It's Truly Going "Orange"! Ele.me Steps Out of the "Yellow - Blue Story"

![]() 11/17 2025

11/17 2025

![]() 471

471

The transition from blue to orange for Ele.me is just the start of its transformation, as the name change implies.

Author | Gu Nian

Editor | Yang Zhou

In November, Meituan hosted a farewell event for its “Blue Buddies”.

On the app's homepage, the “Pay Tribute to Blue Buddies, Present Flowers, and Get Coupons” campaign was launched. Meituan penned a letter: “Dear Blue... May you remain profound in the deep sea and forever free in the clear sky—always remember your yellow.” Subsequently, its official Weibo account posted a lengthy article, summarizing the 12 - year rivalry between the two companies.

Later, some users found that searching for “Meituan” within the Ele.me app would redirect them to the “Daily Must-Have Blowout 18.8” special event. A new line of text prominently emerged: “Eating Well is the Real Deal,” which seemed to be a subtle response from Ele.me to Meituan's campaign.

The phrase “Eating Well is the Real Deal” shifts the focus back to food, transactions, and services. Ele.me didn't dwell on “responding emotionally” but instead invested resources in “providing users with a more affordable and convenient home - delivery experience.”

This response aligns with the core assumption of the Taobao Flash Delivery system: users don't need to engage in platform narratives. What they need is to be able to eat when hungry, buy what they want, and have it delivered promptly.

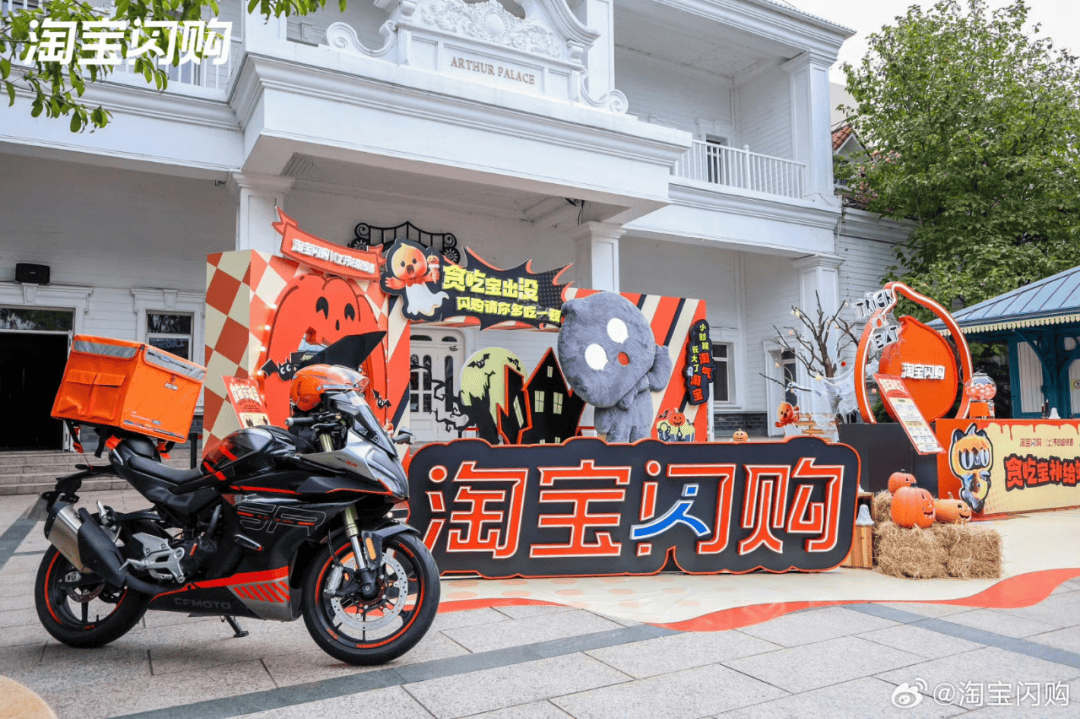

At the same time, Ele.me was making another significant structural adjustment. In the test version of the app, “Ele.me” took a backseat, and the main logo was changed to “Taobao Flash Delivery.” The visual system switched from blue to Taobao's orange, and “Blue Knights” were renamed “City Knights.”

From an external perspective, it's a “name change”; from a product - positioning perspective, it's “stepping out of the single food - delivery scenario.” Viewing these two events together is more significant than the “tribute” or “name change” itself. The first phase of the local life industry was centered around “who delivers food”; the second phase will revolve around “who can meet broader instant - consumption needs.”

Ele.me proactively chose to leave the narrative of the “Blue Era” and enter a framework that can better serve users. This also explains why it's willing to abandon a well - established brand perception: not to reduce user awareness but to expand user choices.

While Meituan concluded the past decade with a commercially nostalgic emotional touch, Ele.me has shifted its transformation towards the more consumer - centric scenario of “instant satisfaction of food, shopping, and life needs.”

