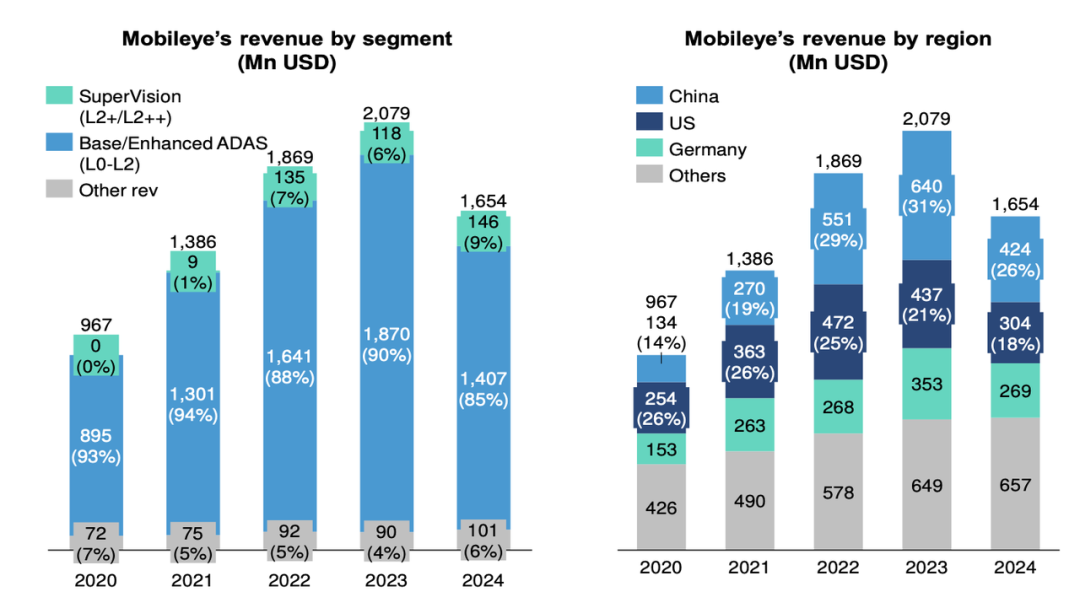

In 2024, China's revenue contribution dropped to 29%, below the 42% from the U.S. and 19% from Germany. This decline stems from Chinese automakers rapidly shifting toward in-house development or opting for domestic supplier solutions.

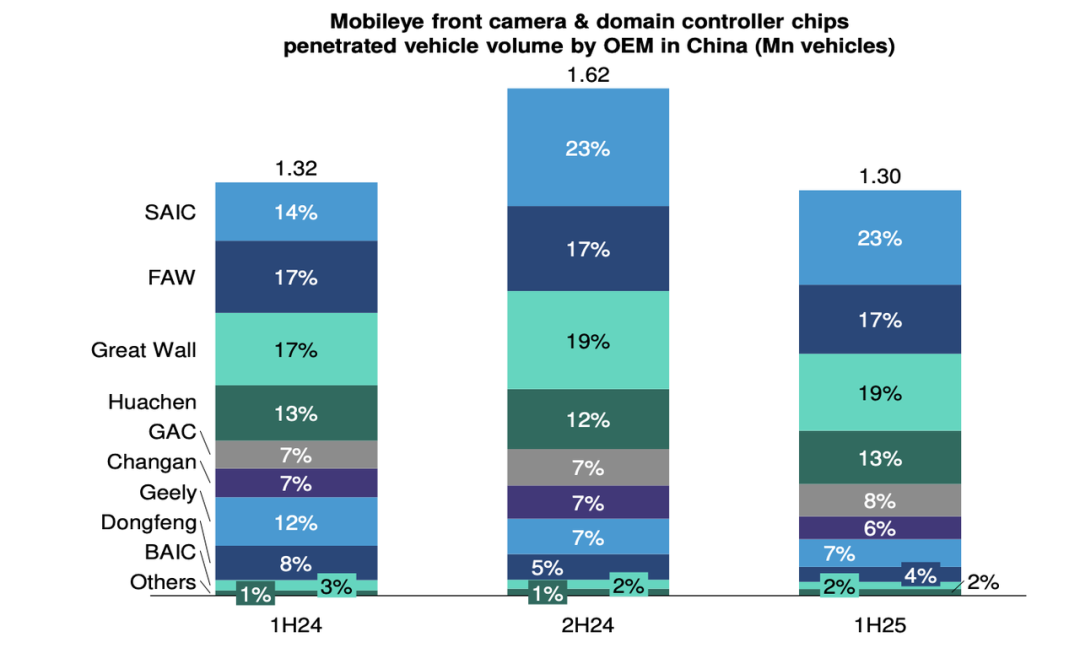

Companies like Horizon Robotics, Black Sesame, and Digico have gradually supplanted Mobileye in certain vehicle models by offering cost advantages, flexibility, and localized support. Even among its remaining partners, such as SAIC, FAW, and Great Wall Motors, shipment volumes have begun to decelerate.

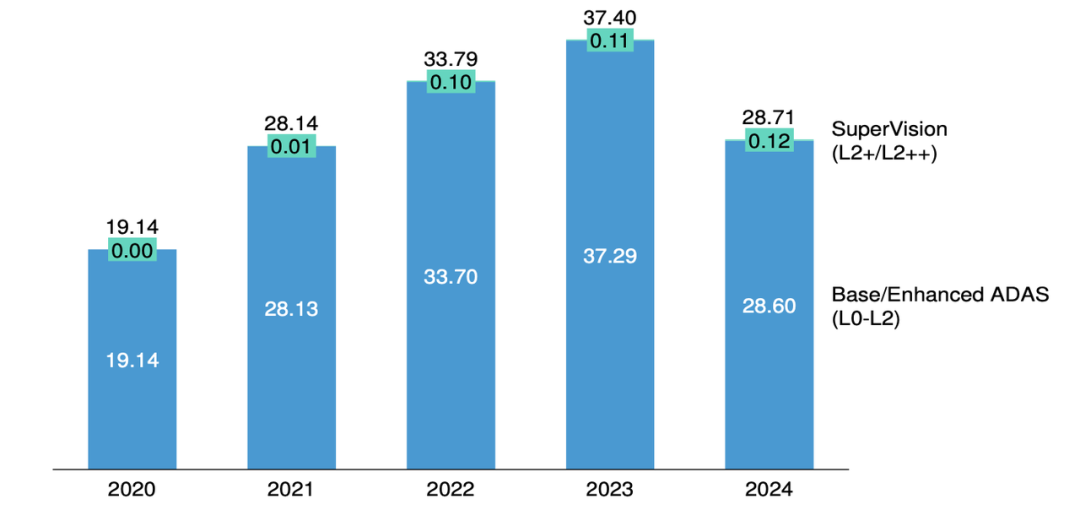

Mobileye's L0-L2 SoC shipments declined from 33.79 million units in 2023 to 28.71 million units in 2024, while shipments of its advanced SuperVision solution remained below 120,000 units. Its scaling advantage remains entrenched in the low-end market, while the high-end market, where significant growth potential lies, remains largely untapped.

Summary

Mobileye has demonstrated revenue growth, healthy cash flow, and robust shipment volumes, transitioning from an early market leader into a 'critical transformation period.' To thrive in the new era of advanced autonomous driving, it must enhance its technological and product offerings while adjusting its business models and ecosystem strategies to align with evolving automaker collaboration patterns and intensifying market competition.