Ultimately, what's being amplified is not the rivalry between platforms but the scope of user experience. Food delivery is just the beginning, and instant delivery is covering more and more aspects of life. Ele.me isn't waiting to be bid farewell but has already entered a new race, upgrading from a food - delivery platform to a lifestyle gateway.

01 Name Changes of Tech Giants in the Global Internet Context

Placing Ele.me's name change in the context of the global internet makes it easier to understand.

Internet company name changes have never been emotional events but strategic ones. After breaking free from the “social media label,” Facebook became Meta, pivoting towards a future immersive world. After shedding the “140 - character information stream,” Twitter became X, reshaping into an “all - in - one AI platform.” Companies like Apple, Didi, Kuaishou, ByteDance, and others have also made similar moves at strategic turning points.

Their rebranding efforts vary, but the underlying logic is similar: when the old name represents the past, the company needs a new name that can carry the future.

Similarly, Ele.me's issue isn't weak brand strength but brand strength that's too strong. Its advertising perception from the past remains deeply ingrained. The name “Ele.me” (Are you hungry?) is so catchy that it has formed a natural boundary: users' first reaction is always “food,” and they can't naturally associate it with non - food items, general merchandise, 3C products, pets, pharmaceuticals, etc.

This was an advantage in the early days, quickly capturing user attention and establishing brand recognition. However, as user demands diversified and the platform expanded into more scenarios like general merchandise, 3C products, flowers, and pharmaceuticals, this association gradually became a limitation.

But as a platform that has been growing for 17 years, Ele.me launched non - food delivery services such as flower, medicine, and general merchandise delivery years ago. It proposed the development concept of “Everything 30min (delivering everything in 30 minutes)” and later made instant retail its core strategy.

In 2023, Ele.me's launch of the “iPhone” delivery service sparked significant attention, successfully helping the brand achieve over 100 million yuan in monthly transaction volume and co - creating multiple billion - yuan non - food categories with the brand. However, users' first reaction remains “Ele.me = food delivery,” even though they have already placed orders for tissues, chargers, or antipyretics on the platform.

This perceptual mismatch also means that although Ele.me has effectively become an instant retail platform, on the user end, it's still just perceived as a food - delivery app.

Over the past few years, Ele.me has made multiple attempts to break through this perceptual anchor point.

The platform engaged in “name change” meme marketing with phrases like “Are you thirsty?”, “Are you sleepy?”, “Are you taking the kids out?” in an attempt to soften the brand label and convey its diverse service capabilities. However, these lightweight approaches were insufficient to penetrate mainstream user perceptions. Even though the business had extended, the brand's connotation remained stagnant.

From this perspective, the name change isn't about abandoning the past but about embracing the future.

For users, they are increasingly opening Ele.me when they are “not hungry,” a result of the platform's business expansion, which also compels the brand to keep up. If a name hinders you from becoming what you aspire to be, the best choice is not to hold on but to upgrade.

02 A New Name That Rides the Momentum

For Ele.me, renaming has never been an easy decision.

As an iconic brand that has witnessed the development of China's food - delivery industry, “Ele.me” possesses strong perceptual and emotional assets. The advertising slogan “Don't call mom when you're hungry, call Ele.me” is still vividly remembered today. Any replacement of a mature brand carries risks of positioning ambiguity and asset depreciation.

However, the role of a brand has never been a static identifier but a reflection of user behavior. Ele.me's new name after the upgrade, “Taobao Flash Delivery,” didn't emerge out of thin air but is a directional indicator accumulated through long - term user behavior.

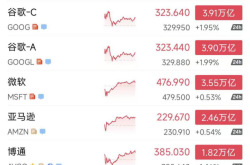

Taking platform data as an example, after “Taobao Flash Delivery” was explicitly positioned as a strategic - level business this year, its daily order peak reached 120 million, with weekly average daily orders exceeding 80 million in August, driving a 20% increase in Taobao's daily active users. The number of daily active riders exceeded 2 million, triple that of April.

Whether it's Ele.me's daily activity or Taobao's user stickiness, Taobao Flash Delivery serves as a powerful engine driving incremental growth. During this year's Double 11 e - commerce battle, Taobao Flash Delivery drove over 2x year - over - year growth in multiple categories, with supermarket convenience stores seeing a 670%+ increase and over 70% of cities experiencing over 200% growth in late - night snacks.

Driven by a combination of subsidies, supply integration, and user perceptual migration, Taobao Flash Delivery has rapidly become a new source of incremental growth within the Alibaba ecosystem. Behind this lies the expansion of the platform's service capability boundaries and changes in user perception. Therefore, for the platform, the brand rename is not merely a simple internal resource integration within the group but a natural progression that aligns with user behavior.

The new name brings not just a “more platform - like” image but “more like a lifestyle.” The brand name Taobao Flash Delivery helps Ele.me break through the limitations of its food - delivery brand perception while further integrating more group ecosystem resources to offer users a richer and more diverse service experience.

Firstly, shopping certainty is enhanced. When home - delivery services are part of the same system as Taobao's main brand, users no longer need to rely on “experience - based ordering” or “take chances” when purchasing non - food items. The genuine product guarantees, after - sales mechanisms, and consumer protection systems accumulated by Taobao over the long term are directly transferred to the instant - delivery scenario, significantly reducing the psychological risks users face when making decisions, especially for high - ticket items like 3C products, beauty products, and maternal and infant goods.

Secondly, the range of choices has expanded. A noticeable change is that users no longer need to distinguish between “food - delivery platforms” and “shopping platforms.” If they have time to spare, they can compare prices on Taobao; if in urgent need, they can fulfill their requirements instantly through Flash Delivery. Long - distance e - commerce and near - field retail are no longer fragmented but integrated into a single entry point. This allows users, for the first time, to avoid choosing between “more” and “faster” and instead obtain both simultaneously.

More importantly, the depth of supply is extending.

With brand flagship stores gradually opening up fulfillment through Taobao Flash Delivery, consumers can also enjoy instant delivery when purchasing brand - name goods, rather than only using instant retail for “low - ticket items.” From category coverage to brand tiers, a wider selection and higher quality are structural outcomes of this round of changes, not short - term phenomena driven by subsidies.

Finally, the service experience is more comprehensive. Once instant home - delivery capabilities and local service capabilities are orchestrated by the same system, delivery is no longer the endpoint of service but may become the starting point. Purchasing home appliances can correspond to post - delivery services like installation and repair; purchasing medications may also include access to medication guidance and health services.

Therefore, “Taobao Flash Delivery” is not a new name replacing “Ele.me” but a confirmation of the direction in which users are heading.

03 A Major Consumption Upgrade Oriented Towards Users

Meituan's flower delivery was an emotional finale; Ele.me's name change marks a structural beginning.

Looking back from a narrative history perspective, “Ele.me” will become a symbol of China's mobile internet golden decade: it was born in the era of ground - promotion subsidies, weathered the food - delivery wars, and propelled the O2O narrative from concept to local life infrastructure. Over this long period, the brand itself has been both a participant and a footnote to the era.

However, from a business structure perspective, this name change is neither a nostalgic farewell nor a mere brand refresh but a systemic realignment that aligns with the overarching trends of the commercial era.

With “Taobao Flash Delivery” becoming the sole external identity, it signifies Alibaba's new approach in the instant retail sector: rather than making users switch scenarios between two brands, it directs resources, supply, and traffic towards a single growth trajectory.

The first layer of effect brought about by this unification is efficiency improvement at the brand level.

In the past, food delivery and instant retail corresponded to different communication targets and perceptual entry points. Now, “Taobao Flash Delivery” can accommodate both needs with a single term, satisfying food scenarios while also covering instant shopping scenarios from daily necessities to big - name merchants. Brand building becomes more concise while possessing greater extensibility.

The second layer of effect occurs internally within the supply chain and algorithms.

Dining and consumer goods originally belonged to two distinct data systems, with entirely different fulfillment logics, demand curves, and repurchase cycles. After unification, a user's lunch, late - night snack, emergency replenishment, and big - name purchase are all integrated into a single consumption trajectory, rapidly enhancing the calculability of supply forecasting and inventory turnover.

More critically, this is intertwined with the upgrade of Alibaba's broad consumer platform, which has been continuously unfolding over the past year. Taobao Flash Delivery gains a primary entry point; the 88VIP system is upgraded; “Taobao Convenience Stores” initiate local supply networks; Tmall flagship store products are connected to instant delivery; and Cainiao's warehousing and distribution network begins powering the Flash Delivery system.

These actions, which may appear as multi - pronged parallel initiatives from the outside, form a closed system after brand unification: traffic, goods, fulfillment, services, and membership systems converge under the same growth logic. Therefore, the name change should be understood not from “where did Ele.me go?” but from “where do users' instant needs ultimately converge?”

The significance of brand integration extends beyond the name; it lies in pre - positioning infrastructure for the “omnichannel consumption” era. This also explains why Meituan's tribute ceremony, while seemingly an end, points to another, more prolonged competition.

Before Ele.me's name change, Meituan's rival might have been just “another food - delivery platform”; after the name change, the rival becomes a triple system: the traffic entry point of Taobao's main site, the supply of goods in Taobao's ecosystem, and the urban fulfillment network established by Ele.me over the years.

As the competition progresses to its next stage, factors like colors, sequences, and slogans will fade into insignificance. The true determinants of success will hinge on three key aspects:

Which player boasts more comprehensive and superior-quality consumption and behavioral data; which one has established a denser and more efficient urban inventory and supply network; and which entity can successfully transition "30-minute delivery for everything" from a subsidy-driven tactic into a stable, enduring, and sustainable core service offering.

What we are witnessing is not just the end of an era dominated by food delivery platforms. Rather, we are on the cusp of opening a new decade, with instant retail at its heart, poised to redefine the local life business ecosystem.